In the age of digital, where screens have become the dominant feature of our lives, the charm of tangible printed material hasn't diminished. Be it for educational use project ideas, artistic or simply adding an element of personalization to your space, When Can You Withdraw From Rollover Ira are now a vital resource. We'll dive into the sphere of "When Can You Withdraw From Rollover Ira," exploring their purpose, where to find them and how they can be used to enhance different aspects of your life.

Get Latest When Can You Withdraw From Rollover Ira Below

When Can You Withdraw From Rollover Ira

When Can You Withdraw From Rollover Ira -

You can take distributions from your IRA including your SEP IRA or SIMPLE IRA at any time There is no need to show a hardship to take a distribution However your

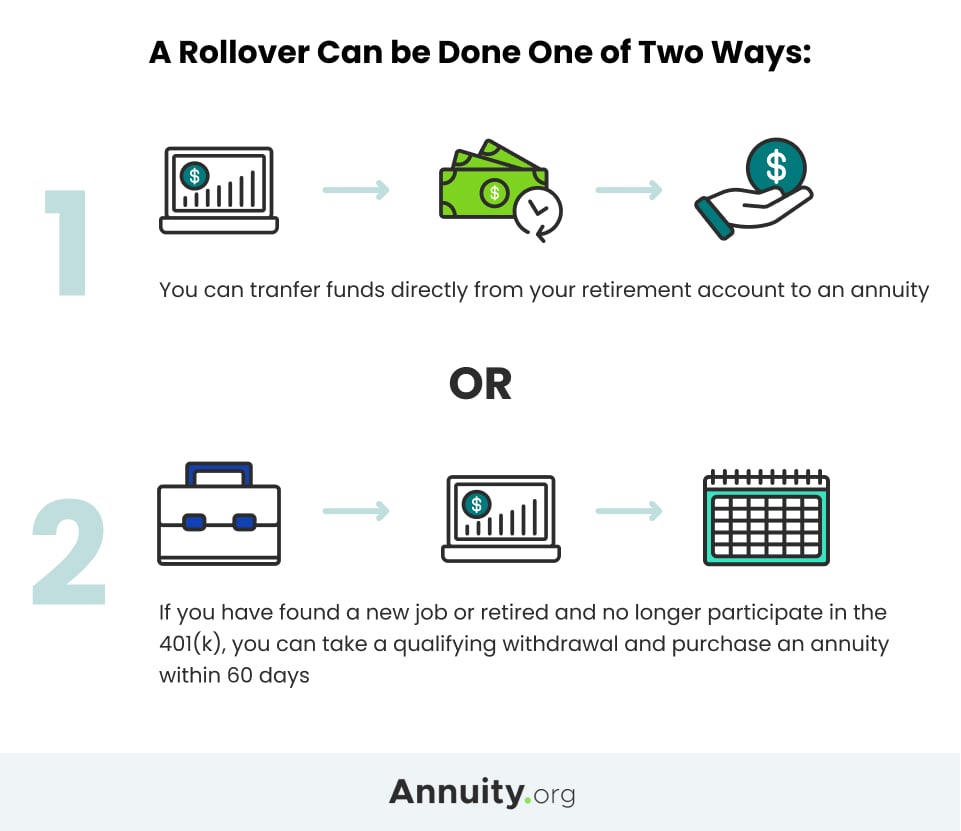

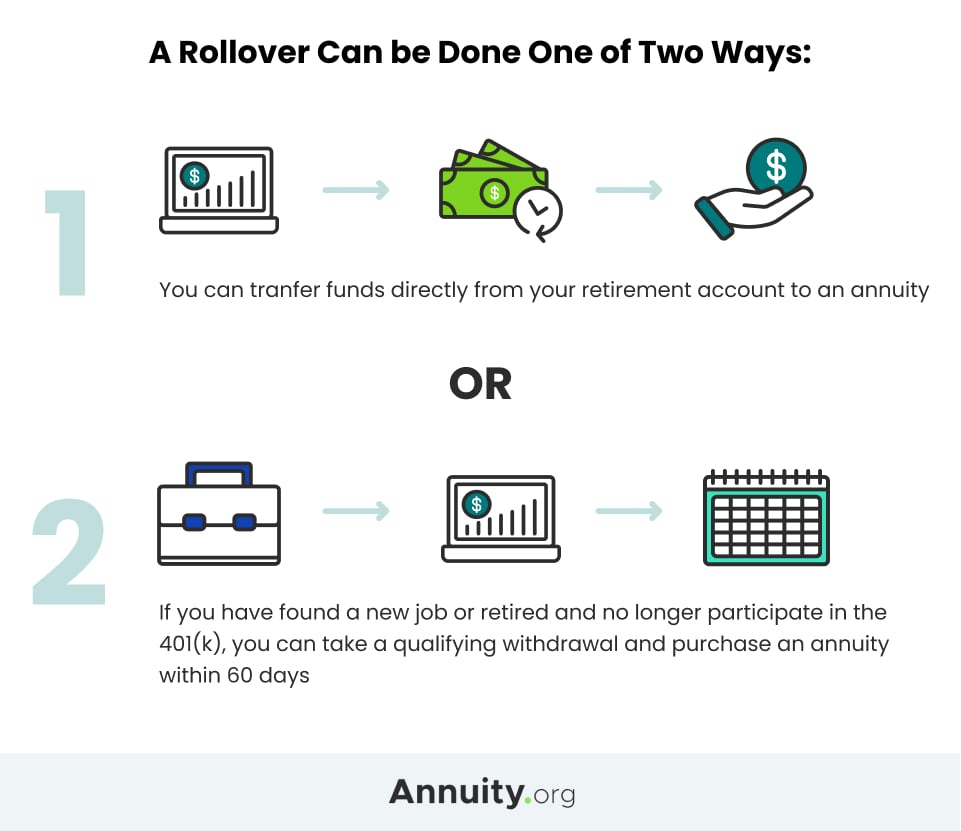

You have 60 days from the date you receive an IRA or retirement plan distribution to roll it over to another plan or IRA The IRS may waive the 60 day rollover requirement in

Printables for free include a vast range of downloadable, printable materials that are accessible online for free cost. They come in many styles, from worksheets to templates, coloring pages and many more. The attraction of printables that are free is in their versatility and accessibility.

More of When Can You Withdraw From Rollover Ira

Using A Rollover IRA The Right Way FortuneBuilders

Using A Rollover IRA The Right Way FortuneBuilders

With a Traditional Rollover SEP or SIMPLE IRA you make contributions on a pre tax basis if your income is under a certain level and certain other qualifications and pay no

At what age can you withdraw from a Rollover IRA without penalties Typically you can withdraw without penalties after age 59 but exceptions apply

The When Can You Withdraw From Rollover Ira have gained huge recognition for a variety of compelling motives:

-

Cost-Effective: They eliminate the need to purchase physical copies or costly software.

-

Modifications: We can customize print-ready templates to your specific requirements for invitations, whether that's creating them making your schedule, or decorating your home.

-

Educational Value: The free educational worksheets can be used by students of all ages, which makes them an invaluable aid for parents as well as educators.

-

An easy way to access HTML0: The instant accessibility to various designs and templates cuts down on time and efforts.

Where to Find more When Can You Withdraw From Rollover Ira

IRA Charitable Rollover QCD Gift Navian Hawaii

IRA Charitable Rollover QCD Gift Navian Hawaii

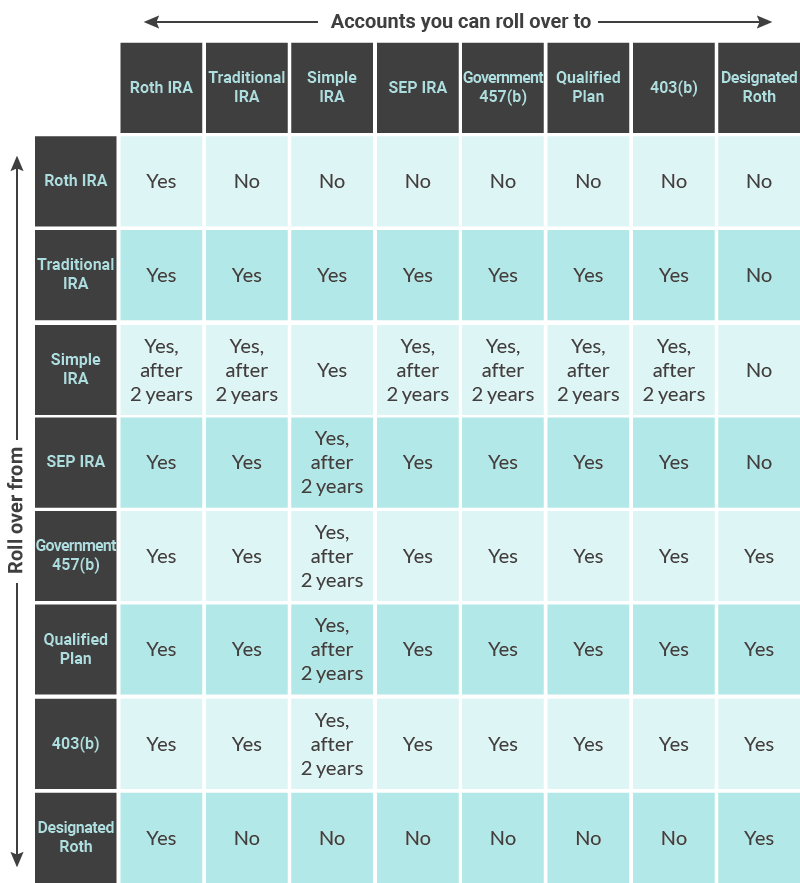

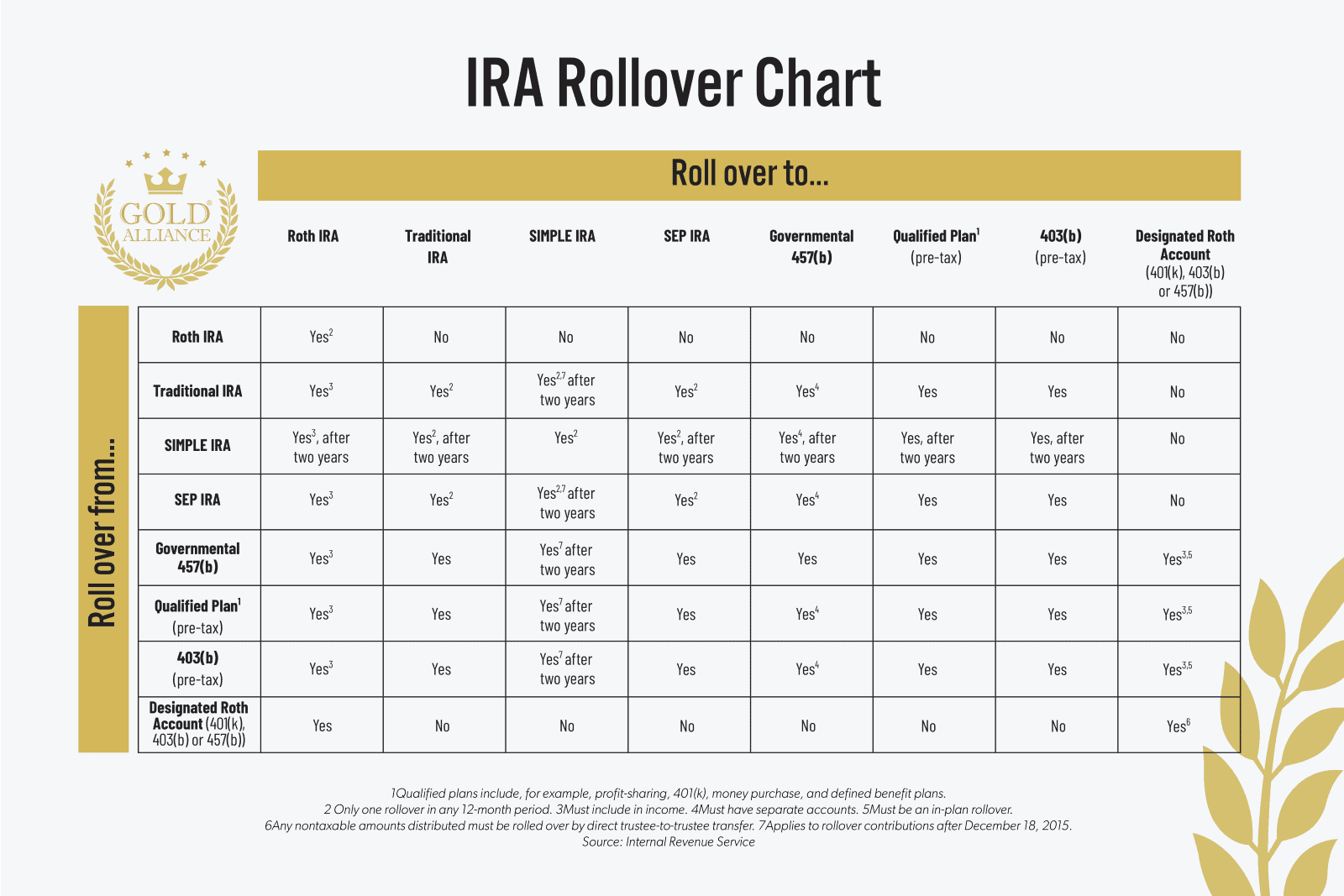

Nerdy takeaways You might use a rollover IRA if you have an old workplace 401 k A rollover involves transferring the assets from your 401 k to a Roth or Traditional IRA You

You have 60 days from receiving an IRA or retirement plan distribution to roll it over or transfer it to another plan or IRA If you don t roll over your funds you may have to pay a 10

Now that we've ignited your curiosity about When Can You Withdraw From Rollover Ira Let's take a look at where you can locate these hidden gems:

1. Online Repositories

- Websites such as Pinterest, Canva, and Etsy provide an extensive selection of When Can You Withdraw From Rollover Ira designed for a variety needs.

- Explore categories like decoration for your home, education, the arts, and more.

2. Educational Platforms

- Forums and educational websites often provide worksheets that can be printed for free or flashcards as well as learning materials.

- Perfect for teachers, parents and students who are in need of supplementary sources.

3. Creative Blogs

- Many bloggers provide their inventive designs and templates for free.

- These blogs cover a wide selection of subjects, everything from DIY projects to planning a party.

Maximizing When Can You Withdraw From Rollover Ira

Here are some unique ways create the maximum value use of printables that are free:

1. Home Decor

- Print and frame gorgeous artwork, quotes, or other seasonal decorations to fill your living spaces.

2. Education

- Print out free worksheets and activities to help reinforce your learning at home (or in the learning environment).

3. Event Planning

- Design invitations, banners and decorations for special occasions such as weddings or birthdays.

4. Organization

- Get organized with printable calendars with to-do lists, planners, and meal planners.

Conclusion

When Can You Withdraw From Rollover Ira are a treasure trove with useful and creative ideas that satisfy a wide range of requirements and hobbies. Their availability and versatility make they a beneficial addition to every aspect of your life, both professional and personal. Explore the endless world of When Can You Withdraw From Rollover Ira right now and uncover new possibilities!

Frequently Asked Questions (FAQs)

-

Are the printables you get for free available for download?

- Yes, they are! You can print and download these documents for free.

-

Does it allow me to use free printables for commercial uses?

- It's based on the terms of use. Always read the guidelines of the creator prior to using the printables in commercial projects.

-

Do you have any copyright concerns when using When Can You Withdraw From Rollover Ira?

- Some printables may contain restrictions regarding usage. Make sure to read the terms and regulations provided by the designer.

-

How can I print When Can You Withdraw From Rollover Ira?

- Print them at home using the printer, or go to the local print shop for top quality prints.

-

What software do I need to run When Can You Withdraw From Rollover Ira?

- Most printables come in PDF format, which is open with no cost programs like Adobe Reader.

Roth IRA Withdrawal Rules Oblivious Investor

What Is A Rollover IRA Rollover IRA IRA Rollover NUA

Check more sample of When Can You Withdraw From Rollover Ira below

Ira Rollover Rules Choosing Your Gold IRA

401k Withdrawal Rules How To Avoid Penalties Personal Capital

How Soon Can You Withdraw From An IRA After Rollover

IRA tutbotax manbetx2 0

Your Guide To Emergency IRA And 401 k Withdrawals Beirne

What Are Traditional IRA Withdrawal Rules DaveRamsey

https://www.irs.gov/.../rollovers-of-retirement-plan-and-ira-distributions

You have 60 days from the date you receive an IRA or retirement plan distribution to roll it over to another plan or IRA The IRS may waive the 60 day rollover requirement in

https://www.fidelity.com/building-savings/learn-about-iras/ira-withdrawal

After you reach age 73 the IRS generally requires you to withdraw an RMD annually from your tax advantaged retirement accounts excluding Roth IRAs and Roth accounts in

You have 60 days from the date you receive an IRA or retirement plan distribution to roll it over to another plan or IRA The IRS may waive the 60 day rollover requirement in

After you reach age 73 the IRS generally requires you to withdraw an RMD annually from your tax advantaged retirement accounts excluding Roth IRAs and Roth accounts in

IRA tutbotax manbetx2 0

401k Withdrawal Rules How To Avoid Penalties Personal Capital

Your Guide To Emergency IRA And 401 k Withdrawals Beirne

What Are Traditional IRA Withdrawal Rules DaveRamsey

What Should You Put In A Rollover IRA Sizemore Insights

401 K Rollover To IRA Self Directed Retirement Plans

401 K Rollover To IRA Self Directed Retirement Plans

The 5 Year Rules For Roth IRA Withdrawals Pure Financial Advisors