In this age of technology, where screens dominate our lives and the appeal of physical printed material hasn't diminished. Whether it's for educational purposes for creative projects, simply to add some personal flair to your area, What Is The Tax Rate On Pensions In North Carolina are a great source. Here, we'll dive into the world of "What Is The Tax Rate On Pensions In North Carolina," exploring the different types of printables, where to locate them, and how they can enrich various aspects of your daily life.

Get Latest What Is The Tax Rate On Pensions In North Carolina Below

What Is The Tax Rate On Pensions In North Carolina

What Is The Tax Rate On Pensions In North Carolina -

Federal Taxes Unless you specify a monthly withholding rate or amount for federal taxes your pension account will default to the rate of married with three allowances If you have already designated a withholding preference no action is required

The tax rate is 5 499 and although there is no retirement centric deductions the state has sizable standard deductions These include the following Single 8 750

What Is The Tax Rate On Pensions In North Carolina cover a large variety of printable, downloadable material that is available online at no cost. These printables come in different formats, such as worksheets, coloring pages, templates and more. The beauty of What Is The Tax Rate On Pensions In North Carolina is their versatility and accessibility.

More of What Is The Tax Rate On Pensions In North Carolina

2021 Nc Standard Deduction Standard Deduction 2021

2021 Nc Standard Deduction Standard Deduction 2021

Income Tax on Taxable Income Low of 2 on up to 500 for single filers and 1 000 for joint filers and a high of 5 on more than 3 000 for single filers and 6 000 for joint filers Social

Social Security is exempt All other forms of retirement income are taxed at the North Carolina flat income tax rate of 5 25 Although the state taxes retirement benefits the standard deduction is 8 750 for single filers 17 500 for joint filers and 14 000 for heads of household

Print-friendly freebies have gained tremendous popularity due to a variety of compelling reasons:

-

Cost-Efficiency: They eliminate the necessity to purchase physical copies or costly software.

-

Individualization Your HTML0 customization options allow you to customize printed materials to meet your requirements for invitations, whether that's creating them or arranging your schedule or even decorating your home.

-

Educational Use: These What Is The Tax Rate On Pensions In North Carolina cater to learners of all ages, which makes these printables a powerful tool for parents and teachers.

-

Affordability: instant access an array of designs and templates, which saves time as well as effort.

Where to Find more What Is The Tax Rate On Pensions In North Carolina

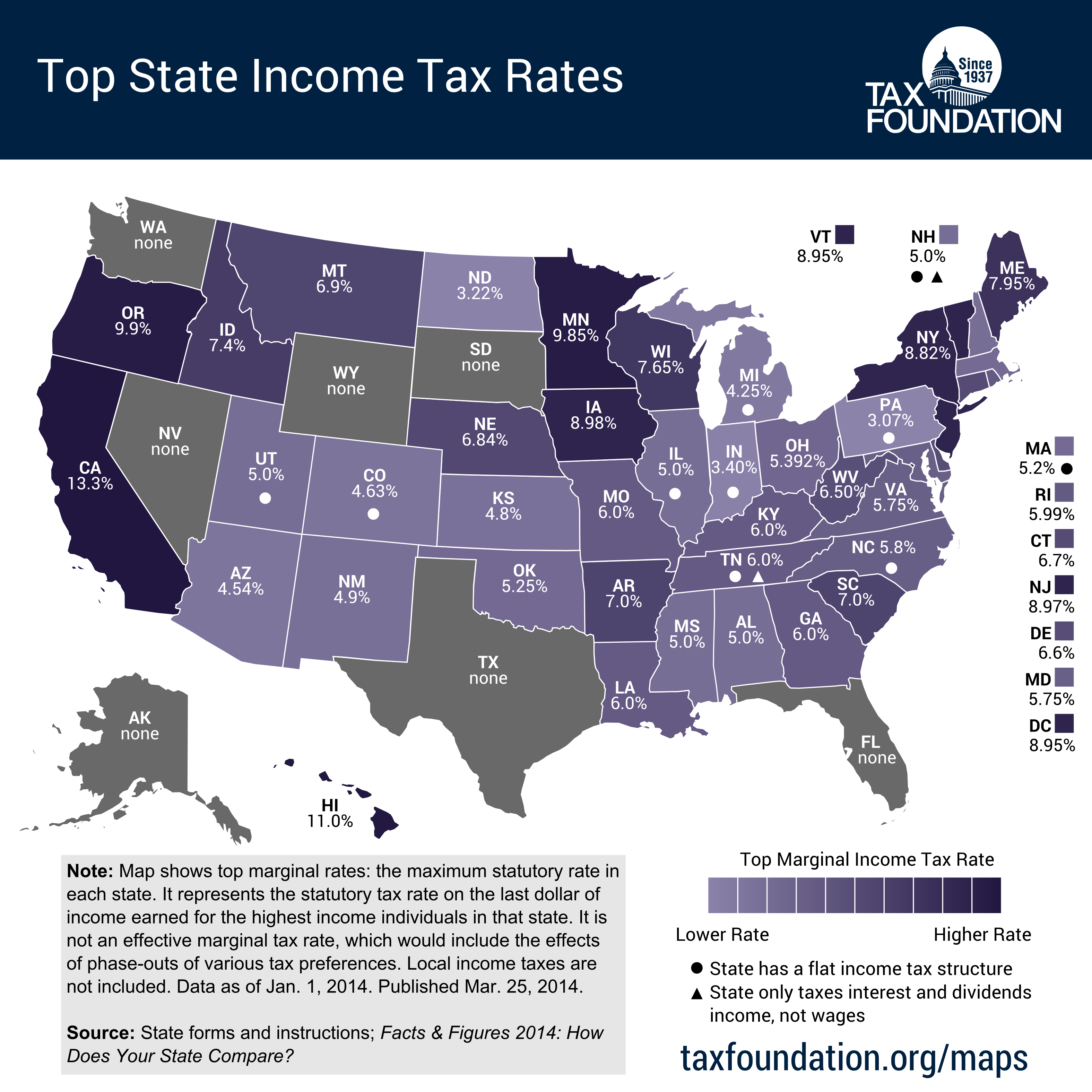

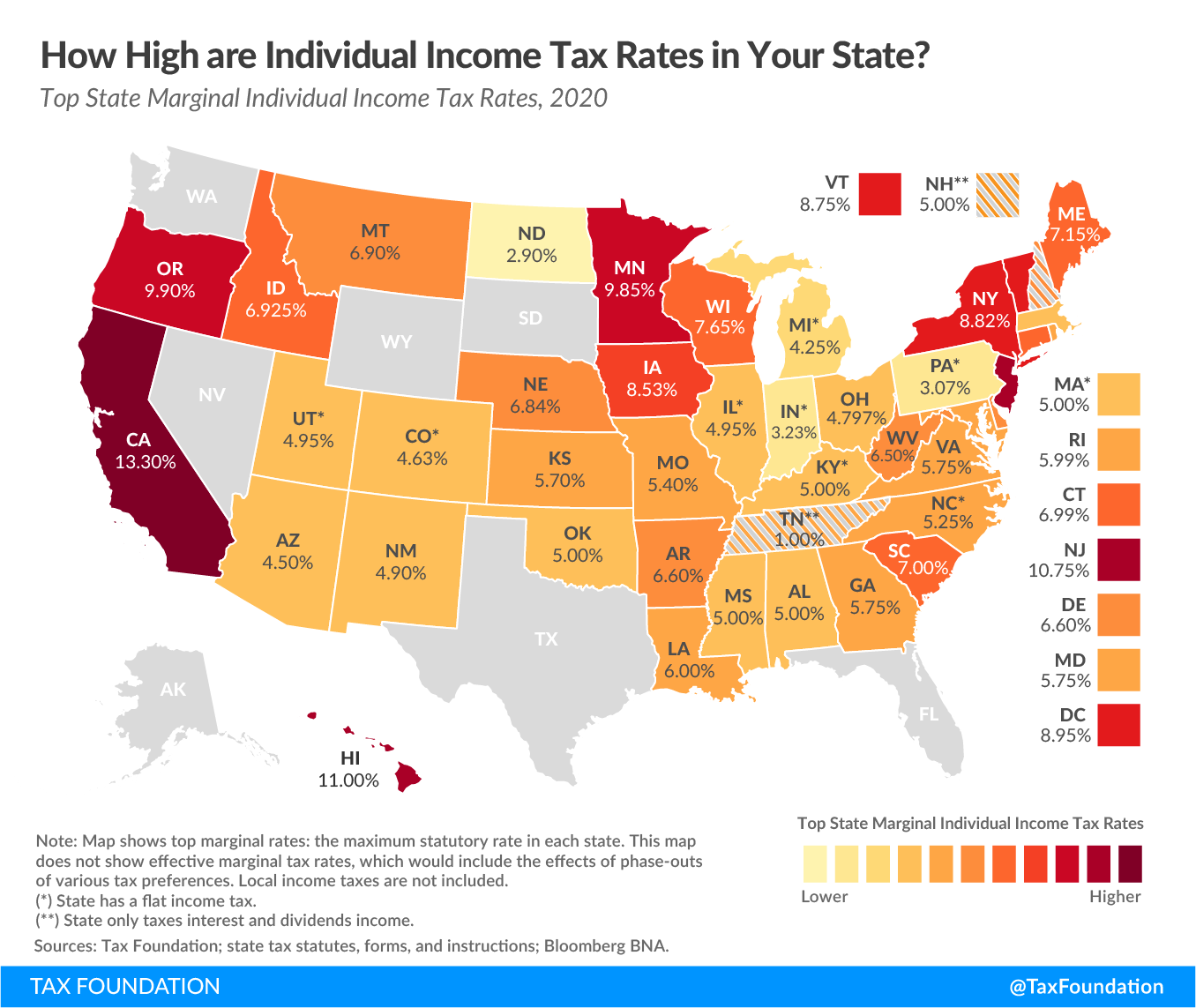

Income Tax Rates By State INVOMERT

Income Tax Rates By State INVOMERT

However North Carolina does charge state income tax as well as taxes on most retirement sources such as 401 k s pensions and IRAs hence the moderate tax friendly label The state also charges a flat tax rate of 4 75 that will gradually decrease to 3 99 in 2027

Taxes in Retirement How All 50 States Tax Retirees Provides an overview of how income from employment investments a pension retirement distributions and Social Security are taxed in every state

We hope we've stimulated your interest in printables for free Let's look into where you can find these elusive gems:

1. Online Repositories

- Websites like Pinterest, Canva, and Etsy provide a wide selection of What Is The Tax Rate On Pensions In North Carolina for various motives.

- Explore categories such as furniture, education, organizational, and arts and crafts.

2. Educational Platforms

- Educational websites and forums often offer worksheets with printables that are free with flashcards and other teaching tools.

- Perfect for teachers, parents as well as students searching for supplementary resources.

3. Creative Blogs

- Many bloggers are willing to share their original designs with templates and designs for free.

- These blogs cover a broad array of topics, ranging that includes DIY projects to planning a party.

Maximizing What Is The Tax Rate On Pensions In North Carolina

Here are some creative ways create the maximum value of What Is The Tax Rate On Pensions In North Carolina:

1. Home Decor

- Print and frame beautiful artwork, quotes, or seasonal decorations to adorn your living areas.

2. Education

- Utilize free printable worksheets to help reinforce your learning at home either in the schoolroom or at home.

3. Event Planning

- Design invitations, banners, and decorations for special occasions such as weddings, birthdays, and other special occasions.

4. Organization

- Get organized with printable calendars including to-do checklists, daily lists, and meal planners.

Conclusion

What Is The Tax Rate On Pensions In North Carolina are an abundance of fun and practical tools that can meet the needs of a variety of people and passions. Their accessibility and versatility make them an essential part of every aspect of your life, both professional and personal. Explore the plethora of What Is The Tax Rate On Pensions In North Carolina today to explore new possibilities!

Frequently Asked Questions (FAQs)

-

Do printables with no cost really are they free?

- Yes they are! You can download and print these tools for free.

-

Do I have the right to use free printables in commercial projects?

- It's contingent upon the specific rules of usage. Always verify the guidelines of the creator before using printables for commercial projects.

-

Are there any copyright issues in printables that are free?

- Some printables may come with restrictions on their use. You should read the terms and conditions set forth by the designer.

-

How can I print What Is The Tax Rate On Pensions In North Carolina?

- Print them at home with any printer or head to a local print shop for the highest quality prints.

-

What software must I use to open printables for free?

- Many printables are offered in the format of PDF, which can be opened with free software like Adobe Reader.

Pension Account Registration Declines Further In Q2 23 Vanguard News

Ca Tax Brackets Chart Jokeragri

Check more sample of What Is The Tax Rate On Pensions In North Carolina below

Editorial On Pensions Rich People s Greed Is Stealing Our Future

Local Government Pensions The 95k Cap On Exit Payments

California Tops List Of 10 States With Highest Taxes

Pensions More Than Just A Tax efficient Way To Save For Retirement

Changes In NHS Pension Contributions Are You A Winner Or Loser

Tax On Pensions Beware The Tax Trap GBM Accounts

https://smartasset.com/retirement/north-carolina-retirement-system

The tax rate is 5 499 and although there is no retirement centric deductions the state has sizable standard deductions These include the following Single 8 750

https://www.actsretirement.org/.../tax-benefits-for-retirees/north-carolina

Social Security income in North Carolina is not taxed However withdrawals from retirement accounts are fully taxed Additionally pension incomes are fully taxed Source smartasset Should You Consider Moving to a Retirement Community in

The tax rate is 5 499 and although there is no retirement centric deductions the state has sizable standard deductions These include the following Single 8 750

Social Security income in North Carolina is not taxed However withdrawals from retirement accounts are fully taxed Additionally pension incomes are fully taxed Source smartasset Should You Consider Moving to a Retirement Community in

Pensions More Than Just A Tax efficient Way To Save For Retirement

Local Government Pensions The 95k Cap On Exit Payments

Changes In NHS Pension Contributions Are You A Winner Or Loser

Tax On Pensions Beware The Tax Trap GBM Accounts

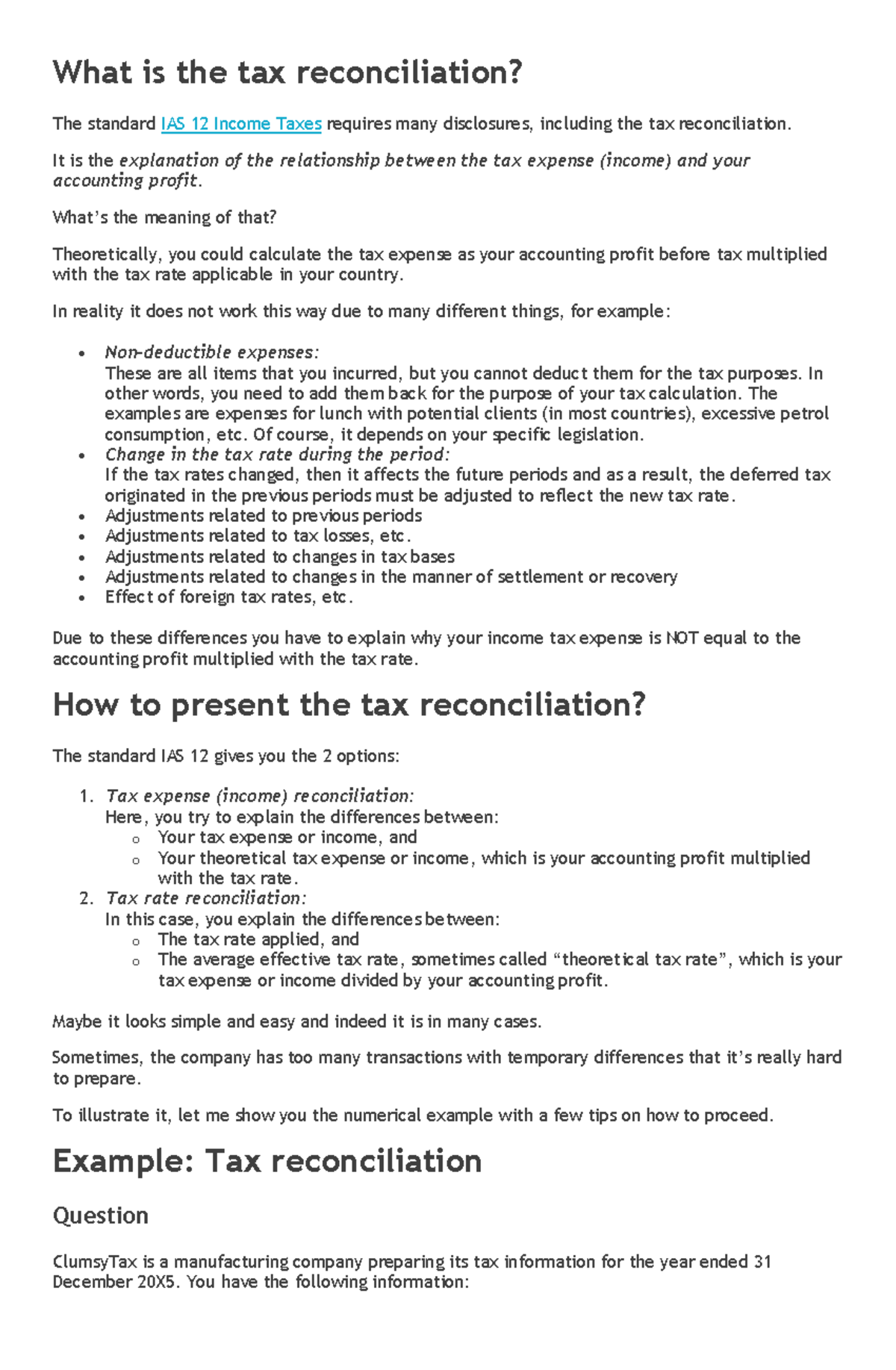

Accounting For Income Deferred Taxes What Is The Tax Reconciliation

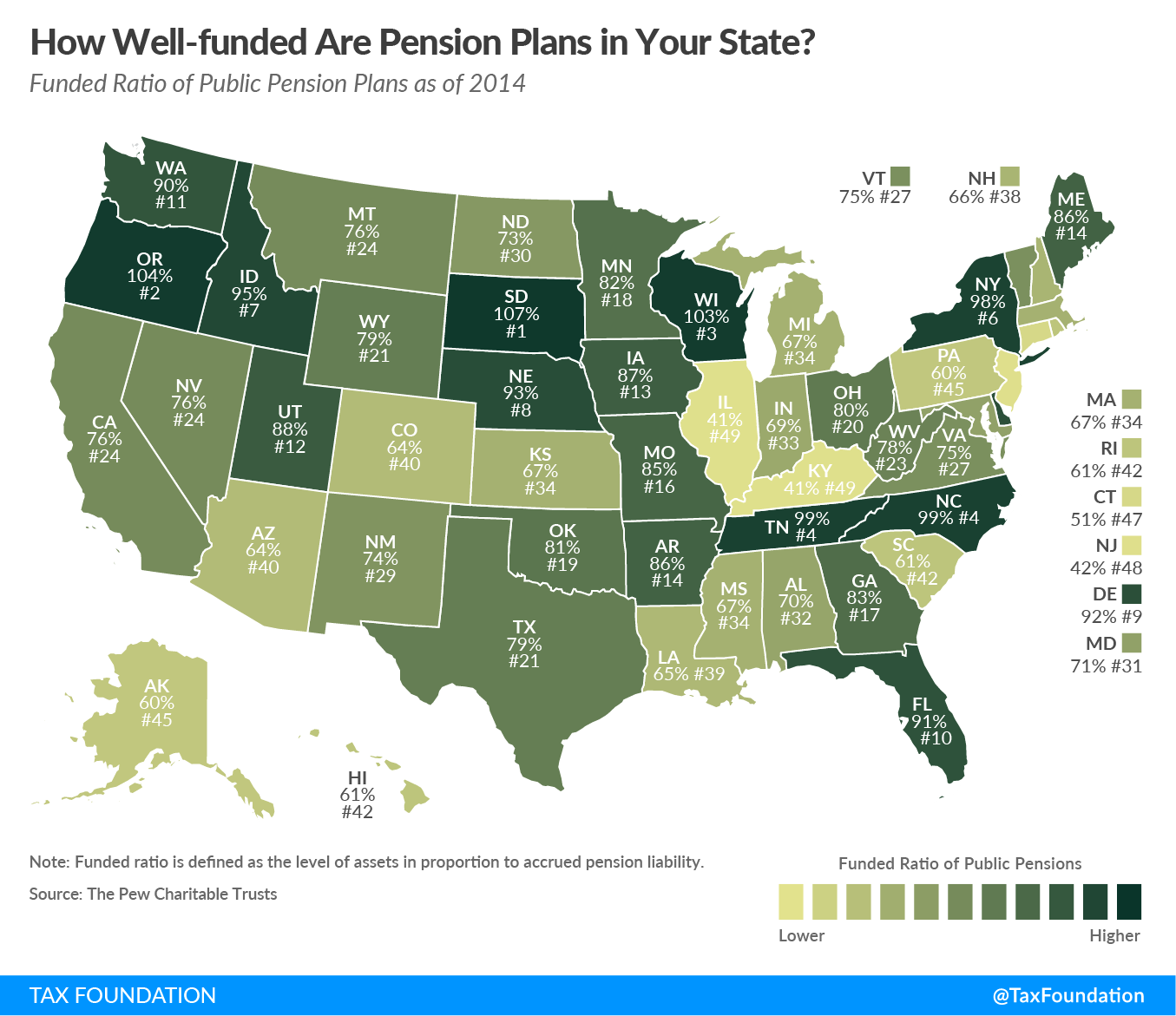

As Pension Debt Crests 1 5 Trillion States Are Headed Toward Crisis

As Pension Debt Crests 1 5 Trillion States Are Headed Toward Crisis

Federal Income Tax Rate For Single Person Rating Walls