Today, with screens dominating our lives and the appeal of physical printed items hasn't gone away. Be it for educational use project ideas, artistic or just adding an element of personalization to your area, What Services Are Exempt From Sales Tax In Texas have proven to be a valuable resource. Here, we'll take a dive in the world of "What Services Are Exempt From Sales Tax In Texas," exploring the different types of printables, where they are available, and how they can improve various aspects of your lives.

Get Latest What Services Are Exempt From Sales Tax In Texas Below

What Services Are Exempt From Sales Tax In Texas

What Services Are Exempt From Sales Tax In Texas -

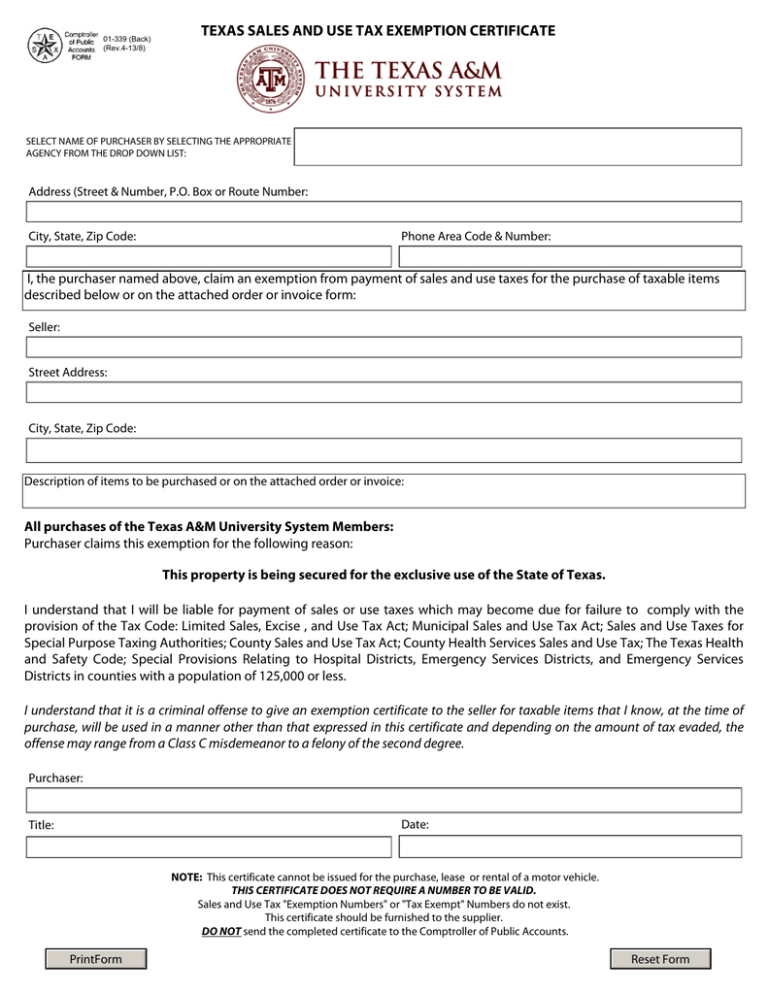

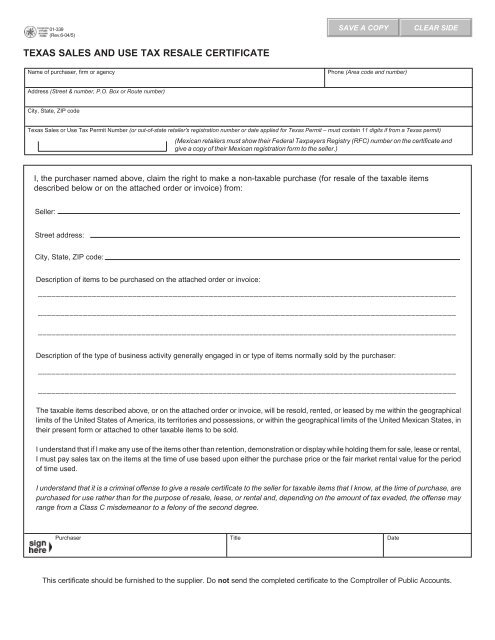

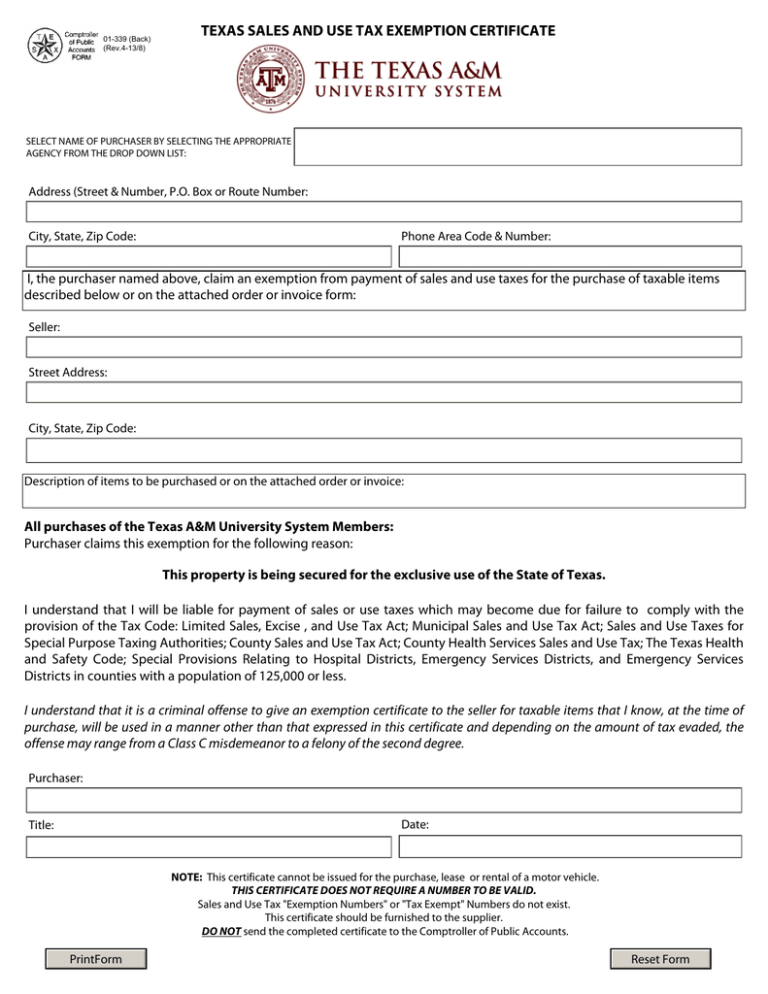

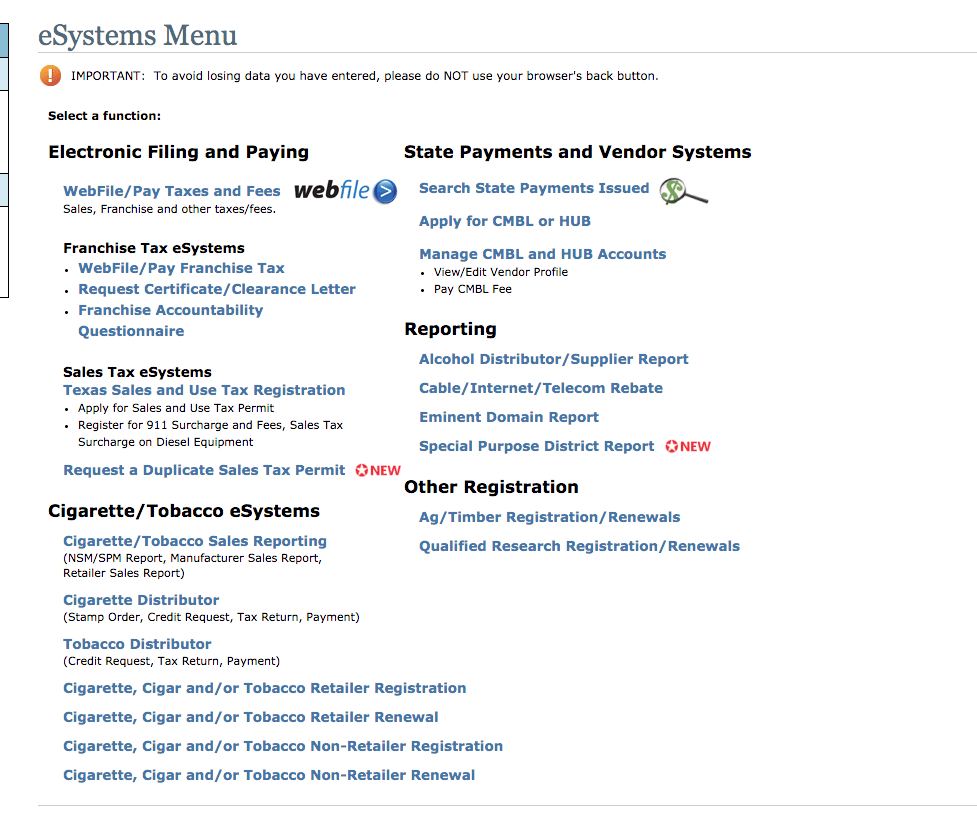

Some customers are exempt from paying sales tax under Texas law Examples include government agencies some nonprofit organizations and merchants purchasing goods for resale Sellers are required to collect a valid exemption or resale certificate from buyers to validate each exempt transaction

The Texas Tax Code provides an exemption from franchise tax and sales tax to Nonprofit organizations with an exemption from Internal Revenue Service IRS under IRC Section 501 c 3 4 8 10 or 19

The What Services Are Exempt From Sales Tax In Texas are a huge assortment of printable resources available online for download at no cost. These printables come in different types, like worksheets, templates, coloring pages, and many more. The great thing about What Services Are Exempt From Sales Tax In Texas lies in their versatility as well as accessibility.

More of What Services Are Exempt From Sales Tax In Texas

Texas Sales Tax Exemption Certificate Form ExemptForm

Texas Sales Tax Exemption Certificate Form ExemptForm

Common Texas sales tax exemptions include those for necessities of life including most food and health related items In addition goods for resale such as wholesale items are exempt from sales tax as well as newspapers containers previously taxed items and certain goods used for manufacturing

Generally exempt organizations must get a sales tax permit and collect and remit sales tax on all goods and taxable services they sell See our Publication 96 122 Nonprofit and Exempt Organizations Purchases and Sales for a list of limited exceptions

What Services Are Exempt From Sales Tax In Texas have risen to immense popularity due to a myriad of compelling factors:

-

Cost-Effective: They eliminate the requirement to purchase physical copies of the software or expensive hardware.

-

Modifications: It is possible to tailor print-ready templates to your specific requirements whether it's making invitations as well as organizing your calendar, or even decorating your house.

-

Education Value Downloads of educational content for free are designed to appeal to students of all ages, making them an essential source for educators and parents.

-

It's easy: Quick access to a myriad of designs as well as templates reduces time and effort.

Where to Find more What Services Are Exempt From Sales Tax In Texas

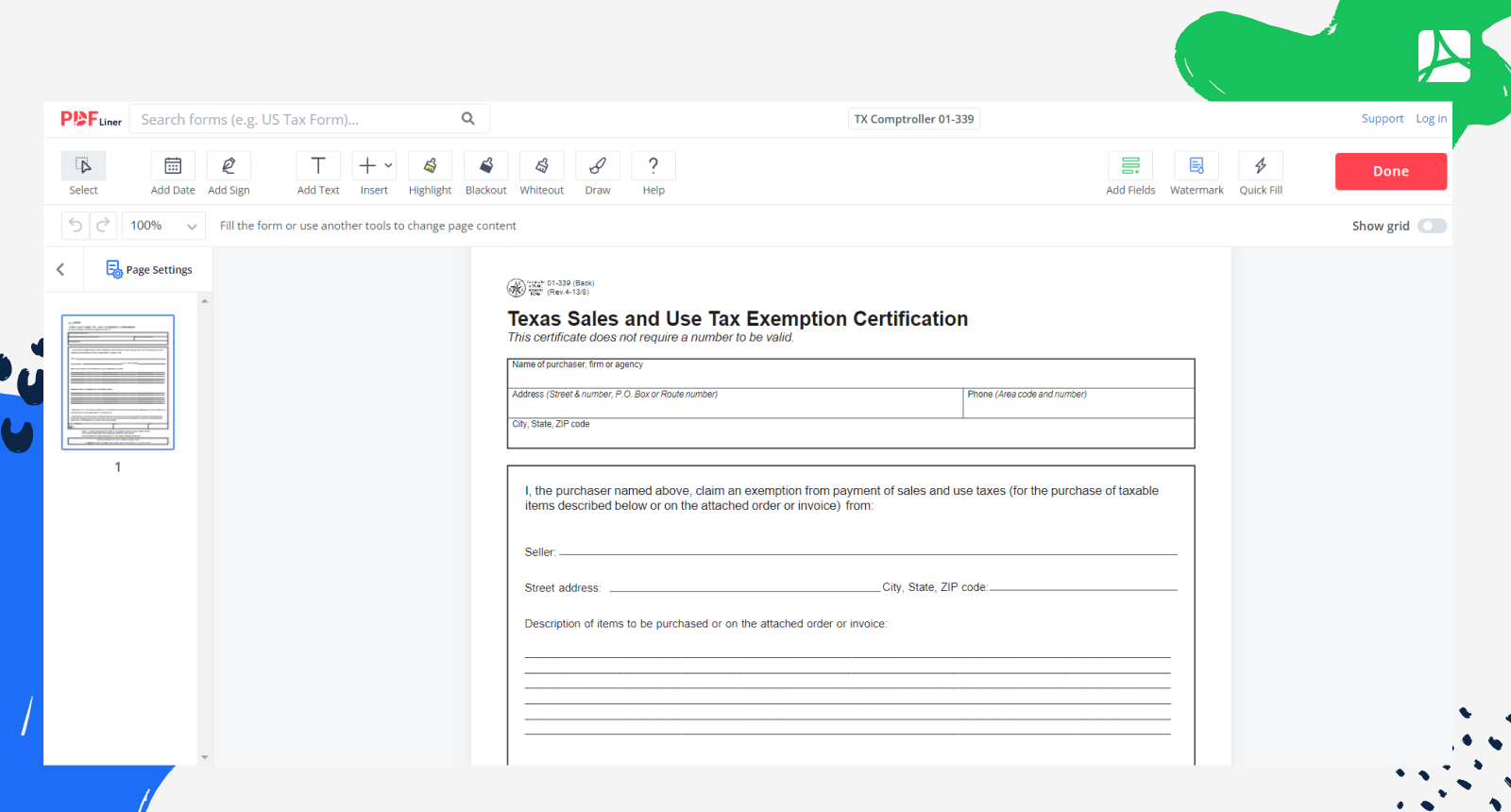

Texas sales tax Exemption Certificate From The Texas Human Rights

Texas sales tax Exemption Certificate From The Texas Human Rights

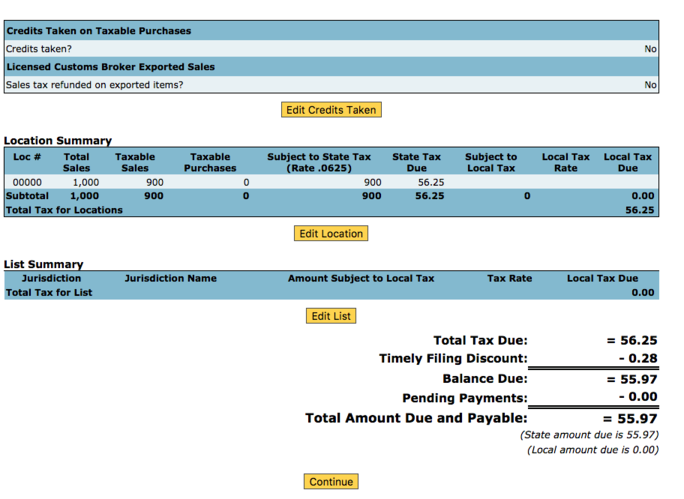

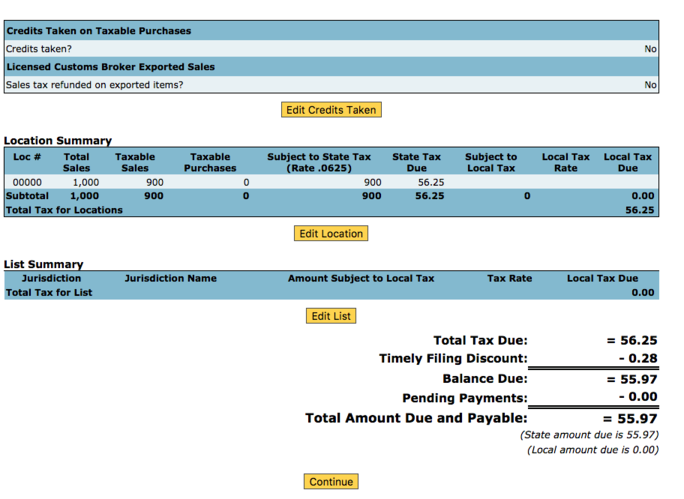

Texas imposes a 6 25 percent state sales and use tax on all retail sales leases and rentals of most goods as well as taxable services Local taxing jurisdictions cities counties special purpose districts and transit authorities can also impose up to 2 percent sales and use tax for a maximum combined rate of 8 25 percent

While most items and services are taxed some items and services are exempt from the state sales and use tax including the discretionary tax Non food items are taxable including paper beauty products clothing hygiene products pet products and some edible items

Now that we've ignited your interest in What Services Are Exempt From Sales Tax In Texas, let's explore where they are hidden gems:

1. Online Repositories

- Websites such as Pinterest, Canva, and Etsy offer a huge selection of What Services Are Exempt From Sales Tax In Texas designed for a variety objectives.

- Explore categories like home decor, education, the arts, and more.

2. Educational Platforms

- Educational websites and forums often offer free worksheets and worksheets for printing along with flashcards, as well as other learning tools.

- Ideal for parents, teachers and students looking for extra sources.

3. Creative Blogs

- Many bloggers are willing to share their original designs and templates at no cost.

- These blogs cover a wide range of interests, including DIY projects to party planning.

Maximizing What Services Are Exempt From Sales Tax In Texas

Here are some inventive ways to make the most of What Services Are Exempt From Sales Tax In Texas:

1. Home Decor

- Print and frame beautiful artwork, quotes or decorations for the holidays to beautify your living areas.

2. Education

- Print free worksheets to build your knowledge at home and in class.

3. Event Planning

- Create invitations, banners, and decorations for special events such as weddings or birthdays.

4. Organization

- Keep track of your schedule with printable calendars for to-do list, lists of chores, and meal planners.

Conclusion

What Services Are Exempt From Sales Tax In Texas are an abundance of fun and practical tools designed to meet a range of needs and interests. Their access and versatility makes them an invaluable addition to both personal and professional life. Explore the plethora of What Services Are Exempt From Sales Tax In Texas today to discover new possibilities!

Frequently Asked Questions (FAQs)

-

Are printables actually absolutely free?

- Yes they are! You can download and print these free resources for no cost.

-

Do I have the right to use free templates for commercial use?

- It's all dependent on the rules of usage. Always verify the guidelines provided by the creator before using printables for commercial projects.

-

Do you have any copyright concerns with printables that are free?

- Some printables may come with restrictions concerning their use. Always read the terms and regulations provided by the author.

-

How can I print What Services Are Exempt From Sales Tax In Texas?

- Print them at home with your printer or visit an in-store print shop to get superior prints.

-

What software must I use to open printables that are free?

- Most PDF-based printables are available in the format PDF. This can be opened using free software, such as Adobe Reader.

Texas Sales And Use Tax Exemption Certification 01 339 Form PDFliner

Texas Sales Use Tax Exemptions Report Lorman Education Services

Check more sample of What Services Are Exempt From Sales Tax In Texas below

Texas Sales And Use Tax Exemption Certificate Form

Map State Sales Taxes And Clothing Exemptions

_0.png)

Texas Sales Tax Guide

.png)

How To File A Texas Sales Tax ReturnTaxJar Blog

Tx Form Sales Tax Exemption Fill Online Printable Fillable Blank

State And Local Sales Tax Rates Midyear 2013 Tax Foundation Texas

https://comptroller.texas.gov/taxes/publications/96-1045.php

The Texas Tax Code provides an exemption from franchise tax and sales tax to Nonprofit organizations with an exemption from Internal Revenue Service IRS under IRC Section 501 c 3 4 8 10 or 19

https://www.salestaxhandbook.com/texas/sales-tax-exemptions

What purchases are exempt from the Texas sales tax While the Texas sales tax of 6 25 applies to most transactions there are certain items that may be exempt from taxation This page discusses various sales tax exemptions in Texas

The Texas Tax Code provides an exemption from franchise tax and sales tax to Nonprofit organizations with an exemption from Internal Revenue Service IRS under IRC Section 501 c 3 4 8 10 or 19

What purchases are exempt from the Texas sales tax While the Texas sales tax of 6 25 applies to most transactions there are certain items that may be exempt from taxation This page discusses various sales tax exemptions in Texas

How To File A Texas Sales Tax ReturnTaxJar Blog

_0.png)

Map State Sales Taxes And Clothing Exemptions

Tx Form Sales Tax Exemption Fill Online Printable Fillable Blank

State And Local Sales Tax Rates Midyear 2013 Tax Foundation Texas

Texas Tax Exempt Certificate Fill And Sign Printable Template Online

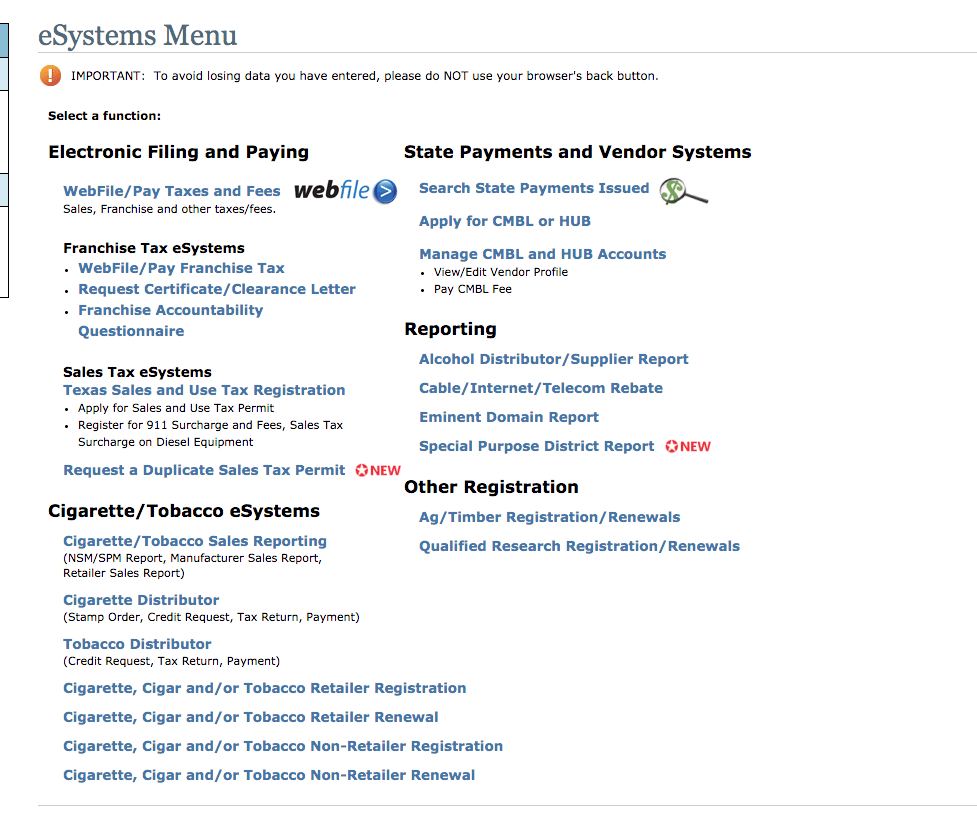

How To File And Pay Sales Tax In Texas TaxValet

How To File And Pay Sales Tax In Texas TaxValet

Top 16 How To Collect sales tax In texas In 2022 G u y