In this day and age with screens dominating our lives but the value of tangible printed items hasn't gone away. No matter whether it's for educational uses as well as creative projects or simply adding some personal flair to your area, What Is The Federal Tax Rate On 401k Withdrawals After 65 are now a vital source. Here, we'll take a dive through the vast world of "What Is The Federal Tax Rate On 401k Withdrawals After 65," exploring the different types of printables, where they can be found, and how they can improve various aspects of your daily life.

Get Latest What Is The Federal Tax Rate On 401k Withdrawals After 65 Below

What Is The Federal Tax Rate On 401k Withdrawals After 65

What Is The Federal Tax Rate On 401k Withdrawals After 65 -

You can make a 401 k withdrawal at any age but doing so before age 59 could trigger a 10 early distribution tax on top of ordinary income taxes Some reasons for taking an early 401 k

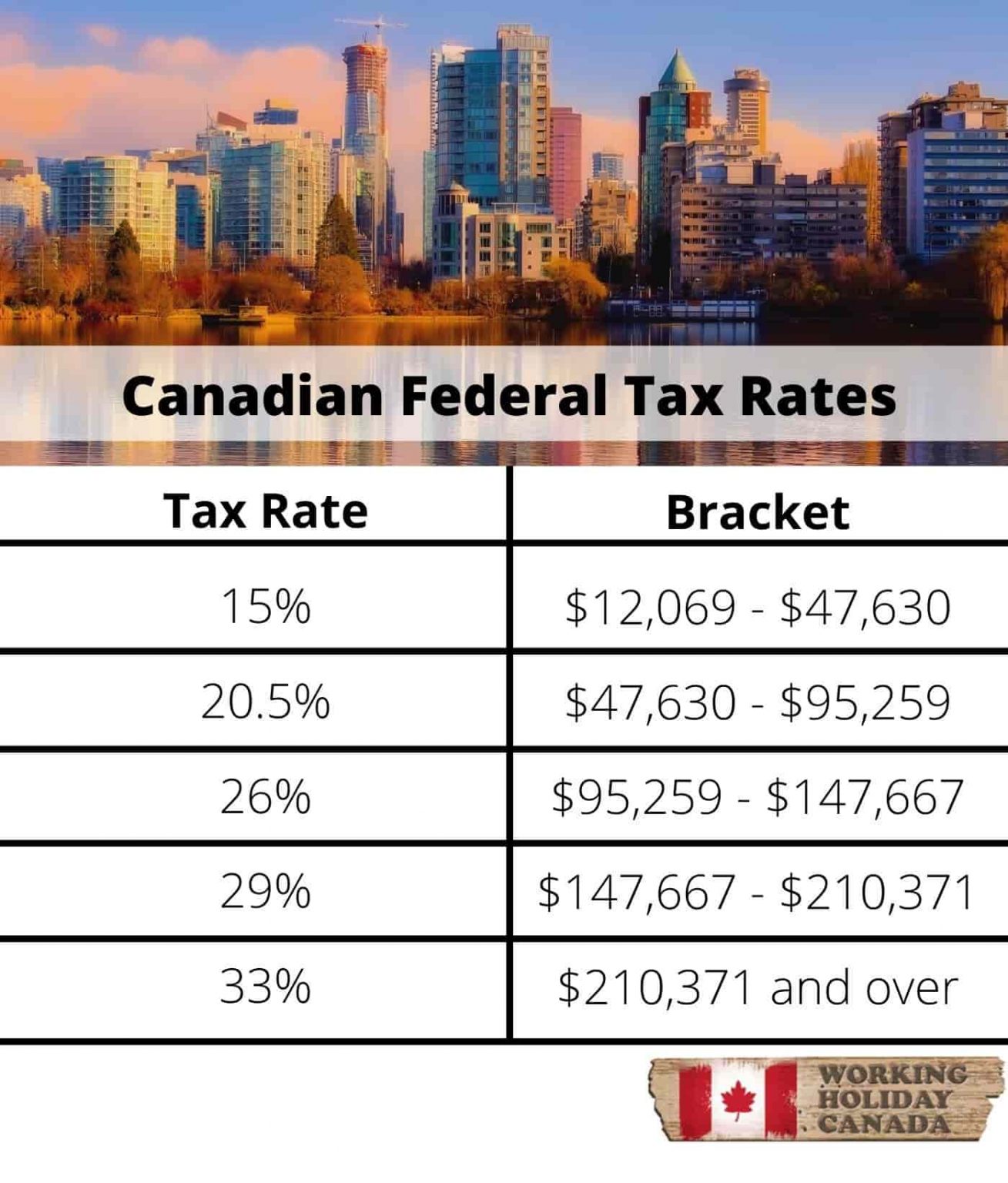

401 k withdrawal rules after age 65 state that your distributions are taxed as ordinary income The amount you pay depends on your tax bracket You should start

What Is The Federal Tax Rate On 401k Withdrawals After 65 provide a diverse range of downloadable, printable documents that can be downloaded online at no cost. These resources come in many forms, including worksheets, templates, coloring pages and much more. The appeal of printables for free lies in their versatility as well as accessibility.

More of What Is The Federal Tax Rate On 401k Withdrawals After 65

401k Rmd Distribution Table Elcho Table

401k Rmd Distribution Table Elcho Table

The tax rate for your 401 k distributions will depend on which federal tax bracket you are in at the time of withdrawal You have to pay taxes on the money you withdraw because you didn t pay income taxes on it when

Tax on early distributions If a distribution is made to you under the plan before you reach age 59 you may have to pay a 10 additional tax on the distribution This tax applies

What Is The Federal Tax Rate On 401k Withdrawals After 65 have gained immense appeal due to many compelling reasons:

-

Cost-Effective: They eliminate the necessity of purchasing physical copies or expensive software.

-

Individualization They can make designs to suit your personal needs whether you're designing invitations, organizing your schedule, or even decorating your house.

-

Educational Worth: Educational printables that can be downloaded for free cater to learners of all ages. This makes them an invaluable source for educators and parents.

-

Simple: Access to a plethora of designs and templates will save you time and effort.

Where to Find more What Is The Federal Tax Rate On 401k Withdrawals After 65

401 K Cash Distributions Understanding The Taxes Penalties

401 K Cash Distributions Understanding The Taxes Penalties

Key Points 401 k s offer an upfront tax break or a tax break in retirement depending on whether you have a traditional 401 k or a Roth 401 k Under the

Key Takeaways One of the easiest ways to lower the amount of taxes you have to pay on 401 k withdrawals is to convert to a Roth IRA or Roth 401 k

After we've peaked your interest in What Is The Federal Tax Rate On 401k Withdrawals After 65 We'll take a look around to see where you can get these hidden treasures:

1. Online Repositories

- Websites like Pinterest, Canva, and Etsy have a large selection with What Is The Federal Tax Rate On 401k Withdrawals After 65 for all goals.

- Explore categories such as furniture, education, craft, and organization.

2. Educational Platforms

- Forums and educational websites often provide worksheets that can be printed for free along with flashcards, as well as other learning materials.

- The perfect resource for parents, teachers and students who are in need of supplementary resources.

3. Creative Blogs

- Many bloggers share their creative designs and templates at no cost.

- These blogs cover a broad array of topics, ranging everything from DIY projects to planning a party.

Maximizing What Is The Federal Tax Rate On 401k Withdrawals After 65

Here are some ideas create the maximum value of printables that are free:

1. Home Decor

- Print and frame beautiful artwork, quotes or even seasonal decorations to decorate your living spaces.

2. Education

- Print worksheets that are free to build your knowledge at home as well as in the class.

3. Event Planning

- Make invitations, banners and other decorations for special occasions like weddings or birthdays.

4. Organization

- Stay organized by using printable calendars checklists for tasks, as well as meal planners.

Conclusion

What Is The Federal Tax Rate On 401k Withdrawals After 65 are an abundance of innovative and useful resources that meet a variety of needs and passions. Their accessibility and versatility make they a beneficial addition to every aspect of your life, both professional and personal. Explore the many options of What Is The Federal Tax Rate On 401k Withdrawals After 65 to open up new possibilities!

Frequently Asked Questions (FAQs)

-

Do printables with no cost really are they free?

- Yes, they are! You can download and print these materials for free.

-

Can I download free printables for commercial purposes?

- It's based on specific conditions of use. Always consult the author's guidelines before utilizing printables for commercial projects.

-

Are there any copyright violations with What Is The Federal Tax Rate On 401k Withdrawals After 65?

- Certain printables could be restricted on their use. Be sure to check these terms and conditions as set out by the designer.

-

How can I print printables for free?

- Print them at home using any printer or head to an in-store print shop to get high-quality prints.

-

What software do I require to open printables that are free?

- A majority of printed materials are in the PDF format, and can be opened with free software such as Adobe Reader.

State Individual Income Tax Rates And Brackets Tax Foundation

2022 Federal Effective Tax Rate Calculator Printable Form Templates

Check more sample of What Is The Federal Tax Rate On 401k Withdrawals After 65 below

Social Security Cost Of Living Adjustments 2023

2022 Tax Brackets KrissDaemon

How Federal Income Tax Rates Work Full Report Tax Policy Center

An Explanation Of 2016 Federal Income Tax Rates

/2016-Federal-Tax-Rates-57a631ca3df78cf459194b33.png)

Pin On Retirement

Tax Brackets 2022 Chart

https://www.sapling.com/8750582/tax-401k-withdrawls-after-65

401 k withdrawal rules after age 65 state that your distributions are taxed as ordinary income The amount you pay depends on your tax bracket You should start

https://www.nerdwallet.com/article/tax…

What is the tax rate on 401 k withdrawals The money you withdraw also called a distribution from a traditional 401 k is taxable as regular income in the year you take the money out

401 k withdrawal rules after age 65 state that your distributions are taxed as ordinary income The amount you pay depends on your tax bracket You should start

What is the tax rate on 401 k withdrawals The money you withdraw also called a distribution from a traditional 401 k is taxable as regular income in the year you take the money out

/2016-Federal-Tax-Rates-57a631ca3df78cf459194b33.png)

An Explanation Of 2016 Federal Income Tax Rates

2022 Tax Brackets KrissDaemon

Pin On Retirement

Tax Brackets 2022 Chart

Federal Tax Withheld Tax Rate 2021 Federal Withholding Tables 2021

25 Percent Corporate Income Tax Rate Details Analysis

25 Percent Corporate Income Tax Rate Details Analysis

IRS Announces 2022 Tax Rates Standard Deduction