In the digital age, where screens rule our lives The appeal of tangible printed products hasn't decreased. Whether it's for educational purposes for creative projects, simply adding some personal flair to your area, 500 Dollar Tax Credit 2022 are now an essential resource. The following article is a take a dive deep into the realm of "500 Dollar Tax Credit 2022," exploring what they are, how to find them and what they can do to improve different aspects of your life.

Get Latest 500 Dollar Tax Credit 2022 Below

500 Dollar Tax Credit 2022

500 Dollar Tax Credit 2022 - 500 Dollar Tax Credit 2022, 500 Dollar Child Tax Credit 2022

According to the IRS the maximum amount a parent can receive for the Credit for Other Dependents tax credit is 500 per dependent These payments will be issued as part of your 2021 tax

The 500 Credit for Other Dependents aka Family Tax Credit was signed into law as part of the 2017 Tax Cuts and Jobs Act and is in effect for tax years 2018 through 2025 The credit allows taxpayers a credit for certain dependents that don t qualify for the Child Tax Credit such as qualifying children age 17 or older adult dependents

500 Dollar Tax Credit 2022 cover a large collection of printable material that is available online at no cost. The resources are offered in a variety kinds, including worksheets templates, coloring pages and much more. The great thing about 500 Dollar Tax Credit 2022 is their flexibility and accessibility.

More of 500 Dollar Tax Credit 2022

EITC TAX CREDIT 2022 EARNED INCOME TAX CREDIT CALCULATOR 2022 YouTube

EITC TAX CREDIT 2022 EARNED INCOME TAX CREDIT CALCULATOR 2022 YouTube

Taxpayers can claim the tax credit for about 374 000 children under six in 2022 the analysis said At least 180 700 children would be eligible for the full 500 while another 99 500 could

What is the 500 claim and who is eligible CRA allows all employees who worked from home during the COVID 19 pandemic in 2022 to claim up to 500 in employment expenses as a flat rate This amount is a tax deduction and not a credit which means you deduct it from your income to reduce your tax liability but will not result in a

500 Dollar Tax Credit 2022 have gained a lot of popularity because of a number of compelling causes:

-

Cost-Effective: They eliminate the necessity to purchase physical copies or expensive software.

-

Individualization They can make printing templates to your own specific requirements when it comes to designing invitations as well as organizing your calendar, or decorating your home.

-

Educational Use: Downloads of educational content for free are designed to appeal to students of all ages, which makes these printables a powerful instrument for parents and teachers.

-

Convenience: The instant accessibility to various designs and templates helps save time and effort.

Where to Find more 500 Dollar Tax Credit 2022

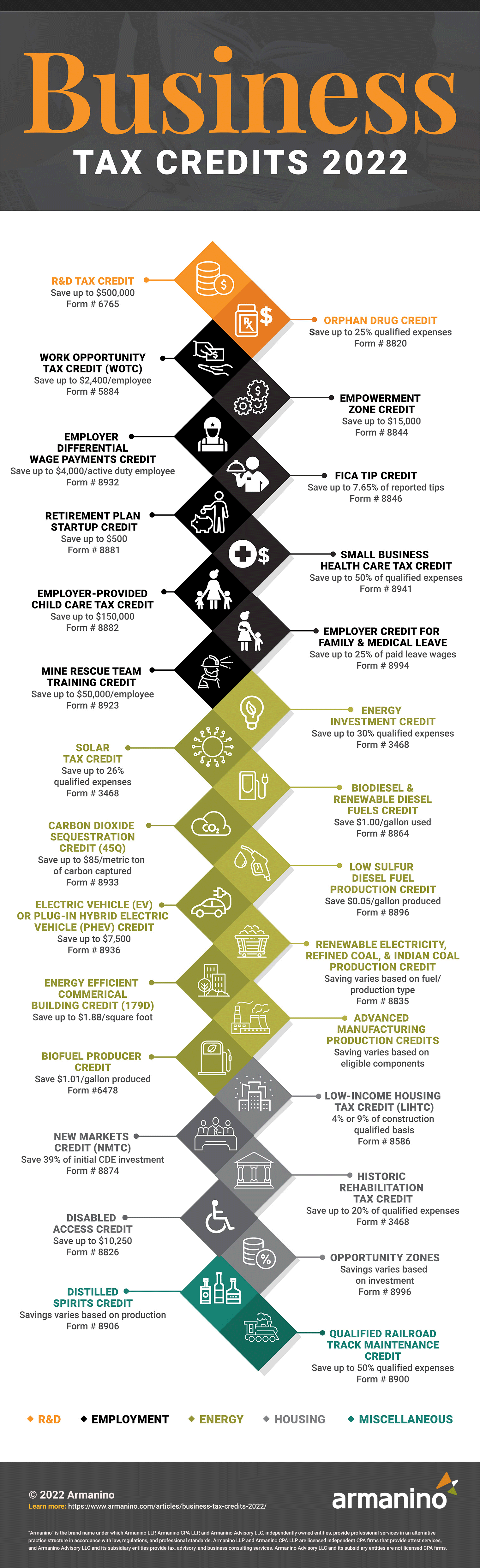

2022 Business Tax Credits Armanino

2022 Business Tax Credits Armanino

Gov Parson vetoes budget item sending 500 tax credits to many Missourians Update July 1 2022 Gov Parson vetoed 500 million set aside in the state budget to send income tax rebates to many Missourians This story has been updated to reflect that change by Meg Cunningham May 12 2022

Tax Credits Deductions The Tax Credit for Other Dependents for Tax Year 2022 You can claim a tax credit for dependents that aren t your children By Beverly Bird Updated on December 16 2022 Reviewed by Ebony J Howard Fact checked by Lars Peterson In This Article Photo katleho Seisa Getty Images

In the event that we've stirred your interest in 500 Dollar Tax Credit 2022 Let's see where you can find these gems:

1. Online Repositories

- Websites such as Pinterest, Canva, and Etsy provide a wide selection of 500 Dollar Tax Credit 2022 designed for a variety purposes.

- Explore categories like decorations for the home, education and crafting, and organization.

2. Educational Platforms

- Educational websites and forums frequently provide free printable worksheets along with flashcards, as well as other learning tools.

- It is ideal for teachers, parents and students looking for extra sources.

3. Creative Blogs

- Many bloggers are willing to share their original designs with templates and designs for free.

- The blogs are a vast range of interests, from DIY projects to planning a party.

Maximizing 500 Dollar Tax Credit 2022

Here are some ways that you can make use use of printables for free:

1. Home Decor

- Print and frame stunning images, quotes, or other seasonal decorations to fill your living areas.

2. Education

- Use these printable worksheets free of charge for teaching at-home, or even in the classroom.

3. Event Planning

- Design invitations for banners, invitations as well as decorations for special occasions like weddings or birthdays.

4. Organization

- Stay organized by using printable calendars or to-do lists. meal planners.

Conclusion

500 Dollar Tax Credit 2022 are a treasure trove filled with creative and practical information which cater to a wide range of needs and preferences. Their accessibility and flexibility make these printables a useful addition to every aspect of your life, both professional and personal. Explore the many options that is 500 Dollar Tax Credit 2022 today, and unlock new possibilities!

Frequently Asked Questions (FAQs)

-

Are 500 Dollar Tax Credit 2022 really for free?

- Yes, they are! You can download and print these documents for free.

-

Do I have the right to use free printables for commercial use?

- It's determined by the specific usage guidelines. Be sure to read the rules of the creator before utilizing their templates for commercial projects.

-

Do you have any copyright issues in 500 Dollar Tax Credit 2022?

- Certain printables could be restricted on their use. Be sure to check these terms and conditions as set out by the creator.

-

How can I print printables for free?

- Print them at home using printing equipment or visit any local print store for the highest quality prints.

-

What program do I need in order to open printables that are free?

- The majority of printables are in the format PDF. This can be opened using free software, such as Adobe Reader.

2022 Standard Deduction Amounts Are Now Available Bankruptcy L Lawyers

Child Tax Credit 2022 When Is The IRS Releasing Refunds With CTC Marca

Check more sample of 500 Dollar Tax Credit 2022 below

Child Tax Credit 2022 How Much Can You Get Shared Economy Tax

IRS W4 Form 2022 Printable PDF Explained 2022 W 4 Form

524 Credit Score Credit Card

Federal Solar Tax Credit What It Is How To Claim It For 2023

The Price Of The Dollar Today And Exchange Rate February 23 2022

What Is The ERC Tax Credit 2022 Updated For 2023 Qualifications For

https:// ttlc.intuit.com /.../L8nYkfc1Q_US_en_US

The 500 Credit for Other Dependents aka Family Tax Credit was signed into law as part of the 2017 Tax Cuts and Jobs Act and is in effect for tax years 2018 through 2025 The credit allows taxpayers a credit for certain dependents that don t qualify for the Child Tax Credit such as qualifying children age 17 or older adult dependents

https://www. irs.gov /newsroom/tax-credits-for...

FS 2023 09 April 2023 A tax credit is a dollar for dollar amount taxpayers claim on their tax return to reduce the income tax they owe Eligible taxpayers can use them to reduce their tax bill and potentially increase their refund Refundable vs nonrefundable tax credits Some tax credits are refundable

The 500 Credit for Other Dependents aka Family Tax Credit was signed into law as part of the 2017 Tax Cuts and Jobs Act and is in effect for tax years 2018 through 2025 The credit allows taxpayers a credit for certain dependents that don t qualify for the Child Tax Credit such as qualifying children age 17 or older adult dependents

FS 2023 09 April 2023 A tax credit is a dollar for dollar amount taxpayers claim on their tax return to reduce the income tax they owe Eligible taxpayers can use them to reduce their tax bill and potentially increase their refund Refundable vs nonrefundable tax credits Some tax credits are refundable

Federal Solar Tax Credit What It Is How To Claim It For 2023

IRS W4 Form 2022 Printable PDF Explained 2022 W 4 Form

The Price Of The Dollar Today And Exchange Rate February 23 2022

What Is The ERC Tax Credit 2022 Updated For 2023 Qualifications For

2022 Education Tax Credits Are You Eligible

Child Tax Credit 2022 Income Phase Out Latest News Update

Child Tax Credit 2022 Income Phase Out Latest News Update

New 2022 IRS Income Tax Brackets And Phaseouts For Education Tax Breaks