In this digital age, when screens dominate our lives it's no wonder that the appeal of tangible printed objects hasn't waned. No matter whether it's for educational uses for creative projects, just adding an individual touch to the area, Tax Rebate U S 87a For Huf have proven to be a valuable source. In this article, we'll dive in the world of "Tax Rebate U S 87a For Huf," exploring their purpose, where they can be found, and how they can improve various aspects of your lives.

Get Latest Tax Rebate U S 87a For Huf Below

Tax Rebate U S 87a For Huf

Tax Rebate U S 87a For Huf -

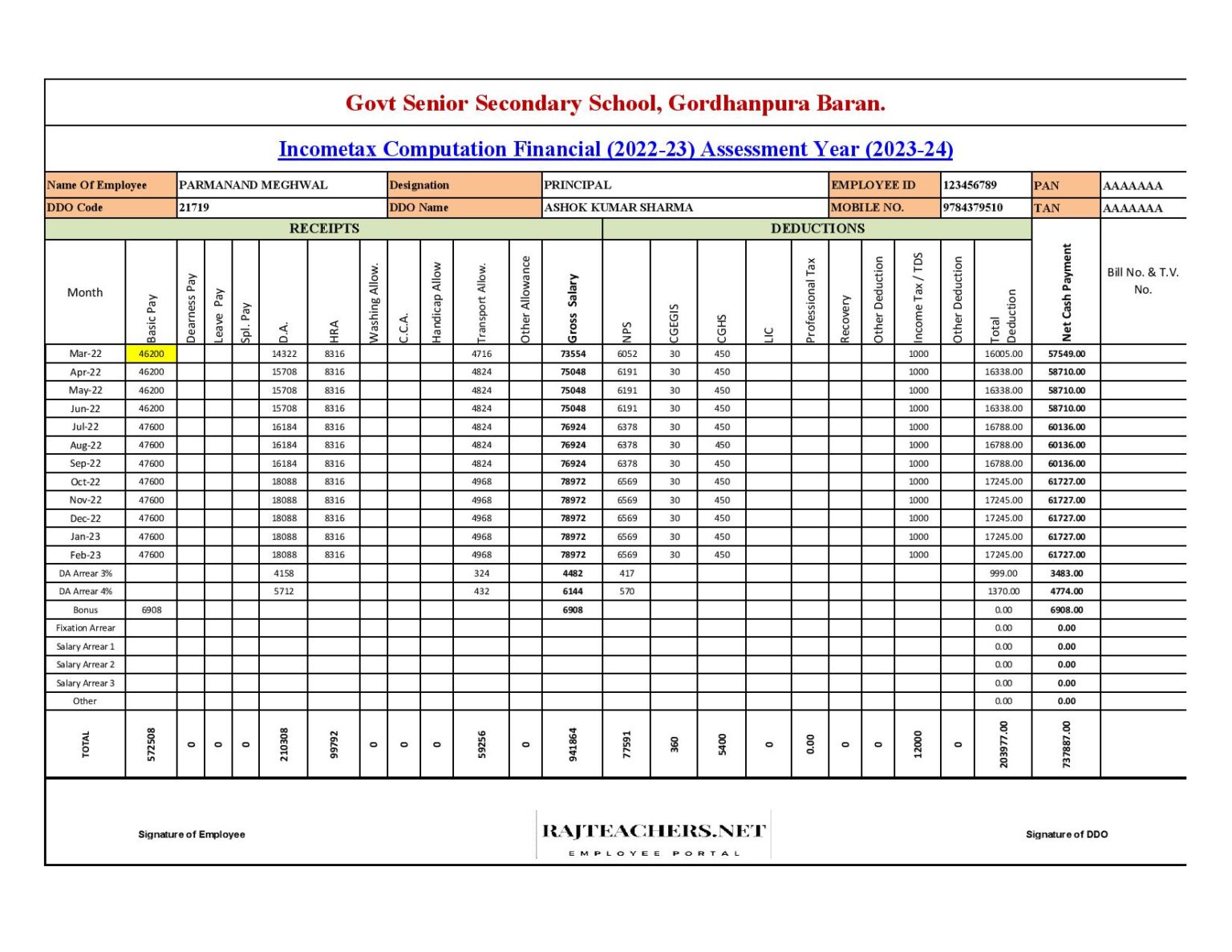

This return is applicable for an Individual or Hindu Undivided Family HUF who is Resident other than Not Ordinarily Resident or a Firm other than LLP which is a Resident having

For the FY 2021 22 and FY 2022 23 AY 2022 23 AY 2023 24 this limit is Rs 5 00 000 This means under both the old and new tax regimes a resident individual

Tax Rebate U S 87a For Huf encompass a wide selection of printable and downloadable materials online, at no cost. These printables come in different types, such as worksheets templates, coloring pages and many more. The benefit of Tax Rebate U S 87a For Huf lies in their versatility as well as accessibility.

More of Tax Rebate U S 87a For Huf

Income Tax Rebate U s 87A For The Financial Year 2022 23

Income Tax Rebate U s 87A For The Financial Year 2022 23

Income Tax Rebate 87A The income tax rebate under Section 87a provides some relief to the taxpayers who fall under the tax category of 10 Any individual whose annual net

Senior citizens above the age of 60 years and below 80 years are also eligible for rebate u s 87A Only Resident individual taxpayers can take benefit of

Tax Rebate U S 87a For Huf have gained immense popularity due to a variety of compelling reasons:

-

Cost-Efficiency: They eliminate the need to purchase physical copies or costly software.

-

Customization: This allows you to modify designs to suit your personal needs be it designing invitations and schedules, or even decorating your home.

-

Educational Value Printables for education that are free offer a wide range of educational content for learners from all ages, making the perfect device for teachers and parents.

-

Affordability: Quick access to a plethora of designs and templates is time-saving and saves effort.

Where to Find more Tax Rebate U S 87a For Huf

Income Tax Sec 87A Amendment Rebate YouTube

Income Tax Sec 87A Amendment Rebate YouTube

Rebate u s 87A is not available to HUF Even the Non Resident are not eligible for tax rebate as this rebate is available to residents only There is a ceiling on

Can HUF s claim tax rebate under section 87A No only resident individuals can claim a rebate under this section Companies and HUF cannot avail this benefit

In the event that we've stirred your interest in Tax Rebate U S 87a For Huf We'll take a look around to see where they are hidden gems:

1. Online Repositories

- Websites such as Pinterest, Canva, and Etsy offer a vast selection and Tax Rebate U S 87a For Huf for a variety needs.

- Explore categories like home decor, education, crafting, and organization.

2. Educational Platforms

- Educational websites and forums frequently provide worksheets that can be printed for free or flashcards as well as learning materials.

- The perfect resource for parents, teachers as well as students who require additional resources.

3. Creative Blogs

- Many bloggers post their original designs and templates, which are free.

- These blogs cover a wide array of topics, ranging starting from DIY projects to party planning.

Maximizing Tax Rebate U S 87a For Huf

Here are some ideas for you to get the best use of printables for free:

1. Home Decor

- Print and frame beautiful art, quotes, as well as seasonal decorations, to embellish your living spaces.

2. Education

- Use these printable worksheets free of charge to help reinforce your learning at home either in the schoolroom or at home.

3. Event Planning

- Make invitations, banners and other decorations for special occasions such as weddings and birthdays.

4. Organization

- Be organized by using printable calendars including to-do checklists, daily lists, and meal planners.

Conclusion

Tax Rebate U S 87a For Huf are an abundance filled with creative and practical information that can meet the needs of a variety of people and desires. Their availability and versatility make them an essential part of the professional and personal lives of both. Explore the vast collection of Tax Rebate U S 87a For Huf and unlock new possibilities!

Frequently Asked Questions (FAQs)

-

Are the printables you get for free free?

- Yes you can! You can print and download the resources for free.

-

Can I make use of free printables for commercial purposes?

- It's contingent upon the specific terms of use. Make sure you read the guidelines for the creator before utilizing their templates for commercial projects.

-

Are there any copyright violations with Tax Rebate U S 87a For Huf?

- Some printables may have restrictions on their use. You should read the terms and regulations provided by the designer.

-

How do I print Tax Rebate U S 87a For Huf?

- You can print them at home using either a printer or go to the local print shop for higher quality prints.

-

What software do I need to run printables free of charge?

- Most PDF-based printables are available in the PDF format, and is open with no cost software like Adobe Reader.

Rebate U s 87A

What Is Income Tax Rebate Under Section 87A HDFC Life

Check more sample of Tax Rebate U S 87a For Huf below

Section 87A Tax Rebate Under Section 87A Rebates Financial

Income Tax Rebate Under Section 87A

Income Tax Rebate Under Section 87A

Income Tax Slab Rates For FY 2021 22 AY 2022 23 Bachat Mantra

Revised Tax Rebate Under Sec 87A After Budget 2019 BasuNivesh

Tax Rebate Under Section 87A In Old New Tax Regime FinCalC

https://tax2win.in/guide/section-87a

For the FY 2021 22 and FY 2022 23 AY 2022 23 AY 2023 24 this limit is Rs 5 00 000 This means under both the old and new tax regimes a resident individual

https://taxguru.in/income-tax/marginal-r…

Wherein it is provided for higher rebate to Individual HUF Association of Person AOP BOI artificial jurisdictional person who opting for the new tax regime u s 115BAC 1A of the Income Tax Act A

For the FY 2021 22 and FY 2022 23 AY 2022 23 AY 2023 24 this limit is Rs 5 00 000 This means under both the old and new tax regimes a resident individual

Wherein it is provided for higher rebate to Individual HUF Association of Person AOP BOI artificial jurisdictional person who opting for the new tax regime u s 115BAC 1A of the Income Tax Act A

Income Tax Slab Rates For FY 2021 22 AY 2022 23 Bachat Mantra

Income Tax Rebate Under Section 87A

Revised Tax Rebate Under Sec 87A After Budget 2019 BasuNivesh

Tax Rebate Under Section 87A In Old New Tax Regime FinCalC

Income Tax Rebate Under Section 87A For Income Up To 5 Lakh

Breathtaking Income Tax Calculation Statement Two Types Of Financial

Breathtaking Income Tax Calculation Statement Two Types Of Financial

Income Tax Calculation For Central Government Employees