In this day and age where screens rule our lives but the value of tangible printed objects hasn't waned. For educational purposes for creative projects, simply adding some personal flair to your space, Tool Tax Deduction have become a valuable source. We'll take a dive to the depths of "Tool Tax Deduction," exploring the benefits of them, where they are available, and what they can do to improve different aspects of your lives.

Get Latest Tool Tax Deduction Below

Tool Tax Deduction

Tool Tax Deduction -

OVERVIEW Did you know there are tax deductions for mechanics tools If you work as a mechanic some of your key business expenses may be tax deductible Learn how your business structure affects your taxes and where you may be able to save TABLE OF CONTENTS Tools for taxes Know your tax status Filing your taxes with Schedule C

Deductions for tools or instruments you use for work including the cost of repairs and insurance Last updated 25 April 2023 Print or Download On this page Eligibility to claim tool and equipment expenses Types of tools and equipment you can claim How to calculate your tools and equipment deduction Keeping records for tools and equipment

Printables for free cover a broad variety of printable, downloadable documents that can be downloaded online at no cost. The resources are offered in a variety formats, such as worksheets, templates, coloring pages and much more. The attraction of printables that are free lies in their versatility and accessibility.

More of Tool Tax Deduction

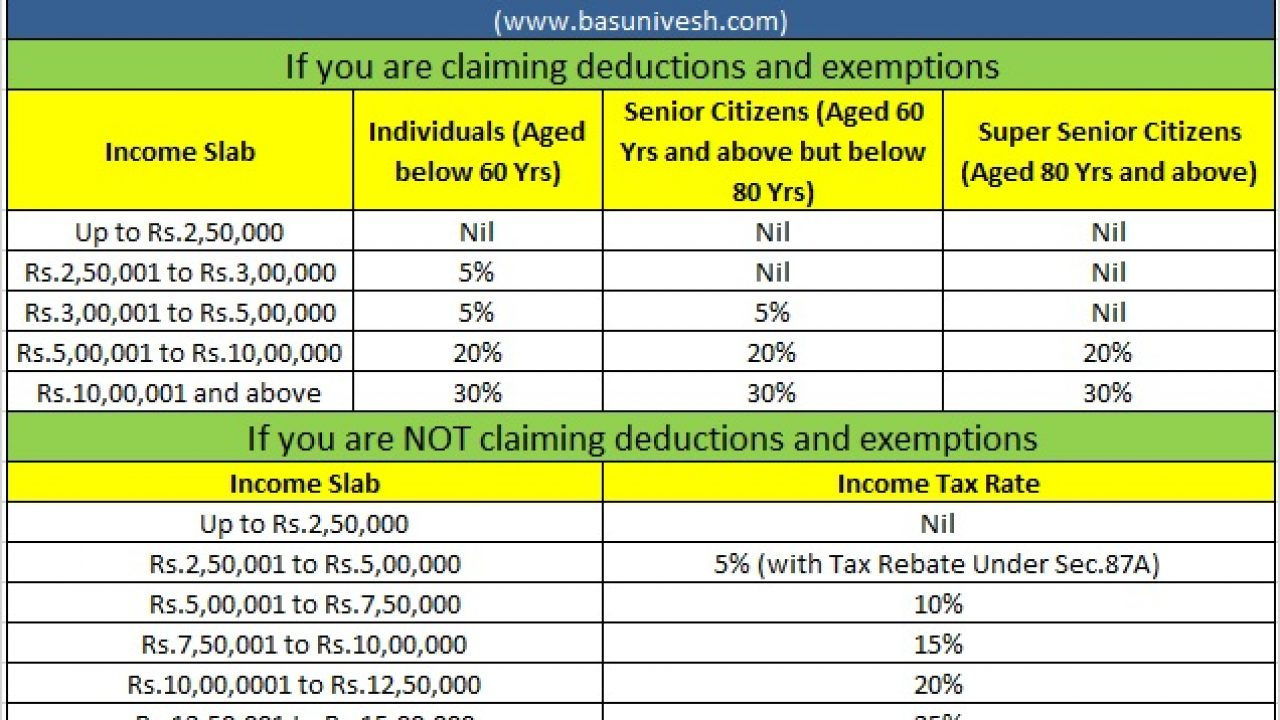

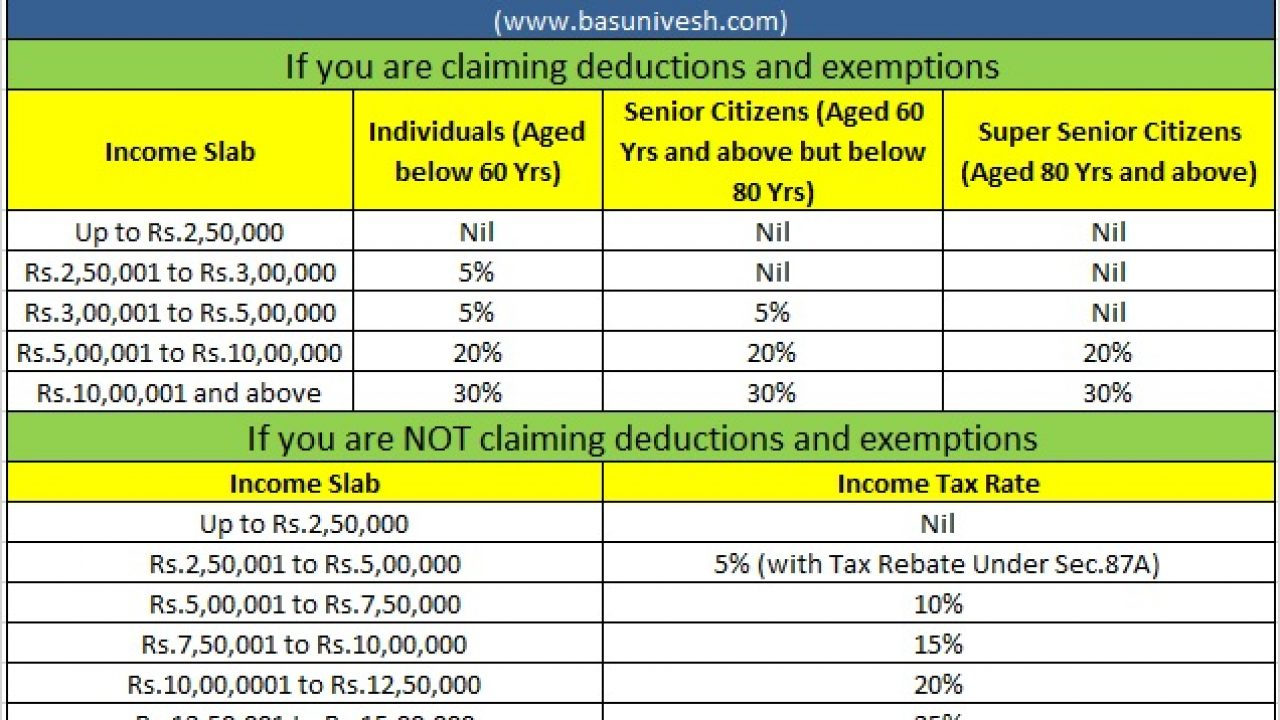

Federal Tax Deduction Table 2021 Tax Withholding Estimator 2021

Federal Tax Deduction Table 2021 Tax Withholding Estimator 2021

Thankfully buying tools equipment or a vehicle for your business can be claimed as a tax expense which reduces your taxable income and tax bill Which type of tax expense you claim depends upon what you re buying and how you keep your financial records Claiming tax expenses for equipment

Here s everything you need to know about the tax implications of tools for a mechanic Check out Beem Income Tax Calculator and Refund Estimator to get an accurate estimate of your tax situation Are Tools Tax Deductible for a Mechanic Yes tools are categorized under tax deductible for mechanics

Tool Tax Deduction have gained a lot of appeal due to many compelling reasons:

-

Cost-Effective: They eliminate the requirement to purchase physical copies or expensive software.

-

Personalization They can make printed materials to meet your requirements for invitations, whether that's creating them and schedules, or decorating your home.

-

Educational Use: Free educational printables provide for students from all ages, making them an essential source for educators and parents.

-

Simple: Access to a myriad of designs as well as templates can save you time and energy.

Where to Find more Tool Tax Deduction

Section 179 Tax Deduction

Section 179 Tax Deduction

The CRA allows you to claim a maximum deduction of 500 However in some cases your allowable deduction may be lower To calculate your deduction start with the lesser of the amount you spent on allowable trade tools or the income you earned as a tradesperson Subtract 1 195 from that amount

As an employed tradesperson the cost of the eligible tools that you buy is deductible You may be able to deduct up to 500 of the cost of eligible tools you bought You may also be able to get a rebate on the Goods and Services Tax Harmonized Sales Tax you paid for the tools you purchased

Now that we've piqued your curiosity about Tool Tax Deduction Let's look into where you can find these hidden treasures:

1. Online Repositories

- Websites such as Pinterest, Canva, and Etsy provide a wide selection with Tool Tax Deduction for all motives.

- Explore categories such as design, home decor, organisation, as well as crafts.

2. Educational Platforms

- Forums and educational websites often provide worksheets that can be printed for free or flashcards as well as learning materials.

- It is ideal for teachers, parents and students who are in need of supplementary resources.

3. Creative Blogs

- Many bloggers post their original designs and templates for free.

- The blogs covered cover a wide variety of topics, that range from DIY projects to planning a party.

Maximizing Tool Tax Deduction

Here are some fresh ways create the maximum value use of Tool Tax Deduction:

1. Home Decor

- Print and frame stunning images, quotes, or even seasonal decorations to decorate your living spaces.

2. Education

- Use these printable worksheets free of charge to enhance your learning at home also in the classes.

3. Event Planning

- Design invitations and banners and other decorations for special occasions like weddings or birthdays.

4. Organization

- Keep your calendars organized by printing printable calendars checklists for tasks, as well as meal planners.

Conclusion

Tool Tax Deduction are an abundance of creative and practical resources that satisfy a wide range of requirements and passions. Their accessibility and versatility make them a great addition to your professional and personal life. Explore the wide world of Tool Tax Deduction to explore new possibilities!

Frequently Asked Questions (FAQs)

-

Are Tool Tax Deduction really available for download?

- Yes, they are! You can download and print these items for free.

-

Can I utilize free templates for commercial use?

- It's based on the conditions of use. Always verify the guidelines provided by the creator before using printables for commercial projects.

-

Are there any copyright issues when you download printables that are free?

- Certain printables may be subject to restrictions in use. Be sure to review the terms and condition of use as provided by the author.

-

How can I print printables for free?

- You can print them at home using printing equipment or visit any local print store for superior prints.

-

What program will I need to access printables that are free?

- A majority of printed materials are as PDF files, which can be opened using free software, such as Adobe Reader.

What Will My Tax Deduction Savings Look Like The Motley Fool

Tax Deduction Tax Deduction 1040 IRS Tax Return Form And C Flickr

Check more sample of Tool Tax Deduction below

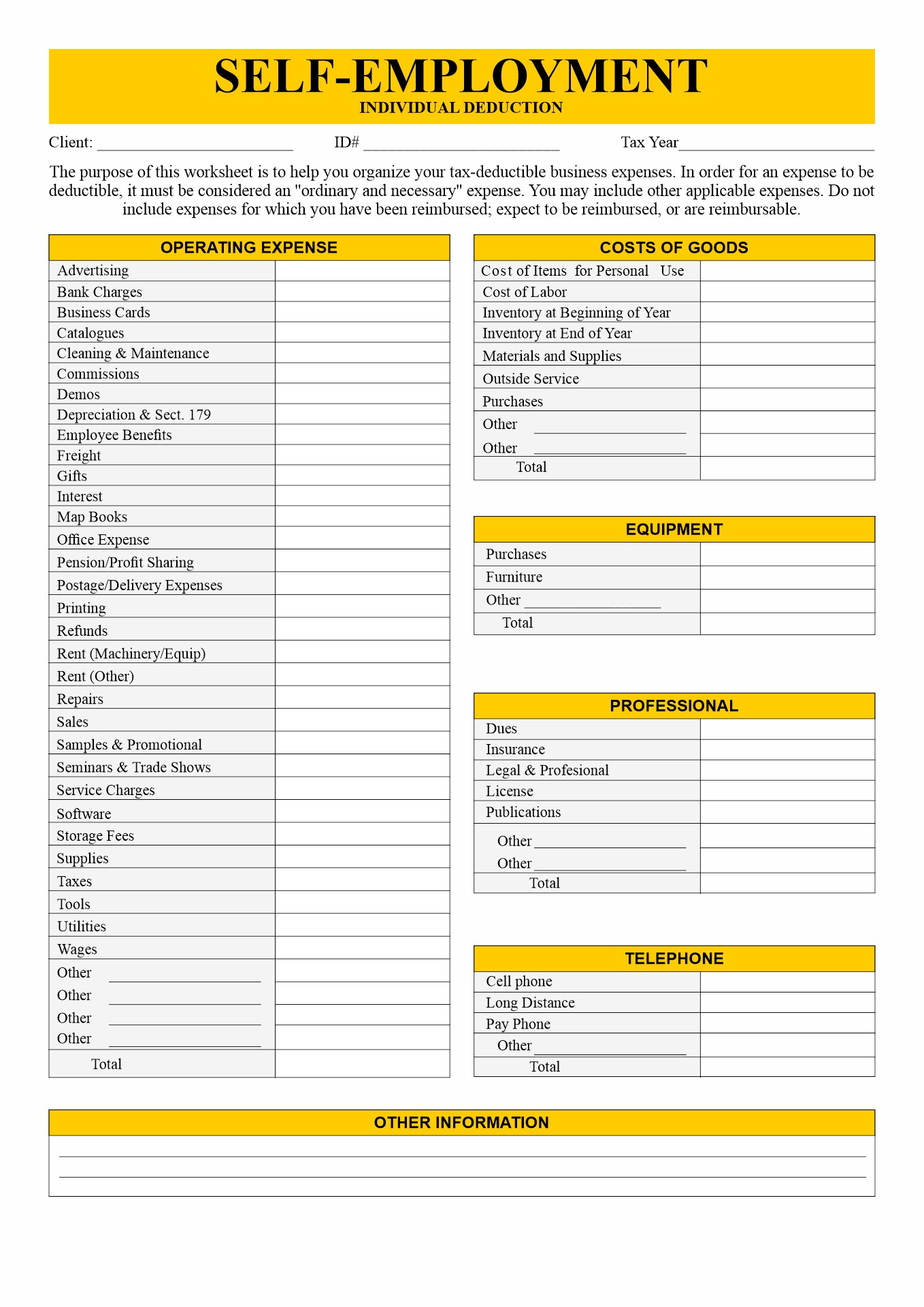

20 Self Motivation Worksheet Worksheeto

How To Fully Maximize Your 1099 Tax Deductions Steady

Tax Deduction Stock Photo Photo By LendingMemo Under CC 2 Flickr

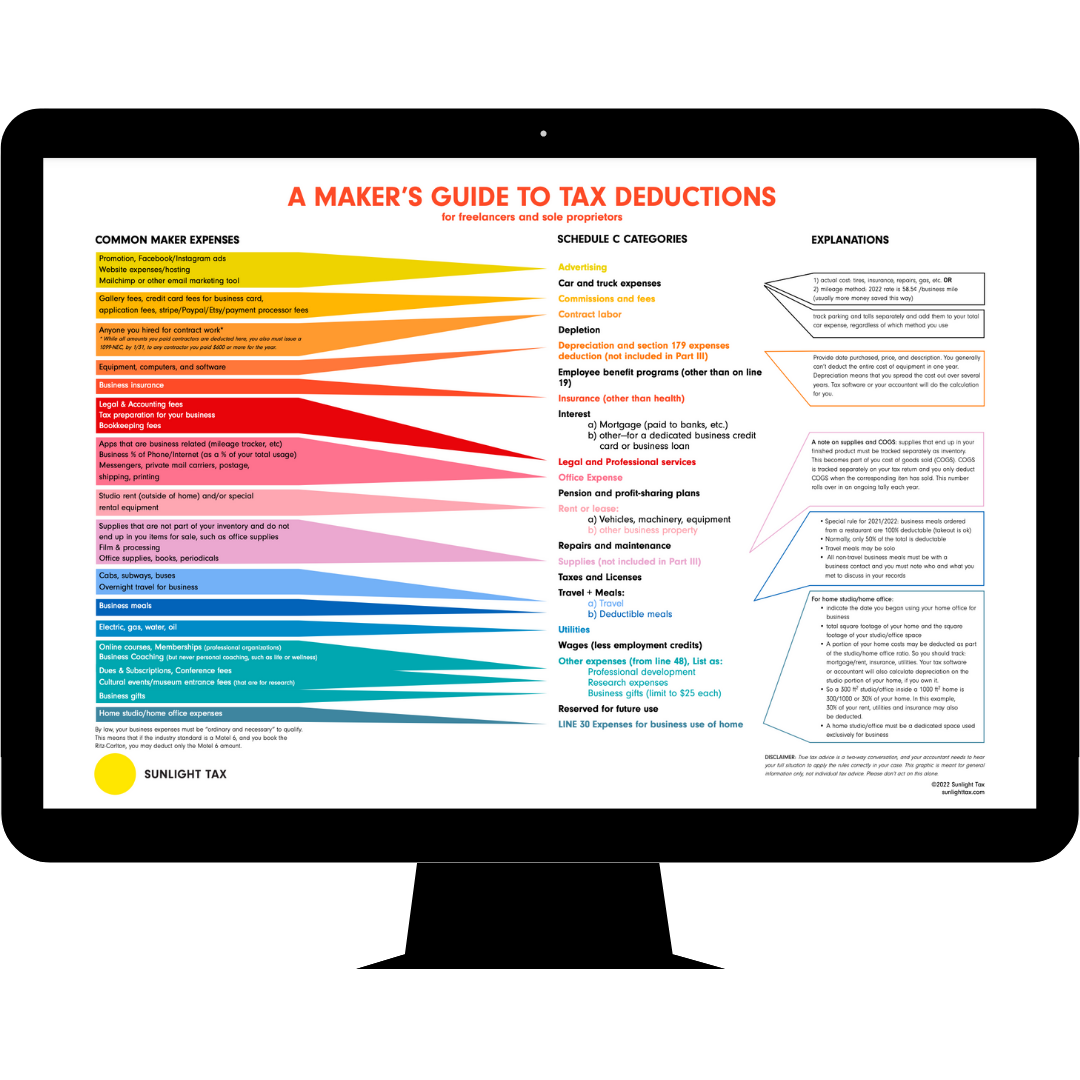

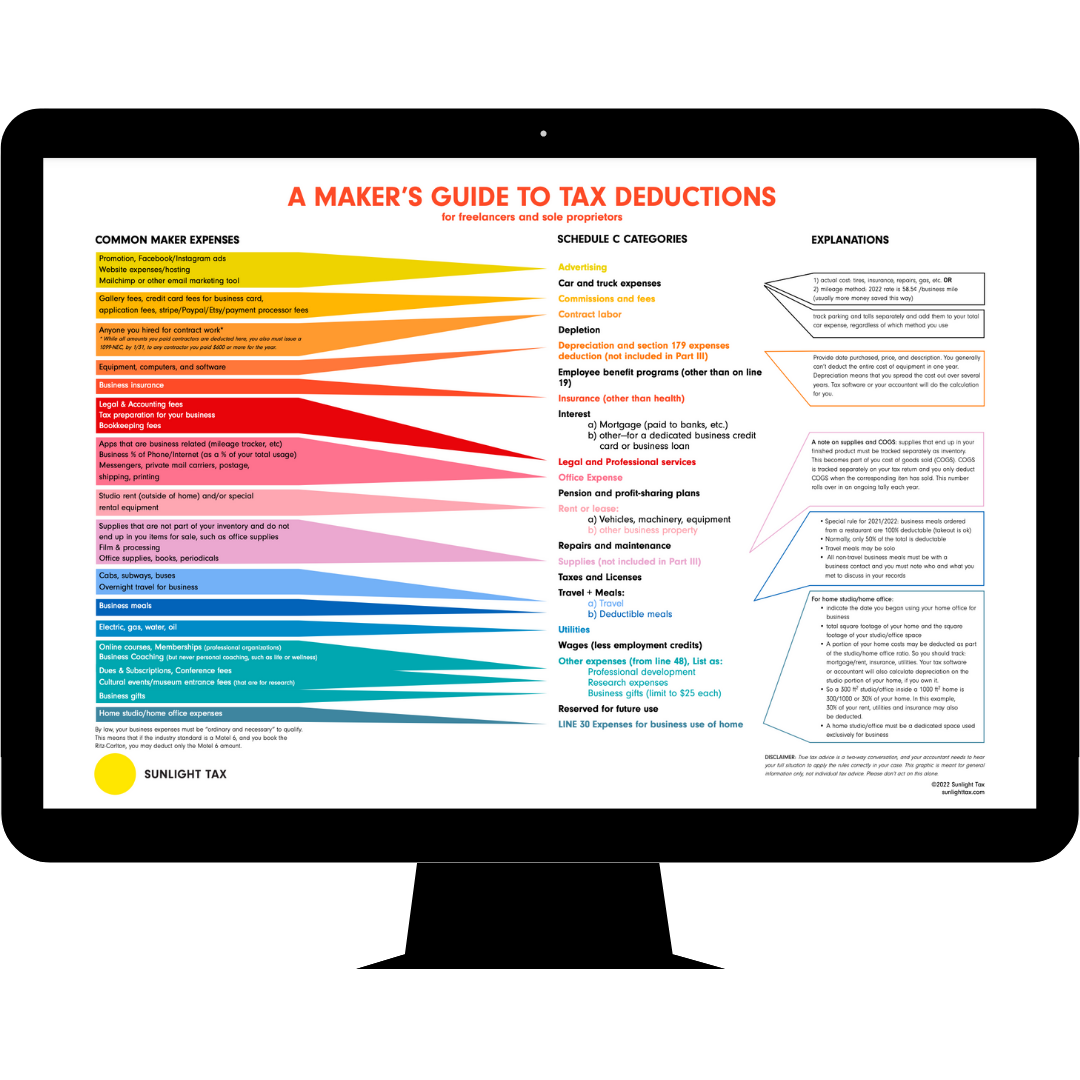

Makers Tax Deductions Guide Sunlight Tax

Tax Deductions For Businesses BUCHBINDER TUNICK CO

Maximising Tax Benefits Your Guide To Claiming A Rental Property

https://www.ato.gov.au/individuals-and-families/...

Deductions for tools or instruments you use for work including the cost of repairs and insurance Last updated 25 April 2023 Print or Download On this page Eligibility to claim tool and equipment expenses Types of tools and equipment you can claim How to calculate your tools and equipment deduction Keeping records for tools and equipment

https://www.goldenappleagencyinc.com/blog/write...

Criteria to Deduct Tools as a Business Expense To qualify as a tax deduction the expense must meet the following criteria set by the Internal Revenue Service IRS 1 Ordinary and Necessary For a tool to qualify as tax deductible the IRS states it must be ordinary and necessary for your business

Deductions for tools or instruments you use for work including the cost of repairs and insurance Last updated 25 April 2023 Print or Download On this page Eligibility to claim tool and equipment expenses Types of tools and equipment you can claim How to calculate your tools and equipment deduction Keeping records for tools and equipment

Criteria to Deduct Tools as a Business Expense To qualify as a tax deduction the expense must meet the following criteria set by the Internal Revenue Service IRS 1 Ordinary and Necessary For a tool to qualify as tax deductible the IRS states it must be ordinary and necessary for your business

Makers Tax Deductions Guide Sunlight Tax

How To Fully Maximize Your 1099 Tax Deductions Steady

Tax Deductions For Businesses BUCHBINDER TUNICK CO

Maximising Tax Benefits Your Guide To Claiming A Rental Property

Printable Tax Deduction Cheat Sheet

Medical Expense Deduction AGI Threshold To Be 10 In 2019 Deductions TAX

Medical Expense Deduction AGI Threshold To Be 10 In 2019 Deductions TAX

Illumination Wealth ManagementSection 199A Tax Reduction Strategies