In the age of digital, when screens dominate our lives it's no wonder that the appeal of tangible printed objects isn't diminished. No matter whether it's for educational uses or creative projects, or just adding a personal touch to your home, printables for free are a great resource. Here, we'll take a dive in the world of "Are 401 K Distributions Taxed In Illinois," exploring what they are, where you can find them, and how they can improve various aspects of your life.

Get Latest Are 401 K Distributions Taxed In Illinois Below

Are 401 K Distributions Taxed In Illinois

Are 401 K Distributions Taxed In Illinois - Are 401 K Distributions Taxed In Illinois, Are 401 K Distributions Taxable In Illinois, Are 401k Withdrawals Taxed In Illinois, Does Il Tax 401k Distributions, Do You Pay Taxes On 401k Distributions

You may subtract the amount of any federally taxed portion not the gross amount included in your Form IL 1040 Line 1 that you received from a qualified employee benefit plan including 401 k plans reported on your U S 1040 or 1040 SR Line 5b Note A qualified employee benefit plan is defined in IRC Sections 402 through 408

Our Illinois retirement tax friendliness calculator can help you estimate your tax burden in retirement using your Social Security 401 k and IRA income

Printables for free include a vast array of printable items that are available online at no cost. The resources are offered in a variety styles, from worksheets to coloring pages, templates and much more. The attraction of printables that are free is in their versatility and accessibility.

More of Are 401 K Distributions Taxed In Illinois

What Does 401 Mean Meaning Of Number

:max_bytes(150000):strip_icc()/401kplan.asp-4103bbcbcf0943068955a6c47d6eca0c.png)

What Does 401 Mean Meaning Of Number

Once you start withdrawing from your traditional 401 k your withdrawals are usually taxed as ordinary taxable income That said you ll report the taxable part of your distribution directly on your Form 1040 for any tax

You may subtract the amount of federally taxed Social Security and retirement income included in your adjusted gross income on Form IL 1040 Line 1 that you received from qualified employee benefit plans including railroad retirement and 401 K plans reported on federal Form 1040 or 1040 SR Line 5b

Are 401 K Distributions Taxed In Illinois have gained immense popularity due to a myriad of compelling factors:

-

Cost-Effective: They eliminate the necessity of purchasing physical copies or costly software.

-

Individualization This allows you to modify printed materials to meet your requirements be it designing invitations making your schedule, or even decorating your home.

-

Educational Use: Education-related printables at no charge can be used by students of all ages, making the perfect resource for educators and parents.

-

Accessibility: Fast access an array of designs and templates reduces time and effort.

Where to Find more Are 401 K Distributions Taxed In Illinois

401 k Contribution Limits In 2023 Meld Financial

401 k Contribution Limits In 2023 Meld Financial

Your 401 k and IRA distributions won t be taxed by the state either That s because Alaska has no state income tax Alaska is one of the states with no inheritance or estate tax which

State Date Illinois Change state Check Date Earnings Gross Pay Method Gross Pay YTD Pay Frequency Federal Taxes enter your W4 info Use 2020 W4 Federal Filing Status Step 2 Two Jobs Step 3 Dependents Amount Step 4a Other Income Step 4b Deductions Additional Federal Withholding Round Federal Withholding

Now that we've piqued your curiosity about Are 401 K Distributions Taxed In Illinois, let's explore where you can locate these hidden gems:

1. Online Repositories

- Websites like Pinterest, Canva, and Etsy provide a variety of Are 401 K Distributions Taxed In Illinois designed for a variety purposes.

- Explore categories such as home decor, education, organizing, and crafts.

2. Educational Platforms

- Forums and websites for education often offer worksheets with printables that are free or flashcards as well as learning materials.

- Great for parents, teachers as well as students searching for supplementary sources.

3. Creative Blogs

- Many bloggers share their creative designs and templates for free.

- The blogs are a vast range of interests, starting from DIY projects to planning a party.

Maximizing Are 401 K Distributions Taxed In Illinois

Here are some fresh ways for you to get the best use of printables that are free:

1. Home Decor

- Print and frame beautiful artwork, quotes, or other seasonal decorations to fill your living spaces.

2. Education

- Use printable worksheets from the internet to enhance learning at home either in the schoolroom or at home.

3. Event Planning

- Design invitations for banners, invitations and decorations for special occasions such as weddings or birthdays.

4. Organization

- Keep track of your schedule with printable calendars, to-do lists, and meal planners.

Conclusion

Are 401 K Distributions Taxed In Illinois are a treasure trove of innovative and useful resources for a variety of needs and pursuits. Their accessibility and flexibility make them a great addition to any professional or personal life. Explore the endless world that is Are 401 K Distributions Taxed In Illinois today, and open up new possibilities!

Frequently Asked Questions (FAQs)

-

Are printables that are free truly available for download?

- Yes, they are! You can print and download these files for free.

-

Can I use free printables for commercial purposes?

- It's contingent upon the specific terms of use. Be sure to read the rules of the creator before using their printables for commercial projects.

-

Do you have any copyright issues in printables that are free?

- Some printables may contain restrictions regarding their use. Be sure to read the terms and regulations provided by the author.

-

How do I print Are 401 K Distributions Taxed In Illinois?

- Print them at home with printing equipment or visit any local print store for top quality prints.

-

What program do I require to view printables for free?

- Most PDF-based printables are available as PDF files, which can be opened using free programs like Adobe Reader.

Battle Of The 401 k Roth Vs Traditional Mercer Advisors

What Are The Benefits Of Having 401 k Plan

Check more sample of Are 401 K Distributions Taxed In Illinois below

New Law Allows New 401 k Distributions And Loans

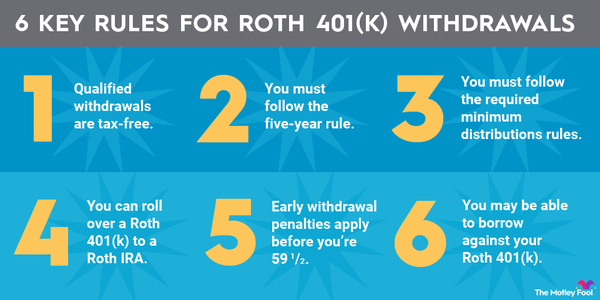

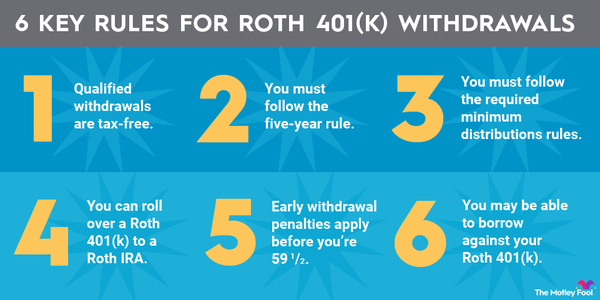

6 Things To Know About Roth 401 k Withdrawals The Motley Fool

Can I Take Two 401 k Distributions Under The CARES Act

How Do We Avoid Double Taxed 401 k Withdrawals I YMYW Podcast YouTube

Are 401 k Loans Taxed

:max_bytes(150000):strip_icc()/GettyImages-166429582-184b05edd9e54492914827e63b4e9e4c.jpg)

Indexed Universal Life IUL Vs 401 k Finance Strategists

https://smartasset.com/retirement/illinois...

Our Illinois retirement tax friendliness calculator can help you estimate your tax burden in retirement using your Social Security 401 k and IRA income

:max_bytes(150000):strip_icc()/401kplan.asp-4103bbcbcf0943068955a6c47d6eca0c.png?w=186)

https://finance.zacks.com/illinois-require-pay...

Illinois also counts early distributions from an IRA 401 k or other qualified retirement plan as tax exempt retirement income that you subtract from federal adjusted gross income

Our Illinois retirement tax friendliness calculator can help you estimate your tax burden in retirement using your Social Security 401 k and IRA income

Illinois also counts early distributions from an IRA 401 k or other qualified retirement plan as tax exempt retirement income that you subtract from federal adjusted gross income

How Do We Avoid Double Taxed 401 k Withdrawals I YMYW Podcast YouTube

6 Things To Know About Roth 401 k Withdrawals The Motley Fool

:max_bytes(150000):strip_icc()/GettyImages-166429582-184b05edd9e54492914827e63b4e9e4c.jpg)

Are 401 k Loans Taxed

Indexed Universal Life IUL Vs 401 k Finance Strategists

401 K Cash Distributions Understanding The Taxes Penalties

The Roth 401 k Tax Trap YouTube

The Roth 401 k Tax Trap YouTube

Cares Act 401k Withdrawal Taxes Calculator FayezTarran