In this digital age, where screens dominate our lives and the appeal of physical printed objects isn't diminished. No matter whether it's for educational uses such as creative projects or simply to add the personal touch to your area, What Taxes Do Retirees Pay In Florida can be an excellent resource. For this piece, we'll dive into the world "What Taxes Do Retirees Pay In Florida," exploring the different types of printables, where to locate them, and ways they can help you improve many aspects of your life.

Get Latest What Taxes Do Retirees Pay In Florida Below

What Taxes Do Retirees Pay In Florida

What Taxes Do Retirees Pay In Florida -

No Income Taxes One of the most attractive tax rules for Florida is that it doesn t have state income taxes In comparison New York has a 10 9 state income tax California has a 13 3 tax

Florida retirees still have to pay federal income taxes However if social security is your only source of income it will most likely be low enough for income tax exempt Expect to pay taxes for up to 50 of your SS if you make over 25 000 If you make over 44 000 expect to pay taxes on up to 85 of your SS income

The What Taxes Do Retirees Pay In Florida are a huge array of printable materials that are accessible online for free cost. These materials come in a variety of types, such as worksheets coloring pages, templates and many more. The benefit of What Taxes Do Retirees Pay In Florida is their flexibility and accessibility.

More of What Taxes Do Retirees Pay In Florida

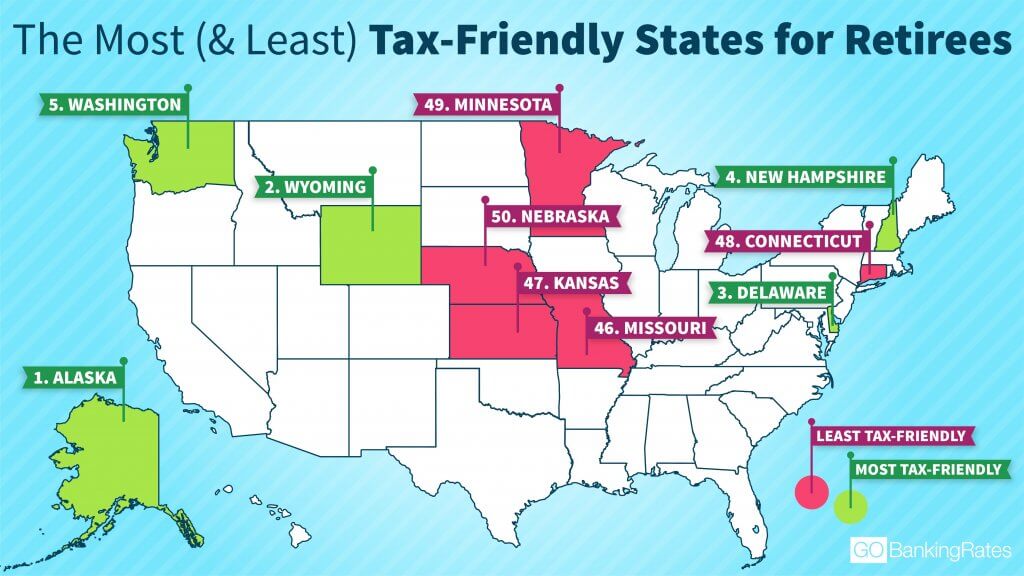

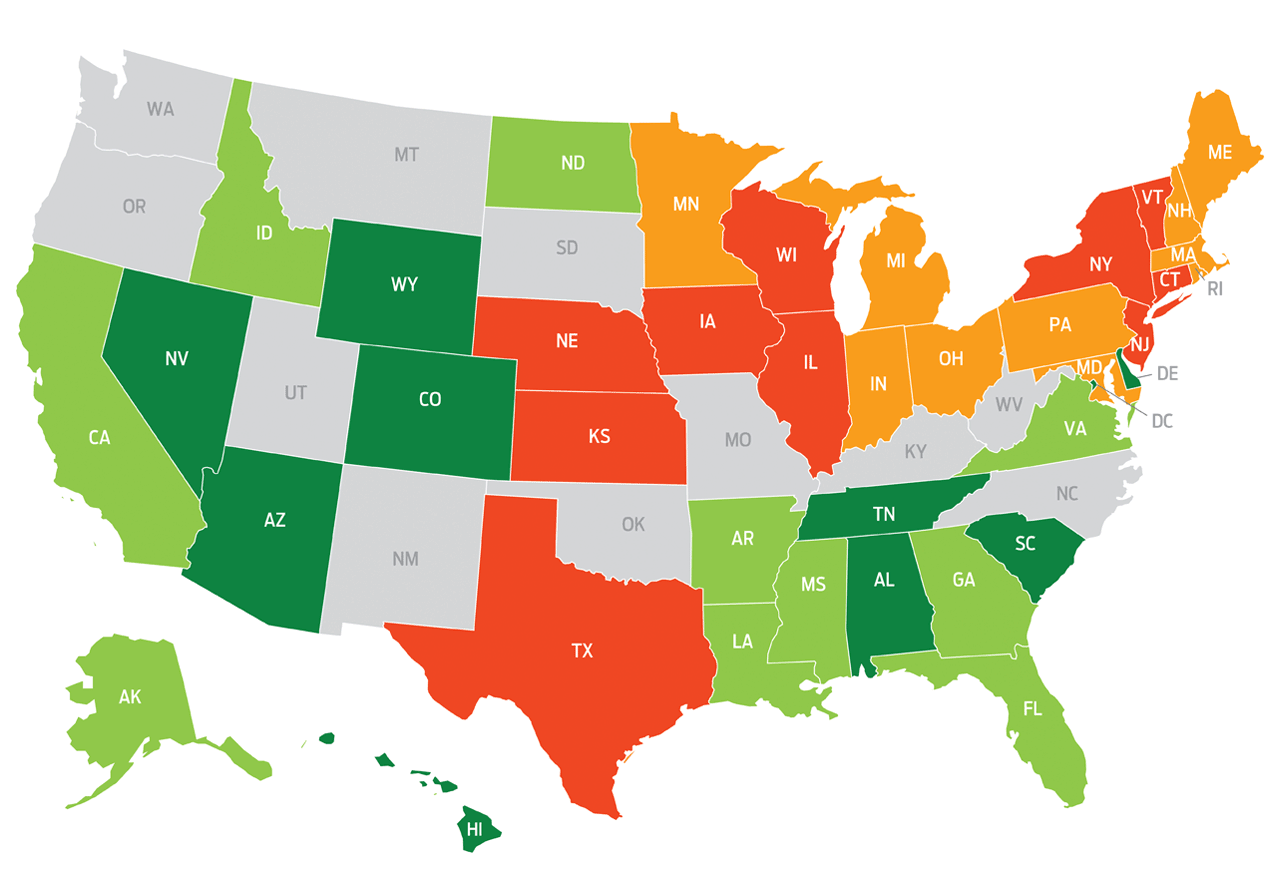

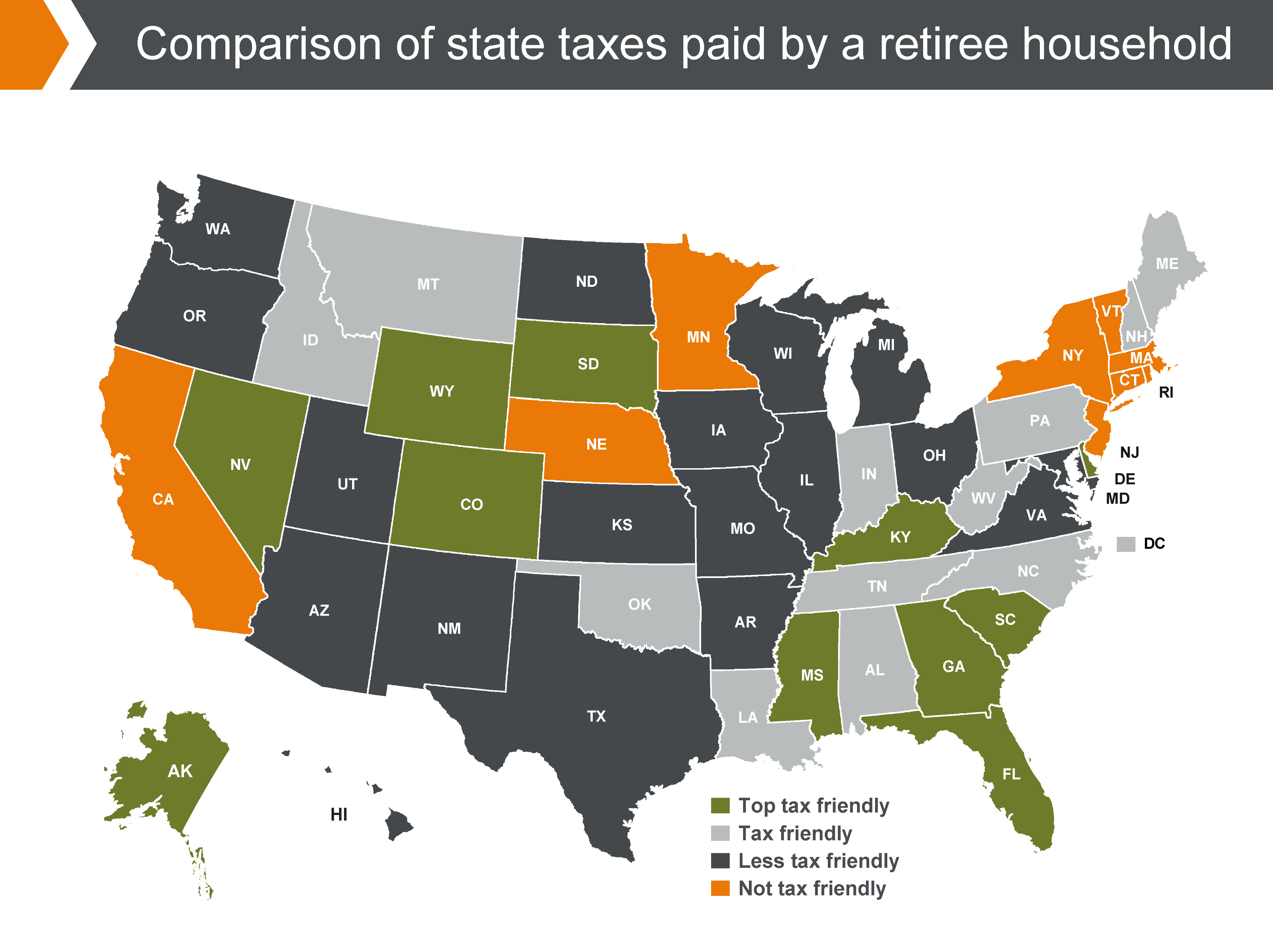

State by State Guide To Taxes On Retirees Flagel Huber Flagel

State by State Guide To Taxes On Retirees Flagel Huber Flagel

There is no state income or retirement income tax in Florida Additionally there are no state taxes on Pension income Income from an IRA or 410K Social security Inheritance or estates These are just some of the many benefits that make Florida an uncommonly tax friendly state

Are pensions or retirement income taxed in Florida No Because Florida does not have a personal income tax distributions from pensions 401 k s 403 b s and IRAs are not taxed at the state or local level AARP s retirement calculator can help you determine if you are saving enough to retire when and how you want

Printables that are free have gained enormous popularity due to numerous compelling reasons:

-

Cost-Efficiency: They eliminate the necessity to purchase physical copies or expensive software.

-

The ability to customize: The Customization feature lets you tailor the design to meet your needs whether it's making invitations as well as organizing your calendar, or decorating your home.

-

Educational Value: Education-related printables at no charge can be used by students of all ages, which makes them an invaluable device for teachers and parents.

-

The convenience of instant access the vast array of design and templates saves time and effort.

Where to Find more What Taxes Do Retirees Pay In Florida

What Taxes Does An LLC Pay In Florida YouTube

What Taxes Does An LLC Pay In Florida YouTube

Florida is one of few states with no income tax meaning you won t get taxed on earned wages and or sources of retirement income such as Social Security benefits pensions 401 k s and IRAs There is also no inheritance or estate tax in Florida allowing you to leave more to your heirs To illustrate this let s assume you re 65 years

Those who retire in Florida are likely to experience no personal income tax no social security tax low property and vehicle taxes as well as both state and federal tax deductions Florida Has Zero Personal Income Tax and Zero Social Security Tax

After we've peaked your curiosity about What Taxes Do Retirees Pay In Florida Let's find out where they are hidden treasures:

1. Online Repositories

- Websites such as Pinterest, Canva, and Etsy provide an extensive selection of What Taxes Do Retirees Pay In Florida designed for a variety uses.

- Explore categories like design, home decor, management, and craft.

2. Educational Platforms

- Educational websites and forums usually offer worksheets with printables that are free Flashcards, worksheets, and other educational tools.

- Great for parents, teachers, and students seeking supplemental sources.

3. Creative Blogs

- Many bloggers provide their inventive designs or templates for download.

- These blogs cover a broad selection of subjects, including DIY projects to party planning.

Maximizing What Taxes Do Retirees Pay In Florida

Here are some inventive ways how you could make the most use of What Taxes Do Retirees Pay In Florida:

1. Home Decor

- Print and frame gorgeous artwork, quotes, or festive decorations to decorate your living spaces.

2. Education

- Print worksheets that are free to help reinforce your learning at home (or in the learning environment).

3. Event Planning

- Create invitations, banners, and other decorations for special occasions such as weddings, birthdays, and other special occasions.

4. Organization

- Get organized with printable calendars along with lists of tasks, and meal planners.

Conclusion

What Taxes Do Retirees Pay In Florida are an abundance of innovative and useful resources that cater to various needs and preferences. Their availability and versatility make them a fantastic addition to both professional and personal lives. Explore the world of What Taxes Do Retirees Pay In Florida right now and unlock new possibilities!

Frequently Asked Questions (FAQs)

-

Are printables for free really free?

- Yes you can! You can download and print these tools for free.

-

Can I use free templates for commercial use?

- It is contingent on the specific conditions of use. Always verify the guidelines provided by the creator prior to utilizing the templates for commercial projects.

-

Are there any copyright violations with printables that are free?

- Some printables may have restrictions concerning their use. Be sure to read these terms and conditions as set out by the creator.

-

How do I print What Taxes Do Retirees Pay In Florida?

- Print them at home with the printer, or go to a local print shop to purchase top quality prints.

-

What software do I require to view printables that are free?

- Many printables are offered in PDF format. They can be opened with free programs like Adobe Reader.

Paying Taxes The Pros And Cons Of Doing It With A Credit Card

Paying Taxes 101 What Is An IRS Audit

Check more sample of What Taxes Do Retirees Pay In Florida below

Income Tax Florida How Much You Could Save Wtsp

Happy Retirement Advice News Features Tips Page 8 Kiplinger

Sin Taxes Hawaii 3rd Highest In USA Hawaii Free Press

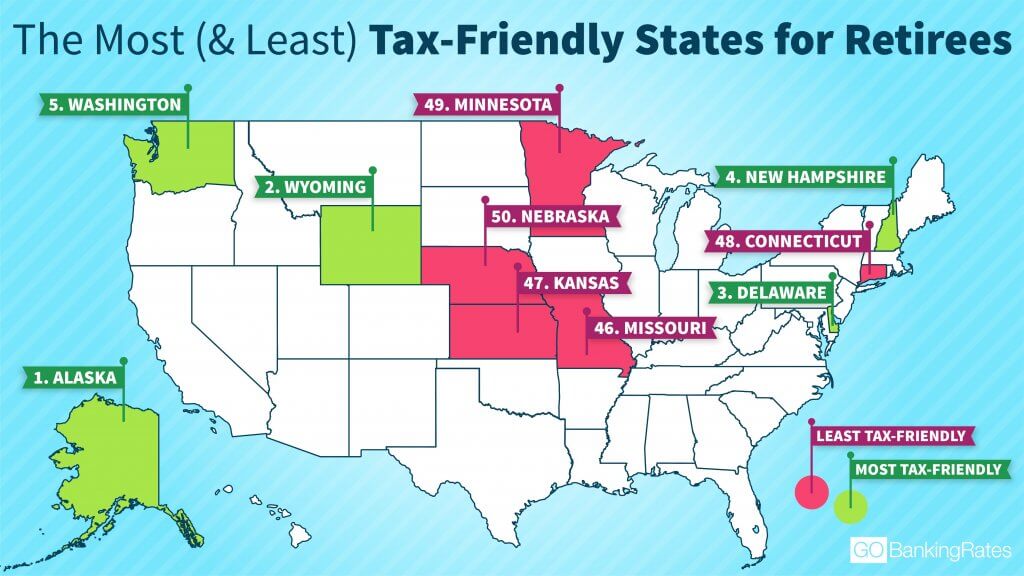

Want To Avoid High Taxes Retire In One Of These 10 States GOBankingRates

How To Increase The Value Of A Business By Paying More Taxes

Every State With A Progressive Tax Also Taxes Retirement Income

https://solivitaliving.com/understanding-your-tax...

Florida retirees still have to pay federal income taxes However if social security is your only source of income it will most likely be low enough for income tax exempt Expect to pay taxes for up to 50 of your SS if you make over 25 000 If you make over 44 000 expect to pay taxes on up to 85 of your SS income

https://www.actsretirement.org/.../florida

Tax Benefits of Retiring in Florida The good news is that because there is no state income tax in Florida retirement income is tax exempt Here is other great information on Florida taxes for retirees Florida has no state income tax No state taxes on pension income income from an IRA or 401K

Florida retirees still have to pay federal income taxes However if social security is your only source of income it will most likely be low enough for income tax exempt Expect to pay taxes for up to 50 of your SS if you make over 25 000 If you make over 44 000 expect to pay taxes on up to 85 of your SS income

Tax Benefits of Retiring in Florida The good news is that because there is no state income tax in Florida retirement income is tax exempt Here is other great information on Florida taxes for retirees Florida has no state income tax No state taxes on pension income income from an IRA or 401K

Want To Avoid High Taxes Retire In One Of These 10 States GOBankingRates

Happy Retirement Advice News Features Tips Page 8 Kiplinger

How To Increase The Value Of A Business By Paying More Taxes

Every State With A Progressive Tax Also Taxes Retirement Income

Florida Trust Advantages Tax Friendly Trust Sarasota FL

7 States That Do Not Tax Retirement Income

7 States That Do Not Tax Retirement Income

States With The Highest and Lowest Taxes For Retirees Money