In this age of electronic devices, where screens have become the dominant feature of our lives The appeal of tangible printed objects hasn't waned. If it's to aid in education as well as creative projects or simply adding personal touches to your area, Tax Rebate Policy In India have become an invaluable resource. We'll dive into the sphere of "Tax Rebate Policy In India," exploring the benefits of them, where they are, and how they can add value to various aspects of your life.

Get Latest Tax Rebate Policy In India Below

Tax Rebate Policy In India

Tax Rebate Policy In India - Tax Deduction Policy In India, Tax Benefit Policies In India, Tax Exemption Policies In India, Tax Exemption Rules In India, Tax Deduction Rules In India, Tax Exemption Laws In India, Tax Deduction Laws In India, Income Tax Return Policy In India, What Is Tax Rebate In India, Tax Rebate Policy

Web 1 f 233 vr 2023 nbsp 0183 32 Budget 2023 Income Tax rebate limit raised to 7 lakh from 5 lakh Finance Minister Nirmala Sitharaman announces that there will not be any new tax for income up to 3 lakh reduces the number of I T

Web 2 f 233 vr 2023 nbsp 0183 32 As part of its Budget 2023 announcement Finance Minister Nirmala Sitharaman said that the tax rebate has been extended on income up to Rs 7 lakh in new tax regime as per Section 87A as against Rs 5

Tax Rebate Policy In India encompass a wide assortment of printable materials that are accessible online for free cost. These printables come in different forms, including worksheets, templates, coloring pages, and more. The appeal of printables for free is in their versatility and accessibility.

More of Tax Rebate Policy In India

Tax Rebate On Income Upto 5 Lakh Under Section 87A

Tax Rebate On Income Upto 5 Lakh Under Section 87A

Web India offers tax relief at both the central and state level Additional incentives are available to investors in specific sectors while India s special economic zones SEZs offer their

Web 2 f 233 vr 2023 nbsp 0183 32 With a hike in the basic exemption limit and rebate and tweaks to the income tax slabs Sitharaman has made the new income tax regime attractive for salaried

Tax Rebate Policy In India have gained immense recognition for a variety of compelling motives:

-

Cost-Effective: They eliminate the requirement to purchase physical copies or costly software.

-

Personalization There is the possibility of tailoring designs to suit your personal needs such as designing invitations making your schedule, or even decorating your house.

-

Educational value: Downloads of educational content for free provide for students of all ages. This makes them an essential tool for parents and teachers.

-

Affordability: You have instant access various designs and templates will save you time and effort.

Where to Find more Tax Rebate Policy In India

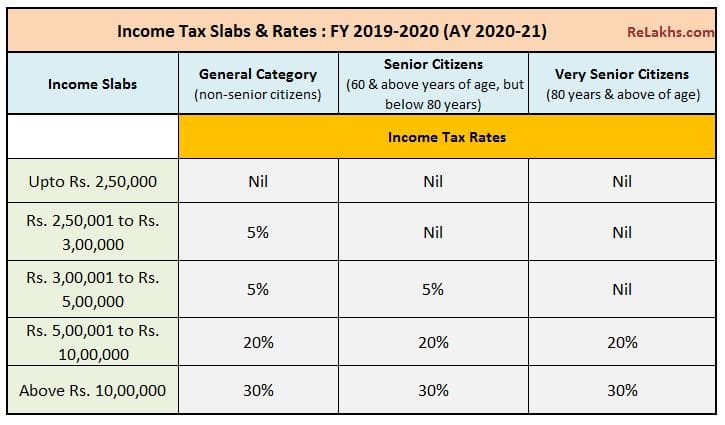

Income Tax Slab For Ay 2020 21 And Financial Year 2019 20

Income Tax Slab For Ay 2020 21 And Financial Year 2019 20

Web Tax rebate under Section 87A of the Income Tax Act 1961 is eligible for people whose taxable income is less than Rs 5 lakh in Financial Year 2022 23 The maximum amount

Web 13 juin 2023 nbsp 0183 32 Resident individuals are eligible for a tax rebate of the lower of the income tax or INR 12 500 where the total income does not exceed INR 500 000 However in case

In the event that we've stirred your interest in Tax Rebate Policy In India Let's see where you can get these hidden gems:

1. Online Repositories

- Websites like Pinterest, Canva, and Etsy offer a vast selection of Tax Rebate Policy In India to suit a variety of applications.

- Explore categories such as the home, decor, craft, and organization.

2. Educational Platforms

- Educational websites and forums often offer free worksheets and worksheets for printing Flashcards, worksheets, and other educational tools.

- Ideal for teachers, parents and students looking for additional resources.

3. Creative Blogs

- Many bloggers offer their unique designs and templates for no cost.

- These blogs cover a wide range of interests, everything from DIY projects to planning a party.

Maximizing Tax Rebate Policy In India

Here are some innovative ways create the maximum value use of Tax Rebate Policy In India:

1. Home Decor

- Print and frame gorgeous art, quotes, or seasonal decorations to adorn your living areas.

2. Education

- Use these printable worksheets free of charge to enhance your learning at home for the classroom.

3. Event Planning

- Design invitations, banners, as well as decorations for special occasions such as weddings or birthdays.

4. Organization

- Stay organized with printable calendars with to-do lists, planners, and meal planners.

Conclusion

Tax Rebate Policy In India are an abundance of practical and innovative resources that can meet the needs of a variety of people and passions. Their access and versatility makes they a beneficial addition to the professional and personal lives of both. Explore the wide world that is Tax Rebate Policy In India today, and explore new possibilities!

Frequently Asked Questions (FAQs)

-

Are Tax Rebate Policy In India truly available for download?

- Yes, they are! You can download and print these items for free.

-

Can I use the free templates for commercial use?

- It's contingent upon the specific conditions of use. Make sure you read the guidelines for the creator before using printables for commercial projects.

-

Do you have any copyright rights issues with Tax Rebate Policy In India?

- Some printables may contain restrictions on their use. Be sure to check the terms and conditions offered by the creator.

-

How do I print printables for free?

- Print them at home using an printer, or go to a print shop in your area for superior prints.

-

What program do I need to run printables at no cost?

- Many printables are offered in the PDF format, and is open with no cost software such as Adobe Reader.

All You Need To Know About Tax Rebate Under Section 87A By Enterslice

Interim Budget 2019 20 The Talk Of The Town Trade Brains

Check more sample of Tax Rebate Policy In India below

Daily current affairs

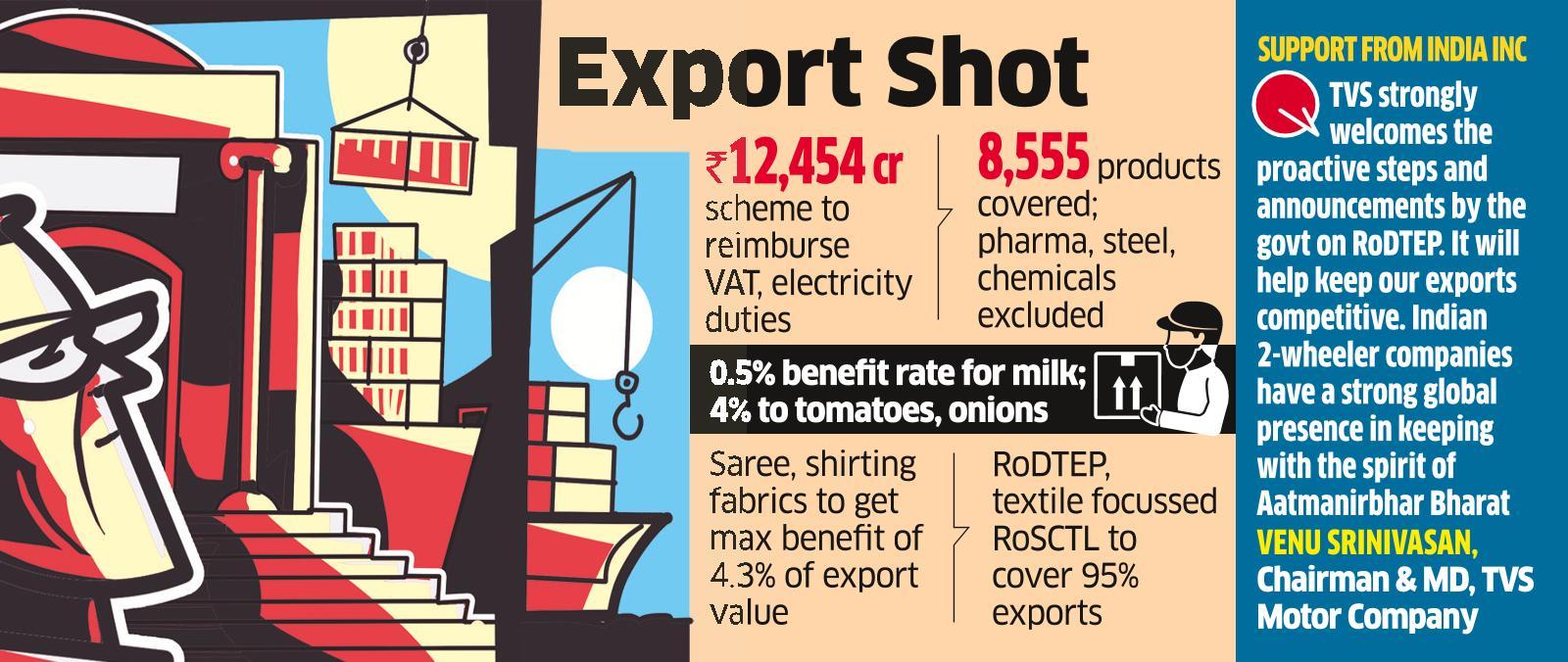

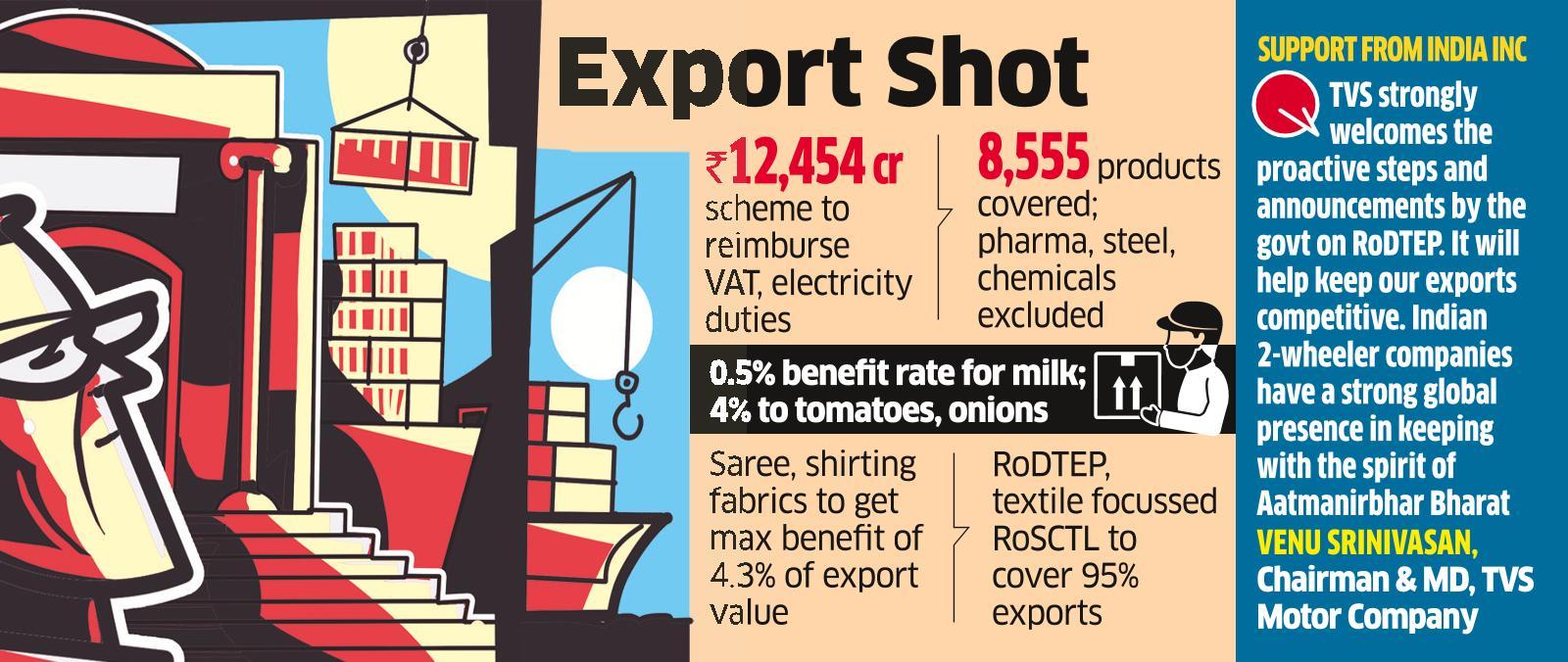

RoDTEP Scheme RoDTEP India Notifies Duty Rebate Rates To Give Exports

Income Tax Slab For FY 2022 23 New Income Tax Rates Slabs In India

FY 2020 21 Income Tax Sections Of Deductions And Rebates For Resident

Income Tax Rebate Under Section 87A For Income Up To 5 Lakh

Tax Benefit Of Buying Health Insurance In India For NRI Section 80D

https://www.cnbctv18.com/personal-finance/b…

Web 2 f 233 vr 2023 nbsp 0183 32 As part of its Budget 2023 announcement Finance Minister Nirmala Sitharaman said that the tax rebate has been extended on income up to Rs 7 lakh in new tax regime as per Section 87A as against Rs 5

https://taxsummaries.pwc.com/india/corporate/tax-credits-and-incentives

Web 1 avr 2016 nbsp 0183 32 Last reviewed 13 June 2023 Tax incentive provisions normally have conditions applicable for the period within which the preferred activity should be

Web 2 f 233 vr 2023 nbsp 0183 32 As part of its Budget 2023 announcement Finance Minister Nirmala Sitharaman said that the tax rebate has been extended on income up to Rs 7 lakh in new tax regime as per Section 87A as against Rs 5

Web 1 avr 2016 nbsp 0183 32 Last reviewed 13 June 2023 Tax incentive provisions normally have conditions applicable for the period within which the preferred activity should be

FY 2020 21 Income Tax Sections Of Deductions And Rebates For Resident

RoDTEP Scheme RoDTEP India Notifies Duty Rebate Rates To Give Exports

Income Tax Rebate Under Section 87A For Income Up To 5 Lakh

Tax Benefit Of Buying Health Insurance In India For NRI Section 80D

Incometax Individual Income Taxes Urban Institute This Service

2016 Property Tax Or Rent Rebate Claim PA 1000 Forms Publications

2016 Property Tax Or Rent Rebate Claim PA 1000 Forms Publications

Tax What Is Tax Taxation In India Tax Calculation