In the digital age, where screens rule our lives but the value of tangible, printed materials hasn't diminished. In the case of educational materials as well as creative projects or just adding a personal touch to your area, What Is Corporate Income Tax are now an essential resource. Through this post, we'll dive into the world "What Is Corporate Income Tax," exploring the benefits of them, where they are, and the ways that they can benefit different aspects of your lives.

Get Latest What Is Corporate Income Tax Below

What Is Corporate Income Tax

What Is Corporate Income Tax -

Corporate income tax or corporation tax is a tax that C corporation legal entities must pay Be sure to take full consideration when incorporating your business to ensure that you are properly classified different classifications of corporation have different taxation rules

The standard applicable CIT rate on taxable income of corporate entities is 30 With effect from 1 January 2023 the two tier taxation system in the telecommunications sector which provided for tax at 30 on taxable income of up to ZMW 250 000 and 40 on taxable income exceeding ZMW 250 000 has been abolished and

The What Is Corporate Income Tax are a huge variety of printable, downloadable documents that can be downloaded online at no cost. These printables come in different designs, including worksheets templates, coloring pages and more. The attraction of printables that are free is in their versatility and accessibility.

More of What Is Corporate Income Tax

Corporate Tax Definition And Meaning Market Business News

Corporate Tax Definition And Meaning Market Business News

Summary Corporate tax is a direct tax paid by businesses to the government on their earnings The funds collected from the taxes serve as a country s source of income and are directed to financing various projects for the benefit of its citizens The maximum corporate tax rate equal to 35

Corporate income taxes are levied by federal and state governments on business profits Companies use everything at their disposal within the tax code to lower the cost of taxes paid by reducing their taxable incomes

What Is Corporate Income Tax have gained a lot of appeal due to many compelling reasons:

-

Cost-Efficiency: They eliminate the need to purchase physical copies of the software or expensive hardware.

-

Modifications: This allows you to modify the design to meet your needs such as designing invitations making your schedule, or decorating your home.

-

Educational Benefits: The free educational worksheets offer a wide range of educational content for learners of all ages, making them a great aid for parents as well as educators.

-

Convenience: immediate access an array of designs and templates can save you time and energy.

Where to Find more What Is Corporate Income Tax

Company Tax Rate 2016 Malaysia

Company Tax Rate 2016 Malaysia

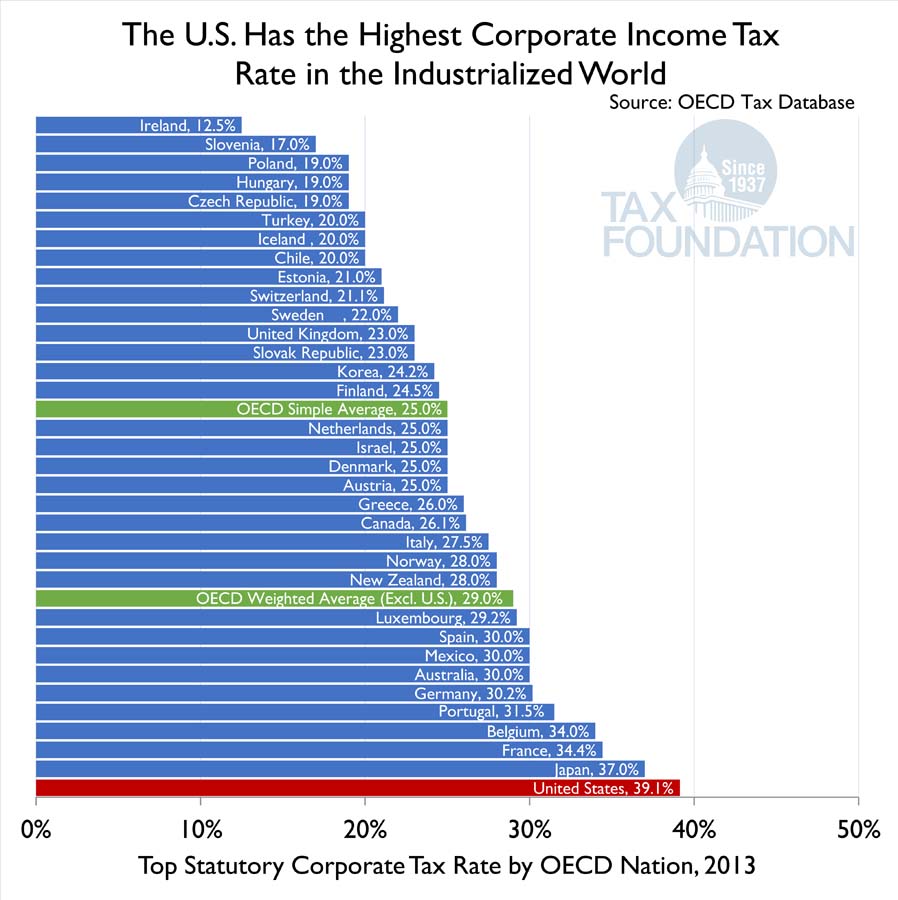

The corporate income tax is the third largest source of federal revenue although substantially smaller than the individual income tax and payroll taxes It raised 230 2 billion in fiscal year 2019 6 6 percent of all federal revenue and 1 1 percent of gross domestic product GDP

1 Tax Treaties and Residence 2 Transaction Taxes 3 Cross border Payments 4 Tax on Business Operations General 5 Capital Gains 6 Local Branch or Subsidiary 7 Overseas Profits 8 Taxation of Commercial Real Estate 9 Anti avoidance and Compliance 10 BEPS Tax Competition and the Digital Economy 1 Tax Treaties

If we've already piqued your interest in What Is Corporate Income Tax, let's explore where you can locate these hidden treasures:

1. Online Repositories

- Websites like Pinterest, Canva, and Etsy offer an extensive collection with What Is Corporate Income Tax for all uses.

- Explore categories such as decorating your home, education, management, and craft.

2. Educational Platforms

- Forums and educational websites often provide worksheets that can be printed for free, flashcards, and learning tools.

- This is a great resource for parents, teachers and students looking for extra sources.

3. Creative Blogs

- Many bloggers offer their unique designs and templates at no cost.

- The blogs covered cover a wide array of topics, ranging everything from DIY projects to party planning.

Maximizing What Is Corporate Income Tax

Here are some creative ways ensure you get the very most use of printables that are free:

1. Home Decor

- Print and frame gorgeous artwork, quotes, or decorations for the holidays to beautify your living areas.

2. Education

- Use free printable worksheets to enhance your learning at home or in the classroom.

3. Event Planning

- Invitations, banners as well as decorations for special occasions such as weddings or birthdays.

4. Organization

- Stay organized with printable calendars with to-do lists, planners, and meal planners.

Conclusion

What Is Corporate Income Tax are an abundance filled with creative and practical information that satisfy a wide range of requirements and desires. Their availability and versatility make them an essential part of the professional and personal lives of both. Explore the wide world of What Is Corporate Income Tax today and unlock new possibilities!

Frequently Asked Questions (FAQs)

-

Are What Is Corporate Income Tax truly gratis?

- Yes they are! You can download and print these documents for free.

-

Can I utilize free printables in commercial projects?

- It's contingent upon the specific conditions of use. Make sure you read the guidelines for the creator prior to using the printables in commercial projects.

-

Do you have any copyright issues when you download What Is Corporate Income Tax?

- Some printables may contain restrictions concerning their use. Be sure to check the terms and regulations provided by the author.

-

How can I print What Is Corporate Income Tax?

- You can print them at home using any printer or head to a local print shop for high-quality prints.

-

What software do I require to view What Is Corporate Income Tax?

- Most printables come as PDF files, which can be opened with free programs like Adobe Reader.

What Is Tax Definition And Meaning Market Business News

Corporate Income Taxes James Abbott CPA

Check more sample of What Is Corporate Income Tax below

Corporate Income Tax Due Dates For Small Businesses TAAG

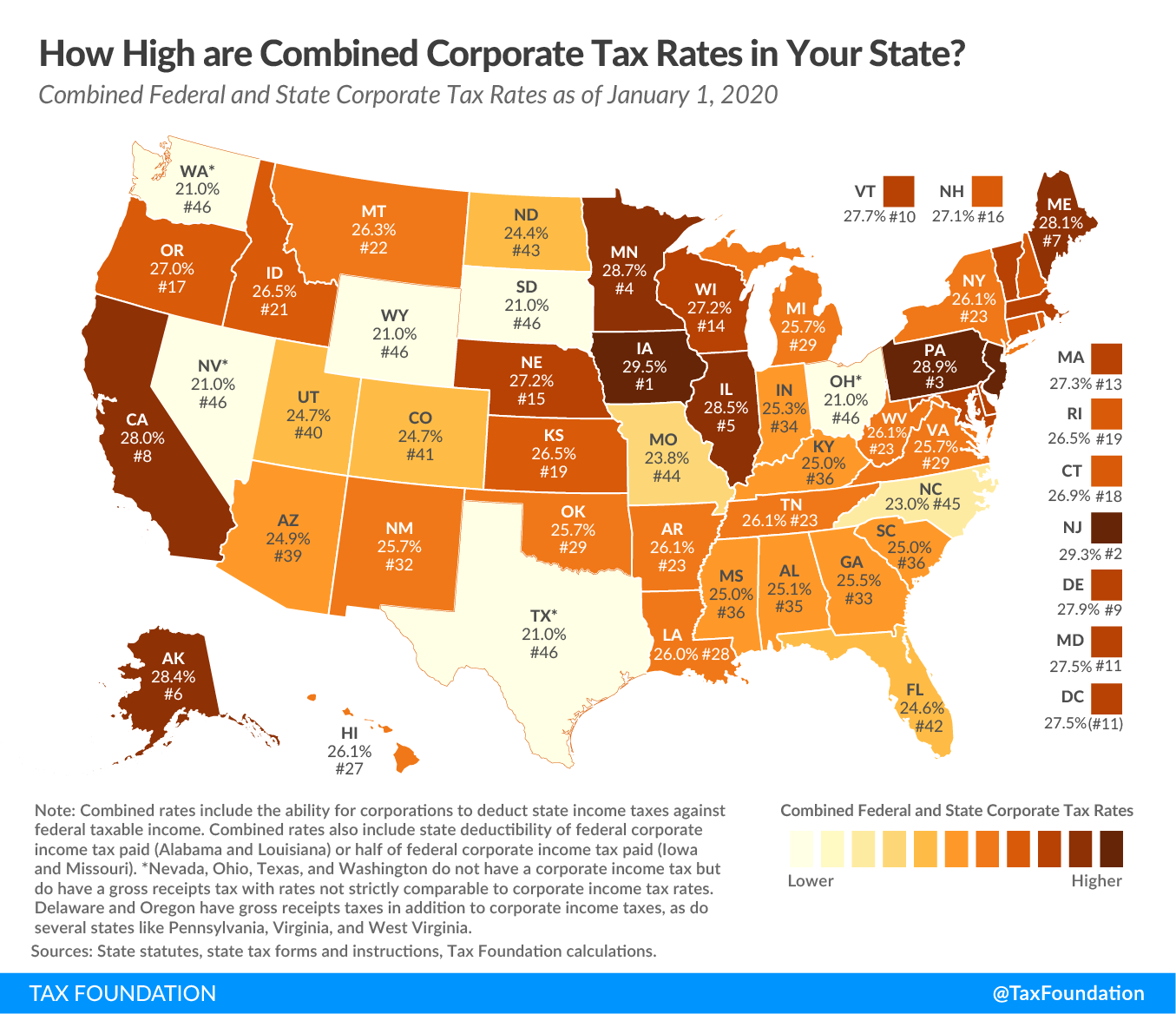

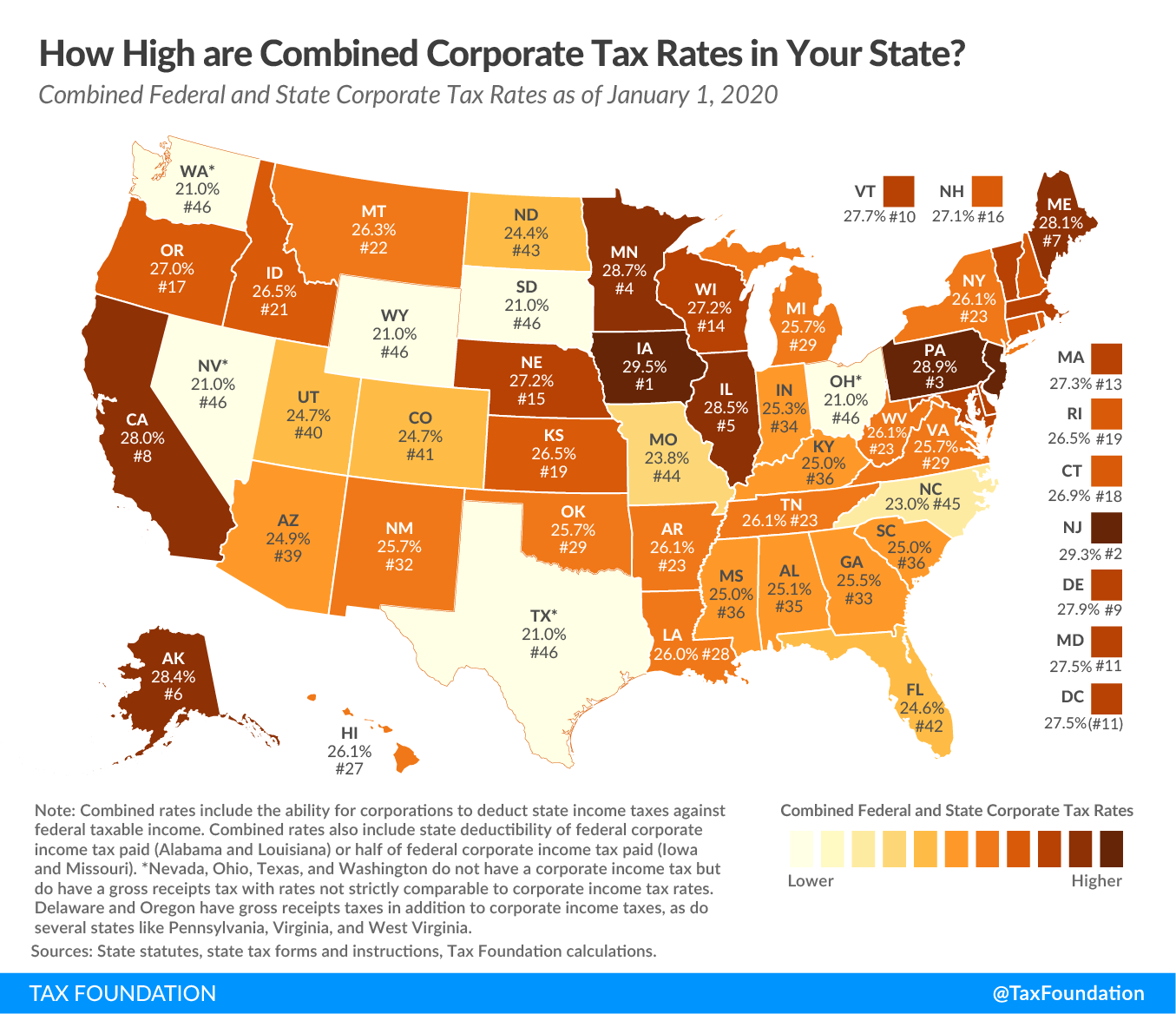

Combined State And Federal Corporate Income Tax Rates In 2020 Upstate

Can Data Tax Replace Corporate Income Tax Business News

TaxTips ca Business 2022 Corporate Income Tax Rates

How Are Income Taxes Calculated The Tech Edvocate

Corporate Income Tax And Profit Rates Short run Shifting In Selected

https://taxsummaries.pwc.com/Zambia/Corporate/...

The standard applicable CIT rate on taxable income of corporate entities is 30 With effect from 1 January 2023 the two tier taxation system in the telecommunications sector which provided for tax at 30 on taxable income of up to ZMW 250 000 and 40 on taxable income exceeding ZMW 250 000 has been abolished and

https://taxfoundation.org/taxedu/glossary/corporate-income-tax-cit

A corporate income tax CIT is levied by federal and state governments on business profits Many companies are not subject to the CIT because they are taxed as pass through businesses with income reportable under the individual income tax

The standard applicable CIT rate on taxable income of corporate entities is 30 With effect from 1 January 2023 the two tier taxation system in the telecommunications sector which provided for tax at 30 on taxable income of up to ZMW 250 000 and 40 on taxable income exceeding ZMW 250 000 has been abolished and

A corporate income tax CIT is levied by federal and state governments on business profits Many companies are not subject to the CIT because they are taxed as pass through businesses with income reportable under the individual income tax

TaxTips ca Business 2022 Corporate Income Tax Rates

Combined State And Federal Corporate Income Tax Rates In 2020 Upstate

How Are Income Taxes Calculated The Tech Edvocate

Corporate Income Tax And Profit Rates Short run Shifting In Selected

Income Tax Rate For Company Private Limited Provenience Provenience

IRS Tax Charts 2021 Federal Withholding Tables 2021

IRS Tax Charts 2021 Federal Withholding Tables 2021

Will Michigan Lower Its Tax Rates Here s How We Compare To Other