In this age of technology, where screens rule our lives it's no wonder that the appeal of tangible, printed materials hasn't diminished. Whatever the reason, whether for education such as creative projects or just adding some personal flair to your area, Work Commute Tax Deduction are a great source. In this article, we'll dive deep into the realm of "Work Commute Tax Deduction," exploring their purpose, where you can find them, and what they can do to improve different aspects of your life.

Get Latest Work Commute Tax Deduction Below

Work Commute Tax Deduction

Work Commute Tax Deduction -

Unfortunately commuting costs are not tax deductible Commuting expenses incurred between your home and your main place of work no matter how far are not an allowable deduction Costs of driving a car from home to work and back again are personal commuting expenses

Commuting expenses If you work remotely for part of the week you can deduct commuting expenses only for the days when you actually go to your workplace Check your pre completed tax return to make sure the commuting expenses correspond to your actual commuting expenses in 2023 Correct the information if necessary

Work Commute Tax Deduction provide a diverse array of printable materials online, at no cost. The resources are offered in a variety designs, including worksheets templates, coloring pages, and many more. The benefit of Work Commute Tax Deduction is in their versatility and accessibility.

More of Work Commute Tax Deduction

Special Tax Deduction On Renovation Extension Jan 20 2022 Johor

Special Tax Deduction On Renovation Extension Jan 20 2022 Johor

The value of the deduction is approx 26 Example If your deduction for transport between home and work is DKK 5 000 you will save approx DKK 1 300 in tax Transport deduction rates for 2024 and 2023 Use your official address and the actual distance you travel If you earn less than DKK 363 700

Commuting expenses between your home and main workplace have never been deductible on your federal return even if your workplace is far away or you conduct business or haul work supplies during your commute

Work Commute Tax Deduction have gained a lot of recognition for a variety of compelling motives:

-

Cost-Efficiency: They eliminate the need to buy physical copies or expensive software.

-

Individualization There is the possibility of tailoring printed materials to meet your requirements in designing invitations, organizing your schedule, or even decorating your house.

-

Educational value: These Work Commute Tax Deduction cater to learners of all ages, which makes them an essential instrument for parents and teachers.

-

Convenience: Access to the vast array of design and templates, which saves time as well as effort.

Where to Find more Work Commute Tax Deduction

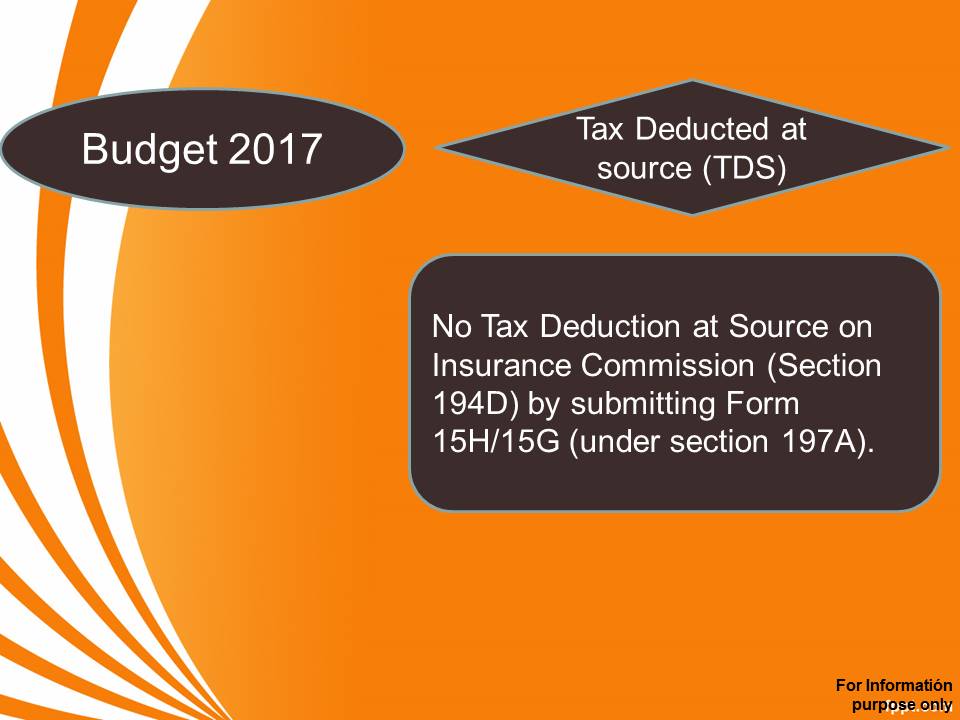

Section 179 Tax Deduction

Section 179 Tax Deduction

As a general rule commuting is not tax deductible However you can get around this by turning your home into an office Your home will only be regarded as your office by the IRS if you prove that you are a large percentage of your income or you do a majority of your administrative tasks from there

You can t deduct the costs of taking a bus trolley subway or taxi or of driving a car between your home and your main or regular place of work These costs are personal commuting expenses You can t deduct commuting expenses no matter how far your home is from your regular place of work

Since we've got your curiosity about Work Commute Tax Deduction, let's explore where you can find these gems:

1. Online Repositories

- Websites like Pinterest, Canva, and Etsy offer a huge selection with Work Commute Tax Deduction for all applications.

- Explore categories like decorating your home, education, organization, and crafts.

2. Educational Platforms

- Forums and websites for education often provide worksheets that can be printed for free for flashcards, lessons, and worksheets. tools.

- Perfect for teachers, parents and students who are in need of supplementary sources.

3. Creative Blogs

- Many bloggers provide their inventive designs and templates free of charge.

- The blogs are a vast spectrum of interests, starting from DIY projects to party planning.

Maximizing Work Commute Tax Deduction

Here are some innovative ways in order to maximize the use use of Work Commute Tax Deduction:

1. Home Decor

- Print and frame gorgeous artwork, quotes or seasonal decorations to adorn your living areas.

2. Education

- Print out free worksheets and activities for reinforcement of learning at home (or in the learning environment).

3. Event Planning

- Design invitations and banners and decorations for special events like weddings or birthdays.

4. Organization

- Stay organized by using printable calendars including to-do checklists, daily lists, and meal planners.

Conclusion

Work Commute Tax Deduction are a treasure trove of practical and innovative resources for a variety of needs and pursuits. Their access and versatility makes them a fantastic addition to your professional and personal life. Explore the vast array of Work Commute Tax Deduction to open up new possibilities!

Frequently Asked Questions (FAQs)

-

Are printables that are free truly are they free?

- Yes they are! You can print and download these tools for free.

-

Can I make use of free templates for commercial use?

- It's based on specific conditions of use. Be sure to read the rules of the creator before using any printables on commercial projects.

-

Are there any copyright issues in printables that are free?

- Some printables may contain restrictions regarding usage. Be sure to check the terms and conditions provided by the author.

-

How do I print Work Commute Tax Deduction?

- You can print them at home using your printer or visit the local print shop for top quality prints.

-

What software is required to open printables for free?

- The majority are printed in the format of PDF, which is open with no cost software, such as Adobe Reader.

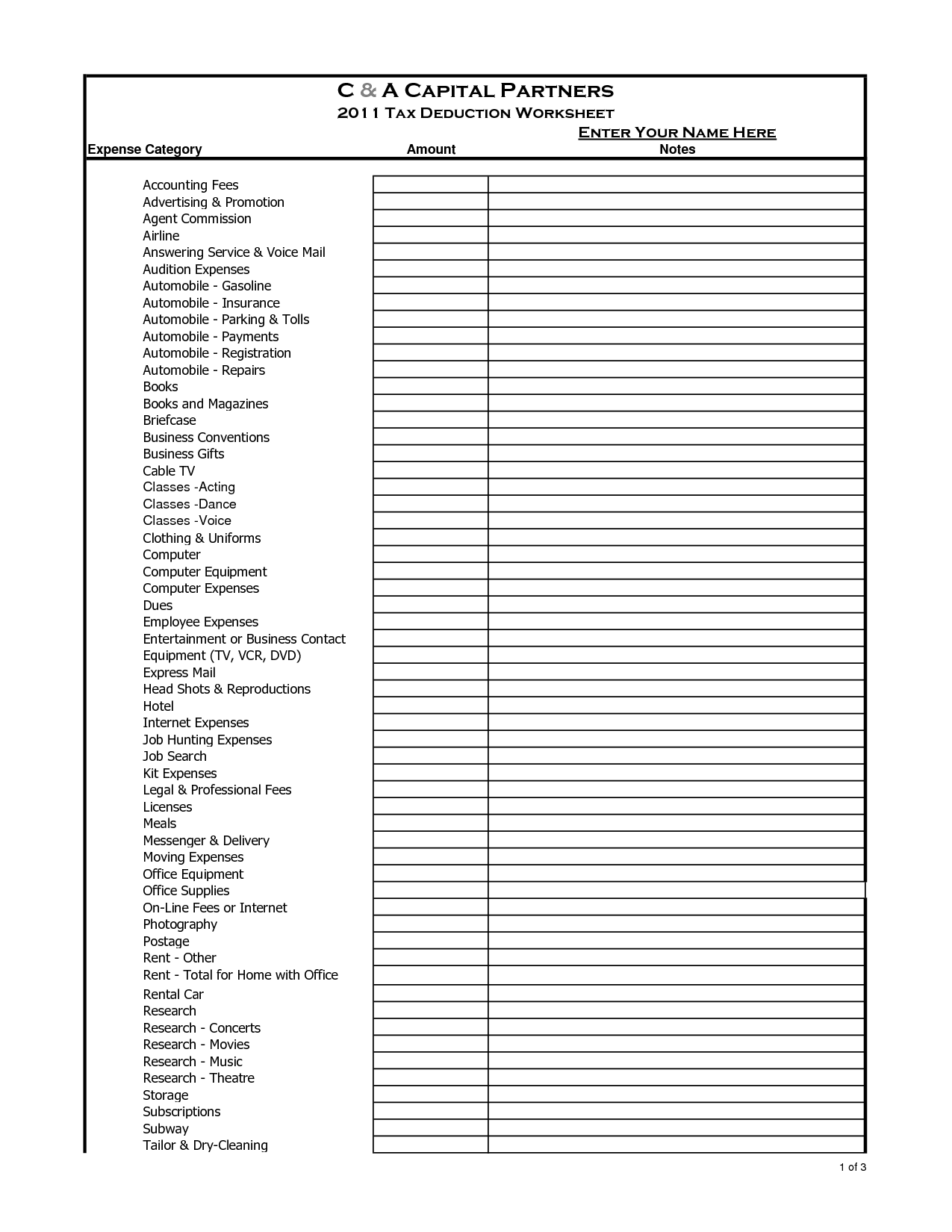

Tax Deductions You Can Deduct What Napkin Finance

10 2014 Itemized Deductions Worksheet Worksheeto

Check more sample of Work Commute Tax Deduction below

Tax And Law Directory Solution Of All Your Taxation Needs Now The

The Best Ways To Make The Most Of Your Commute Tax Deductions Local

Tax Deduction Stock Photo Photo By LendingMemo Under CC 2 Flickr

Tax Deduction Tax Deduction 1040 IRS Tax Return Form And C Flickr

How To Fully Maximize Your 1099 Tax Deductions Steady

Tax Deduction 2022 Sonosite

https://www.vero.fi/.../remote-working-and-deductions

Commuting expenses If you work remotely for part of the week you can deduct commuting expenses only for the days when you actually go to your workplace Check your pre completed tax return to make sure the commuting expenses correspond to your actual commuting expenses in 2023 Correct the information if necessary

https://www.vero.fi/en/individuals/tax-cards-and...

Commuting expenses There are many different travel expenses that qualify for tax deductions on the condition that they relate to your work You can already now claim deductions for any commuting and travel expenses in 2024

Commuting expenses If you work remotely for part of the week you can deduct commuting expenses only for the days when you actually go to your workplace Check your pre completed tax return to make sure the commuting expenses correspond to your actual commuting expenses in 2023 Correct the information if necessary

Commuting expenses There are many different travel expenses that qualify for tax deductions on the condition that they relate to your work You can already now claim deductions for any commuting and travel expenses in 2024

Tax Deduction Tax Deduction 1040 IRS Tax Return Form And C Flickr

The Best Ways To Make The Most Of Your Commute Tax Deductions Local

How To Fully Maximize Your 1099 Tax Deductions Steady

Tax Deduction 2022 Sonosite

Maximising Tax Benefits Your Guide To Claiming A Rental Property

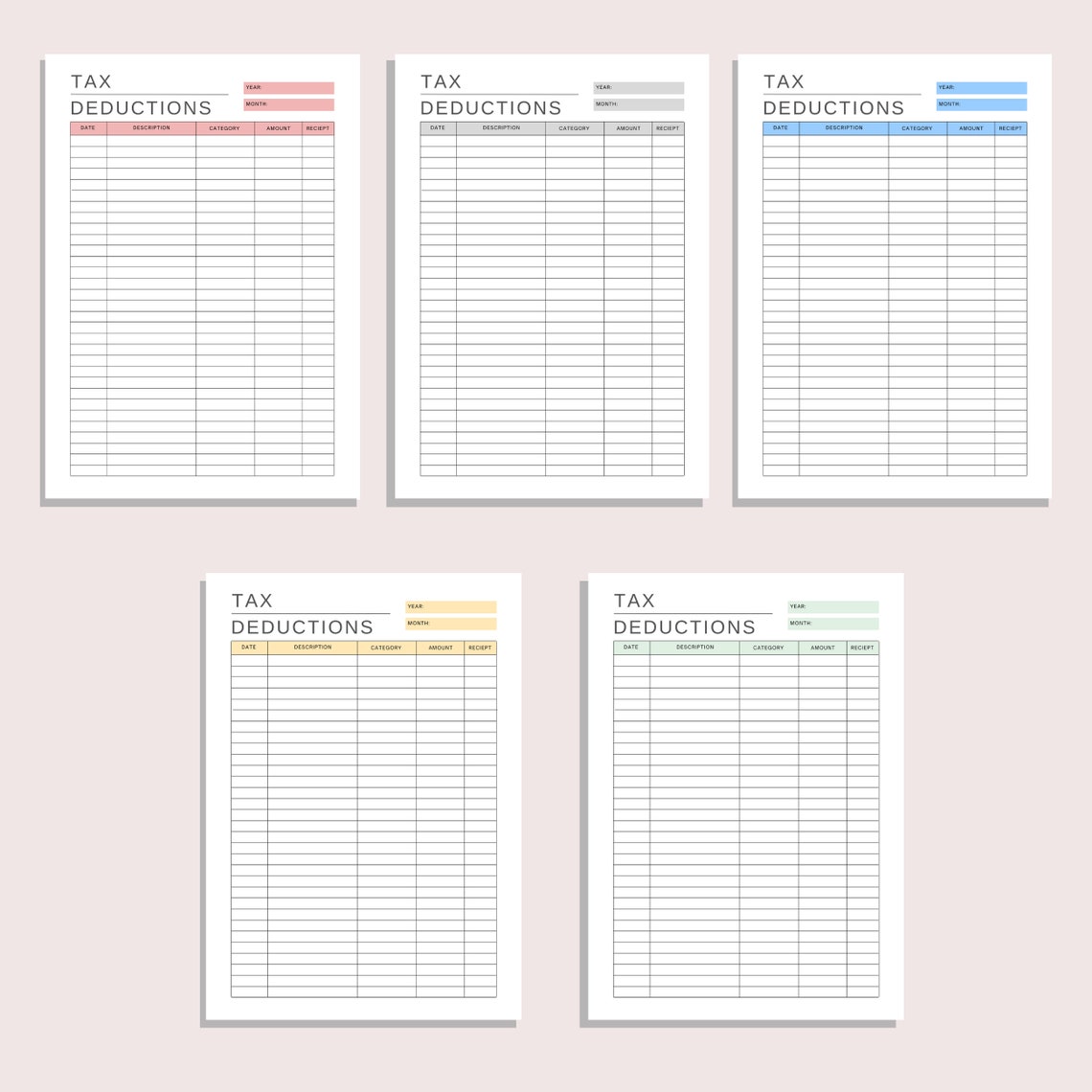

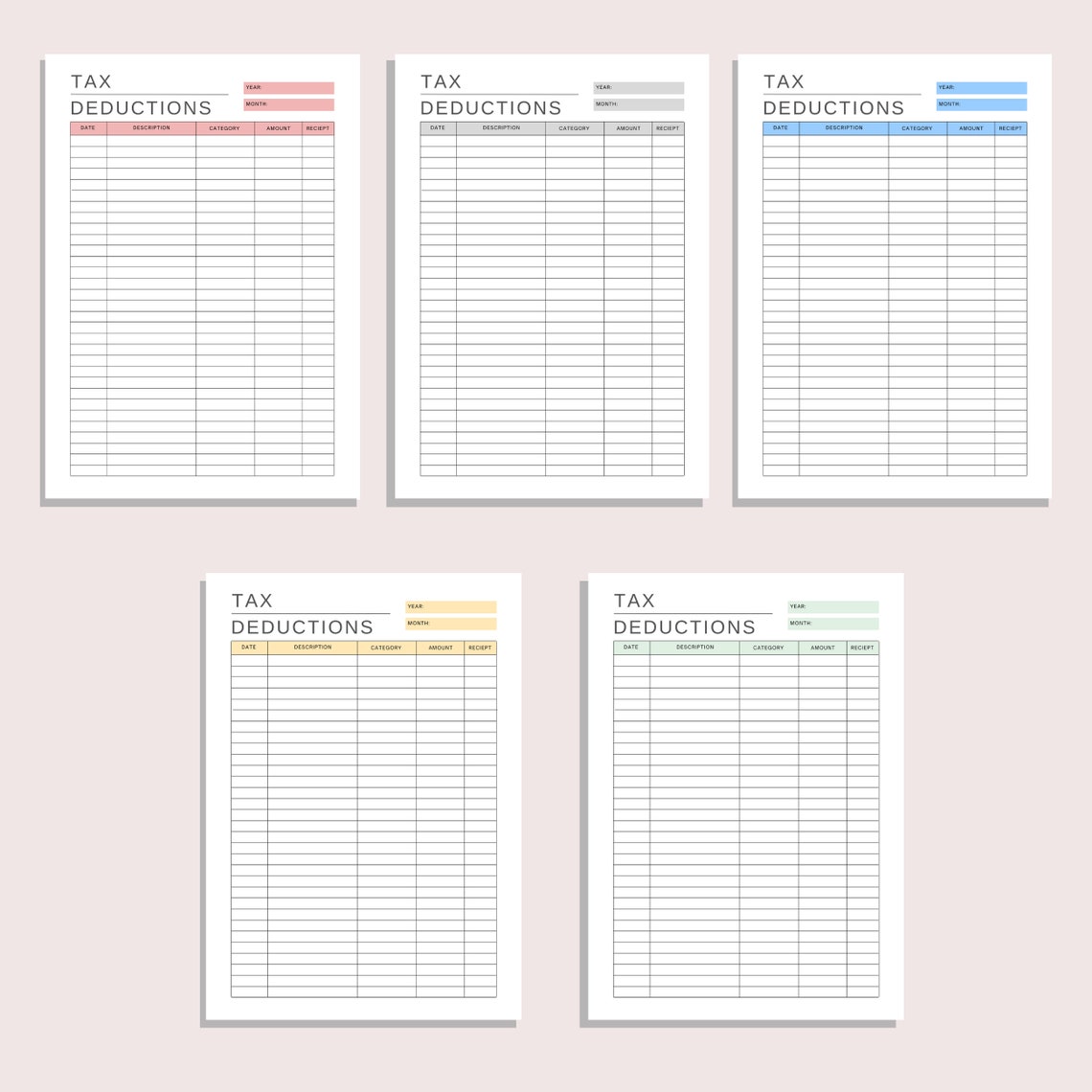

Tax Deduction Tracker Printable Tax Sheet Business Etsy

Tax Deduction Tracker Printable Tax Sheet Business Etsy

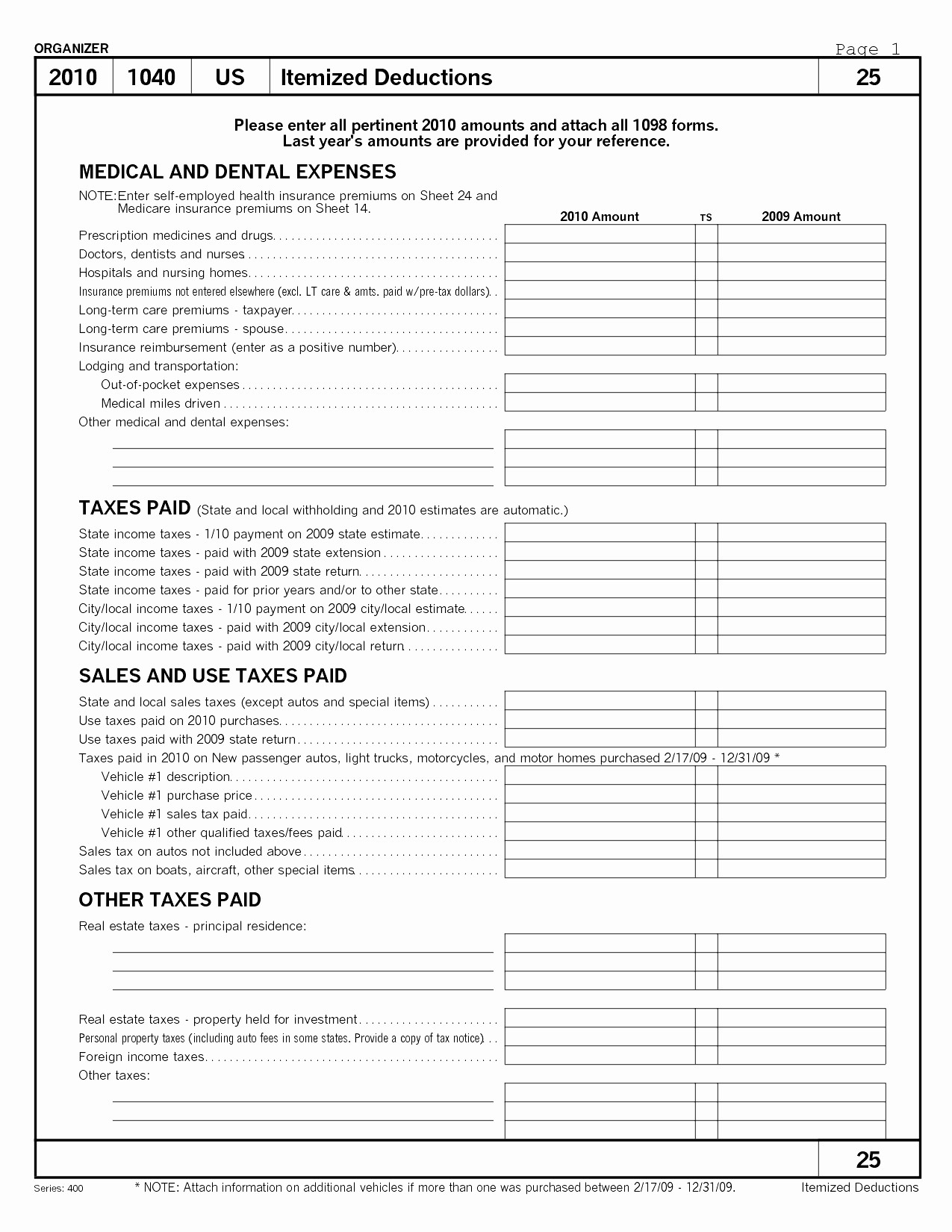

Printable Tax Organizer Template