In the age of digital, in which screens are the norm however, the attraction of tangible printed products hasn't decreased. No matter whether it's for educational uses such as creative projects or simply adding personal touches to your area, What Is The Threshold For Additional Medicare Tax have proven to be a valuable resource. This article will dive into the world of "What Is The Threshold For Additional Medicare Tax," exploring the different types of printables, where they can be found, and how they can add value to various aspects of your daily life.

Get Latest What Is The Threshold For Additional Medicare Tax Below

What Is The Threshold For Additional Medicare Tax

What Is The Threshold For Additional Medicare Tax -

The threshold amounts are based on your filing status Single head of household or qualifying widow er 200 000 Married filing jointly 250 000 Married filing separately 125 000 For purposes of the additional Medicare tax earned income includes Wages Bonuses Tips Certain noncash fringe benefits Self employment income

The Additional Medicare Tax applies to wages railroad retirement RRTA compensation and self employment income over certain thresholds Employers are responsible for withholding the tax on wages and RRTA compensation in certain circumstances

What Is The Threshold For Additional Medicare Tax cover a large range of downloadable, printable materials online, at no cost. These printables come in different styles, from worksheets to coloring pages, templates and many more. The appealingness of What Is The Threshold For Additional Medicare Tax is their versatility and accessibility.

More of What Is The Threshold For Additional Medicare Tax

What Is Additional Medicare Tax

What Is Additional Medicare Tax

Step 1 Calculate the Additional Medicare Tax on any wages in excess of the applicable threshold for the filing status without regard to whether any tax was withheld Step 2 Reduce the applicable threshold for the filing status by the total amount of Medicare wages received but not below zero

Fact checked by Pete Rathburn What Is Medicare Tax Medicare tax is a federal employment tax that funds a portion of the Medicare insurance program In 2024 the Medicare tax rate is

What Is The Threshold For Additional Medicare Tax have risen to immense recognition for a variety of compelling motives:

-

Cost-Effective: They eliminate the need to purchase physical copies of the software or expensive hardware.

-

Individualization They can make printing templates to your own specific requirements such as designing invitations for your guests, organizing your schedule or decorating your home.

-

Educational Worth: Printables for education that are free are designed to appeal to students of all ages. This makes them a useful aid for parents as well as educators.

-

Affordability: Quick access to a myriad of designs as well as templates is time-saving and saves effort.

Where to Find more What Is The Threshold For Additional Medicare Tax

What Is Medicare Tax Definitions Rates And Calculations ValuePenguin

What Is Medicare Tax Definitions Rates And Calculations ValuePenguin

What is the Income Thresholds subject to Additional Medicare Tax The income thresholds for the AMT vary based on the taxpayer s filing status Single Filer 200 000 Married Filing Jointly 250 000 Married Filing Separate 125 000 Head of household with qualifying person 200 000 Qualifying widow er with dependent

The Additional Medicare Tax only applies to the portion of your employment self employment and railroad retirement earnings that exceed the income thresholds for your filing status You can find these thresholds in

If we've already piqued your interest in printables for free and other printables, let's discover where you can find these elusive gems:

1. Online Repositories

- Websites like Pinterest, Canva, and Etsy offer a huge selection of printables that are free for a variety of purposes.

- Explore categories like the home, decor, crafting, and organization.

2. Educational Platforms

- Educational websites and forums typically offer free worksheets and worksheets for printing or flashcards as well as learning tools.

- Ideal for parents, teachers, and students seeking supplemental resources.

3. Creative Blogs

- Many bloggers share their innovative designs and templates for free.

- These blogs cover a broad array of topics, ranging ranging from DIY projects to planning a party.

Maximizing What Is The Threshold For Additional Medicare Tax

Here are some unique ways to make the most use of printables for free:

1. Home Decor

- Print and frame beautiful art, quotes, as well as seasonal decorations, to embellish your living areas.

2. Education

- Print out free worksheets and activities to aid in learning at your home either in the schoolroom or at home.

3. Event Planning

- Design invitations, banners and other decorations for special occasions like weddings and birthdays.

4. Organization

- Get organized with printable calendars or to-do lists. meal planners.

Conclusion

What Is The Threshold For Additional Medicare Tax are an abundance filled with creative and practical information catering to different needs and preferences. Their accessibility and versatility make they a beneficial addition to both personal and professional life. Explore the plethora of printables for free today and uncover new possibilities!

Frequently Asked Questions (FAQs)

-

Do printables with no cost really cost-free?

- Yes you can! You can print and download these materials for free.

-

Are there any free printables for commercial use?

- It's determined by the specific rules of usage. Always review the terms of use for the creator before using printables for commercial projects.

-

Are there any copyright violations with What Is The Threshold For Additional Medicare Tax?

- Certain printables may be subject to restrictions regarding usage. Be sure to read these terms and conditions as set out by the designer.

-

How do I print printables for free?

- You can print them at home using any printer or head to an in-store print shop to get higher quality prints.

-

What software will I need to access What Is The Threshold For Additional Medicare Tax?

- The majority of printables are in the format PDF. This is open with no cost programs like Adobe Reader.

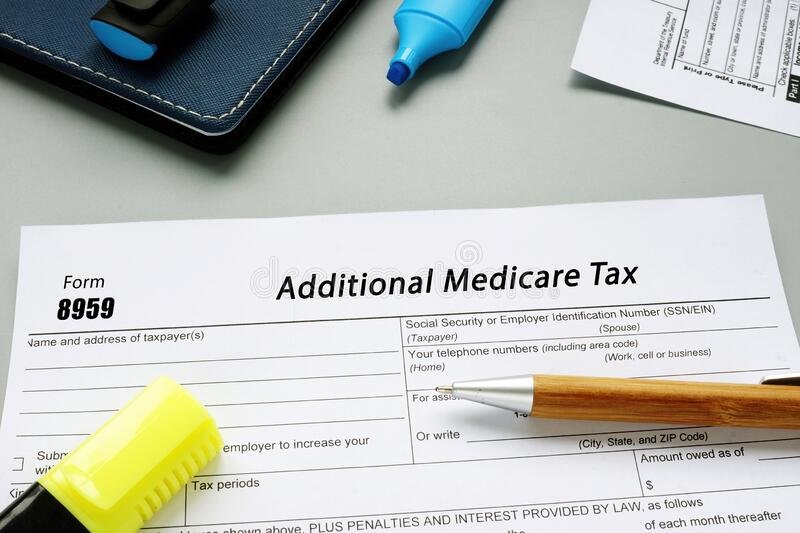

Form 8959 All You Need To Know GMU Consults

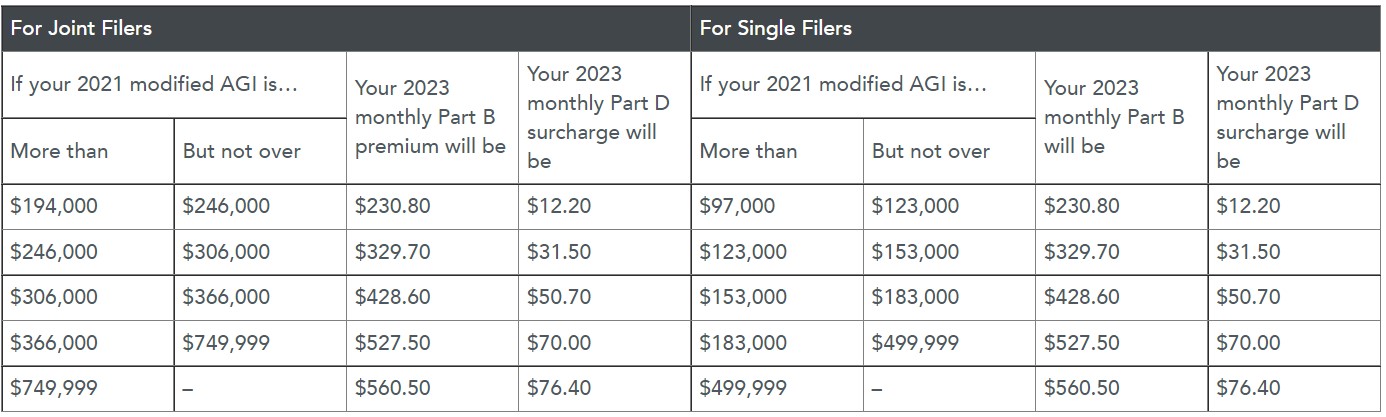

Medicare Premiums And Income Levels Acumen Wealth Advisors

Check more sample of What Is The Threshold For Additional Medicare Tax below

What Is The Additional Medicare Tax Who Pays Tax Rate

Your Guide To Medicare Premiums RetireMed

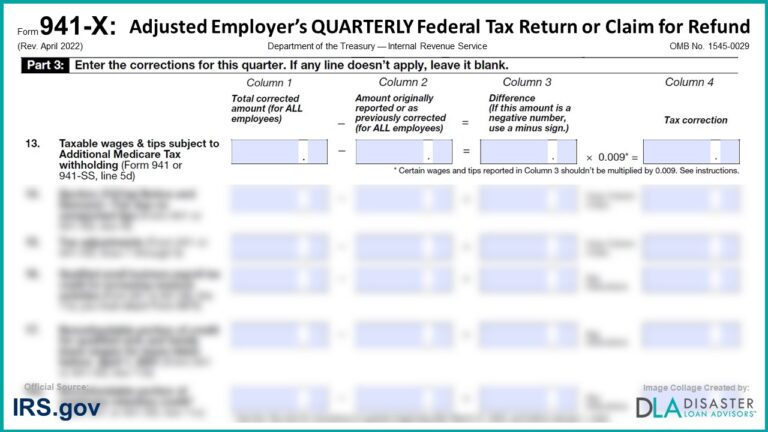

941 X 13 Taxable Wages And Tips Subject To Additional Medicare Tax

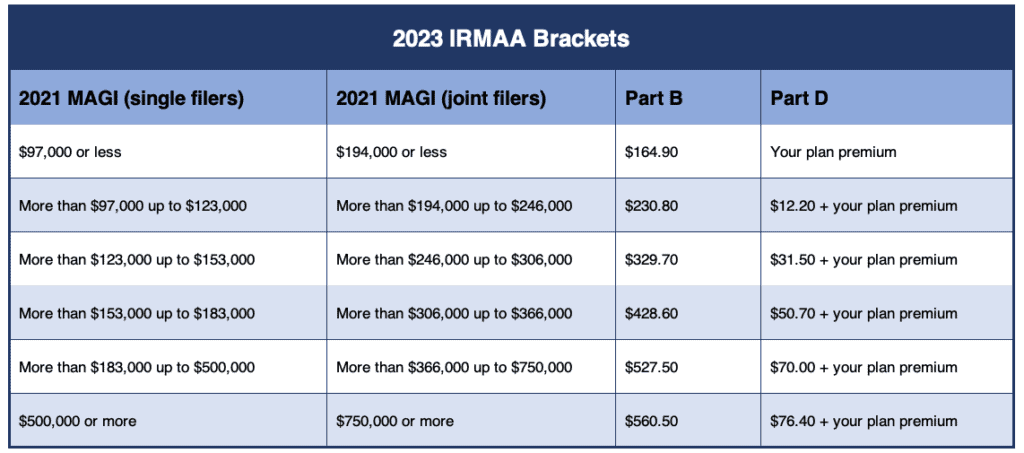

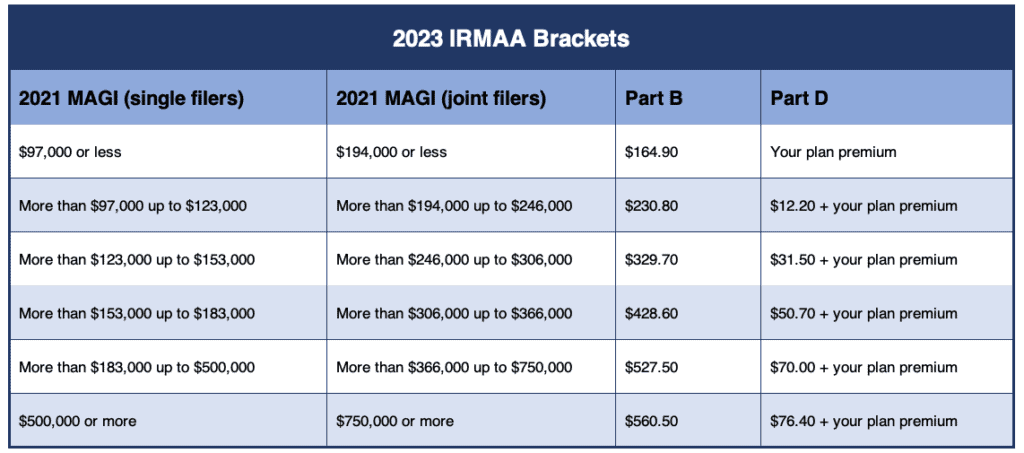

The 2023 IRMAA Brackets Social Security Intelligence

Oak Adjustable Threshold 5 3 4 Wide Capitol City Lumber

What Is Medicare Tax Purpose Rate Additional Medicare And More

https://www. irs.gov /businesses/small-businesses-self-employed/...

The Additional Medicare Tax applies to wages railroad retirement RRTA compensation and self employment income over certain thresholds Employers are responsible for withholding the tax on wages and RRTA compensation in certain circumstances

https://www. retireguide.com /.../tax/additional-medicare-tax

The additional Medicare tax is 0 9 but it doesn t apply to everyone like standard Medicare tax does You ll only have to pay the additional tax if your income surpasses a specific threshold Knowing how it s calculated along with what the additional tax pays for can help you understand the functionality and reasoning behind the

The Additional Medicare Tax applies to wages railroad retirement RRTA compensation and self employment income over certain thresholds Employers are responsible for withholding the tax on wages and RRTA compensation in certain circumstances

The additional Medicare tax is 0 9 but it doesn t apply to everyone like standard Medicare tax does You ll only have to pay the additional tax if your income surpasses a specific threshold Knowing how it s calculated along with what the additional tax pays for can help you understand the functionality and reasoning behind the

The 2023 IRMAA Brackets Social Security Intelligence

Your Guide To Medicare Premiums RetireMed

Oak Adjustable Threshold 5 3 4 Wide Capitol City Lumber

What Is Medicare Tax Purpose Rate Additional Medicare And More

Additional Medicare Tax Thresholds For 2023 Married Filing Separately

Medicare Costs 2023 Chart Hot Sex Picture

Medicare Costs 2023 Chart Hot Sex Picture

Social Security Tax Wage Base For 2023 Kiplinger