In this age of electronic devices, where screens have become the dominant feature of our lives but the value of tangible printed products hasn't decreased. Be it for educational use and creative work, or simply adding an extra personal touch to your space, Annuity And Lump Sum Difference have become a valuable resource. In this article, we'll dive into the world "Annuity And Lump Sum Difference," exploring the different types of printables, where they are available, and how they can be used to enhance different aspects of your daily life.

Get Latest Annuity And Lump Sum Difference Below

Annuity And Lump Sum Difference

Annuity And Lump Sum Difference - Annuity And Lump Sum Difference, Difference Between Annuity And Lump Sum, Difference Between Annuity And Lump Sum Lottery, Difference Between Annuity Value And Lump Sum Value In Nps, Lump Sum Vs Annuity, Which Is Better Lump Sum Or Annuity

Retirement Features Pension Lump Sum Option vs Annuity Payment Which Is Better Lump sum vs annuity payments Single life benefits vs joint and survivor benefits Finding the right

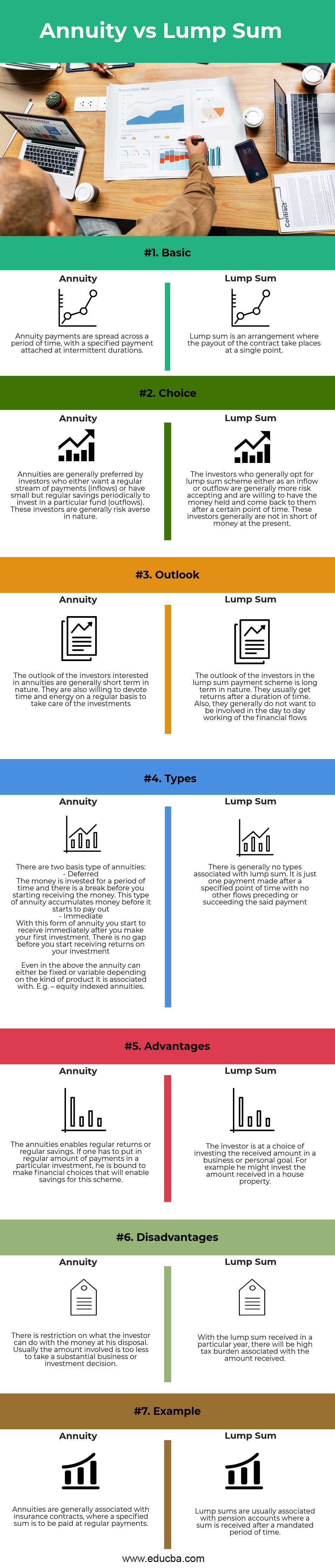

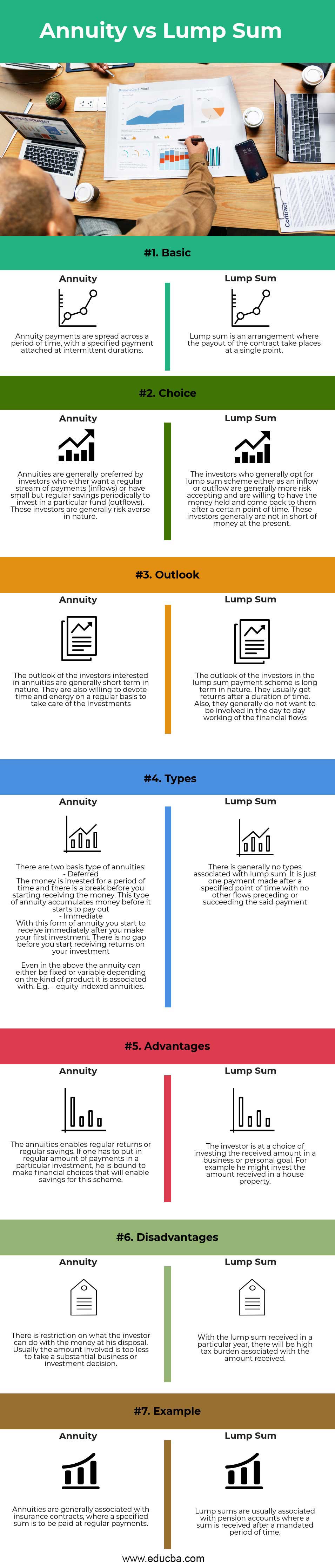

Annuity refers to a fixed payment on a regular basis which can be monthly or quarterly or on any other basis as per the contract whereas lump sum is a payment of the whole amount due at once and the whole amount is received in

Annuity And Lump Sum Difference provide a diverse selection of printable and downloadable materials that are accessible online for free cost. They are available in a variety of forms, like worksheets coloring pages, templates and much more. One of the advantages of Annuity And Lump Sum Difference is their versatility and accessibility.

More of Annuity And Lump Sum Difference

Setting Up A Secure Financial Future With Your Lottery Winnings

Setting Up A Secure Financial Future With Your Lottery Winnings

What is the difference between a lump sum and an annuity payment A lump sum payment is a one time payment while an annuity payment is a series of regular payments made over a period of time What factors should be considered when deciding between a lump sum and an annuity payment

A lump sum is often a payment that is paid out at once rather than through multiple payments paid out over time A lump sum allows you to collect all of your money at one time An annuity is often

Annuity And Lump Sum Difference have garnered immense popularity due to a myriad of compelling factors:

-

Cost-Effective: They eliminate the need to buy physical copies of the software or expensive hardware.

-

The ability to customize: Your HTML0 customization options allow you to customize designs to suit your personal needs in designing invitations making your schedule, or even decorating your house.

-

Educational Impact: These Annuity And Lump Sum Difference provide for students of all ages, making them an essential tool for teachers and parents.

-

It's easy: The instant accessibility to various designs and templates helps save time and effort.

Where to Find more Annuity And Lump Sum Difference

Monthly Annuity Or Lump Sum Due

Monthly Annuity Or Lump Sum Due

A lump sum pays out the full amount of money owed in one single payment An annuity pays the amount in smaller payments over a period of time Lump sums and annuities have pros and cons unique to their payout structure Both payment types have different tax implications depending on the investment type

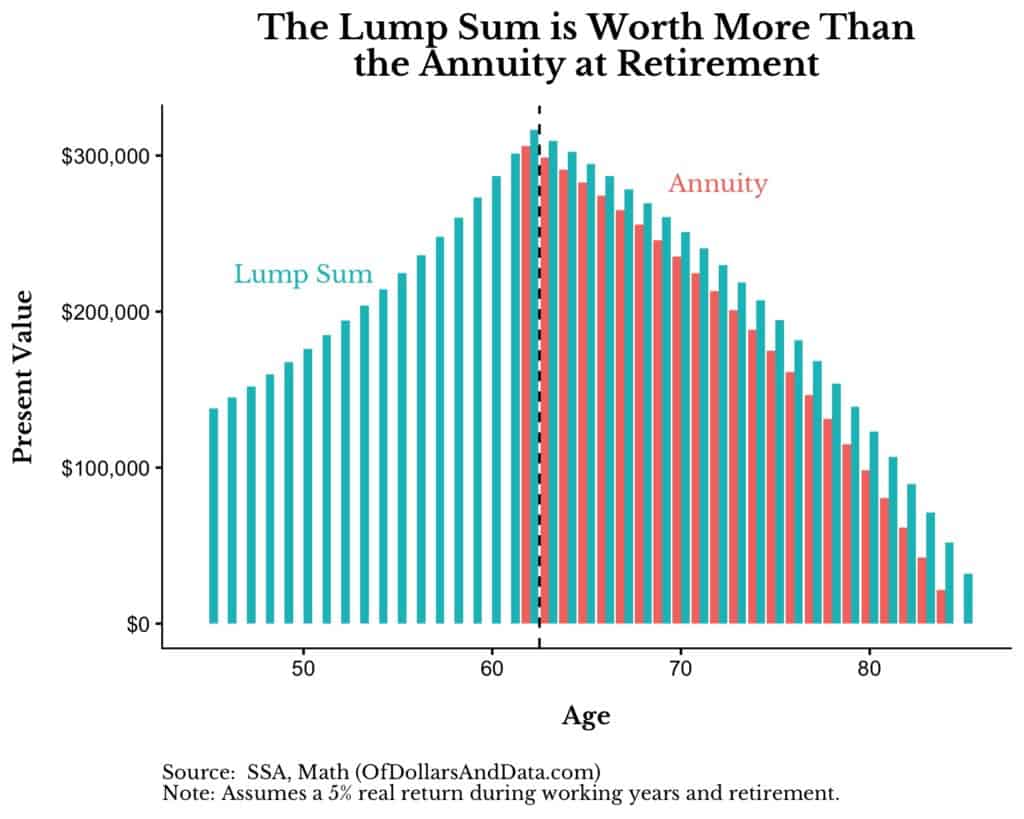

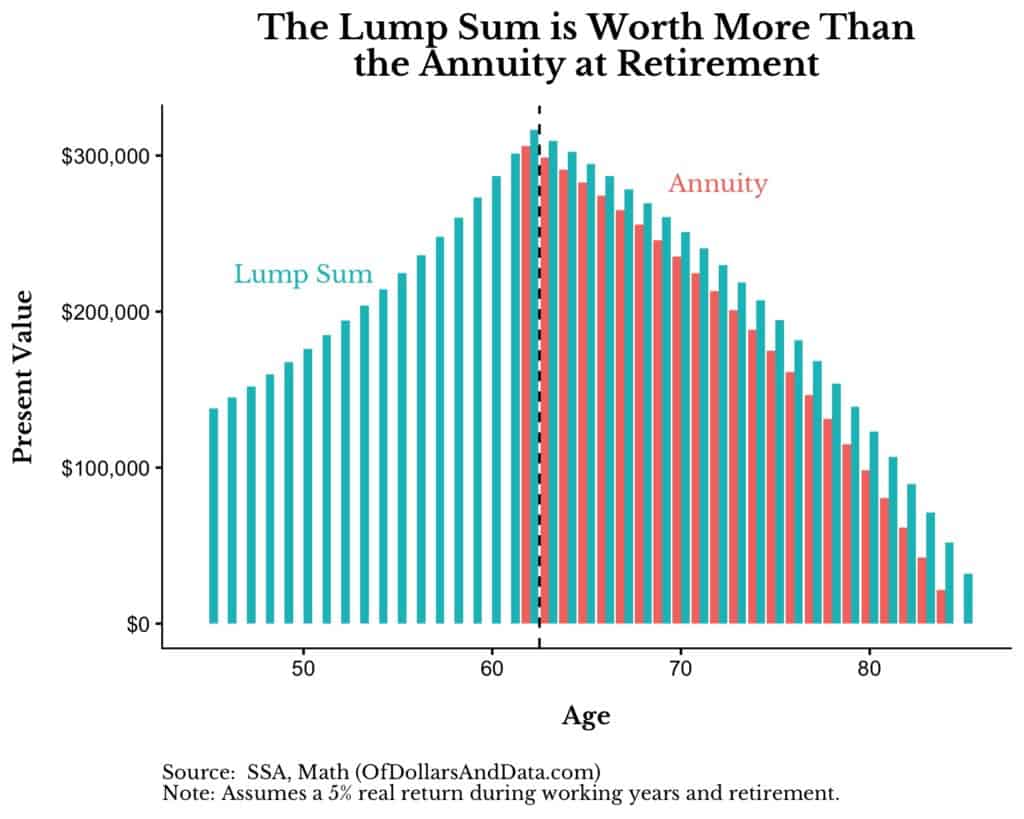

At age 65 you can choose between a single life annuity of 1 470 per month 17 640 per year for life or a lump sum payment of 300 000 At first glance the annuity may appear better as 17 640 per year is equivalent to that 300 000 consistently generating an annual return of 5 9 17 640 300 000 5 9

Now that we've ignited your interest in printables for free Let's look into where they are hidden treasures:

1. Online Repositories

- Websites like Pinterest, Canva, and Etsy offer an extensive collection of printables that are free for a variety of uses.

- Explore categories such as decorations for the home, education and organisation, as well as crafts.

2. Educational Platforms

- Educational websites and forums typically provide worksheets that can be printed for free including flashcards, learning materials.

- Perfect for teachers, parents and students looking for extra resources.

3. Creative Blogs

- Many bloggers share their imaginative designs as well as templates for free.

- The blogs are a vast range of topics, from DIY projects to party planning.

Maximizing Annuity And Lump Sum Difference

Here are some unique ways for you to get the best of printables for free:

1. Home Decor

- Print and frame beautiful artwork, quotes, or festive decorations to decorate your living spaces.

2. Education

- Utilize free printable worksheets to build your knowledge at home or in the classroom.

3. Event Planning

- Design invitations, banners, and decorations for special events such as weddings or birthdays.

4. Organization

- Make sure you are organized with printable calendars as well as to-do lists and meal planners.

Conclusion

Annuity And Lump Sum Difference are a treasure trove of creative and practical resources which cater to a wide range of needs and interests. Their accessibility and flexibility make them a great addition to both professional and personal lives. Explore the vast collection of Annuity And Lump Sum Difference and uncover new possibilities!

Frequently Asked Questions (FAQs)

-

Are the printables you get for free are they free?

- Yes they are! You can download and print these resources at no cost.

-

Does it allow me to use free printables for commercial use?

- It is contingent on the specific conditions of use. Always verify the guidelines provided by the creator before using printables for commercial projects.

-

Do you have any copyright issues in Annuity And Lump Sum Difference?

- Certain printables could be restricted concerning their use. You should read the conditions and terms of use provided by the creator.

-

How do I print Annuity And Lump Sum Difference?

- Print them at home with any printer or head to a local print shop for better quality prints.

-

What software must I use to open printables for free?

- A majority of printed materials are with PDF formats, which is open with no cost software, such as Adobe Reader.

Difference Between Ordinary Annuity And Annuity Due

Lump Sum Vs Annuity

Check more sample of Annuity And Lump Sum Difference below

Should You Take A Lump Sum Or An Annuity Balanced Wealth Management

Lump Sum Vs Annuity Pay Out Webinar With Peter Song View Financial

Lump Sum In Malay Tips To Take Retirement Money As Lump Sum Or

Should You Take The Annuity Or The Lump Sum Of Dollars And Data

Difference Between Annuity And Lump Sum Payment Infographics

Top 18 5 What Is A Fixed Annuity 2022 Things To Know Dream Cheeky

https://www.wallstreetmojo.com/annuity-vs-lump-sum

Annuity refers to a fixed payment on a regular basis which can be monthly or quarterly or on any other basis as per the contract whereas lump sum is a payment of the whole amount due at once and the whole amount is received in

https://www.schwab.com/learn/story/investing-lump-sum-vs-annuity

At age 65 you can choose between a single life annuity of 1 470 per month 17 640 per year for life or a lump sum payment of 300 000 At first glance the annuity may appear better as 17 640 per year is equivalent to that 300 000 consistently generating an annual return of 5 9 17 640 300 000 5 9

Annuity refers to a fixed payment on a regular basis which can be monthly or quarterly or on any other basis as per the contract whereas lump sum is a payment of the whole amount due at once and the whole amount is received in

At age 65 you can choose between a single life annuity of 1 470 per month 17 640 per year for life or a lump sum payment of 300 000 At first glance the annuity may appear better as 17 640 per year is equivalent to that 300 000 consistently generating an annual return of 5 9 17 640 300 000 5 9

Should You Take The Annuity Or The Lump Sum Of Dollars And Data

Lump Sum Vs Annuity Pay Out Webinar With Peter Song View Financial

Difference Between Annuity And Lump Sum Payment Infographics

Top 18 5 What Is A Fixed Annuity 2022 Things To Know Dream Cheeky

Lump Sum Or Annuity Quiz The Sudden Wealth Solution

Annuity Vs Lump Sum Top 7 Useful Differences To Know

Annuity Vs Lump Sum Top 7 Useful Differences To Know

Get Your Jackpot In Annuity Or Lump Sum Which Is The Best