In the digital age, with screens dominating our lives yet the appeal of tangible printed material hasn't diminished. It doesn't matter if it's for educational reasons or creative projects, or simply to add a personal touch to your space, Who Is Responsible For Tracking Non Deductible Contributions To A Traditional Ira are a great source. For this piece, we'll take a dive in the world of "Who Is Responsible For Tracking Non Deductible Contributions To A Traditional Ira," exploring what they are, where to find them and ways they can help you improve many aspects of your life.

Get Latest Who Is Responsible For Tracking Non Deductible Contributions To A Traditional Ira Below

Who Is Responsible For Tracking Non Deductible Contributions To A Traditional Ira

Who Is Responsible For Tracking Non Deductible Contributions To A Traditional Ira -

Contributions to a traditional IRA may or may not be deductible from your earned income in a given tax year depending on your situation Income limits apply if either you or your

Calculating your basis in a traditional IRA begins by identifying all non deductible contributions made Add these contributions for each year to get your total

Who Is Responsible For Tracking Non Deductible Contributions To A Traditional Ira cover a large assortment of printable, downloadable materials online, at no cost. They are available in numerous forms, like worksheets templates, coloring pages, and more. The value of Who Is Responsible For Tracking Non Deductible Contributions To A Traditional Ira is in their versatility and accessibility.

More of Who Is Responsible For Tracking Non Deductible Contributions To A Traditional Ira

A Guide To The Traditional IRA Honeygo Financial

A Guide To The Traditional IRA Honeygo Financial

Since you don t have to file the Form 8606 in years you don t make a non deductible IRA contribution you can t find your after tax basis After all most of us don t

The form is not just for reporting nondeductible contributions to traditional IRAs You also use it to report other IRA related transactions where the government

Who Is Responsible For Tracking Non Deductible Contributions To A Traditional Ira have gained immense popularity because of a number of compelling causes:

-

Cost-Efficiency: They eliminate the need to buy physical copies or costly software.

-

The ability to customize: You can tailor the design to meet your needs for invitations, whether that's creating them planning your schedule or even decorating your house.

-

Educational Benefits: Education-related printables at no charge cater to learners of all ages. This makes them an invaluable device for teachers and parents.

-

Easy to use: Quick access to an array of designs and templates cuts down on time and efforts.

Where to Find more Who Is Responsible For Tracking Non Deductible Contributions To A Traditional Ira

Simple Ira Contribution Limits 2022 Choosing Your Gold IRA

Simple Ira Contribution Limits 2022 Choosing Your Gold IRA

The term non deductible IRA refers to traditional IRA contributions you make that aren t eligible for the tax advantages of a traditional IRA Even if you don t qualify for deductible

In 2024 if you are a single filer and you are covered by a retirement plan at work you re no longer eligible to deduct contributions to a traditional IRA at incomes

In the event that we've stirred your interest in Who Is Responsible For Tracking Non Deductible Contributions To A Traditional Ira and other printables, let's discover where you can find these hidden gems:

1. Online Repositories

- Websites like Pinterest, Canva, and Etsy offer a vast selection of printables that are free for a variety of motives.

- Explore categories like furniture, education, craft, and organization.

2. Educational Platforms

- Educational websites and forums often offer worksheets with printables that are free along with flashcards, as well as other learning materials.

- The perfect resource for parents, teachers and students looking for extra resources.

3. Creative Blogs

- Many bloggers share their imaginative designs with templates and designs for free.

- The blogs covered cover a wide array of topics, ranging from DIY projects to planning a party.

Maximizing Who Is Responsible For Tracking Non Deductible Contributions To A Traditional Ira

Here are some new ways of making the most of Who Is Responsible For Tracking Non Deductible Contributions To A Traditional Ira:

1. Home Decor

- Print and frame beautiful artwork, quotes as well as seasonal decorations, to embellish your living spaces.

2. Education

- Print free worksheets to help reinforce your learning at home and in class.

3. Event Planning

- Invitations, banners and other decorations for special occasions such as weddings, birthdays, and other special occasions.

4. Organization

- Keep your calendars organized by printing printable calendars along with lists of tasks, and meal planners.

Conclusion

Who Is Responsible For Tracking Non Deductible Contributions To A Traditional Ira are a treasure trove of creative and practical resources for a variety of needs and hobbies. Their accessibility and versatility make they a beneficial addition to both professional and personal life. Explore the many options that is Who Is Responsible For Tracking Non Deductible Contributions To A Traditional Ira today, and discover new possibilities!

Frequently Asked Questions (FAQs)

-

Are printables available for download really free?

- Yes you can! You can print and download these materials for free.

-

Can I use free printouts for commercial usage?

- It's determined by the specific terms of use. Always check the creator's guidelines prior to utilizing the templates for commercial projects.

-

Do you have any copyright problems with Who Is Responsible For Tracking Non Deductible Contributions To A Traditional Ira?

- Some printables may come with restrictions concerning their use. Check the terms and conditions set forth by the designer.

-

How can I print printables for free?

- Print them at home using an printer, or go to the local print shops for premium prints.

-

What program do I require to open printables for free?

- The majority of printed documents are in PDF format. They can be opened using free software like Adobe Reader.

Simple Ira Contribution Rules Choosing Your Gold IRA

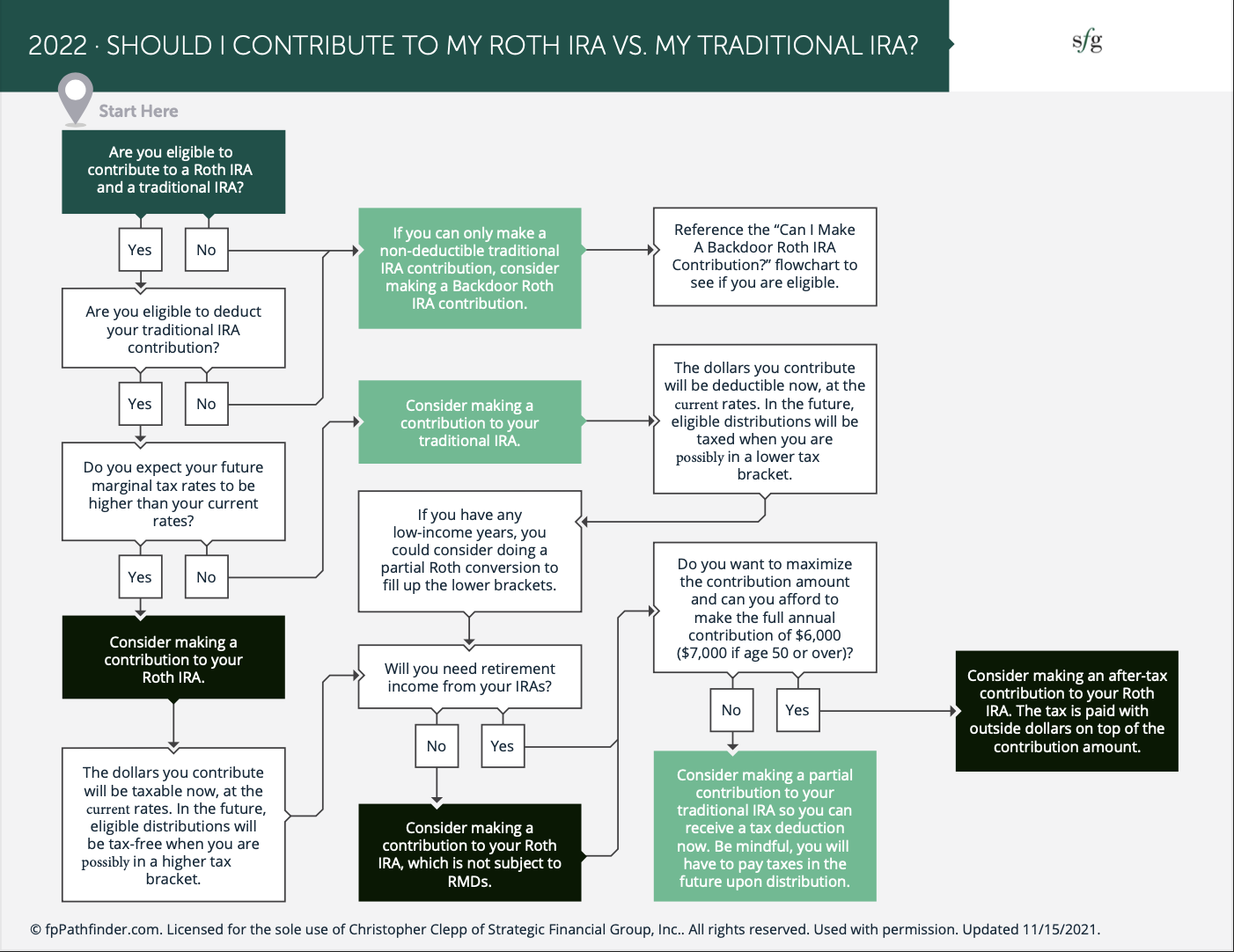

Are Roth Contributions Right For Me

Check more sample of Who Is Responsible For Tracking Non Deductible Contributions To A Traditional Ira below

Should I Contribute To My Roth IRA Vs My Traditional IRA Building

Savings Account Vs Roth IRA What s The Difference

:max_bytes(150000):strip_icc()/savingsvs.ira_V1-b63b805de8554f589543be193cad9857.png)

Are Roth IRA Contributions Tax Deductible Roth Ira Contributions

2022 RETIREMENT ACCOUNT CONTRIBUTION LIMITS ANNOUNCED Day Hagan

Traditional Vs Roth IRAs What s The Difference Fi3 Advisors

Where Does Ira Contribution Go On Tax Return

https://smartasset.com/retirement/total-basis-in-traditional-iras

Calculating your basis in a traditional IRA begins by identifying all non deductible contributions made Add these contributions for each year to get your total

https://dwcadvisors.com/carefully-track...

If like many people your traditional IRA holds a mixture of deductible after tax and nondeductible pretax contributions it s important to track your contributions

Calculating your basis in a traditional IRA begins by identifying all non deductible contributions made Add these contributions for each year to get your total

If like many people your traditional IRA holds a mixture of deductible after tax and nondeductible pretax contributions it s important to track your contributions

2022 RETIREMENT ACCOUNT CONTRIBUTION LIMITS ANNOUNCED Day Hagan

:max_bytes(150000):strip_icc()/savingsvs.ira_V1-b63b805de8554f589543be193cad9857.png)

Savings Account Vs Roth IRA What s The Difference

Traditional Vs Roth IRAs What s The Difference Fi3 Advisors

Where Does Ira Contribution Go On Tax Return

Entering IRA Contributions In A 1040 Return In ProSeries

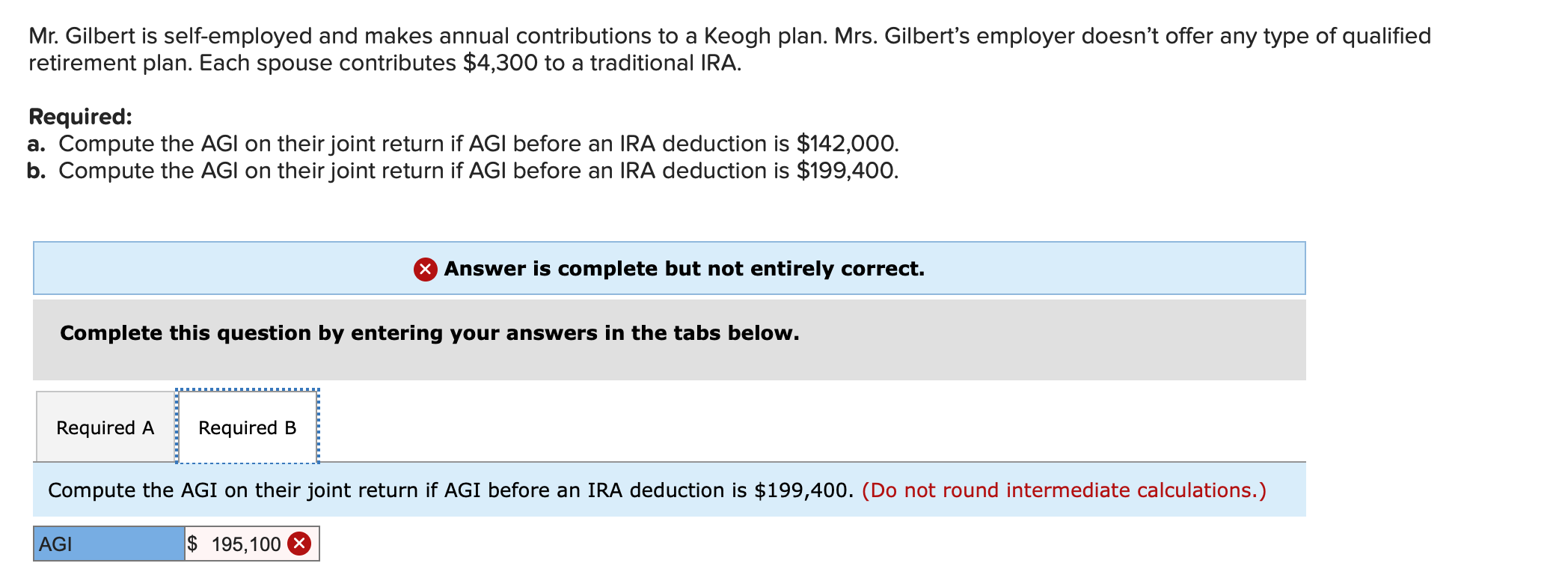

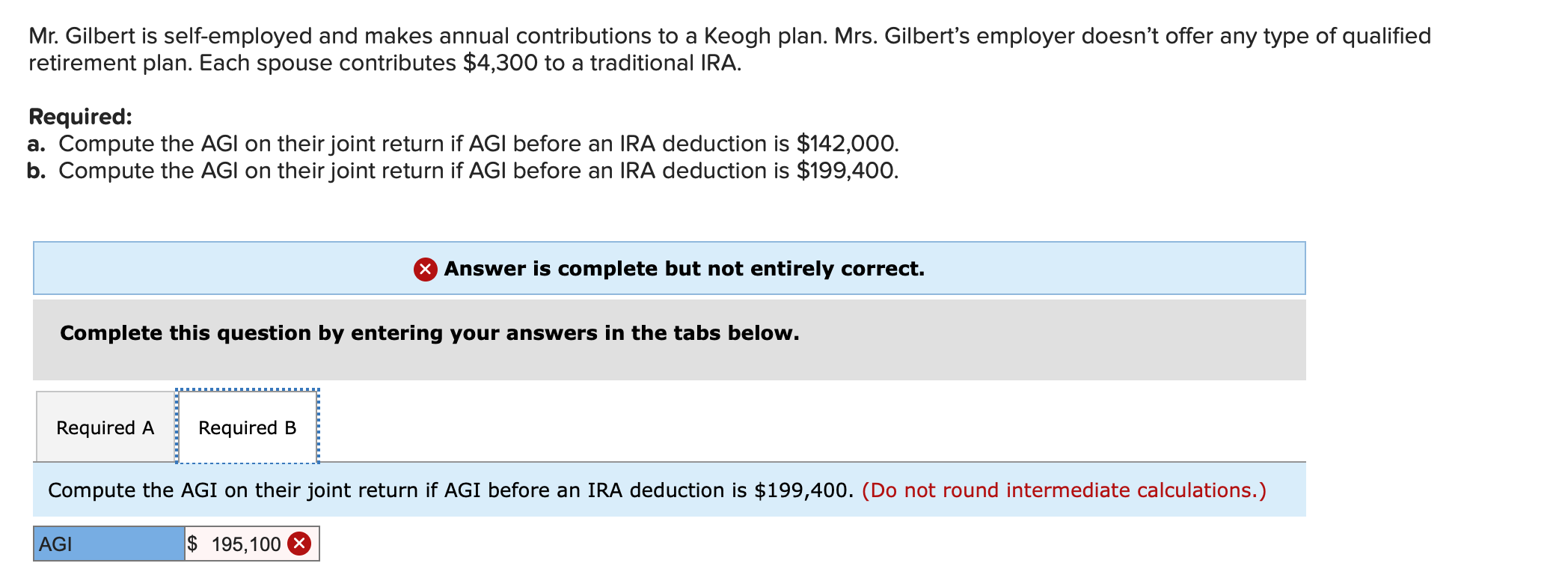

Solved Mr Gilbert Is Self employed And Makes Annual Chegg

Solved Mr Gilbert Is Self employed And Makes Annual Chegg

Ask The Hammer Is It Possible To Prove I Made Non Deductible