Today, when screens dominate our lives and our lives are dominated by screens, the appeal of tangible printed material hasn't diminished. It doesn't matter if it's for educational reasons for creative projects, simply to add a personal touch to your area, What Is The Tax Rate On Pensions In Michigan are now an essential source. In this article, we'll dive into the sphere of "What Is The Tax Rate On Pensions In Michigan," exploring what they are, how they can be found, and how they can enrich various aspects of your lives.

Get Latest What Is The Tax Rate On Pensions In Michigan Below

What Is The Tax Rate On Pensions In Michigan

What Is The Tax Rate On Pensions In Michigan -

If you plan on working during retirement keep in mind that many Michigan cities collect their own income taxes in addition to the state income tax rate of 4 05 In general these city income taxes range from about 1 to

Retirement and pension benefits include most income that is reported on Form 1099 R for federal tax purposes This includes defined benefit pensions IRA distributions and

Printables for free include a vast selection of printable and downloadable content that can be downloaded from the internet at no cost. They are available in a variety of types, such as worksheets templates, coloring pages, and many more. The appealingness of What Is The Tax Rate On Pensions In Michigan is in their variety and accessibility.

More of What Is The Tax Rate On Pensions In Michigan

Short Term Capital Gains Tax Equitymultiple Free Download Nude Photo

Short Term Capital Gains Tax Equitymultiple Free Download Nude Photo

Under Michigan law retirement and pension benefits include most payments that are reported on a 1099 R for federal tax purposes This includes defined benefit pensions

The Department has revised a chart that shows the Michigan individual income tax treatment for pension and retirement benefits effective for tax year 2022

The What Is The Tax Rate On Pensions In Michigan have gained huge popularity because of a number of compelling causes:

-

Cost-Effective: They eliminate the requirement of buying physical copies or costly software.

-

Flexible: It is possible to tailor print-ready templates to your specific requirements for invitations, whether that's creating them as well as organizing your calendar, or even decorating your home.

-

Educational Benefits: Downloads of educational content for free can be used by students of all ages. This makes them a valuable device for teachers and parents.

-

Simple: Instant access to the vast array of design and templates, which saves time as well as effort.

Where to Find more What Is The Tax Rate On Pensions In Michigan

2022 Federal Effective Tax Rate Calculator Printable Form Templates

2022 Federal Effective Tax Rate Calculator Printable Form Templates

Feb 6 2023 Michigan inflation relief checks Whitmer seeks 180 per taxpayer LANSING There appears to be bipartisan support in Lansing for repealing Michigan s unpopular retirement tax But some

For all taxpayers the Michigan income tax rate has dropped to 4 05 in 2023 down from 4 25 in 2022 The bad news Many retirees will be looking at extra work to figure out if they can get

Now that we've piqued your interest in printables for free Let's take a look at where the hidden gems:

1. Online Repositories

- Websites such as Pinterest, Canva, and Etsy provide an extensive selection in What Is The Tax Rate On Pensions In Michigan for different uses.

- Explore categories such as interior decor, education, craft, and organization.

2. Educational Platforms

- Educational websites and forums frequently offer free worksheets and worksheets for printing with flashcards and other teaching materials.

- Ideal for parents, teachers, and students seeking supplemental sources.

3. Creative Blogs

- Many bloggers are willing to share their original designs and templates for free.

- These blogs cover a wide range of topics, everything from DIY projects to party planning.

Maximizing What Is The Tax Rate On Pensions In Michigan

Here are some inventive ways in order to maximize the use of printables for free:

1. Home Decor

- Print and frame beautiful images, quotes, as well as seasonal decorations, to embellish your living spaces.

2. Education

- Use printable worksheets for free for teaching at-home or in the classroom.

3. Event Planning

- Design invitations for banners, invitations as well as decorations for special occasions such as weddings, birthdays, and other special occasions.

4. Organization

- Get organized with printable calendars along with lists of tasks, and meal planners.

Conclusion

What Is The Tax Rate On Pensions In Michigan are an abundance of practical and innovative resources designed to meet a range of needs and pursuits. Their access and versatility makes them a valuable addition to both professional and personal lives. Explore the vast collection of What Is The Tax Rate On Pensions In Michigan now and uncover new possibilities!

Frequently Asked Questions (FAQs)

-

Are the printables you get for free for free?

- Yes, they are! You can download and print these free resources for no cost.

-

Can I make use of free printables for commercial uses?

- It is contingent on the specific terms of use. Always check the creator's guidelines before utilizing their templates for commercial projects.

-

Do you have any copyright issues with printables that are free?

- Certain printables could be restricted in their usage. Make sure to read the terms and condition of use as provided by the designer.

-

How do I print printables for free?

- Print them at home with either a printer at home or in an in-store print shop to get high-quality prints.

-

What software do I require to open printables that are free?

- The majority of printed documents are in PDF format, which is open with no cost software, such as Adobe Reader.

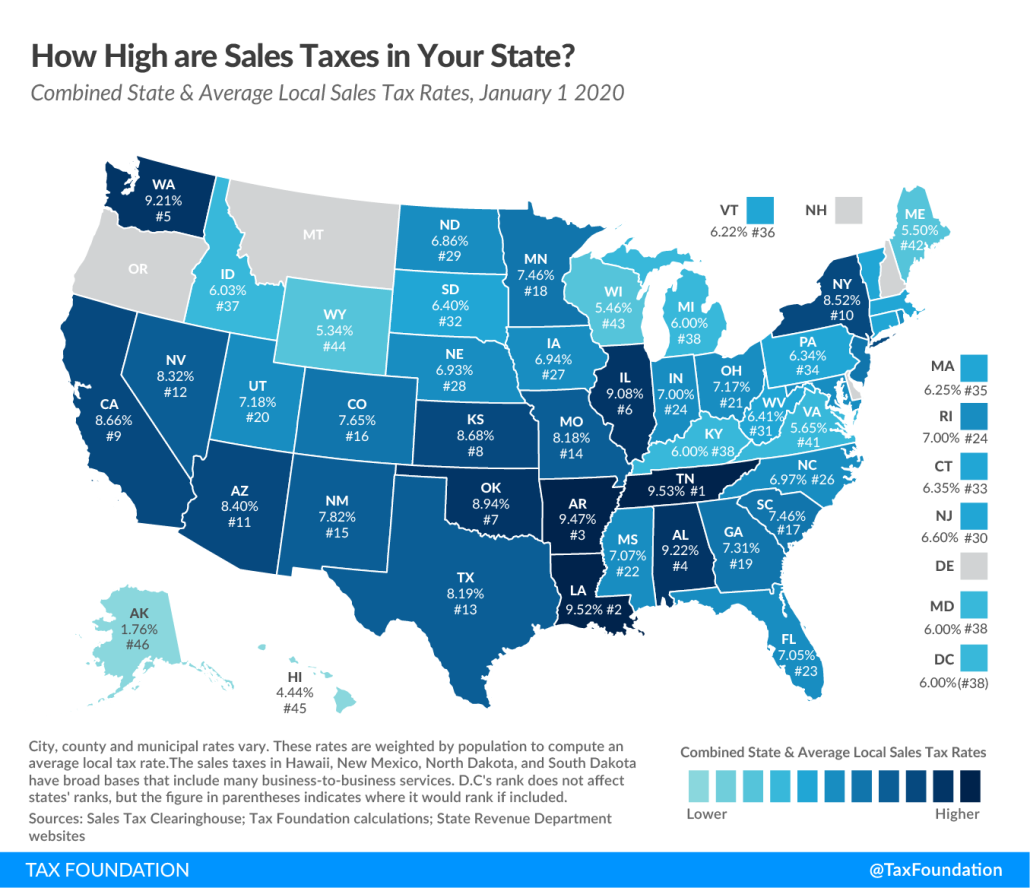

Sales Tax By State Here s How Much You re Really Paying Sales Tax

Ranking Of State Income Tax Rates INCOBEMAN

Check more sample of What Is The Tax Rate On Pensions In Michigan below

State Individual Income Tax Rates And Brackets Tax Foundation

Three Common Misconceptions About Pensions NPPC

ILLINOIS SALES TAX RATES AMONG THE HIGHEST IN THE COUNTRY Taxpayer

Pensions More Than Just A Tax efficient Way To Save For Retirement

2022 Tax Brackets Lashell Ahern

CARPE DIEM Average Federal Income Tax Rates By Income Group Are Highly

https://www.michigan.gov/taxes/iit/retirement-and-pension-benefits

Retirement and pension benefits include most income that is reported on Form 1099 R for federal tax purposes This includes defined benefit pensions IRA distributions and

https://www.michigan.gov/ors/faqs-for-public-act-4...

You can always elect to have state income tax withheld from your pension PA 4 of 2023 is being phased in over four years from 2023 to 2026 Depending on your tax situation

Retirement and pension benefits include most income that is reported on Form 1099 R for federal tax purposes This includes defined benefit pensions IRA distributions and

You can always elect to have state income tax withheld from your pension PA 4 of 2023 is being phased in over four years from 2023 to 2026 Depending on your tax situation

Pensions More Than Just A Tax efficient Way To Save For Retirement

Three Common Misconceptions About Pensions NPPC

2022 Tax Brackets Lashell Ahern

CARPE DIEM Average Federal Income Tax Rates By Income Group Are Highly

Changes In NHS Pension Contributions Are You A Winner Or Loser

How High Are Income Tax Rates In Your State

How High Are Income Tax Rates In Your State

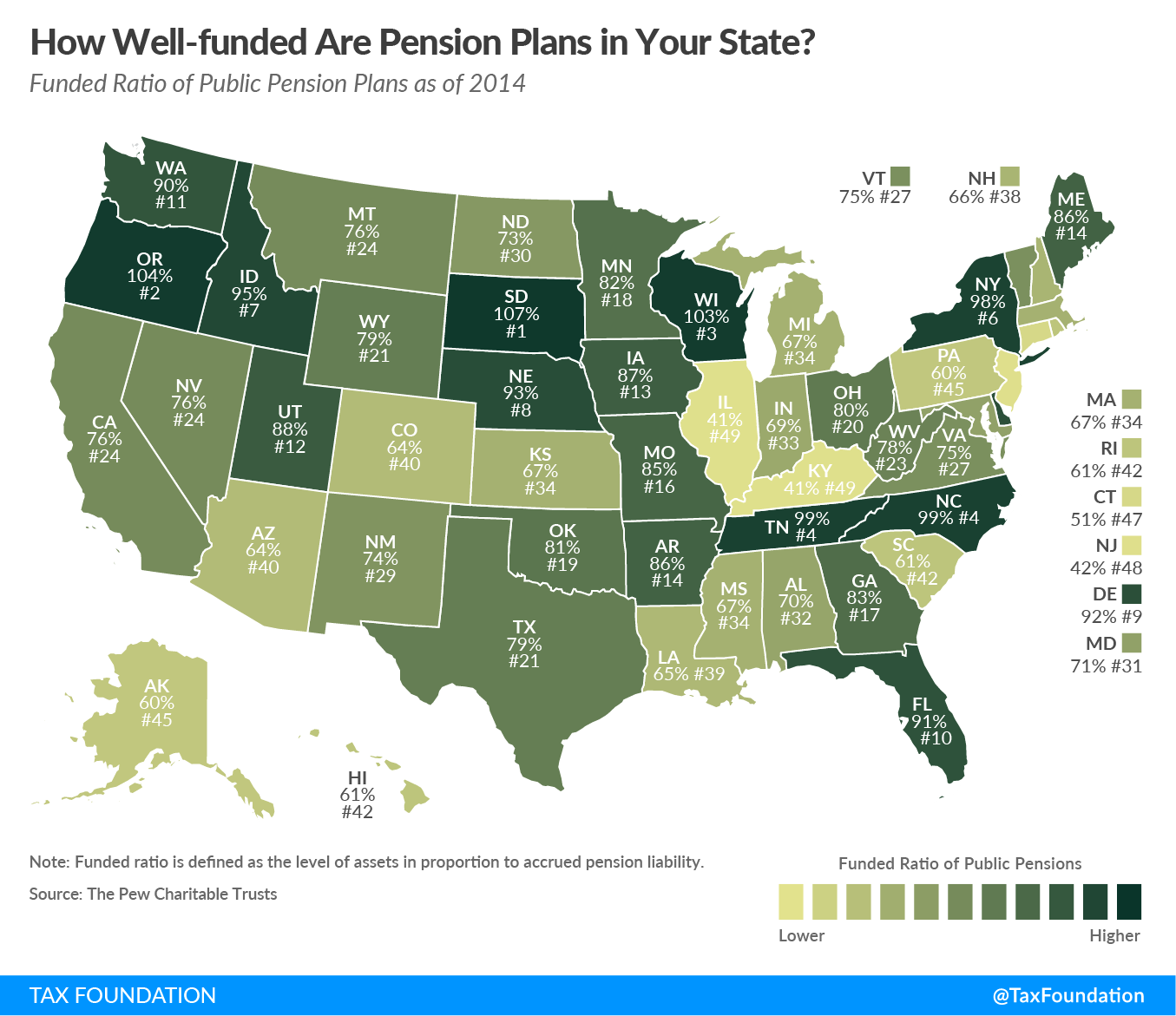

As Pension Debt Crests 1 5 Trillion States Are Headed Toward Crisis