In this age of electronic devices, where screens have become the dominant feature of our lives and the appeal of physical printed materials isn't diminishing. It doesn't matter if it's for educational reasons in creative or artistic projects, or simply adding personal touches to your home, printables for free have proven to be a valuable resource. This article will take a dive into the world "What Part Of Pension Income Is Taxable," exploring the benefits of them, where they are available, and how they can enrich various aspects of your lives.

Get Latest What Part Of Pension Income Is Taxable Below

What Part Of Pension Income Is Taxable

What Part Of Pension Income Is Taxable -

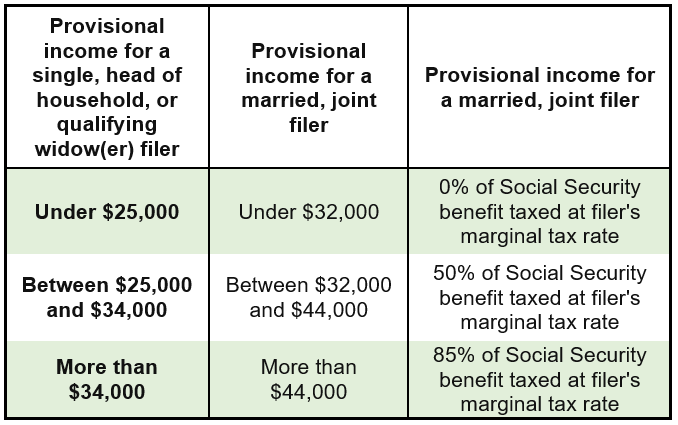

Find Out Whether Your Pension IRA or Other Retirement Income Is Taxable Certain sources of retirement income are taxable partially taxable or tax free Learn which ones may apply to your financial situation so you re prepared come tax season

You ll pay Income Tax on any part of the lump sum that goes above either your lump sum allowance your lump sum and death benefit allowance Find out what your lump sum allowances are Tax

What Part Of Pension Income Is Taxable provide a diverse assortment of printable material that is available online at no cost. They are available in a variety of designs, including worksheets coloring pages, templates and more. The appeal of printables for free lies in their versatility as well as accessibility.

More of What Part Of Pension Income Is Taxable

What Types Of Pensions Are Available True Potential Wealth Management

What Types Of Pensions Are Available True Potential Wealth Management

Taxable portion of your pension and annuity income is in the Instructions for Form 1040 and Form 1040 SR For additional information see Publication 575 Pension and Annuity Income CONTINUED

According to the IRS your pension income is fully taxable if any of the following applies to you You didn t contribute anything for your pension or annuity Your employer didn t withhold contributions from your salary or You received all of your contributions tax free in prior years

What Part Of Pension Income Is Taxable have gained immense popularity due to a myriad of compelling factors:

-

Cost-Effective: They eliminate the need to purchase physical copies of the software or expensive hardware.

-

Flexible: They can make the templates to meet your individual needs when it comes to designing invitations and schedules, or even decorating your house.

-

Educational value: Printables for education that are free offer a wide range of educational content for learners of all ages, making these printables a powerful resource for educators and parents.

-

It's easy: Quick access to an array of designs and templates, which saves time as well as effort.

Where to Find more What Part Of Pension Income Is Taxable

What Business Income Is Not Taxable

What Business Income Is Not Taxable

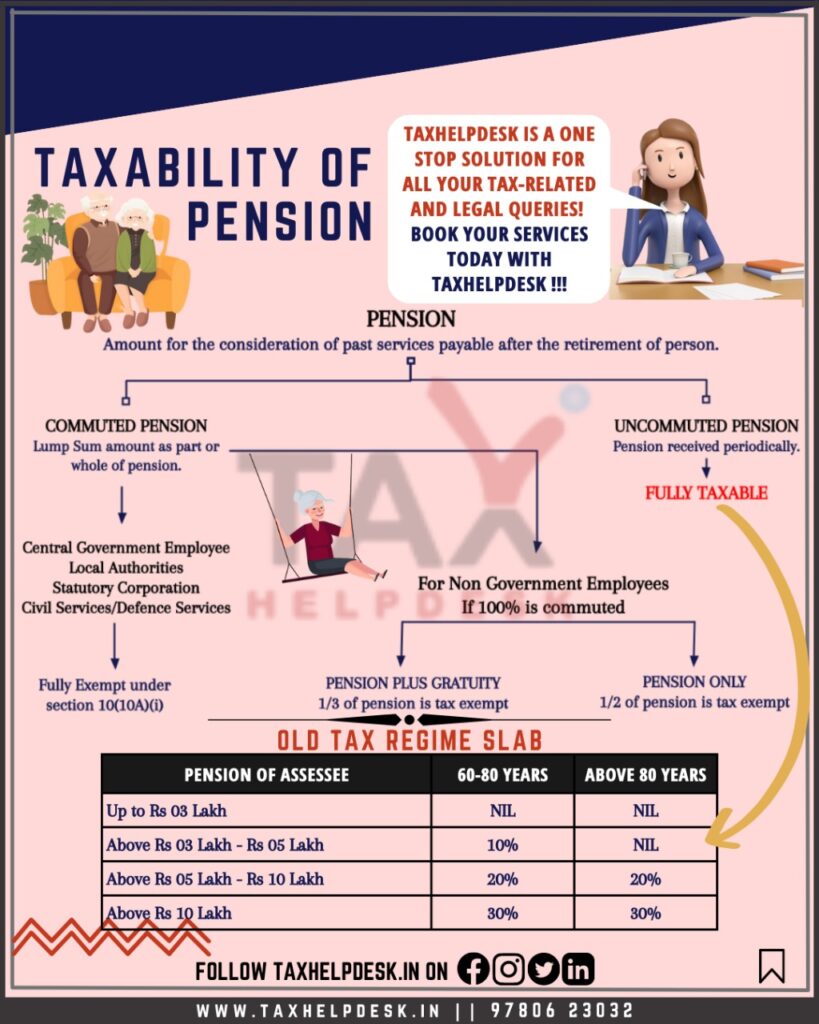

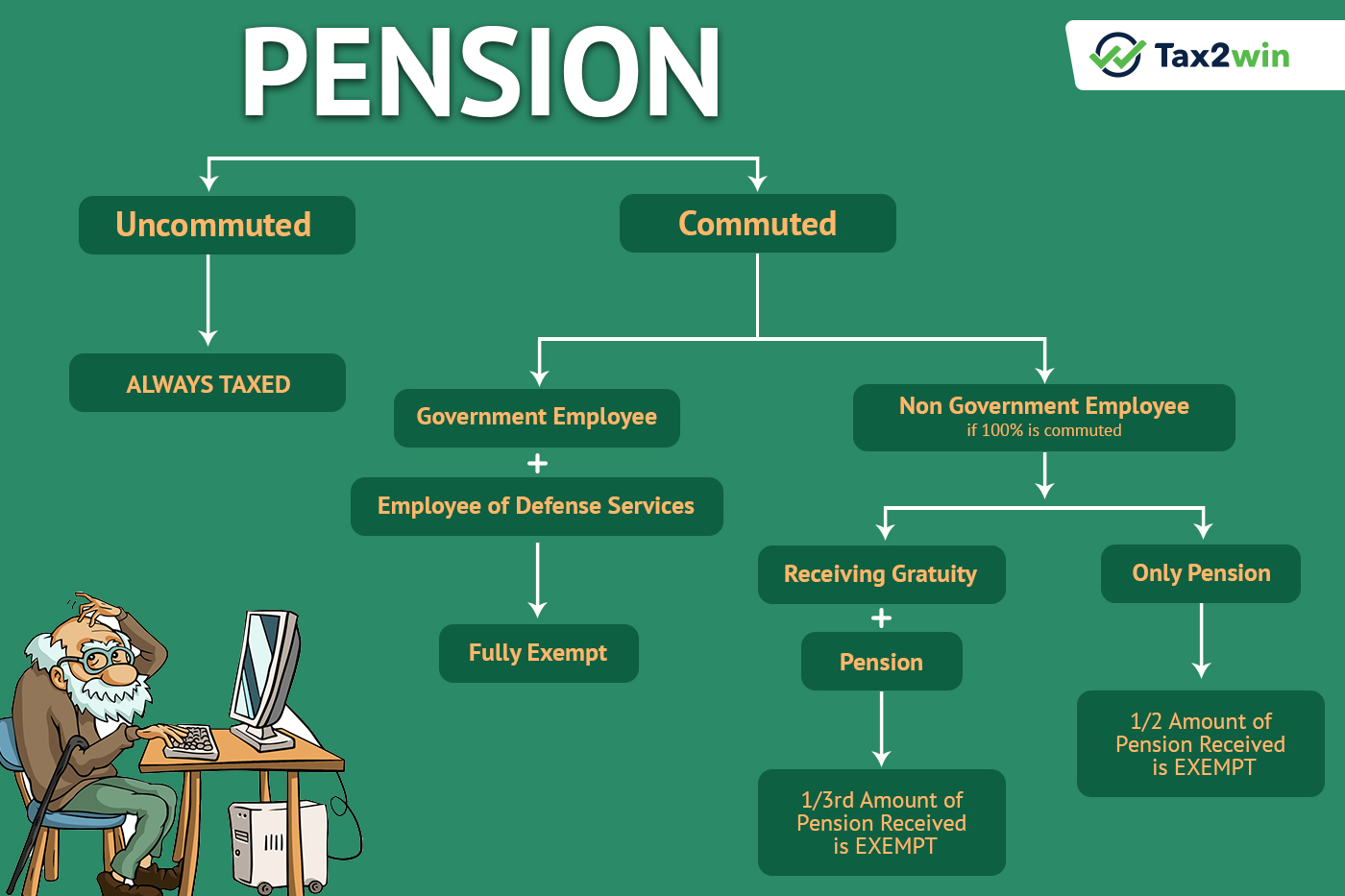

Pension is taxable under the head salaries in your income tax return Pensions are paid out periodically generally every month However you may also choose to receive your pension as a lump sum also called commuted pension instead of a periodical payment

Calculating the taxable portion usually involves using what s known as the Simplified Method To do so you ll fill out a worksheet from the IRS to come up with exact numbers

We've now piqued your curiosity about What Part Of Pension Income Is Taxable and other printables, let's discover where you can discover these hidden treasures:

1. Online Repositories

- Websites like Pinterest, Canva, and Etsy provide a wide selection of printables that are free for a variety of reasons.

- Explore categories like the home, decor, organizational, and arts and crafts.

2. Educational Platforms

- Educational websites and forums frequently provide worksheets that can be printed for free, flashcards, and learning materials.

- Great for parents, teachers and students in need of additional resources.

3. Creative Blogs

- Many bloggers share their innovative designs and templates free of charge.

- These blogs cover a wide array of topics, ranging that includes DIY projects to planning a party.

Maximizing What Part Of Pension Income Is Taxable

Here are some ways of making the most use of printables for free:

1. Home Decor

- Print and frame beautiful art, quotes, or seasonal decorations to adorn your living spaces.

2. Education

- Utilize free printable worksheets to build your knowledge at home or in the classroom.

3. Event Planning

- Make invitations, banners and other decorations for special occasions like weddings and birthdays.

4. Organization

- Stay organized with printable planners with to-do lists, planners, and meal planners.

Conclusion

What Part Of Pension Income Is Taxable are a treasure trove filled with creative and practical information for a variety of needs and passions. Their accessibility and flexibility make them a wonderful addition to both personal and professional life. Explore the plethora of What Part Of Pension Income Is Taxable and open up new possibilities!

Frequently Asked Questions (FAQs)

-

Are What Part Of Pension Income Is Taxable really for free?

- Yes they are! You can print and download these items for free.

-

Can I download free printables in commercial projects?

- It's based on the conditions of use. Make sure you read the guidelines for the creator prior to using the printables in commercial projects.

-

Are there any copyright issues in What Part Of Pension Income Is Taxable?

- Some printables may come with restrictions in their usage. Be sure to review the terms of service and conditions provided by the author.

-

How can I print printables for free?

- You can print them at home using your printer or visit the local print shop for superior prints.

-

What software will I need to access printables that are free?

- Many printables are offered in PDF format. These can be opened with free programs like Adobe Reader.

Free Of Charge Creative Commons Pension Income Image Financial 8

Pension Account Registration Declines Further In Q2 23 Vanguard News

Check more sample of What Part Of Pension Income Is Taxable below

Taxability Of Pension All You Need To Know

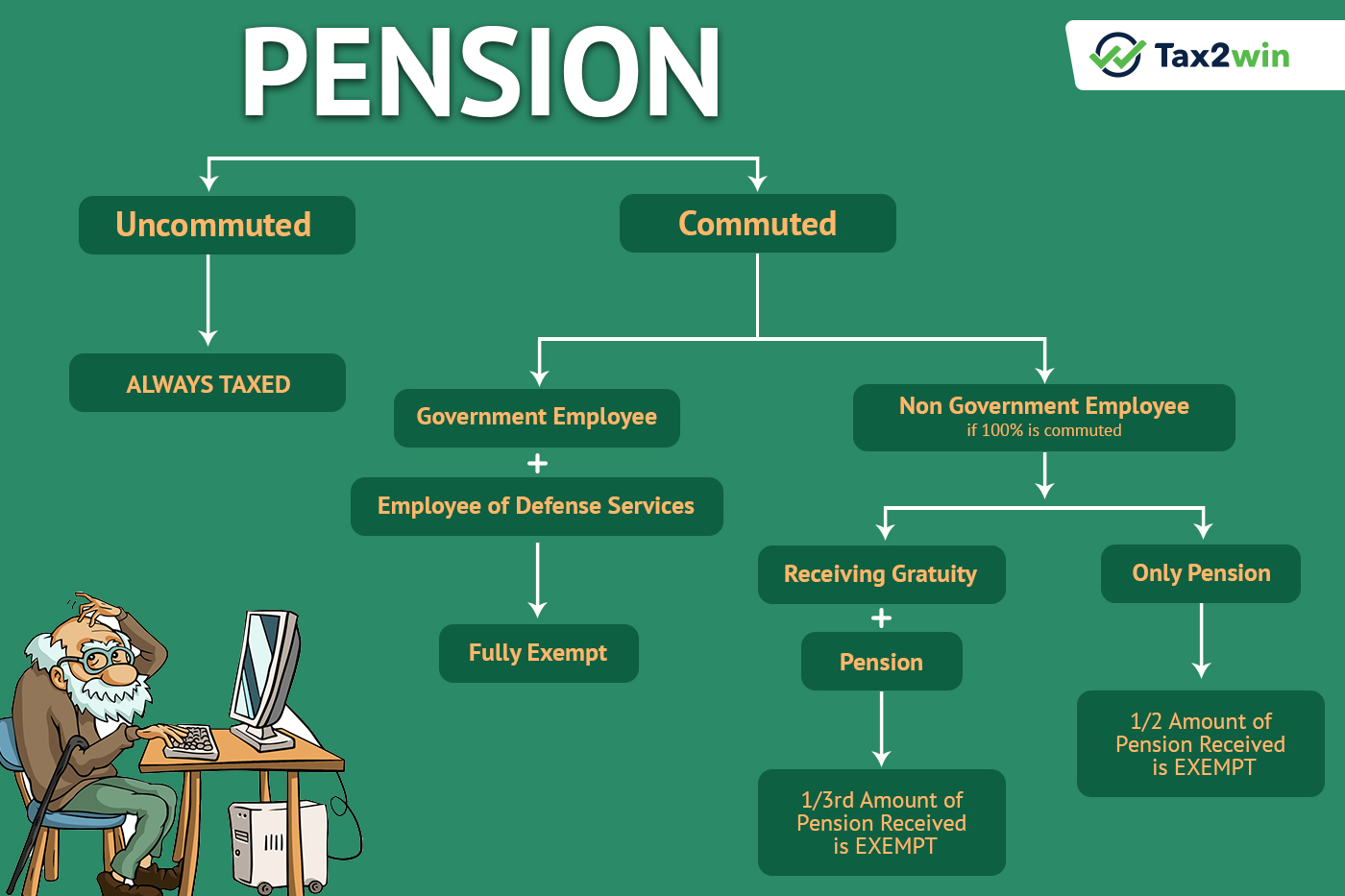

Income Tax Return For Pension Earners No More A Tedious Task Tax2win Blog

Your State Pension Forecast Explained Which

Is Pension Taxable Max Life Insurance

What is taxable income Financial Wellness Starts Here

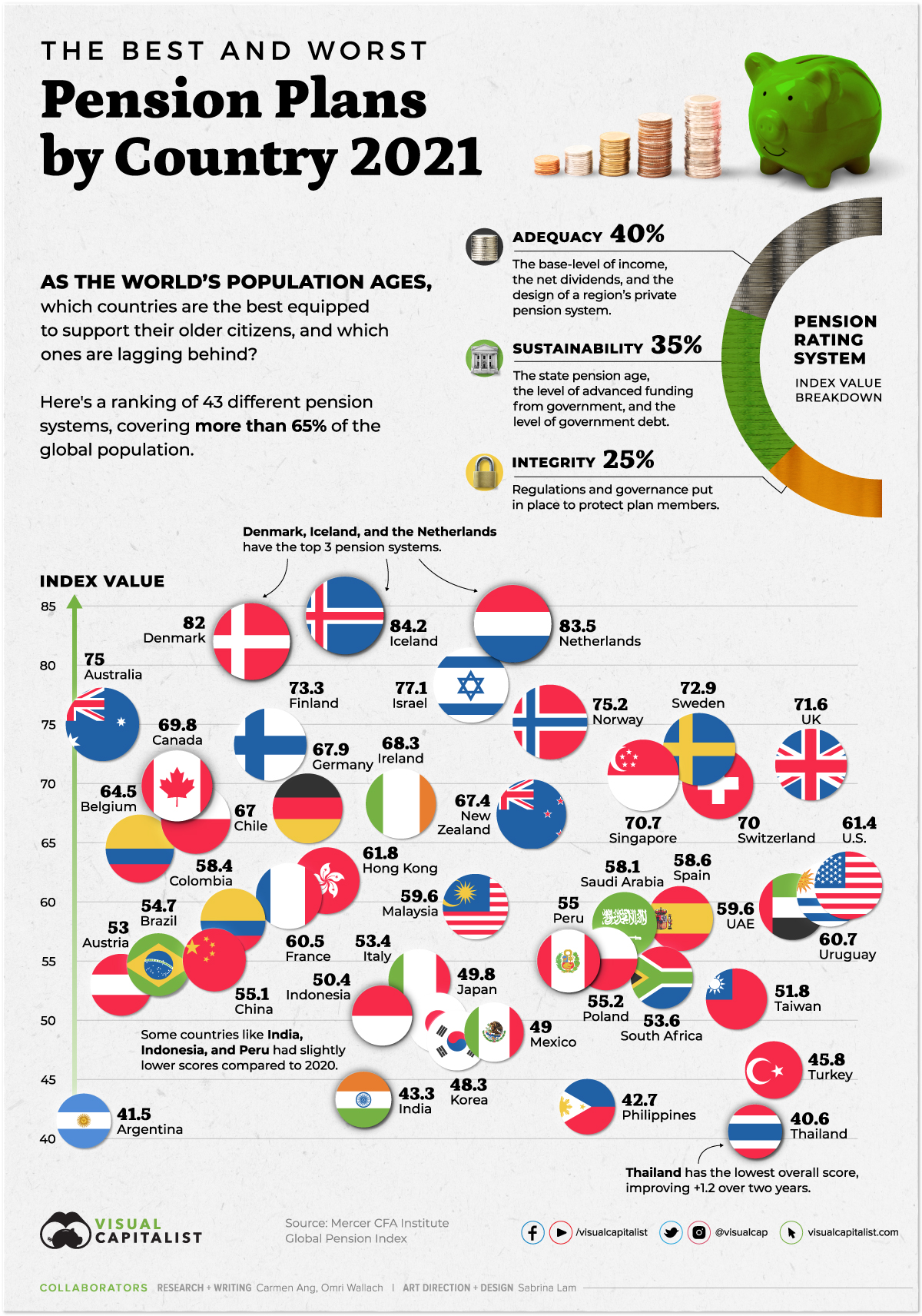

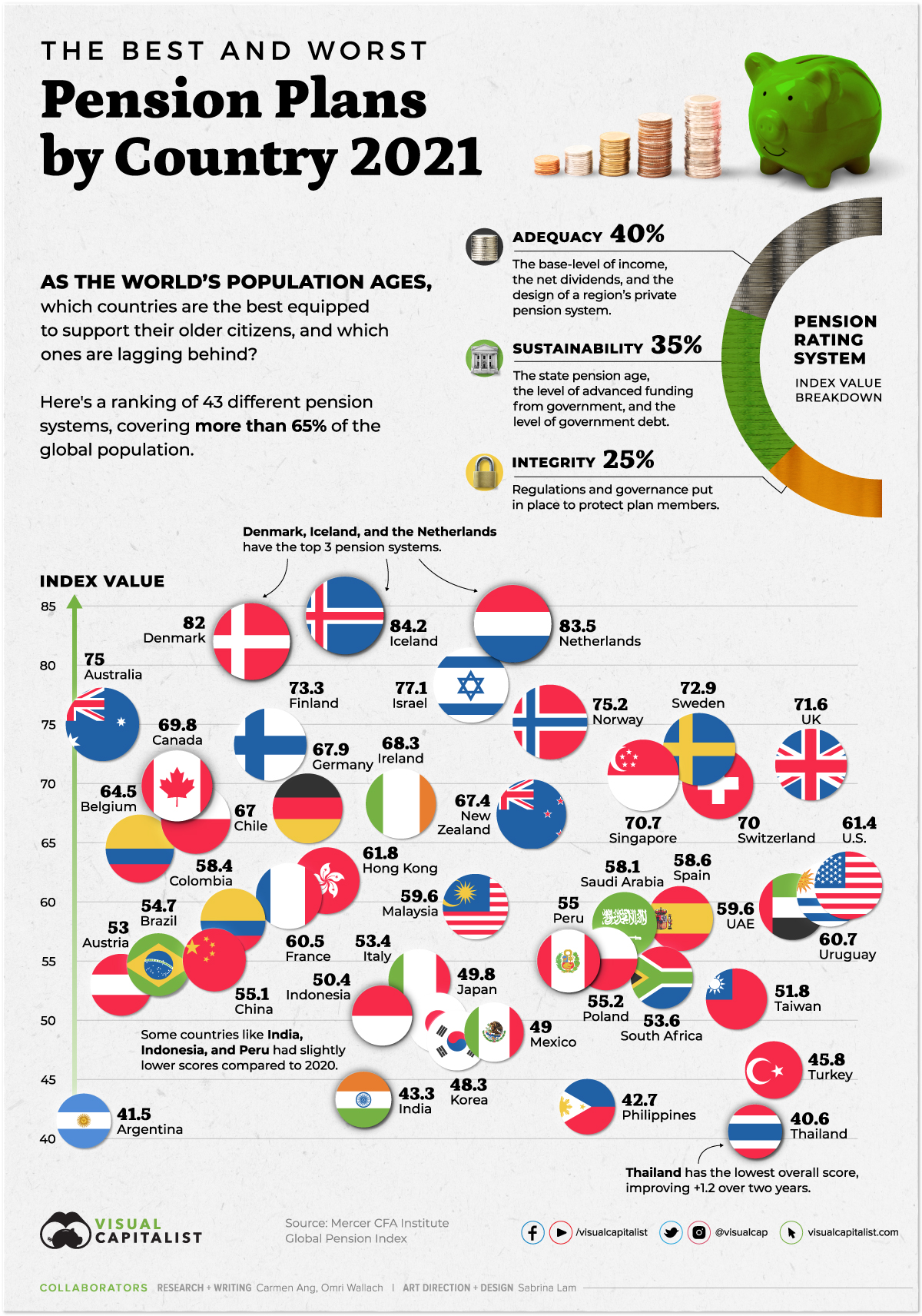

Ranked The Best And Worst Pension Plans By Country

https://www.gov.uk/tax-on-pension

You ll pay Income Tax on any part of the lump sum that goes above either your lump sum allowance your lump sum and death benefit allowance Find out what your lump sum allowances are Tax

https://www.irs.gov/taxtopics/tc411

Topic no 411 Pensions The general rule and the simplified method If some contributions to your pension or annuity plan were previously included in gross income you can exclude part of the distributions from income You must figure the tax free part when the payments first begin

You ll pay Income Tax on any part of the lump sum that goes above either your lump sum allowance your lump sum and death benefit allowance Find out what your lump sum allowances are Tax

Topic no 411 Pensions The general rule and the simplified method If some contributions to your pension or annuity plan were previously included in gross income you can exclude part of the distributions from income You must figure the tax free part when the payments first begin

Is Pension Taxable Max Life Insurance

Income Tax Return For Pension Earners No More A Tedious Task Tax2win Blog

What is taxable income Financial Wellness Starts Here

Ranked The Best And Worst Pension Plans By Country

What Is Taxable Income Explanation Importance Calculation Bizness

Age Pension Changes JBS Financial Strategists

Age Pension Changes JBS Financial Strategists

How To Calculate Exemption On Pension Income