In the age of digital, where screens rule our lives however, the attraction of tangible printed objects isn't diminished. For educational purposes, creative projects, or just adding an extra personal touch to your space, What Is The Current Federal Tax Credit For Solar are a great resource. Through this post, we'll take a dive into the world "What Is The Current Federal Tax Credit For Solar," exploring their purpose, where to find them, and what they can do to improve different aspects of your life.

Get Latest What Is The Current Federal Tax Credit For Solar Below

What Is The Current Federal Tax Credit For Solar

What Is The Current Federal Tax Credit For Solar -

Your federal tax credit For example if your solar PV system was installed before December 31 2022 installation costs totaled 18 000 and your state government gave you a one time rebate of 1 000 for installing the system your federal tax credit would be calculated as follows 0 26 18 000 4 680 State Tax Credit

The federal solar tax credit can cover up to 30 of the cost of a system in 2024 The amount you can claim directly reduces the amount of tax you owe

What Is The Current Federal Tax Credit For Solar provide a diverse collection of printable content that can be downloaded from the internet at no cost. These resources come in many forms, like worksheets templates, coloring pages, and more. The great thing about What Is The Current Federal Tax Credit For Solar is in their versatility and accessibility.

More of What Is The Current Federal Tax Credit For Solar

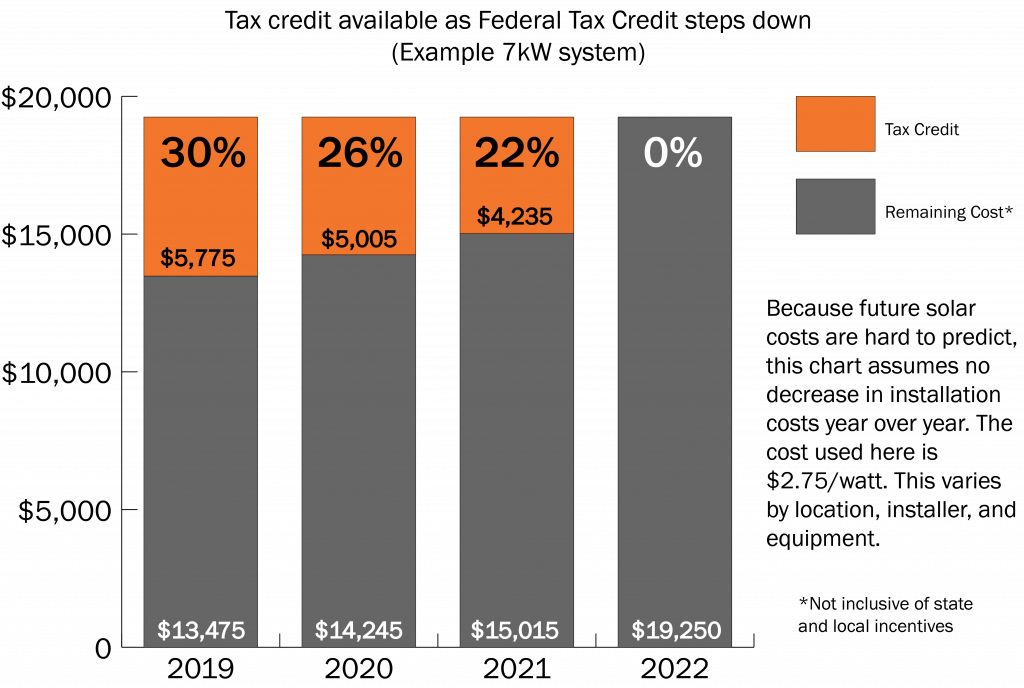

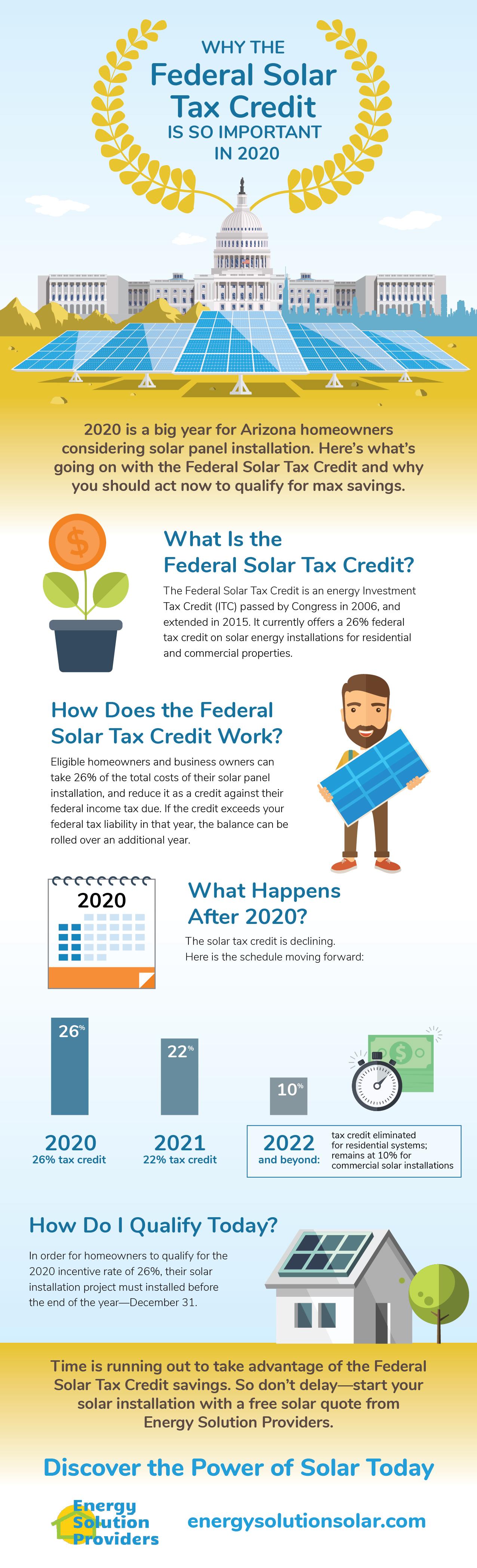

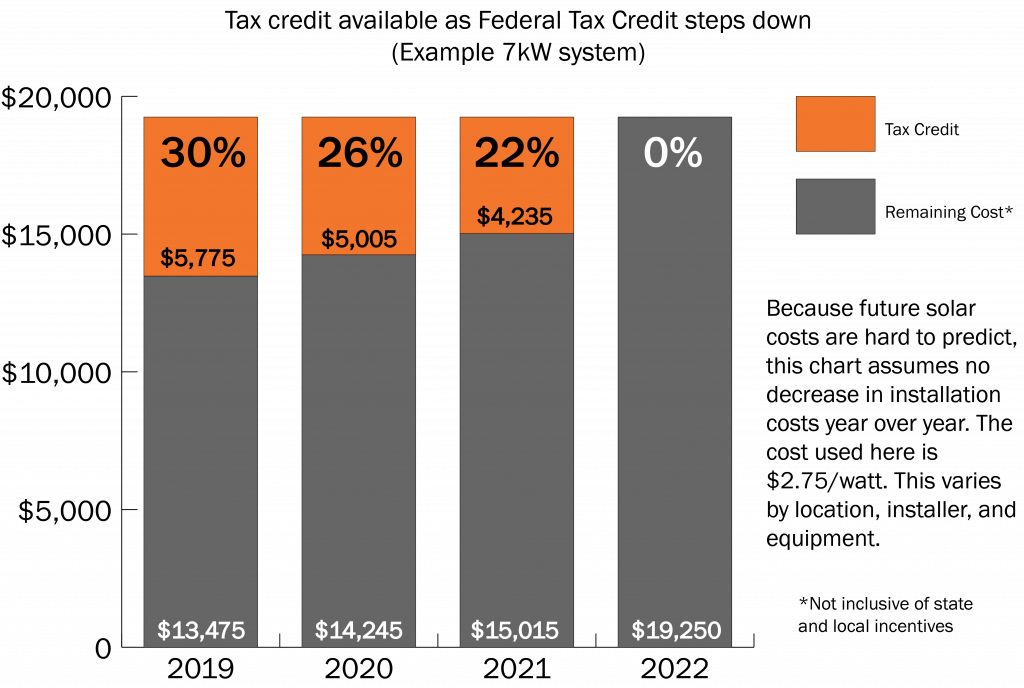

The Federal Solar Tax Credit Energy Solution Providers Arizona

The Federal Solar Tax Credit Energy Solution Providers Arizona

Solar PV systems installed in 2020 and 2021 are eligible for a 26 tax credit In August 2022 Congress passed an extension of the ITC raising it to 30 for the installation of which was between 2022 2032 4 It will decrease to 26 for systems installed in 2033 and to 22 for systems installed in 2034

IR 2024 113 April 17 2024 WASHINGTON The Internal Revenue Service today updated frequently asked questions in Fact Sheet 2024 15 PDF to address the federal income tax treatment of amounts paid for the purchase

What Is The Current Federal Tax Credit For Solar have gained a lot of popularity for several compelling reasons:

-

Cost-Effective: They eliminate the need to purchase physical copies of the software or expensive hardware.

-

The ability to customize: It is possible to tailor printables to fit your particular needs when it comes to designing invitations to organize your schedule or decorating your home.

-

Educational Benefits: Printables for education that are free are designed to appeal to students of all ages, making these printables a powerful resource for educators and parents.

-

Convenience: Quick access to various designs and templates saves time and effort.

Where to Find more What Is The Current Federal Tax Credit For Solar

How Does The Federal Tax Credit For Solar Work Tampa Bay Solar

How Does The Federal Tax Credit For Solar Work Tampa Bay Solar

For tax years 2022 to 2032 you can get a credit for up to 30 of the expense of installing solar panels this may include the price of the panels themselves sales taxes and labor costs

The federal solar tax credit is back to 30 and there s never been a better time to install solar and start saving on energy costs On August 16 2022 President Biden signed the Inflation Reduction Act IRA of 2022 into law immediately activating the Residential Clean Energy Credit for solar battery storage and more

Now that we've ignited your interest in printables for free We'll take a look around to see where you can find these hidden gems:

1. Online Repositories

- Websites like Pinterest, Canva, and Etsy provide an extensive selection of What Is The Current Federal Tax Credit For Solar to suit a variety of applications.

- Explore categories such as decorations for the home, education and organisation, as well as crafts.

2. Educational Platforms

- Educational websites and forums frequently provide worksheets that can be printed for free as well as flashcards and other learning tools.

- It is ideal for teachers, parents and students who are in need of supplementary resources.

3. Creative Blogs

- Many bloggers share their creative designs and templates for free.

- The blogs covered cover a wide spectrum of interests, all the way from DIY projects to planning a party.

Maximizing What Is The Current Federal Tax Credit For Solar

Here are some creative ways ensure you get the very most use of printables for free:

1. Home Decor

- Print and frame stunning images, quotes, or decorations for the holidays to beautify your living areas.

2. Education

- Use free printable worksheets to aid in learning at your home or in the classroom.

3. Event Planning

- Design invitations, banners, as well as decorations for special occasions like birthdays and weddings.

4. Organization

- Stay organized with printable calendars or to-do lists. meal planners.

Conclusion

What Is The Current Federal Tax Credit For Solar are a treasure trove of fun and practical tools which cater to a wide range of needs and preferences. Their availability and versatility make them a valuable addition to every aspect of your life, both professional and personal. Explore the vast collection of What Is The Current Federal Tax Credit For Solar and unlock new possibilities!

Frequently Asked Questions (FAQs)

-

Are What Is The Current Federal Tax Credit For Solar truly absolutely free?

- Yes, they are! You can download and print these materials for free.

-

Can I use the free printables for commercial uses?

- It's all dependent on the rules of usage. Make sure you read the guidelines for the creator prior to printing printables for commercial projects.

-

Do you have any copyright concerns with printables that are free?

- Certain printables might have limitations in their usage. Always read the terms and conditions provided by the author.

-

How do I print printables for free?

- Print them at home using an printer, or go to a local print shop to purchase the highest quality prints.

-

What program do I require to view What Is The Current Federal Tax Credit For Solar?

- A majority of printed materials are in the format of PDF, which can be opened with free software, such as Adobe Reader.

The Federal Solar Tax Credit Has Been Extended Through 2032 Ecohouse

Federal Solar Tax Credit What It Is How To Claim It For 2023

Check more sample of What Is The Current Federal Tax Credit For Solar below

When Does Solar Tax Credit End SolarProGuide 2022

How Does The Federal Solar Tax Credit Work Nicki Karen

The Federal Tax Credit For Electric Cars Is Set To Expire OsVehicle

Federal Solar Tax Credit A Quick Rundown Next Energy Solution

The Federal Solar Tax Credit What You Need To Know 2022

Go Solar In 2019 To Take Full Advantage Of The Federal Solar Tax Credit

https://www.nerdwallet.com/article/taxes/solar-tax-credit

The federal solar tax credit can cover up to 30 of the cost of a system in 2024 The amount you can claim directly reduces the amount of tax you owe

https://www.irs.gov/credits-deductions/residential-clean-energy-credit

Related Resources How It Works The Residential Clean Energy Credit equals 30 of the costs of new qualified clean energy property for your home installed anytime from 2022 through 2032 The credit percentage rate phases down to 26 percent for property placed in service in 2033 and 22 percent for property placed in service in 2034

The federal solar tax credit can cover up to 30 of the cost of a system in 2024 The amount you can claim directly reduces the amount of tax you owe

Related Resources How It Works The Residential Clean Energy Credit equals 30 of the costs of new qualified clean energy property for your home installed anytime from 2022 through 2032 The credit percentage rate phases down to 26 percent for property placed in service in 2033 and 22 percent for property placed in service in 2034

Federal Solar Tax Credit A Quick Rundown Next Energy Solution

How Does The Federal Solar Tax Credit Work Nicki Karen

The Federal Solar Tax Credit What You Need To Know 2022

Go Solar In 2019 To Take Full Advantage Of The Federal Solar Tax Credit

Federal Investment Solar Tax Credit Guide Learn How To Claim The

Everything You Need To Know The New 2021 Solar Federal Tax Credit

Everything You Need To Know The New 2021 Solar Federal Tax Credit

The Federal Solar Tax Credit Explained Sunshine Plus Solar