In this digital age, where screens have become the dominant feature of our lives and the appeal of physical printed items hasn't gone away. If it's to aid in education as well as creative projects or simply to add an extra personal touch to your home, printables for free have proven to be a valuable source. Here, we'll dive through the vast world of "Are 401k Withdrawals Taxed As Income Or Capital Gains," exploring what they are, where they are, and how they can add value to various aspects of your lives.

Get Latest Are 401k Withdrawals Taxed As Income Or Capital Gains Below

Are 401k Withdrawals Taxed As Income Or Capital Gains

Are 401k Withdrawals Taxed As Income Or Capital Gains - Are 401k Withdrawals Taxed As Income Or Capital Gains, Are 401 K Distributions Taxed As Ordinary Income Or Capital Gains, Are 401k Withdrawals Taxed As Capital Gains, Is 401k Taxed As Income Or Capital Gains, Are Ira Distributions Taxed As Income Or Capital Gains, Are 401k Withdrawals Taxed As Ordinary Income

Confused about 401 k tax rules From deductions to pre tax contributions to taxes on distributions we break down the 401 k tax rules you need to know

All traditional non Roth 401 k plan withdrawals are considered income and subject to income tax because traditional 401 k contributions are made with pretax dollars As a result

Are 401k Withdrawals Taxed As Income Or Capital Gains cover a large variety of printable, downloadable materials that are accessible online for free cost. The resources are offered in a variety forms, like worksheets templates, coloring pages, and many more. The attraction of printables that are free is in their variety and accessibility.

More of Are 401k Withdrawals Taxed As Income Or Capital Gains

Are 401K Withdrawals For Non Residents Taxable In The US YouTube

Are 401K Withdrawals For Non Residents Taxable In The US YouTube

Contributions to a traditional 401 k plan as well as any employer matches and earnings in the account such as gains interest or dividends are considered tax deferred This means you

When you take distributions the money you take each year will be taxed as ordinary income A Roth 401 k or traditional 401 k may be a better option if you d prefer to pay taxes now and enjoy tax free distributions at

Are 401k Withdrawals Taxed As Income Or Capital Gains have gained a lot of appeal due to many compelling reasons:

-

Cost-Effective: They eliminate the requirement to purchase physical copies or expensive software.

-

Customization: They can make print-ready templates to your specific requirements in designing invitations and schedules, or even decorating your home.

-

Educational Use: These Are 401k Withdrawals Taxed As Income Or Capital Gains provide for students of all ages, making them an invaluable device for teachers and parents.

-

Convenience: Access to an array of designs and templates can save you time and energy.

Where to Find more Are 401k Withdrawals Taxed As Income Or Capital Gains

How Are Dividends Taxed Clear House Accountants

How Are Dividends Taxed Clear House Accountants

Withdrawals from your 401 k do not qualify for capital gain tax breaks when you start to take them out at retirement so you can t pay the capital gains rate

One of the easiest ways to lower the amount of taxes you have to pay on 401 k withdrawals is to convert those funds to a Roth 401 k or a Roth individual retirement account IRA Withdrawals

We hope we've stimulated your curiosity about Are 401k Withdrawals Taxed As Income Or Capital Gains Let's find out where you can discover these hidden treasures:

1. Online Repositories

- Websites such as Pinterest, Canva, and Etsy have a large selection of Are 401k Withdrawals Taxed As Income Or Capital Gains suitable for many applications.

- Explore categories such as decorating your home, education, the arts, and more.

2. Educational Platforms

- Educational websites and forums usually offer free worksheets and worksheets for printing Flashcards, worksheets, and other educational materials.

- This is a great resource for parents, teachers as well as students who require additional resources.

3. Creative Blogs

- Many bloggers are willing to share their original designs and templates at no cost.

- The blogs are a vast spectrum of interests, ranging from DIY projects to party planning.

Maximizing Are 401k Withdrawals Taxed As Income Or Capital Gains

Here are some unique ways to make the most of printables that are free:

1. Home Decor

- Print and frame stunning artwork, quotes or decorations for the holidays to beautify your living areas.

2. Education

- Use these printable worksheets free of charge for teaching at-home also in the classes.

3. Event Planning

- Invitations, banners and decorations for special events such as weddings or birthdays.

4. Organization

- Make sure you are organized with printable calendars including to-do checklists, daily lists, and meal planners.

Conclusion

Are 401k Withdrawals Taxed As Income Or Capital Gains are an abundance of fun and practical tools that cater to various needs and preferences. Their availability and versatility make them an invaluable addition to both personal and professional life. Explore the many options that is Are 401k Withdrawals Taxed As Income Or Capital Gains today, and discover new possibilities!

Frequently Asked Questions (FAQs)

-

Are printables that are free truly are they free?

- Yes they are! You can print and download these tools for free.

-

Can I use free printables for commercial purposes?

- It depends on the specific terms of use. Make sure you read the guidelines for the creator prior to using the printables in commercial projects.

-

Do you have any copyright issues when you download Are 401k Withdrawals Taxed As Income Or Capital Gains?

- Some printables could have limitations in their usage. Check the terms and conditions set forth by the creator.

-

How can I print printables for free?

- You can print them at home using either a printer at home or in the local print shops for more high-quality prints.

-

What program will I need to access printables that are free?

- The majority of PDF documents are provided in the format PDF. This can be opened with free programs like Adobe Reader.

Here s How 401k Withdrawals Are Taxed

Social Security Cost Of Living Adjustments 2023

Check more sample of Are 401k Withdrawals Taxed As Income Or Capital Gains below

6 Things To Know About Roth 401 k Withdrawals The Motley Fool

After Tax 401 k Contribution Definition Pros Cons Rollover

Understanding The Capital Gains Tax A Case Study

Best Tax Breaks 12 Most Overlooked Tax Breaks Deductions 2021

What Are The Capital Gains Tax Rates Armstrong Advisory Group

Short Term And Long Term Capital Gains Tax Rates By Income

https://www.investopedia.com/ask/ans…

All traditional non Roth 401 k plan withdrawals are considered income and subject to income tax because traditional 401 k contributions are made with pretax dollars As a result

https://www.hrblock.com/tax-center/inc…

Once you start withdrawing from your traditional 401 k your withdrawals are usually taxed as ordinary taxable income That said you ll report

All traditional non Roth 401 k plan withdrawals are considered income and subject to income tax because traditional 401 k contributions are made with pretax dollars As a result

Once you start withdrawing from your traditional 401 k your withdrawals are usually taxed as ordinary taxable income That said you ll report

Best Tax Breaks 12 Most Overlooked Tax Breaks Deductions 2021

After Tax 401 k Contribution Definition Pros Cons Rollover

What Are The Capital Gains Tax Rates Armstrong Advisory Group

Short Term And Long Term Capital Gains Tax Rates By Income

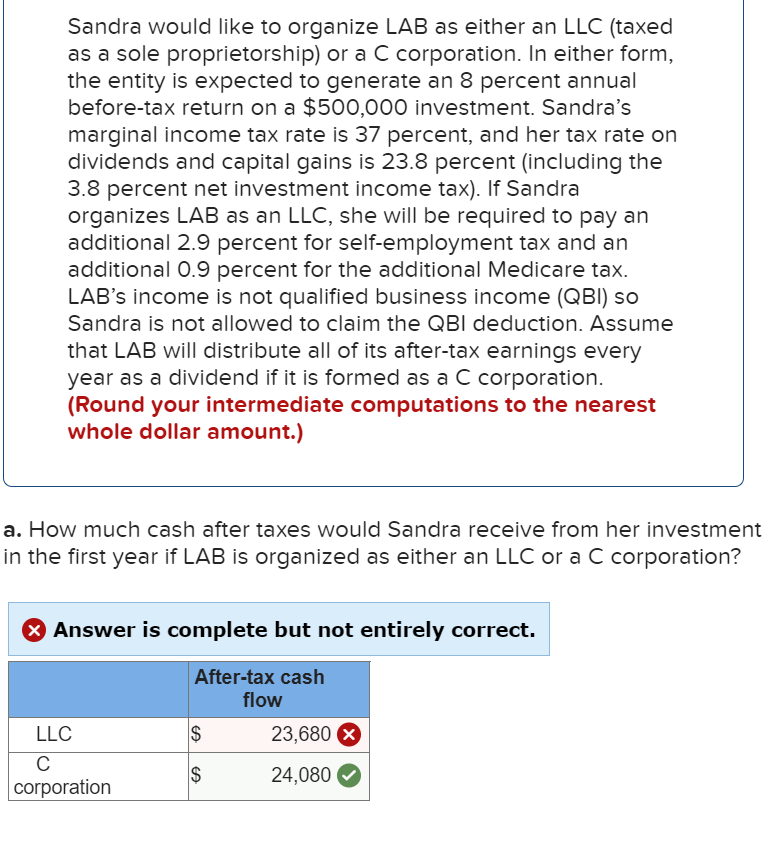

Solved Sandra Would Like To Organize LAB As Either An LLC Chegg

.png)

How High Are Personal Dividends Income Tax Rates In Your State Tax

.png)

How High Are Personal Dividends Income Tax Rates In Your State Tax

Understanding Your Forms W 2 Wage Tax Statement Tax Tax Refund