Today, where screens dominate our lives and the appeal of physical printed materials hasn't faded away. Whether it's for educational purposes for creative projects, simply to add personal touches to your space, Are Additional Pension Contributions Tax Deductible are now a useful source. This article will dive into the world of "Are Additional Pension Contributions Tax Deductible," exploring the different types of printables, where they are, and the ways that they can benefit different aspects of your life.

Get Latest Are Additional Pension Contributions Tax Deductible Below

Are Additional Pension Contributions Tax Deductible

Are Additional Pension Contributions Tax Deductible - Are Additional Pension Contributions Tax Deductible, Are Additional Pension Contributions Tax Free, Are Pension Contributions Tax Deductible, Are Personal Pension Contributions Tax Deductible, Are State Pension Contributions Tax Deductible, Are Defined Benefit Contributions Tax Deductible

If a plan allows after tax contributions they are not excluded from income and an employee cannot deduct them on his or her tax return

26 March 2024 6 min read How much can a company or employer pay into a pension plan Key facts Company and employer contributions are not restricted however they

Printables for free include a vast variety of printable, downloadable items that are available online at no cost. They are available in numerous styles, from worksheets to templates, coloring pages, and many more. One of the advantages of Are Additional Pension Contributions Tax Deductible lies in their versatility as well as accessibility.

More of Are Additional Pension Contributions Tax Deductible

Tax Relief On Pension Contributions Chartered Accountants

Tax Relief On Pension Contributions Chartered Accountants

Tax relief on employer contributions to a registered pension scheme is given by allowing contributions to be deducted as an expense in computing the profits of a trade

Yes certain superannuation contributions are tax deductible A tax deduction can be claimed by the contributor for certain contributions such as employer contributions

Printables for free have gained immense popularity due to numerous compelling reasons:

-

Cost-Effective: They eliminate the necessity of purchasing physical copies or costly software.

-

Customization: The Customization feature lets you tailor printables to your specific needs such as designing invitations planning your schedule or even decorating your home.

-

Education Value Free educational printables are designed to appeal to students of all ages, which makes them an invaluable source for educators and parents.

-

Affordability: The instant accessibility to an array of designs and templates helps save time and effort.

Where to Find more Are Additional Pension Contributions Tax Deductible

The Complete Charitable Deductions Tax Guide 2023 2024

The Complete Charitable Deductions Tax Guide 2023 2024

For 2021 an employer can contribute up to 25 of an employee s compensation or 58 000 whichever is less and in 2022 that amount rises to 61 000

Contributions made to registered pension plans in Canada are generally tax deductible This means that the amount contributed to a pension plan is not subject to

After we've peaked your curiosity about Are Additional Pension Contributions Tax Deductible and other printables, let's discover where you can discover these hidden treasures:

1. Online Repositories

- Websites like Pinterest, Canva, and Etsy offer a huge selection of Are Additional Pension Contributions Tax Deductible designed for a variety needs.

- Explore categories like design, home decor, craft, and organization.

2. Educational Platforms

- Educational websites and forums frequently offer worksheets with printables that are free as well as flashcards and other learning materials.

- Ideal for teachers, parents or students in search of additional sources.

3. Creative Blogs

- Many bloggers are willing to share their original designs and templates for no cost.

- These blogs cover a broad range of topics, including DIY projects to planning a party.

Maximizing Are Additional Pension Contributions Tax Deductible

Here are some new ways ensure you get the very most of printables that are free:

1. Home Decor

- Print and frame gorgeous art, quotes, as well as seasonal decorations, to embellish your living areas.

2. Education

- Use free printable worksheets to enhance learning at home, or even in the classroom.

3. Event Planning

- Create invitations, banners, as well as decorations for special occasions such as weddings and birthdays.

4. Organization

- Make sure you are organized with printable calendars with to-do lists, planners, and meal planners.

Conclusion

Are Additional Pension Contributions Tax Deductible are a treasure trove filled with creative and practical information which cater to a wide range of needs and pursuits. Their access and versatility makes them an essential part of the professional and personal lives of both. Explore the plethora of Are Additional Pension Contributions Tax Deductible and uncover new possibilities!

Frequently Asked Questions (FAQs)

-

Are printables available for download really cost-free?

- Yes you can! You can download and print these items for free.

-

Can I use free printables for commercial purposes?

- It depends on the specific conditions of use. Be sure to read the rules of the creator before using any printables on commercial projects.

-

Do you have any copyright rights issues with printables that are free?

- Some printables may have restrictions regarding their use. You should read these terms and conditions as set out by the designer.

-

How can I print Are Additional Pension Contributions Tax Deductible?

- Print them at home using printing equipment or visit a local print shop to purchase superior prints.

-

What software is required to open Are Additional Pension Contributions Tax Deductible?

- The majority of printed documents are in the format PDF. This can be opened using free software such as Adobe Reader.

Public Pension Funding It s No Easy Task Opinion Pennlive

Pension Tax Relief In The United Kingdom UK Pension Help

Check more sample of Are Additional Pension Contributions Tax Deductible below

Pension Tax Relief On Pension Contributions Freetrade

Budget 2020 Pension Relief For Dentists SmallBiz Accounts

Self Employed Pension Contributions Tax Deductible Ways To Make Money

Tax Relief On Pension Contributions FKGB Accounting

More Pension Transfers Help Spur 17 Rise In Pension Payouts

Pre tax Vs Post tax Contributions Personal Finance Series YouTube

https://adviser.royallondon.com/technical-central/...

26 March 2024 6 min read How much can a company or employer pay into a pension plan Key facts Company and employer contributions are not restricted however they

https://www.irs.gov/taxtopics/tc410

If you receive pension or annuity payments before age 59 you may be subject to an additional 10 tax on early distributions unless the distribution qualifies for an

26 March 2024 6 min read How much can a company or employer pay into a pension plan Key facts Company and employer contributions are not restricted however they

If you receive pension or annuity payments before age 59 you may be subject to an additional 10 tax on early distributions unless the distribution qualifies for an

Tax Relief On Pension Contributions FKGB Accounting

Budget 2020 Pension Relief For Dentists SmallBiz Accounts

More Pension Transfers Help Spur 17 Rise In Pension Payouts

Pre tax Vs Post tax Contributions Personal Finance Series YouTube

Pension Contributions Tax Efficient For Both Employee Employer

How To File Back Taxes Without Records Accounting Firms In Luton L

How To File Back Taxes Without Records Accounting Firms In Luton L

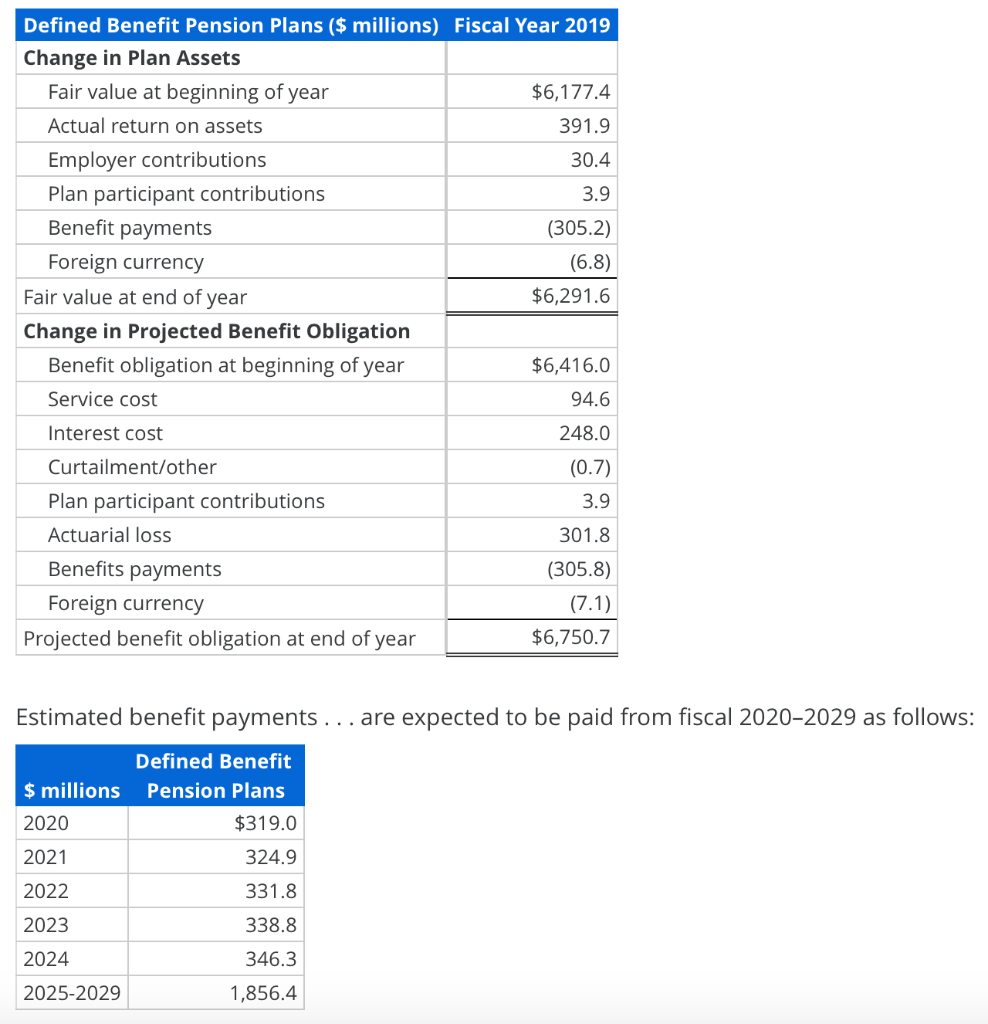

Solved General Mills Inc Reports The Following Pension Chegg