In this age of electronic devices, where screens dominate our lives however, the attraction of tangible printed items hasn't gone away. If it's to aid in education for creative projects, simply adding an individual touch to your area, 80c Tax Rebate have become a valuable source. We'll take a dive in the world of "80c Tax Rebate," exploring the benefits of them, where to find them and what they can do to improve different aspects of your daily life.

Get Latest 80c Tax Rebate Below

80c Tax Rebate

80c Tax Rebate - 80c Tax Rebate, 80c Tax Exemption Limit 2022-23, 80c Tax Benefit Limit, 80c Tax Benefit Schemes, 80c Tax Deduction List, 80c Tax Exemption Limit 2023-24, 80c Tax Exemption Mutual Funds, 80c Tax Exemption Calculation, 80c Tax Exemption Fixed Deposit, 80c Tax Exemption Limit 2021-22

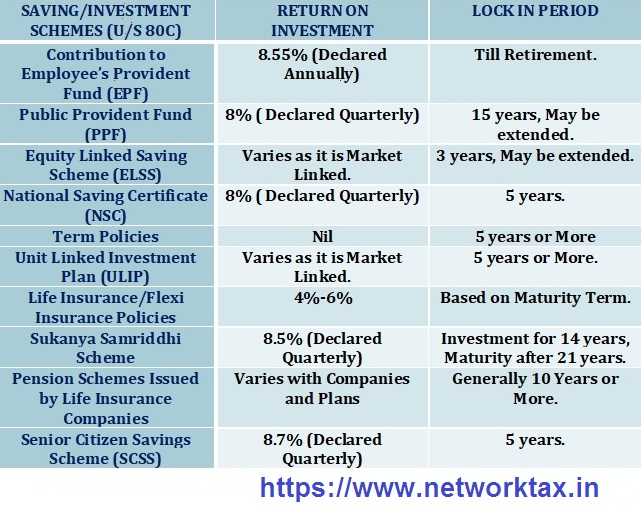

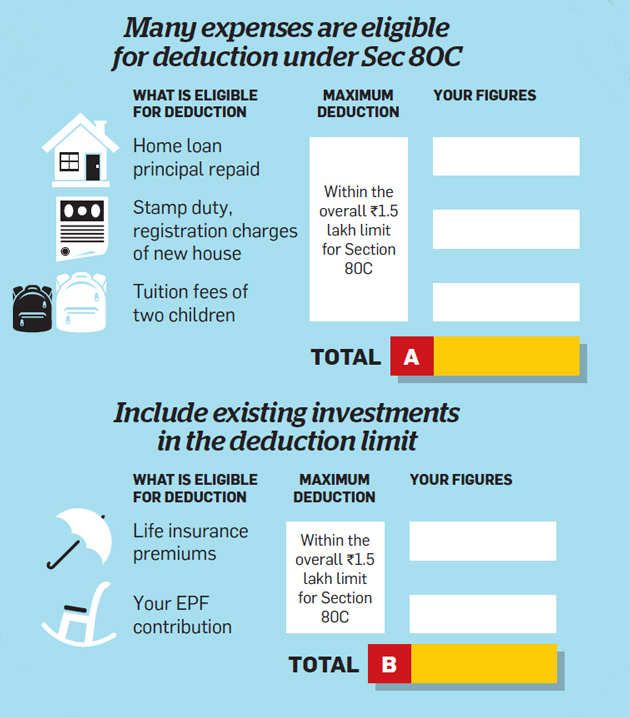

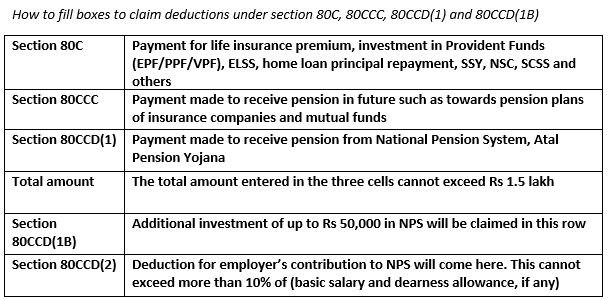

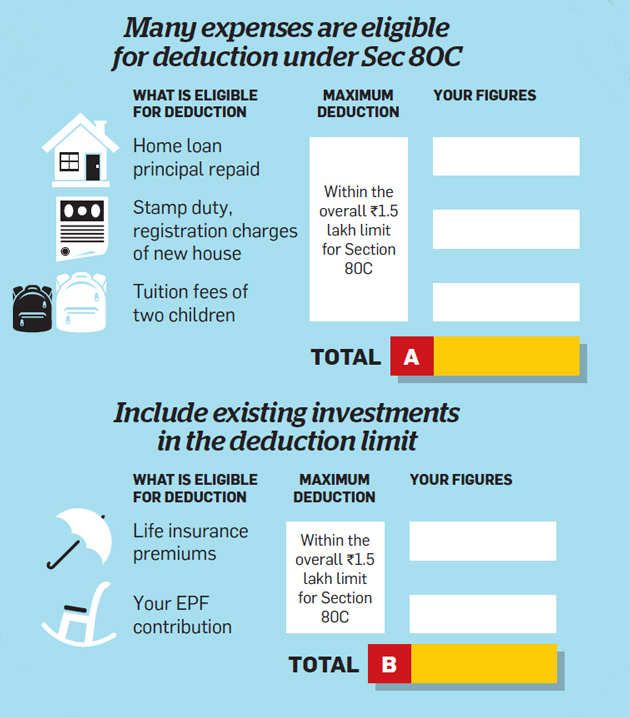

Web 6 sept 2023 nbsp 0183 32 Section 80C An individual can claim a deduction up to INR 1 5 lakh of the total income under Section 80C Rebate under section 80C is only available for HUF and individuals Apart from 80C there are other

Web 30 janv 2022 nbsp 0183 32 Seven ways to get the Section 80C tax rebate Shipra Singh 4 min read 31 Jan 2022 12 00 AM IST Istock Summary Most of the time tax saving instruments are

The 80c Tax Rebate are a huge variety of printable, downloadable resources available online for download at no cost. These resources come in various designs, including worksheets coloring pages, templates and more. The benefit of 80c Tax Rebate is their flexibility and accessibility.

More of 80c Tax Rebate

How To Claim Health Insurance Under Section 80D From 2018 19

How To Claim Health Insurance Under Section 80D From 2018 19

Web 11 janv 2023 nbsp 0183 32 How to maximise tax rebate under Section 80C Deductions allowed on home loan interest Deductions under Section 24 Terms and conditions for home buyers

Web 1 f 233 vr 2023 nbsp 0183 32 Going by the current income tax slab and rates the deduction under section 80C can help an individual paying tax at 31 2 per cent to save tax of Rs 46 800 This tax saving is inclusive of cess at 4 per cent and

80c Tax Rebate have gained immense popularity due to numerous compelling reasons:

-

Cost-Effective: They eliminate the necessity to purchase physical copies of the software or expensive hardware.

-

The ability to customize: The Customization feature lets you tailor printables to fit your particular needs whether it's making invitations as well as organizing your calendar, or even decorating your house.

-

Education Value Printing educational materials for no cost are designed to appeal to students of all ages. This makes them a vital tool for parents and educators.

-

Affordability: You have instant access the vast array of design and templates saves time and effort.

Where to Find more 80c Tax Rebate

80C TO 80U DEDUCTIONS LIST PDF

80C TO 80U DEDUCTIONS LIST PDF

Web 28 mai 2020 nbsp 0183 32 Deduction on stamp duty and registration charges on property purchase could be claimed under Section 80C of the Income Tax Act 1961 Under Section 80C a homebuyer not only claims rebate on his home

Web Section 80C Investment in ELSS Fund or Tax Saving Mutual Fund is considered as the best tax saving option These funds are specially designed to give you dual benefit of saving taxes and getting higher

After we've peaked your interest in printables for free, let's explore where they are hidden gems:

1. Online Repositories

- Websites like Pinterest, Canva, and Etsy provide a variety of printables that are free for a variety of purposes.

- Explore categories such as home decor, education, organisation, as well as crafts.

2. Educational Platforms

- Educational websites and forums usually provide free printable worksheets or flashcards as well as learning tools.

- Ideal for teachers, parents as well as students who require additional resources.

3. Creative Blogs

- Many bloggers provide their inventive designs with templates and designs for free.

- These blogs cover a broad spectrum of interests, everything from DIY projects to party planning.

Maximizing 80c Tax Rebate

Here are some ways create the maximum value of printables for free:

1. Home Decor

- Print and frame beautiful artwork, quotes, or seasonal decorations to adorn your living areas.

2. Education

- Use printable worksheets for free to build your knowledge at home also in the classes.

3. Event Planning

- Make invitations, banners and decorations for special events like birthdays and weddings.

4. Organization

- Be organized by using printable calendars along with lists of tasks, and meal planners.

Conclusion

80c Tax Rebate are an abundance of fun and practical tools that cater to various needs and pursuits. Their access and versatility makes them an invaluable addition to your professional and personal life. Explore the world of 80c Tax Rebate to uncover new possibilities!

Frequently Asked Questions (FAQs)

-

Are 80c Tax Rebate really available for download?

- Yes, they are! You can print and download these materials for free.

-

Can I utilize free printables in commercial projects?

- It's based on the conditions of use. Make sure you read the guidelines for the creator prior to printing printables for commercial projects.

-

Do you have any copyright rights issues with printables that are free?

- Some printables may have restrictions in use. Make sure to read the terms and conditions set forth by the creator.

-

How can I print printables for free?

- You can print them at home with either a printer at home or in the local print shop for higher quality prints.

-

What software is required to open 80c Tax Rebate?

- Many printables are offered as PDF files, which is open with no cost software like Adobe Reader.

DEDUCTION UNDER SECTION 80C TO 80U PDF

Income Tax For Under Construction House The Property Files

Check more sample of 80c Tax Rebate below

HOW TO SAVE TAX UNDER SECTION 80 C WHAT COMES UNDER SECTION 80C FULL

80C Checklist Tax Checklist Indirect Tax Income Tax

Common Tax Benefits Under Section 80C Of Income Tax Act 1961 With

Have You Utilised The Sec 80C Tax Saving Limit Fully Find Out The

Budget 2014 Impact On Money Taxes And Savings

Tax Benefit Investment Know About Section 80C Deductions

https://www.livemint.com/money/personal-finance/seven-ways-to-get-the...

Web 30 janv 2022 nbsp 0183 32 Seven ways to get the Section 80C tax rebate Shipra Singh 4 min read 31 Jan 2022 12 00 AM IST Istock Summary Most of the time tax saving instruments are

https://www.financialexpress.com/money/income-tax/before-claiming...

Web 8 juin 2021 nbsp 0183 32 Tax benefit for repayment of the principal amount of home loans is eligible for deduction under Section 80C but the deduction is available only in respect of home

Web 30 janv 2022 nbsp 0183 32 Seven ways to get the Section 80C tax rebate Shipra Singh 4 min read 31 Jan 2022 12 00 AM IST Istock Summary Most of the time tax saving instruments are

Web 8 juin 2021 nbsp 0183 32 Tax benefit for repayment of the principal amount of home loans is eligible for deduction under Section 80C but the deduction is available only in respect of home

Have You Utilised The Sec 80C Tax Saving Limit Fully Find Out The

80C Checklist Tax Checklist Indirect Tax Income Tax

Budget 2014 Impact On Money Taxes And Savings

Tax Benefit Investment Know About Section 80C Deductions

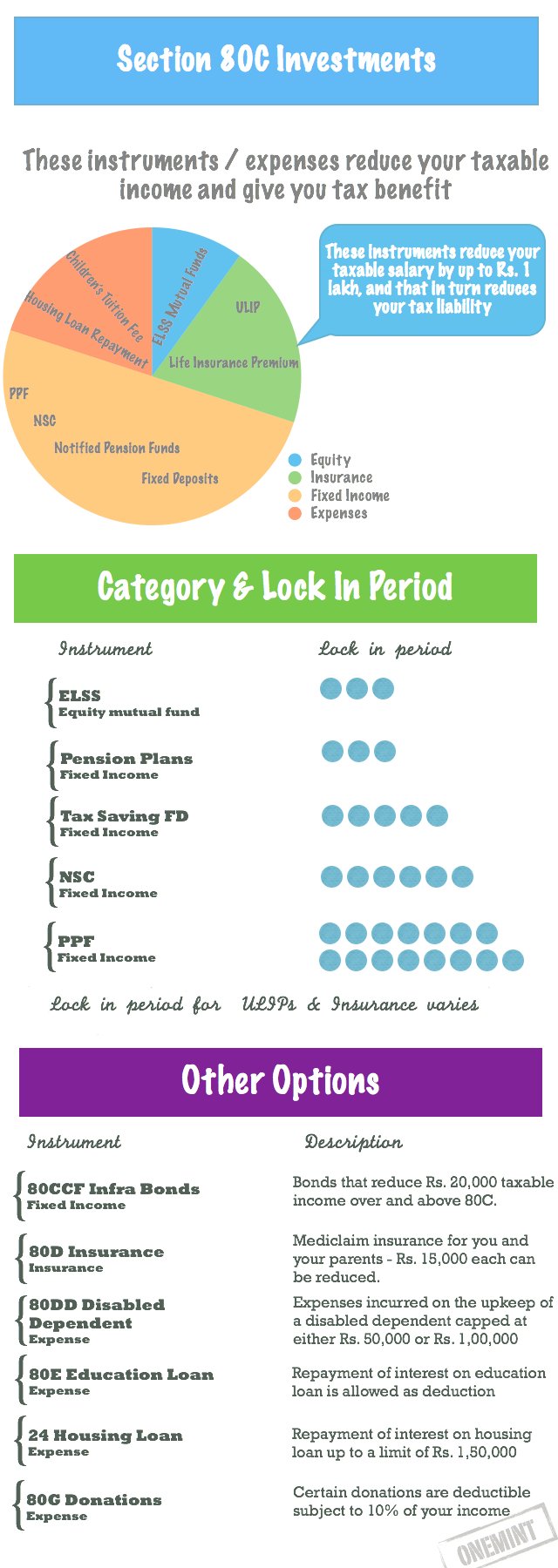

Section 80C Tax Saving Instruments Infographic OneMint

Income Tax 80C TAMNEWS

Income Tax 80C TAMNEWS

Section 80C 80 Investment