In the age of digital, where screens rule our lives and the appeal of physical printed products hasn't decreased. For educational purposes, creative projects, or simply to add an individual touch to your area, What Is The Federal Income Tax Rate On A Retirement Pension In Florida are a great source. For this piece, we'll take a dive through the vast world of "What Is The Federal Income Tax Rate On A Retirement Pension In Florida," exploring the different types of printables, where to get them, as well as what they can do to improve different aspects of your lives.

Get Latest What Is The Federal Income Tax Rate On A Retirement Pension In Florida Below

What Is The Federal Income Tax Rate On A Retirement Pension In Florida

What Is The Federal Income Tax Rate On A Retirement Pension In Florida -

Some retirees might pay an income tax rate as high as 14 4 if they are still working and their taxable income reaches 1 000 000 but most retirees will pay a lower rate

The federal tax rate on pensions is the ordinary income tax rate although not all pension distributions are taxable If you contributed post tax dollars to the pension you will not

Printables for free cover a broad array of printable materials available online at no cost. These printables come in different kinds, including worksheets coloring pages, templates and many more. The great thing about What Is The Federal Income Tax Rate On A Retirement Pension In Florida is in their variety and accessibility.

More of What Is The Federal Income Tax Rate On A Retirement Pension In Florida

The Union Role In Our Growing Taxocracy California Policy Center

The Union Role In Our Growing Taxocracy California Policy Center

Is Florida Tax Friendly for Retirees Yes Florida is one of the most tax friendly states for retirees Florida has no state income tax no taxes on Social Security no inheritance tax

Social Security Benefits Depending on provisional income up to 85 of Social Security benefits can be taxed by the IRS at ordinary income tax rates Pensions

The What Is The Federal Income Tax Rate On A Retirement Pension In Florida have gained huge popularity because of a number of compelling causes:

-

Cost-Effective: They eliminate the necessity of purchasing physical copies of the software or expensive hardware.

-

The ability to customize: There is the possibility of tailoring printing templates to your own specific requirements, whether it's designing invitations planning your schedule or even decorating your home.

-

Educational Use: Printing educational materials for no cost cater to learners of all ages, making these printables a powerful aid for parents as well as educators.

-

It's easy: Access to the vast array of design and templates helps save time and effort.

Where to Find more What Is The Federal Income Tax Rate On A Retirement Pension In Florida

States With The Lowest Corporate Income Tax Rates Infographic

States With The Lowest Corporate Income Tax Rates Infographic

Understanding how federal income tax rates work is critical to estimating your tax burden today and planning for retirement tomorrow This guide to taxes can help you understand tax brackets for retirees

Federal tax rates vary by income type and level It s important to evaluate what each type of income you expect is going to look like so that you can plan for

In the event that we've stirred your interest in What Is The Federal Income Tax Rate On A Retirement Pension In Florida Let's find out where you can find these elusive gems:

1. Online Repositories

- Websites such as Pinterest, Canva, and Etsy provide a large collection with What Is The Federal Income Tax Rate On A Retirement Pension In Florida for all needs.

- Explore categories such as design, home decor, organization, and crafts.

2. Educational Platforms

- Educational websites and forums often offer worksheets with printables that are free as well as flashcards and other learning tools.

- Ideal for teachers, parents and students looking for additional sources.

3. Creative Blogs

- Many bloggers share their innovative designs and templates for no cost.

- The blogs are a vast range of interests, everything from DIY projects to planning a party.

Maximizing What Is The Federal Income Tax Rate On A Retirement Pension In Florida

Here are some ideas that you can make use use of printables for free:

1. Home Decor

- Print and frame gorgeous art, quotes, or seasonal decorations to adorn your living spaces.

2. Education

- Use free printable worksheets to enhance your learning at home for the classroom.

3. Event Planning

- Design invitations, banners, and other decorations for special occasions such as weddings or birthdays.

4. Organization

- Make sure you are organized with printable calendars including to-do checklists, daily lists, and meal planners.

Conclusion

What Is The Federal Income Tax Rate On A Retirement Pension In Florida are a treasure trove of fun and practical tools that meet a variety of needs and preferences. Their accessibility and flexibility make them a valuable addition to any professional or personal life. Explore the wide world of What Is The Federal Income Tax Rate On A Retirement Pension In Florida and discover new possibilities!

Frequently Asked Questions (FAQs)

-

Are printables actually completely free?

- Yes they are! You can download and print these files for free.

-

Can I use the free printables for commercial uses?

- It's determined by the specific usage guidelines. Always consult the author's guidelines prior to printing printables for commercial projects.

-

Are there any copyright concerns when using printables that are free?

- Certain printables could be restricted on their use. Make sure to read the conditions and terms of use provided by the author.

-

How do I print printables for free?

- Print them at home with your printer or visit the local print shops for premium prints.

-

What program do I need in order to open printables that are free?

- The majority of printed documents are in the PDF format, and is open with no cost software like Adobe Reader.

Your State Pension Forecast Explained Which

What Income Is Subject To The 3 8 Medicare Tax

Check more sample of What Is The Federal Income Tax Rate On A Retirement Pension In Florida below

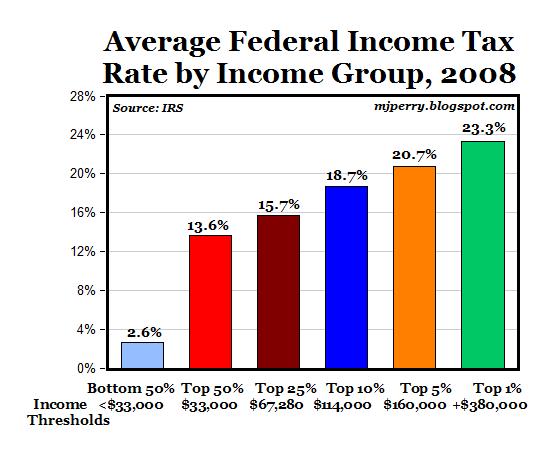

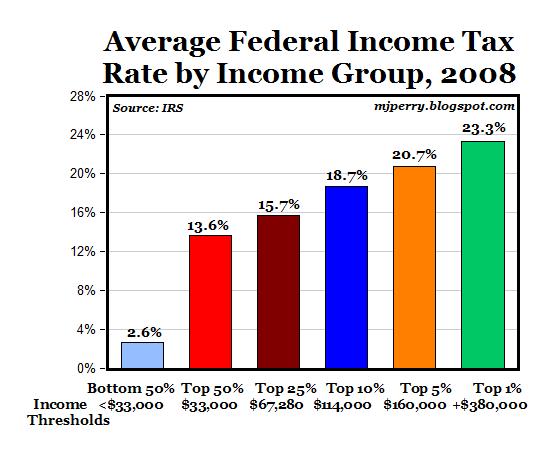

CARPE DIEM Average Federal Income Tax Rates By Income Group Are Highly

California Tops List Of 10 States With Highest Taxes

How Federal Income Tax Rates Work Full Report Tax Policy Center

Income Tax Rates 2022 Vs 2021 Kami Cartwright

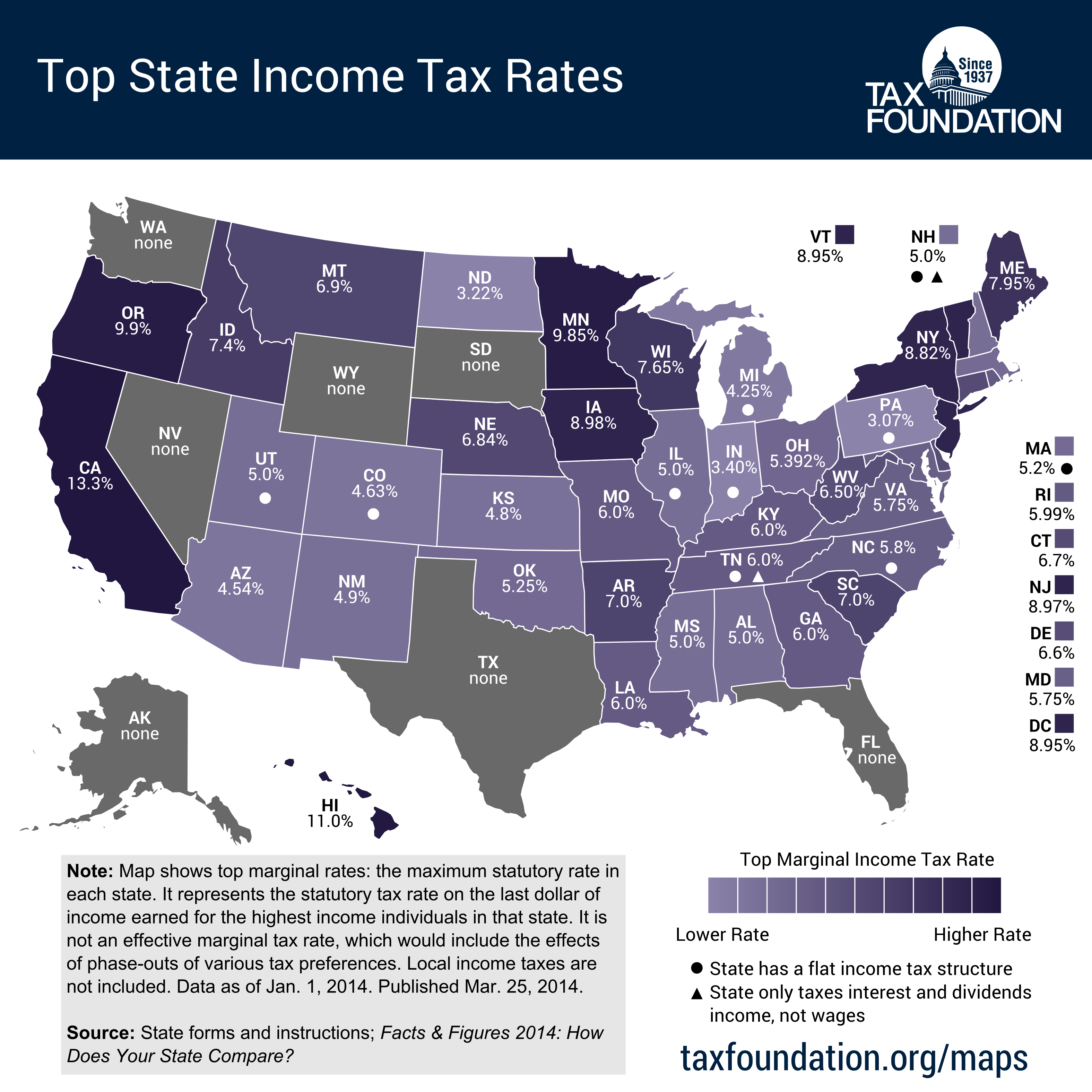

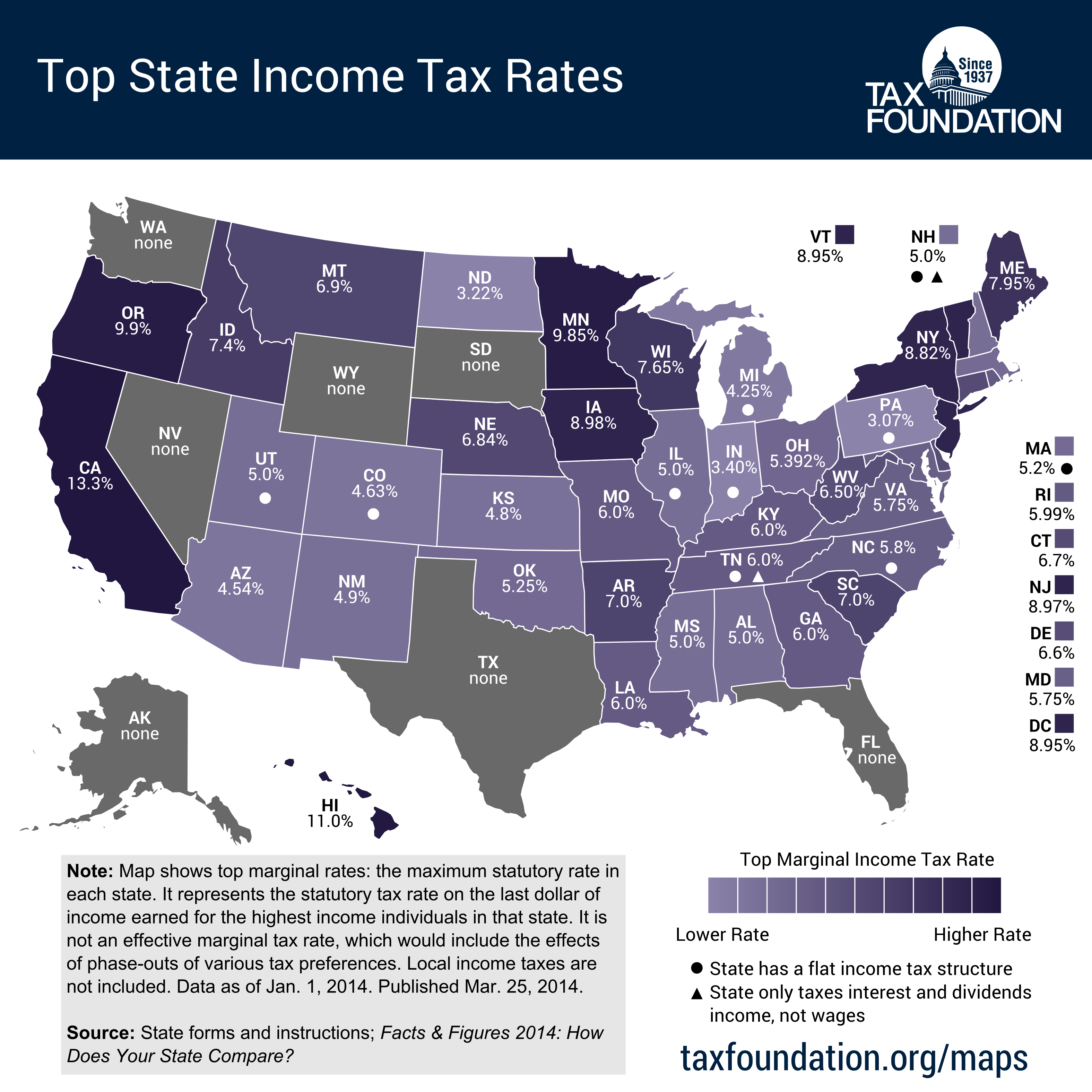

How High Are Income Tax Rates In Your State

2022 Tax Brackets PersiaKiylah

https://www. sapling.com /5956081/federal-tax-rate...

The federal tax rate on pensions is the ordinary income tax rate although not all pension distributions are taxable If you contributed post tax dollars to the pension you will not

https://www. thebalancemoney.com /taxe…

Your tax rate in retirement will depend on the total amount of your taxable income and your deductions List each type of income and

The federal tax rate on pensions is the ordinary income tax rate although not all pension distributions are taxable If you contributed post tax dollars to the pension you will not

Your tax rate in retirement will depend on the total amount of your taxable income and your deductions List each type of income and

Income Tax Rates 2022 Vs 2021 Kami Cartwright

California Tops List Of 10 States With Highest Taxes

How High Are Income Tax Rates In Your State

2022 Tax Brackets PersiaKiylah

2023 Tax Rates Federal Income Tax Brackets Top Dollar

CARPE DIEM Average Federal Income Tax Rates By Income Group Are Highly

CARPE DIEM Average Federal Income Tax Rates By Income Group Are Highly

2021 IRS Tax Brackets Table Federal Withholding Tables 2021