In this age of technology, with screens dominating our lives it's no wonder that the appeal of tangible printed products hasn't decreased. Whatever the reason, whether for education for creative projects, simply adding an individual touch to your home, printables for free are now an essential resource. With this guide, you'll take a dive in the world of "What Is 80d In Itr," exploring what they are, where to locate them, and ways they can help you improve many aspects of your lives.

Get Latest What Is 80d In Itr Below

What Is 80d In Itr

What Is 80d In Itr -

Section 80D of the Income tax Act allows you to save tax by claiming medical expenditures incurred as a deduction from income before levy of tax You can claim this deduction if these two conditions are satisfied a The medical expenditure must be incurred either on self spouse or dependent children or and parents

Section 80D of the Income Tax Act 1961 was introduced to promote health planning Under this section taxpayers can claim deductions and tax benefits under health insurance premiums Section 80D provides a deduction for expenditure on the Medical insurance premium Contribution to CGHS Central Govt Health Scheme notified scheme

What Is 80d In Itr offer a wide selection of printable and downloadable documents that can be downloaded online at no cost. They are available in a variety of formats, such as worksheets, coloring pages, templates and much more. One of the advantages of What Is 80d In Itr lies in their versatility as well as accessibility.

More of What Is 80d In Itr

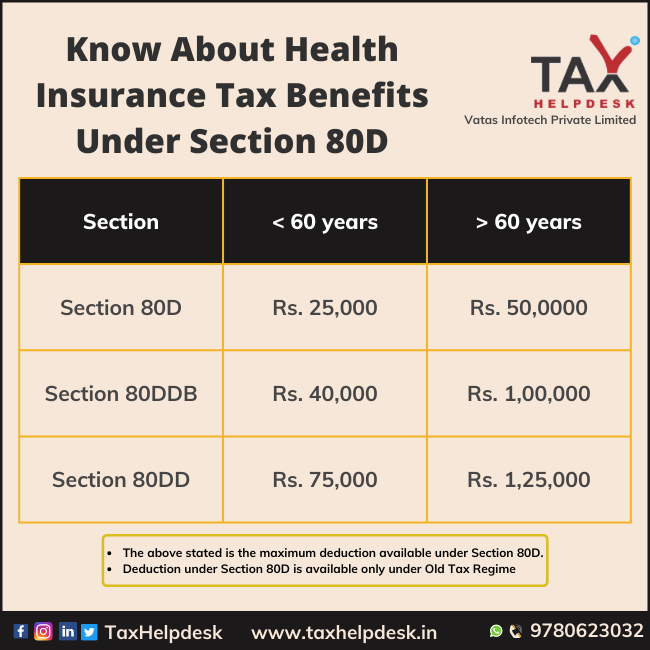

Know About Health Insurance Tax Benefits Under Section 80D

Know About Health Insurance Tax Benefits Under Section 80D

Section 80D is a facility introduced in the Income Tax Act to allow taxpayers to claim a deduction for medical insurance premium paid Claiming a deduction under this section reduces the tax burden of individuals by allowing a claim of deduction for up to Rs 25 000 per year for medical insurance premium

Fill Schedule 80D in ITR Firstly let us understand the eligibility for health insurance premiums paid under Section 80D of the Income Tax Act Taxpayers below 60 years old can claim deductions of up to INR 25 000 annually Senior citizens can claim a maximum deduction of INR 50 000 each year

Printables for free have gained immense popularity due to numerous compelling reasons:

-

Cost-Efficiency: They eliminate the requirement to purchase physical copies or expensive software.

-

customization: Your HTML0 customization options allow you to customize designs to suit your personal needs for invitations, whether that's creating them for your guests, organizing your schedule or even decorating your house.

-

Educational Value Educational printables that can be downloaded for free cater to learners of all ages, making these printables a powerful aid for parents as well as educators.

-

An easy way to access HTML0: Fast access a variety of designs and templates is time-saving and saves effort.

Where to Find more What Is 80d In Itr

10 Best Lenses For Canon 80D In 2024

10 Best Lenses For Canon 80D In 2024

Understanding Section 80D What is Section 80D Who Can Avail Benefits under Section 80D Budget 2023 Impact Increased Deduction Limits Separate Deductions for Parents Inclusion of Preventive Health Checkups The Importance of Filing ITR How to Maximize Your Benefits Choose the Right Health Insurance Plan Keep Documentation in Order

What is Deduction under section 80D Section 80D of the Income Tax Act allows a deduction to an Individual including non resident individuals or HUF for the amount paid towards medical insurance premiums medical expenditures and preventive health checkups in a financial year

Now that we've ignited your interest in printables for free Let's find out where you can find these elusive gems:

1. Online Repositories

- Websites like Pinterest, Canva, and Etsy provide a wide selection of printables that are free for a variety of applications.

- Explore categories such as decorating your home, education, management, and craft.

2. Educational Platforms

- Forums and websites for education often offer worksheets with printables that are free Flashcards, worksheets, and other educational tools.

- Great for parents, teachers and students looking for extra sources.

3. Creative Blogs

- Many bloggers share their innovative designs or templates for download.

- These blogs cover a broad variety of topics, that includes DIY projects to party planning.

Maximizing What Is 80d In Itr

Here are some inventive ways to make the most use of printables for free:

1. Home Decor

- Print and frame beautiful images, quotes, or seasonal decorations to adorn your living areas.

2. Education

- Use printable worksheets for free to enhance your learning at home or in the classroom.

3. Event Planning

- Invitations, banners as well as decorations for special occasions like weddings or birthdays.

4. Organization

- Make sure you are organized with printable calendars for to-do list, lists of chores, and meal planners.

Conclusion

What Is 80d In Itr are a treasure trove of practical and imaginative resources which cater to a wide range of needs and preferences. Their availability and versatility make them a great addition to both personal and professional life. Explore the plethora of What Is 80d In Itr to uncover new possibilities!

Frequently Asked Questions (FAQs)

-

Are What Is 80d In Itr really are they free?

- Yes they are! You can print and download these resources at no cost.

-

Can I download free printables in commercial projects?

- It's contingent upon the specific rules of usage. Make sure you read the guidelines for the creator prior to printing printables for commercial projects.

-

Do you have any copyright problems with What Is 80d In Itr?

- Certain printables might have limitations regarding their use. Check the conditions and terms of use provided by the author.

-

How do I print printables for free?

- You can print them at home with either a printer or go to a print shop in your area for superior prints.

-

What software do I need to open printables free of charge?

- Many printables are offered in PDF format. These is open with no cost programs like Adobe Reader.

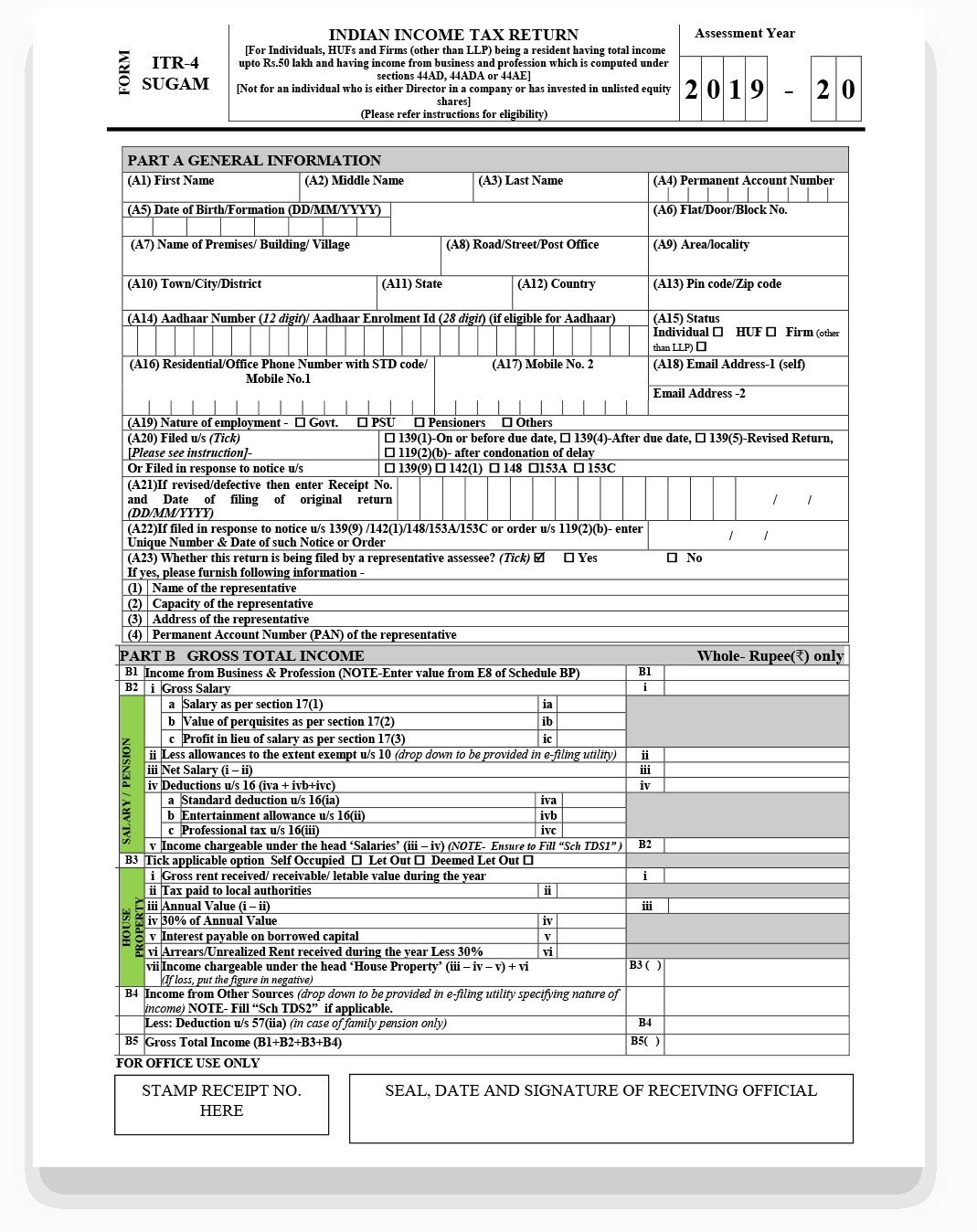

What Is ITR Filing Know ITR Filings Process Check Status

Section 80D Of Income Tax 80D Deduction For Medical Insurance Mediclaim

Check more sample of What Is 80d In Itr below

ITR Live Story Time

File ITR Now Tech Company Logos Company Logo Cards

Buy Canon EOS 80D DSLR Camera Black With EFS 18 135mm IS USM Lens

80D 5 80D OpenSea

Definition Meaning Of ITR Forms Tax2win

80d 30mmf14dc Dollfiedream DD

https://tax2win.in/guide/section-80d-deduction...

Section 80D of the Income Tax Act 1961 was introduced to promote health planning Under this section taxpayers can claim deductions and tax benefits under health insurance premiums Section 80D provides a deduction for expenditure on the Medical insurance premium Contribution to CGHS Central Govt Health Scheme notified scheme

https://m.economictimes.com/wealth/tax/you-can...

Section 80D of the Income tax Act 1961 allows an individual to claim deduction from gross taxable income The deduction can be claimed if an individual has paid medical insurance premium during the year for self spouse and dependent children

Section 80D of the Income Tax Act 1961 was introduced to promote health planning Under this section taxpayers can claim deductions and tax benefits under health insurance premiums Section 80D provides a deduction for expenditure on the Medical insurance premium Contribution to CGHS Central Govt Health Scheme notified scheme

Section 80D of the Income tax Act 1961 allows an individual to claim deduction from gross taxable income The deduction can be claimed if an individual has paid medical insurance premium during the year for self spouse and dependent children

80D 5 80D OpenSea

File ITR Now Tech Company Logos Company Logo Cards

Definition Meaning Of ITR Forms Tax2win

80d 30mmf14dc Dollfiedream DD

What Is 80D For Senior Citizens

What Is Culture really Culture Is Hard To Define Shane Michael

What Is Culture really Culture Is Hard To Define Shane Michael

Business Income Tax Return Online Filing Infinity Compliance