In the age of digital, with screens dominating our lives but the value of tangible printed materials isn't diminishing. Whether it's for educational purposes such as creative projects or simply adding the personal touch to your home, printables for free can be an excellent source. We'll take a dive deep into the realm of "What S The Federal Tax Rate On Social Security," exploring the benefits of them, where to find them, and how they can add value to various aspects of your life.

Get Latest What S The Federal Tax Rate On Social Security Below

What S The Federal Tax Rate On Social Security

What S The Federal Tax Rate On Social Security -

The federal government can tax up to 85 of your Social Security benefits so it s good to know how those taxes are calculated

Single filers with a combined income of 25 000 to 34 000 must pay income taxes on up to 50 of their Social Security benefits If

What S The Federal Tax Rate On Social Security provide a diverse variety of printable, downloadable items that are available online at no cost. They come in many types, like worksheets, coloring pages, templates and much more. The benefit of What S The Federal Tax Rate On Social Security is in their versatility and accessibility.

More of What S The Federal Tax Rate On Social Security

The Union Role In Our Growing Taxocracy California Policy Center

The Union Role In Our Growing Taxocracy California Policy Center

Up to 85 of a taxpayer s benefits may be taxable if they are Filing single head of household or qualifying widow or widower with more than 34 000 income

Key Takeaways The Social Security tax rate for employees and employers is 6 2 of employee compensation each for a total of 12 4 The Social Security tax rate for those who are

Printables for free have gained immense popularity due to a variety of compelling reasons:

-

Cost-Efficiency: They eliminate the necessity of purchasing physical copies or costly software.

-

Individualization Your HTML0 customization options allow you to customize the design to meet your needs when it comes to designing invitations for your guests, organizing your schedule or even decorating your home.

-

Educational value: Downloads of educational content for free can be used by students of all ages, making them a great source for educators and parents.

-

Easy to use: immediate access numerous designs and templates reduces time and effort.

Where to Find more What S The Federal Tax Rate On Social Security

Ca Tax Brackets Chart Jokeragri

Ca Tax Brackets Chart Jokeragri

The current tax rate for Social Security is 6 2 for the employer and 6 2 for the employee or 12 4 total The current rate for Medicare is 1 45 for the

You ll be taxed on up to 50 percent of your benefits if your income is 25 000 to 34 000 for an individual or 32 000 to 44 000 for a married couple filing jointly up to 85 percent of your benefits if your

If we've already piqued your curiosity about What S The Federal Tax Rate On Social Security Let's look into where you can discover these hidden treasures:

1. Online Repositories

- Websites like Pinterest, Canva, and Etsy offer an extensive collection of What S The Federal Tax Rate On Social Security designed for a variety purposes.

- Explore categories such as decorating your home, education, management, and craft.

2. Educational Platforms

- Educational websites and forums typically provide free printable worksheets with flashcards and other teaching materials.

- It is ideal for teachers, parents and students looking for extra sources.

3. Creative Blogs

- Many bloggers are willing to share their original designs and templates, which are free.

- The blogs covered cover a wide range of interests, from DIY projects to planning a party.

Maximizing What S The Federal Tax Rate On Social Security

Here are some innovative ways in order to maximize the use of printables that are free:

1. Home Decor

- Print and frame stunning art, quotes, or even seasonal decorations to decorate your living spaces.

2. Education

- Use these printable worksheets free of charge for teaching at-home and in class.

3. Event Planning

- Create invitations, banners, and decorations for special events like weddings and birthdays.

4. Organization

- Keep your calendars organized by printing printable calendars checklists for tasks, as well as meal planners.

Conclusion

What S The Federal Tax Rate On Social Security are a treasure trove of fun and practical tools that can meet the needs of a variety of people and interests. Their accessibility and versatility make they a beneficial addition to each day life. Explore the vast collection of printables for free today and uncover new possibilities!

Frequently Asked Questions (FAQs)

-

Are printables for free really are they free?

- Yes, they are! You can download and print these documents for free.

-

Can I download free printables for commercial purposes?

- It's dependent on the particular usage guidelines. Make sure you read the guidelines for the creator prior to printing printables for commercial projects.

-

Do you have any copyright rights issues with What S The Federal Tax Rate On Social Security?

- Certain printables could be restricted in use. Be sure to read the terms of service and conditions provided by the creator.

-

How do I print printables for free?

- Print them at home with either a printer at home or in the local print shops for better quality prints.

-

What software do I need to open printables free of charge?

- Many printables are offered with PDF formats, which is open with no cost software such as Adobe Reader.

Recent Personal And Corporate Tax Developments Tax Canada

Graph Of The Week World s Highest Tax Rates

Check more sample of What S The Federal Tax Rate On Social Security below

California Individual Tax Rate Table 2021 20 Brokeasshome

CARPE DIEM Average Federal Income Tax Rates By Income Group Are Highly

2022 Federal Effective Tax Rate Calculator Printable Form Templates

Social Security Tax Rate 2023 2024 Zrivo

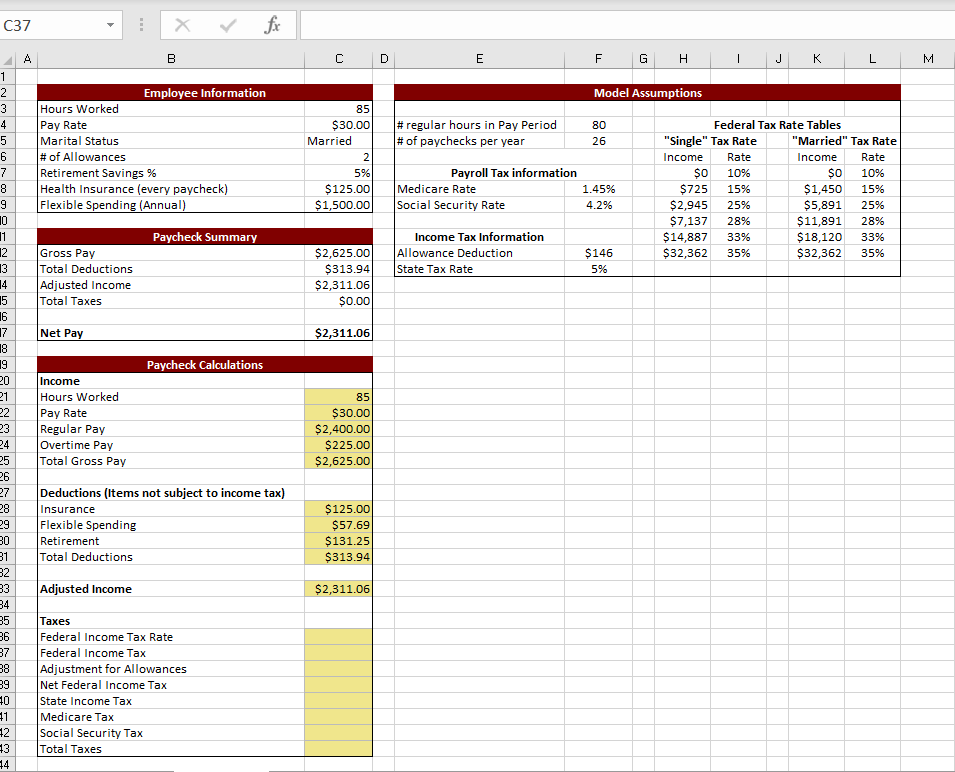

Use An IF Function To Calculate The Federal Income Chegg

Tax On Social Security Benefits Social Security Intelligence

https://smartasset.com › retirement › is-s…

Single filers with a combined income of 25 000 to 34 000 must pay income taxes on up to 50 of their Social Security benefits If

https://www.usatoday.com › story › mo…

Up to 85 of your Social Security benefits are taxable if You file a federal tax return as an individual and your combined income is

Single filers with a combined income of 25 000 to 34 000 must pay income taxes on up to 50 of their Social Security benefits If

Up to 85 of your Social Security benefits are taxable if You file a federal tax return as an individual and your combined income is

Social Security Tax Rate 2023 2024 Zrivo

CARPE DIEM Average Federal Income Tax Rates By Income Group Are Highly

Use An IF Function To Calculate The Federal Income Chegg

Tax On Social Security Benefits Social Security Intelligence

Social Security Tax Explained How Much State Tax Will I Pay On Social

States That Tax Social Security Benefits Tax Foundation

States That Tax Social Security Benefits Tax Foundation

Federal Income Tax Due Date 2022 Latest News Update