In a world where screens rule our lives however, the attraction of tangible printed materials isn't diminishing. Whether it's for educational purposes for creative projects, simply to add an extra personal touch to your area, 1098 T Tax Return are a great source. We'll dive deeper into "1098 T Tax Return," exploring what they are, how you can find them, and how they can enhance various aspects of your life.

Get Latest 1098 T Tax Return Below

1098 T Tax Return

1098 T Tax Return - 1098 T Tax Return, 1098-t Tax Return Calculator, 1098-t Tax Form For International Students, 1098-t Tax Form Explained, 1098 T Tax Refund, 1098-t Tax Form 2022, 1098-t Tax Form Ucsd, 1098 T Tax Form Temple University, 1098-t Tax Reporting, 1098-t Tax Form Box 1

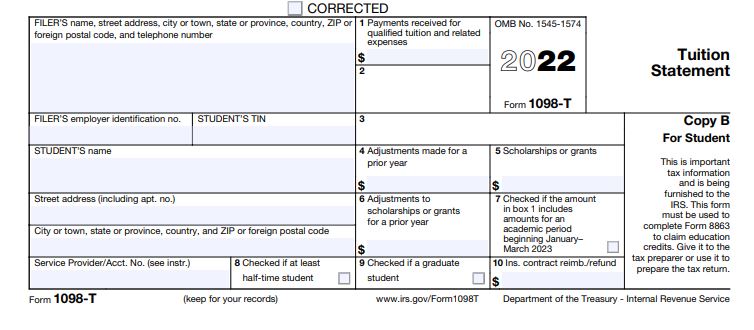

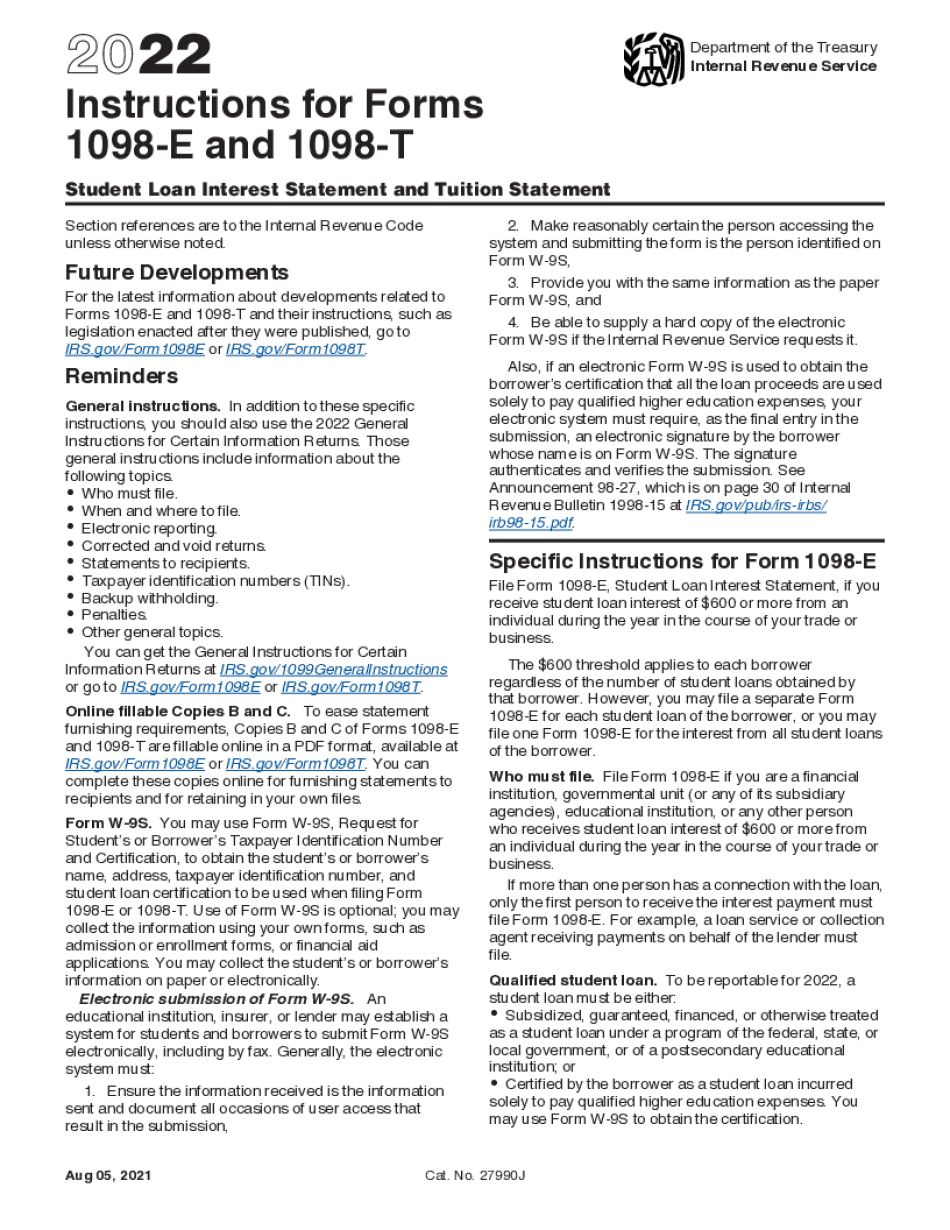

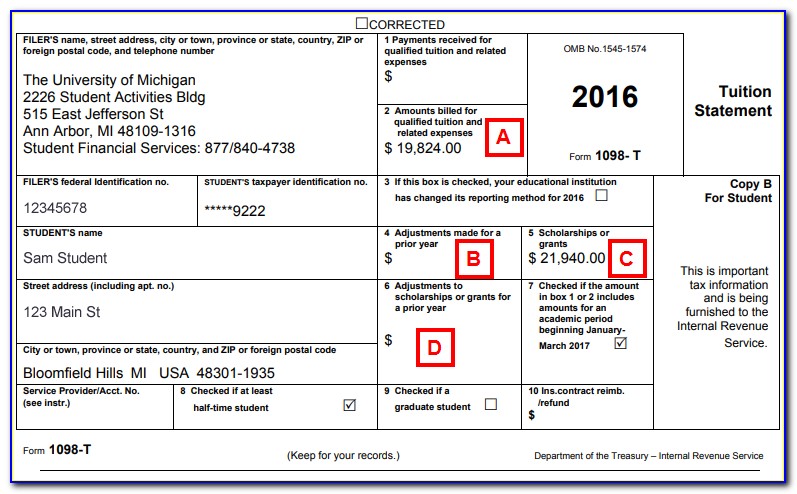

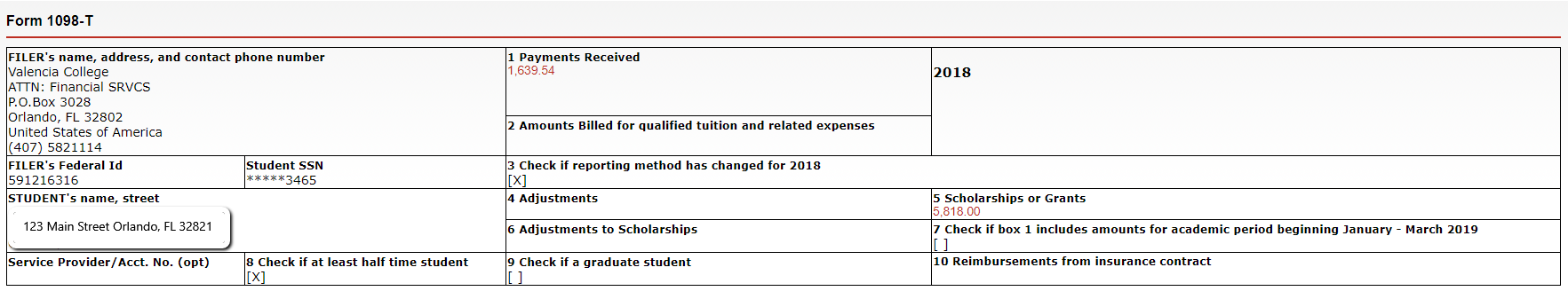

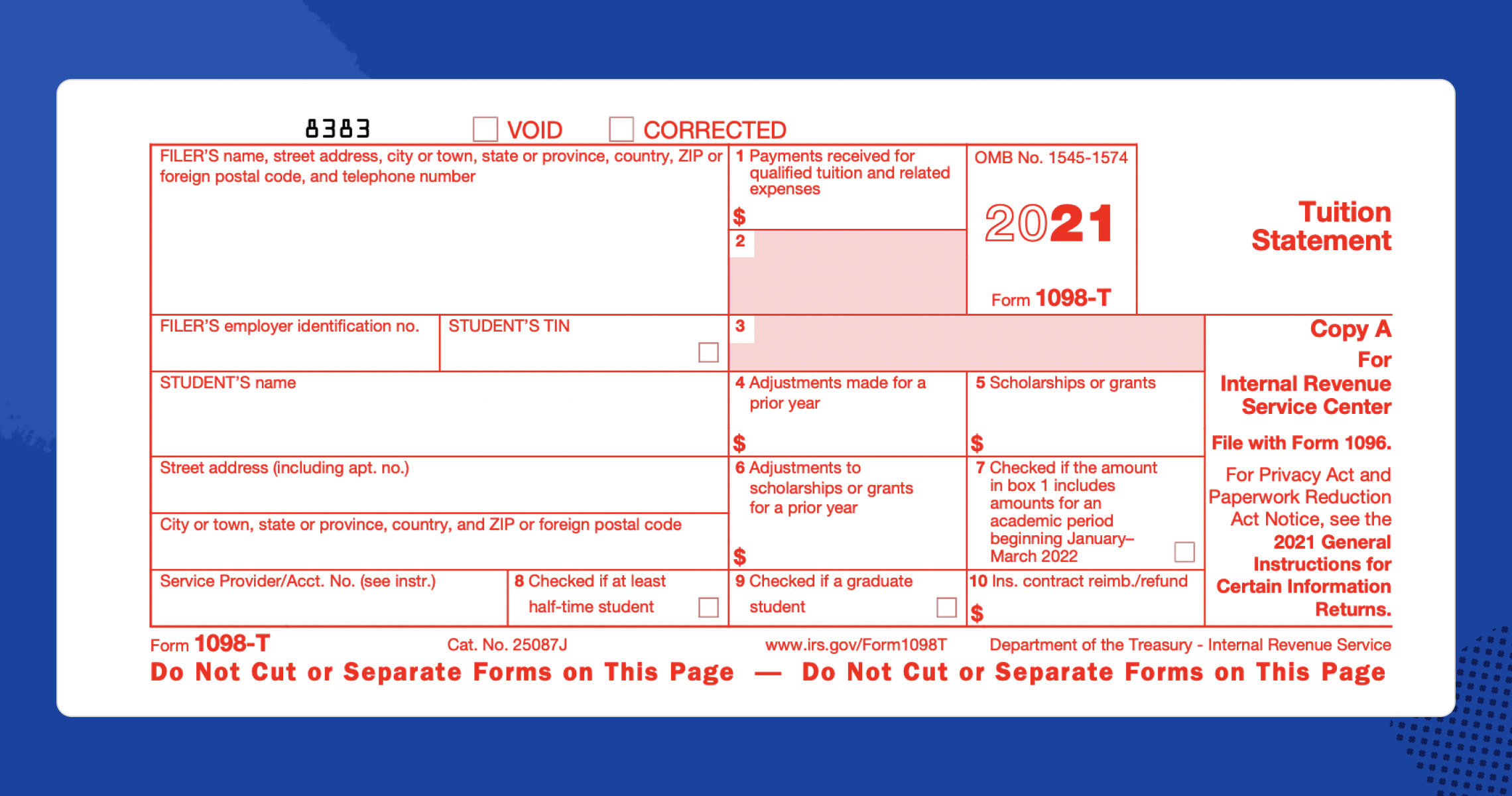

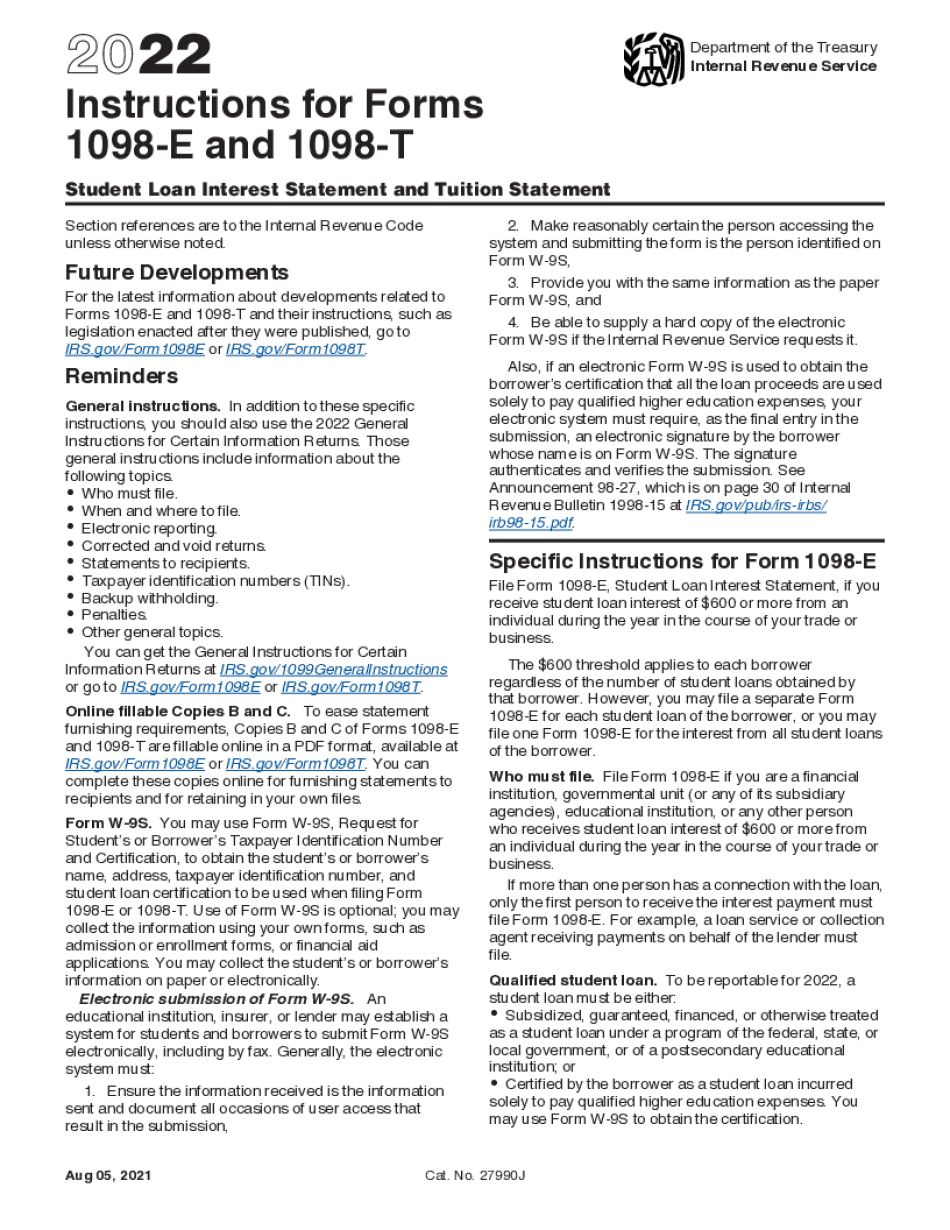

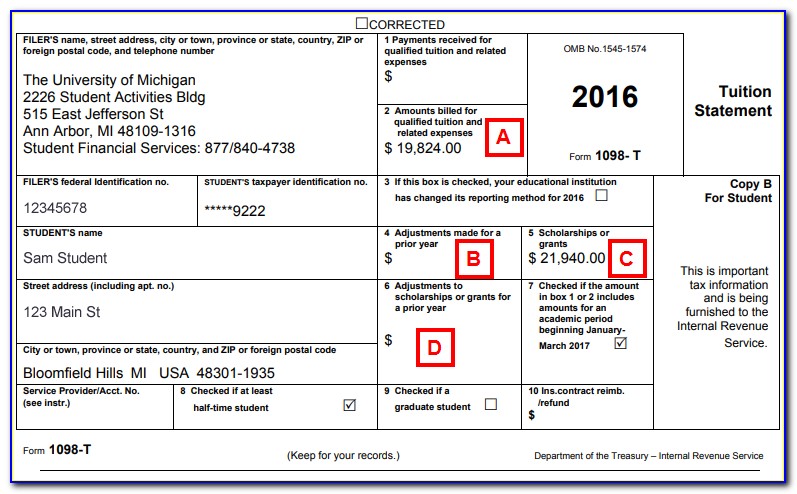

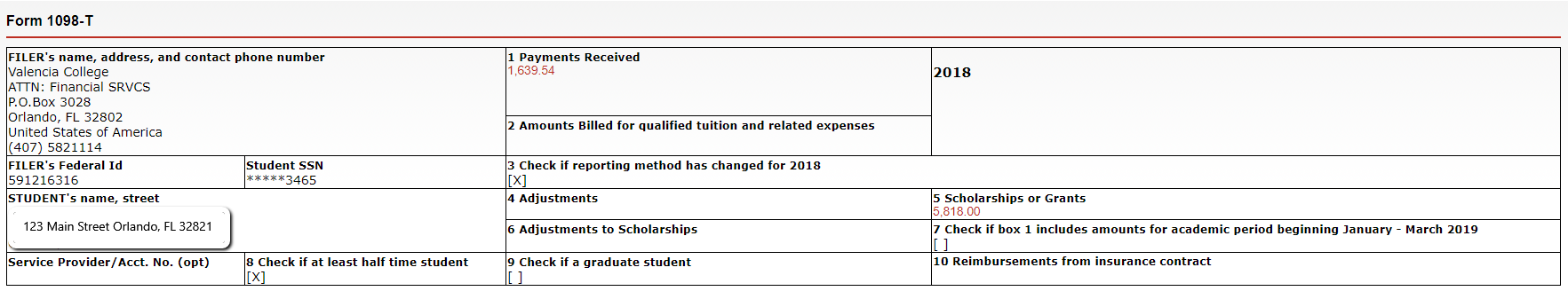

Q18 What is Form 1098 T Tuition Statement and do I need to receive a Form 1098 T to claim the AOTC A18 Yes The Form 1098 T is a form provided to you and the IRS by an eligible educational institution that reports among other things amounts paid for qualified tuition and related expenses

Who gets the 1098 T form Schools are required to send Form 1098 T to any student who paid qualified educational expenses in the preceding tax year Qualified expenses include tuition fees that are required for enrollment course materials required for a

1098 T Tax Return cover a large assortment of printable, downloadable materials online, at no cost. They are available in a variety of kinds, including worksheets templates, coloring pages, and more. The value of 1098 T Tax Return lies in their versatility as well as accessibility.

More of 1098 T Tax Return

1098 T Form How To Complete And File Your Tuition Statement

1098 T Form How To Complete And File Your Tuition Statement

Form 1098 T Tuition Statement explained Schools must make Form 1098 T available to any student who paid in the previous tax year qualified educational expenses Tuition any fees that are required for enrollment and course materials the student was required to buy from the school are qualified expenses

Form 1098 T contains helpful instructions and other information you ll need to claim education credits on your federal tax form These credits help offset your out of pocket expenses for tuition and fees books and equipment

1098 T Tax Return have risen to immense popularity due to numerous compelling reasons:

-

Cost-Efficiency: They eliminate the necessity to purchase physical copies or expensive software.

-

The ability to customize: It is possible to tailor print-ready templates to your specific requirements in designing invitations or arranging your schedule or even decorating your home.

-

Educational Worth: Downloads of educational content for free cater to learners of all ages, which makes them an essential instrument for parents and teachers.

-

Affordability: Quick access to a myriad of designs as well as templates cuts down on time and efforts.

Where to Find more 1098 T Tax Return

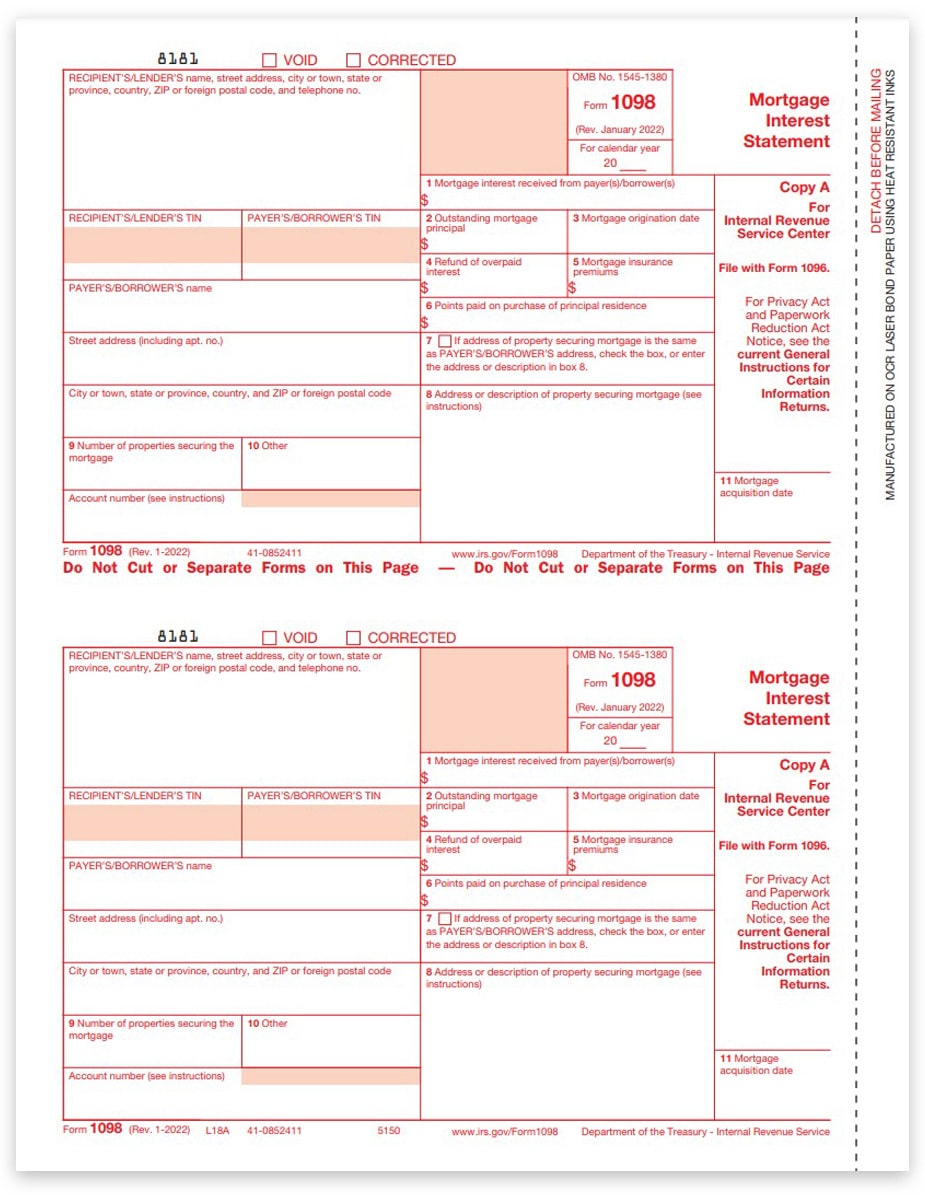

1098 Tax Forms For Mortgage Interest Copy B ZBPforms

1098 Tax Forms For Mortgage Interest Copy B ZBPforms

A 1098 T form or tuition statement is an American IRS tax form filed by eligible education institutions to report payments received and payments due from paying students The institution is required to report a form for every student who is currently enrolled and paying qualifying tuition and related expenses to attend their school

Schools are supposed to give a Form 1098 T to students by Jan 31 of the calendar year following the tax year in which the expenses were paid Here s what to know about this form and what to do with it when you file your federal income tax return

If we've already piqued your interest in printables for free Let's take a look at where the hidden gems:

1. Online Repositories

- Websites like Pinterest, Canva, and Etsy have a large selection in 1098 T Tax Return for different motives.

- Explore categories such as interior decor, education, crafting, and organization.

2. Educational Platforms

- Forums and websites for education often offer worksheets with printables that are free or flashcards as well as learning materials.

- Great for parents, teachers and students looking for extra sources.

3. Creative Blogs

- Many bloggers are willing to share their original designs and templates, which are free.

- The blogs covered cover a wide spectrum of interests, starting from DIY projects to party planning.

Maximizing 1098 T Tax Return

Here are some unique ways in order to maximize the use of 1098 T Tax Return:

1. Home Decor

- Print and frame beautiful artwork, quotes, and seasonal decorations, to add a touch of elegance to your living spaces.

2. Education

- Use these printable worksheets free of charge to build your knowledge at home or in the classroom.

3. Event Planning

- Create invitations, banners, and other decorations for special occasions like birthdays and weddings.

4. Organization

- Be organized by using printable calendars or to-do lists. meal planners.

Conclusion

1098 T Tax Return are an abundance of innovative and useful resources designed to meet a range of needs and hobbies. Their availability and versatility make them an essential part of any professional or personal life. Explore the vast array of printables for free today and unlock new possibilities!

Frequently Asked Questions (FAQs)

-

Do printables with no cost really completely free?

- Yes, they are! You can print and download these items for free.

-

Do I have the right to use free printables for commercial use?

- It's based on the terms of use. Make sure you read the guidelines for the creator prior to printing printables for commercial projects.

-

Are there any copyright concerns when using printables that are free?

- Some printables may have restrictions regarding usage. You should read the terms of service and conditions provided by the creator.

-

How do I print printables for free?

- Print them at home with an printer, or go to an in-store print shop to get the highest quality prints.

-

What program do I need in order to open printables free of charge?

- The majority of printables are in PDF format. These is open with no cost software, such as Adobe Reader.

1098 T Form 2023 Pdf Printable Forms Free Online

IRS Form 1098 T University Of Dayton Ohio

Check more sample of 1098 T Tax Return below

Form 1098 T Information Student Financial Services CSUSM

Where To Put 1098 T On Tax Return H r Block Fill Online Printable

How To File Your 1098 T Form Universal Network

Free File Fillable Forms 1098 T Printable Forms Free Online

Blank 1098 T Form Form Resume Examples qlkmaBjkaj

1098 T Payment Statements Business Office Valencia College

turbotax.intuit.com /tax-tips/college-and...

Who gets the 1098 T form Schools are required to send Form 1098 T to any student who paid qualified educational expenses in the preceding tax year Qualified expenses include tuition fees that are required for enrollment course materials required for a

ttlc.intuit.com /turbotax-support/en-us/...

Here s how to enter your 1098 T in TurboTax Desktop Open or continue your return Select Federal Taxes and then Deductions Credits Select I ll choose what I work on Under Education select Start or Update next to ESA and 529 qualified tuition programs Form 1099 Q Follow the screens to enter your info Some important tips about entering

Who gets the 1098 T form Schools are required to send Form 1098 T to any student who paid qualified educational expenses in the preceding tax year Qualified expenses include tuition fees that are required for enrollment course materials required for a

Here s how to enter your 1098 T in TurboTax Desktop Open or continue your return Select Federal Taxes and then Deductions Credits Select I ll choose what I work on Under Education select Start or Update next to ESA and 529 qualified tuition programs Form 1099 Q Follow the screens to enter your info Some important tips about entering

Free File Fillable Forms 1098 T Printable Forms Free Online

Where To Put 1098 T On Tax Return H r Block Fill Online Printable

Blank 1098 T Form Form Resume Examples qlkmaBjkaj

1098 T Payment Statements Business Office Valencia College

Form 1098 T Quickly Securely File Tuition Statement Return

Where Do I Enter My 1098 T

Where Do I Enter My 1098 T

Form 1098 Mortgage Interest Statement