In this age of technology, where screens rule our lives, the charm of tangible, printed materials hasn't diminished. If it's to aid in education, creative projects, or just adding a personal touch to your area, Tax Rebate On Principal Amount Of Home Loan Before Possession are now an essential resource. This article will dive into the world of "Tax Rebate On Principal Amount Of Home Loan Before Possession," exploring the different types of printables, where they are, and ways they can help you improve many aspects of your life.

Get Latest Tax Rebate On Principal Amount Of Home Loan Before Possession Below

Tax Rebate On Principal Amount Of Home Loan Before Possession

Tax Rebate On Principal Amount Of Home Loan Before Possession -

Web 11 janv 2023 nbsp 0183 32 Tax deduction on the principal component is limited to Rs 1 50 lakhs per annum under Section 80C while rebate towards interest is capped at Rs 2 lakhs

Web 22 juin 2023 nbsp 0183 32 Tax benefits on home loans can only be claimed once possession of the property is obtained Interest paid prior to

Tax Rebate On Principal Amount Of Home Loan Before Possession include a broad selection of printable and downloadable materials online, at no cost. These materials come in a variety of types, like worksheets, coloring pages, templates and many more. The great thing about Tax Rebate On Principal Amount Of Home Loan Before Possession lies in their versatility as well as accessibility.

More of Tax Rebate On Principal Amount Of Home Loan Before Possession

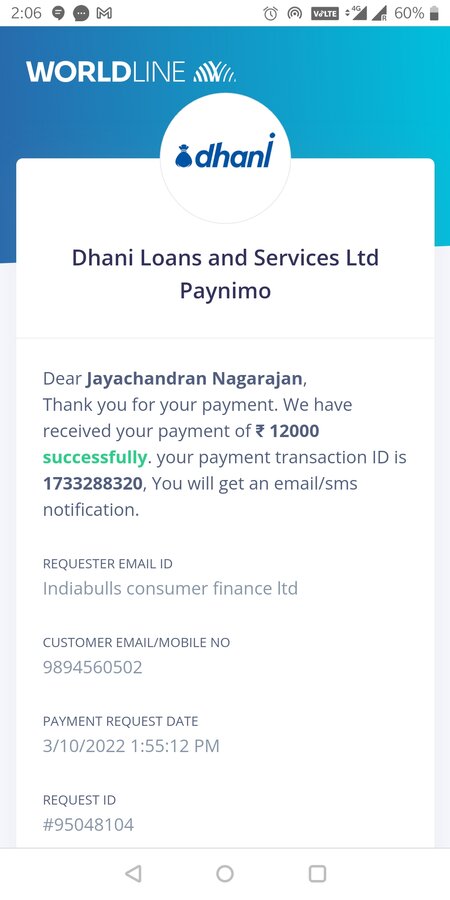

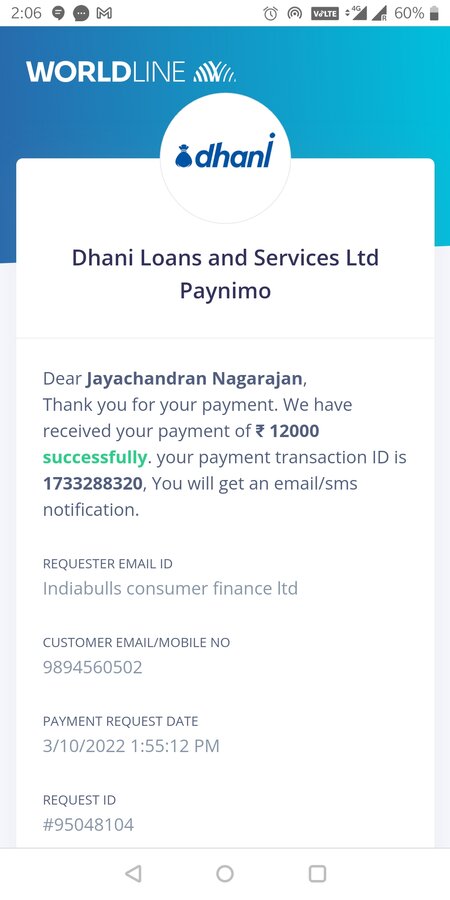

Payment View

Payment View

Web Can an individual claim Home Loan tax benefit before possession Yes it is possible to claim a tax rebate on Home Loan before possession However these tax rebates are

Web 28 janv 2014 nbsp 0183 32 3 Answers Sorted by 1 The rebate is available from the financial year in which you have taken the possession of the property All the interest paid in that

The Tax Rebate On Principal Amount Of Home Loan Before Possession have gained huge popularity due to a myriad of compelling factors:

-

Cost-Effective: They eliminate the requirement to purchase physical copies or expensive software.

-

Customization: The Customization feature lets you tailor printing templates to your own specific requirements, whether it's designing invitations to organize your schedule or decorating your home.

-

Education Value Printables for education that are free offer a wide range of educational content for learners from all ages, making these printables a powerful aid for parents as well as educators.

-

Convenience: The instant accessibility to a myriad of designs as well as templates will save you time and effort.

Where to Find more Tax Rebate On Principal Amount Of Home Loan Before Possession

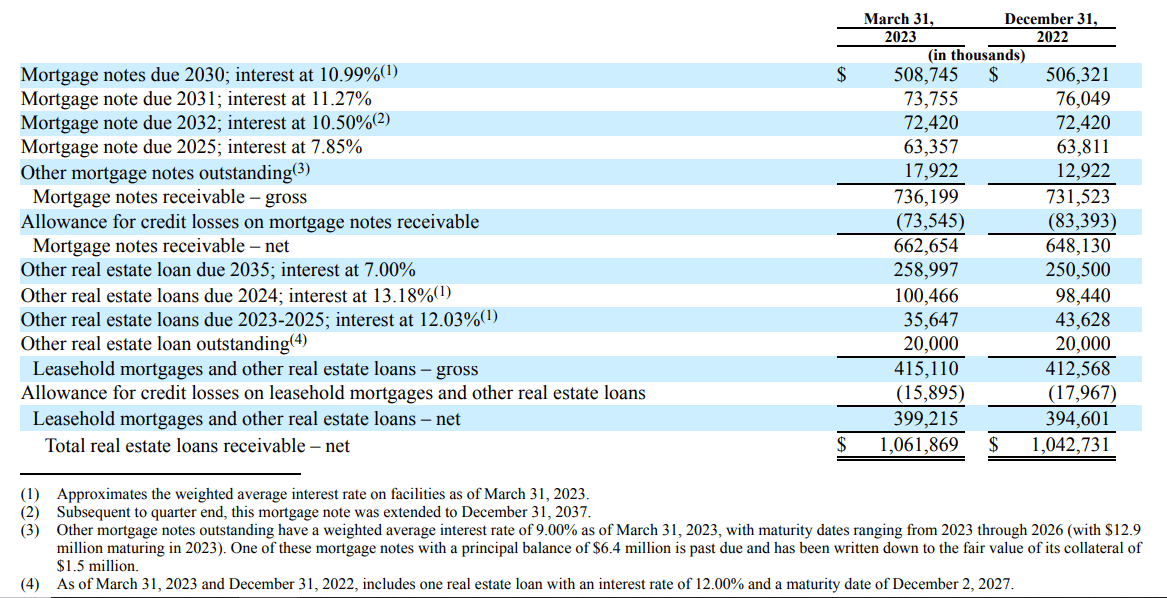

Omega Healthcare Why The Stock Is A Hold NYSE OHI Seeking Alpha

Omega Healthcare Why The Stock Is A Hold NYSE OHI Seeking Alpha

Web 31 mai 2022 nbsp 0183 32 One of the primary benefits of home loans is that you get to enjoy substantial tax rebates which significantly reduce your tax outgo If you already have a home loan

Web Combined with tax exemptions on the principal amount a home loan for under construction property makes your dream house more affordable Yes you can claim

We hope we've stimulated your interest in Tax Rebate On Principal Amount Of Home Loan Before Possession Let's find out where you can find these elusive treasures:

1. Online Repositories

- Websites such as Pinterest, Canva, and Etsy have a large selection of Tax Rebate On Principal Amount Of Home Loan Before Possession suitable for many goals.

- Explore categories like interior decor, education, organizational, and arts and crafts.

2. Educational Platforms

- Forums and educational websites often offer free worksheets and worksheets for printing with flashcards and other teaching tools.

- Ideal for teachers, parents as well as students searching for supplementary sources.

3. Creative Blogs

- Many bloggers offer their unique designs and templates free of charge.

- The blogs are a vast array of topics, ranging from DIY projects to planning a party.

Maximizing Tax Rebate On Principal Amount Of Home Loan Before Possession

Here are some innovative ways of making the most of Tax Rebate On Principal Amount Of Home Loan Before Possession:

1. Home Decor

- Print and frame beautiful artwork, quotes or decorations for the holidays to beautify your living areas.

2. Education

- Use these printable worksheets free of charge for teaching at-home also in the classes.

3. Event Planning

- Make invitations, banners as well as decorations for special occasions like weddings and birthdays.

4. Organization

- Stay organized by using printable calendars for to-do list, lists of chores, and meal planners.

Conclusion

Tax Rebate On Principal Amount Of Home Loan Before Possession are an abundance of creative and practical resources which cater to a wide range of needs and interests. Their availability and versatility make they a beneficial addition to both personal and professional life. Explore the vast world of Tax Rebate On Principal Amount Of Home Loan Before Possession to uncover new possibilities!

Frequently Asked Questions (FAQs)

-

Do printables with no cost really free?

- Yes you can! You can print and download these documents for free.

-

Are there any free printing templates for commercial purposes?

- It's based on specific usage guidelines. Always check the creator's guidelines prior to using the printables in commercial projects.

-

Do you have any copyright rights issues with printables that are free?

- Certain printables may be subject to restrictions on use. Be sure to read the terms and condition of use as provided by the designer.

-

How can I print Tax Rebate On Principal Amount Of Home Loan Before Possession?

- Print them at home using any printer or head to an in-store print shop to get superior prints.

-

What software do I need to run printables at no cost?

- The majority are printed in PDF format, which is open with no cost programs like Adobe Reader.

ITR Filing You Can Claim Interest Paid Before Possession Even If You

Home Loan Tax Rebate 5

Check more sample of Tax Rebate On Principal Amount Of Home Loan Before Possession below

Writing Displaying Text Rate Of Interest Concept Meaning Percentage

Deferred Tax And Temporary Differences The Footnotes Analyst

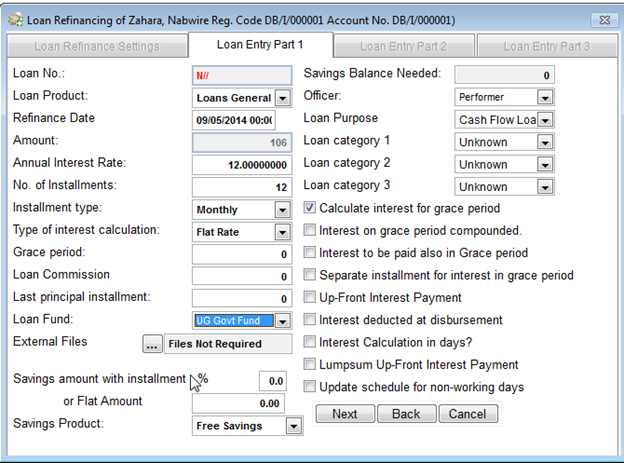

Loan Amount Principal COOKING WITH THE PROS

Handwriting Text Rate Of Interest Business Concept Percentage Computed

Home Loan EMI Calculator Free Excel Sheet Stable Investor

Sign Displaying Rate Of Interest Business Concept Percentage Computed

https://www.livemint.com/money/personal-fina…

Web 22 juin 2023 nbsp 0183 32 Tax benefits on home loans can only be claimed once possession of the property is obtained Interest paid prior to

https://economictimes.indiatimes.com/wealth/tax/can-i-claim-deduction...

Web Shubham Agrawal Senior Taxation Advisor TaxFile in says quot Yes the principal portion of the EMI paid for the year is allowed as deduction under Section 80C in the year of

Web 22 juin 2023 nbsp 0183 32 Tax benefits on home loans can only be claimed once possession of the property is obtained Interest paid prior to

Web Shubham Agrawal Senior Taxation Advisor TaxFile in says quot Yes the principal portion of the EMI paid for the year is allowed as deduction under Section 80C in the year of

Handwriting Text Rate Of Interest Business Concept Percentage Computed

Deferred Tax And Temporary Differences The Footnotes Analyst

Home Loan EMI Calculator Free Excel Sheet Stable Investor

Sign Displaying Rate Of Interest Business Concept Percentage Computed

Loan Calc Adfition Principal Polizload

IndiaBulls Loan Foreclosure By Paying Entire Principal Amount And

IndiaBulls Loan Foreclosure By Paying Entire Principal Amount And

Conceptual Display Rate Of Interest Business Showcase Percentage