In this age of electronic devices, with screens dominating our lives and the appeal of physical, printed materials hasn't diminished. It doesn't matter if it's for educational reasons such as creative projects or just adding an individual touch to your space, What Line Does Social Security Tax Withheld Go On 1040 are now an essential resource. For this piece, we'll take a dive deeper into "What Line Does Social Security Tax Withheld Go On 1040," exploring what they are, how you can find them, and ways they can help you improve many aspects of your daily life.

Get Latest What Line Does Social Security Tax Withheld Go On 1040 Below

What Line Does Social Security Tax Withheld Go On 1040

What Line Does Social Security Tax Withheld Go On 1040 -

1040 SR and their instructions such as legislation enacted after they were published go to IRS gov Form1040 Free File is the fast safe and free way to prepare and e le your taxes See IRS gov FreeFile Pay Online It s fast simple and secure Go to IRS gov Payments Including the instructions for Schedules 1 through 3 2023 TAX YEAR

If you or your spouse if filing a joint tax return had more than one employer for 2023 and total wages of more than 160 200 too much social security tax may have been withheld You can take a credit on this line for the amount withheld in excess of 9 932 40

What Line Does Social Security Tax Withheld Go On 1040 offer a wide selection of printable and downloadable materials that are accessible online for free cost. These resources come in many designs, including worksheets templates, coloring pages and more. The great thing about What Line Does Social Security Tax Withheld Go On 1040 is in their versatility and accessibility.

More of What Line Does Social Security Tax Withheld Go On 1040

Can I Get Out Of Paying Social Security Tax NJMoneyHelp

Can I Get Out Of Paying Social Security Tax NJMoneyHelp

You report the taxable portion of your social security benefits on line 6b of Form 1040 or Form 1040 SR Your benefits may be taxable if the total of 1 one half of your benefits plus 2 all of your other income including tax exempt interest is greater than the base amount for your filing status

You can have 7 10 12 or 22 percent of your monthly benefit withheld for taxes Only these percentages can be withheld Flat dollar amounts are not accepted Sign the form and return it to your local Social Security office by mail or in person

What Line Does Social Security Tax Withheld Go On 1040 have gained a lot of popularity for several compelling reasons:

-

Cost-Efficiency: They eliminate the necessity of purchasing physical copies or expensive software.

-

The ability to customize: You can tailor designs to suit your personal needs be it designing invitations for your guests, organizing your schedule or even decorating your home.

-

Educational Impact: Educational printables that can be downloaded for free are designed to appeal to students from all ages, making them an invaluable source for educators and parents.

-

Accessibility: The instant accessibility to the vast array of design and templates will save you time and effort.

Where to Find more What Line Does Social Security Tax Withheld Go On 1040

How To Calculate Taxable Social Security Form 1040 Line 6b Marotta

How To Calculate Taxable Social Security Form 1040 Line 6b Marotta

Lines 1 through 7 are all about your income If you have a W 2 you will need to enter the earnings information from that form here You also need to attach any and all W 2 forms you have Then you can

Line 6 of the 2020 Form 1040 is used to report your Social Security income Much like retirement income on line 4 and line 5 line 6 is split into a taxable and nontaxable component unfortunately it is not as easy to

Since we've got your interest in What Line Does Social Security Tax Withheld Go On 1040 Let's look into where you can find these elusive gems:

1. Online Repositories

- Websites such as Pinterest, Canva, and Etsy provide an extensive selection of What Line Does Social Security Tax Withheld Go On 1040 designed for a variety objectives.

- Explore categories such as decorating your home, education, organizational, and arts and crafts.

2. Educational Platforms

- Educational websites and forums usually offer free worksheets and worksheets for printing or flashcards as well as learning tools.

- This is a great resource for parents, teachers as well as students searching for supplementary resources.

3. Creative Blogs

- Many bloggers provide their inventive designs and templates at no cost.

- These blogs cover a broad selection of subjects, including DIY projects to planning a party.

Maximizing What Line Does Social Security Tax Withheld Go On 1040

Here are some ideas how you could make the most of printables for free:

1. Home Decor

- Print and frame beautiful artwork, quotes, as well as seasonal decorations, to embellish your living spaces.

2. Education

- Print worksheets that are free for teaching at-home for the classroom.

3. Event Planning

- Design invitations, banners, and decorations for special events like weddings and birthdays.

4. Organization

- Stay organized with printable calendars checklists for tasks, as well as meal planners.

Conclusion

What Line Does Social Security Tax Withheld Go On 1040 are an abundance of useful and creative resources that cater to various needs and desires. Their access and versatility makes they a beneficial addition to every aspect of your life, both professional and personal. Explore the world that is What Line Does Social Security Tax Withheld Go On 1040 today, and open up new possibilities!

Frequently Asked Questions (FAQs)

-

Are printables actually completely free?

- Yes, they are! You can print and download these resources at no cost.

-

Can I download free printouts for commercial usage?

- It's all dependent on the terms of use. Be sure to read the rules of the creator before using printables for commercial projects.

-

Do you have any copyright issues when you download printables that are free?

- Certain printables might have limitations regarding their use. Be sure to check the conditions and terms of use provided by the author.

-

How can I print What Line Does Social Security Tax Withheld Go On 1040?

- You can print them at home using printing equipment or visit an in-store print shop to get better quality prints.

-

What program do I require to view printables for free?

- Many printables are offered in PDF format. These can be opened with free software such as Adobe Reader.

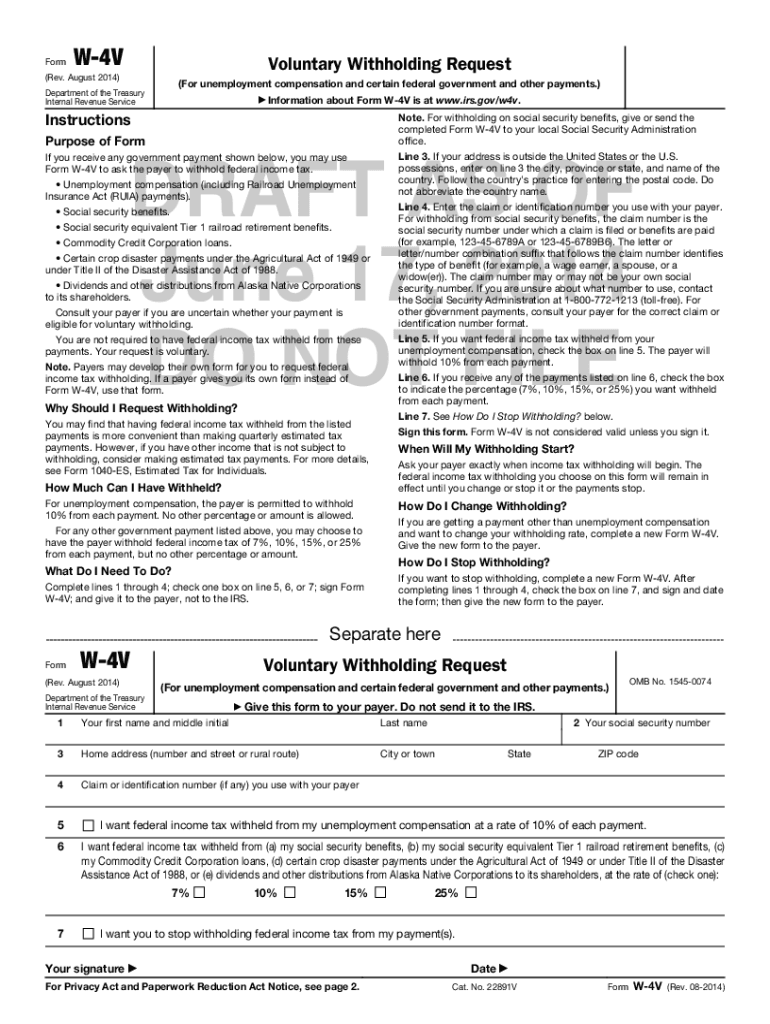

Social Security Tax Withholding Form 2022 WithholdingForm

Irs Releases Form 1040 For 2020 Tax Year Free Download Nude Photo Gallery

Check more sample of What Line Does Social Security Tax Withheld Go On 1040 below

Social Security GuangGurpage

Completing Form 1040 The Face Of Your Tax Return US 2021 Tax Forms

Social Security Tax Withholding What Do YOU Pay YouTube

Pin On Finance

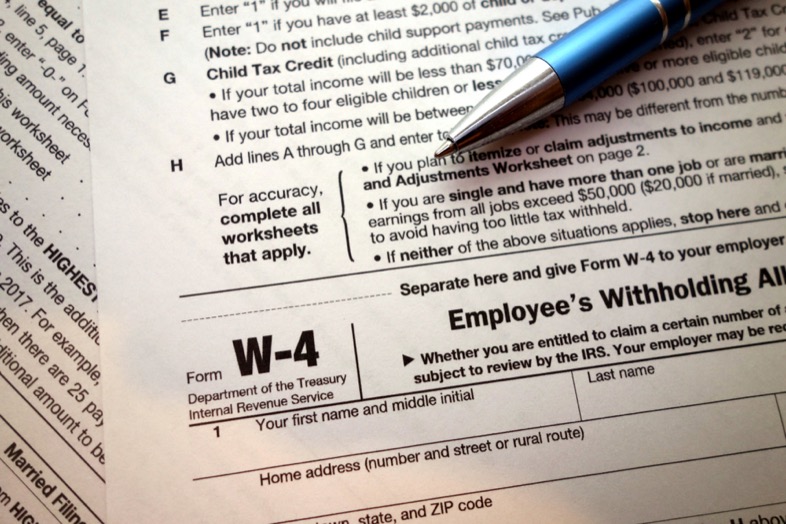

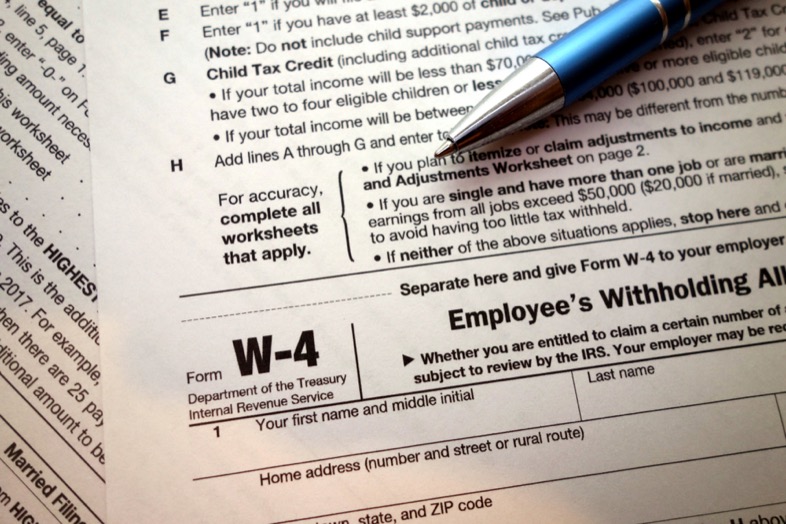

New W 4 IRS Tax Form How It Affects You MyBankTracker

A Way To Cut Tax On Social Security Benefits

https://www.irs.gov/instructions/i1040ss

If you or your spouse if filing a joint tax return had more than one employer for 2023 and total wages of more than 160 200 too much social security tax may have been withheld You can take a credit on this line for the amount withheld in excess of 9 932 40

https://money.stackexchange.com/questions/156288/...

1 Answer Sorted by 5 You do not need to attach the form SSA 1099 to your tax return The instructions to the IRS form 1040 line 25 b which is where you need to put the value from box 6 explicitly mention form SSA 1099 but also explicitly only instruct to attach copies of form 1099 R

If you or your spouse if filing a joint tax return had more than one employer for 2023 and total wages of more than 160 200 too much social security tax may have been withheld You can take a credit on this line for the amount withheld in excess of 9 932 40

1 Answer Sorted by 5 You do not need to attach the form SSA 1099 to your tax return The instructions to the IRS form 1040 line 25 b which is where you need to put the value from box 6 explicitly mention form SSA 1099 but also explicitly only instruct to attach copies of form 1099 R

Pin On Finance

Completing Form 1040 The Face Of Your Tax Return US 2021 Tax Forms

New W 4 IRS Tax Form How It Affects You MyBankTracker

A Way To Cut Tax On Social Security Benefits

Social Security Cost Of Living Adjustments 2023

Form W PDF Withholding Tax Social Security Number

Form W PDF Withholding Tax Social Security Number

What Is Federal Tax Withholding DaveRamsey