In a world where screens have become the dominant feature of our lives however, the attraction of tangible printed items hasn't gone away. Whether it's for educational purposes, creative projects, or just adding an element of personalization to your space, Tax Energy Credit are a great resource. This article will take a dive to the depths of "Tax Energy Credit," exploring their purpose, where to get them, as well as how they can improve various aspects of your lives.

Get Latest Tax Energy Credit Below

Tax Energy Credit

Tax Energy Credit -

If you make qualified energy efficient improvements to your home after Jan 1 2023 you may qualify for a tax credit up to 3 200 You can claim the credit for improvements made through 2032 For improvements installed in 2022 or earlier Use previous versions of Form 5695

You can claim a tax credit for electricity that you have used in your permanent home between 1 January and 30 April 2023 The credit is 60 of the electricity expenses exceeding 2 000 However you can claim a credit

Tax Energy Credit encompass a wide selection of printable and downloadable documents that can be downloaded online at no cost. They are available in a variety of types, such as worksheets coloring pages, templates and more. The benefit of Tax Energy Credit is their versatility and accessibility.

More of Tax Energy Credit

Tracy s Tax Tips 10 Credit For Energy Efficient Improvements News

Tracy s Tax Tips 10 Credit For Energy Efficient Improvements News

An energy tax credit is a government incentive that reduces the cost for people and businesses to use alternative energy resources The credit amount either reduces the total sum owed to the

Federal Tax Credits for Energy Efficiency The Inflation Reduction Act of 2022 empowers Americans to make homes and buildings more energy efficient by providing federal tax credits and deductions that will help reduce energy costs and demand as we transition to cleaner energy sources

The Tax Energy Credit have gained huge recognition for a variety of compelling motives:

-

Cost-Efficiency: They eliminate the necessity to purchase physical copies of the software or expensive hardware.

-

The ability to customize: They can make the templates to meet your individual needs in designing invitations and schedules, or decorating your home.

-

Educational Value: Printing educational materials for no cost offer a wide range of educational content for learners from all ages, making the perfect tool for parents and teachers.

-

Easy to use: Access to numerous designs and templates can save you time and energy.

Where to Find more Tax Energy Credit

Residential Energy Credit Application 2024 ElectricRate

Residential Energy Credit Application 2024 ElectricRate

The IRS and Treasury finalized proposed rules issued last June over how eligible taxpayers can effectively buy or sell certain energy tax credits and clarify who is eligible to monetize the credits and how credits can be transferred Transferability is expected to bring in a wider array of buyers and capital into clean energy financing The

The Residential Clean Energy Credit equals 30 of the costs of new qualified clean energy property for your home installed anytime from 2022 through 2032 The credit percentage rate phases down to 26 percent for property placed in service in 2033 and 22 percent for property placed in service in 2034

After we've peaked your interest in printables for free We'll take a look around to see where you can discover these hidden treasures:

1. Online Repositories

- Websites such as Pinterest, Canva, and Etsy offer a vast selection of printables that are free for a variety of needs.

- Explore categories such as decorations for the home, education and the arts, and more.

2. Educational Platforms

- Educational websites and forums often provide worksheets that can be printed for free along with flashcards, as well as other learning tools.

- This is a great resource for parents, teachers as well as students searching for supplementary sources.

3. Creative Blogs

- Many bloggers offer their unique designs and templates, which are free.

- The blogs are a vast range of interests, all the way from DIY projects to party planning.

Maximizing Tax Energy Credit

Here are some new ways in order to maximize the use use of printables that are free:

1. Home Decor

- Print and frame gorgeous images, quotes, or other seasonal decorations to fill your living areas.

2. Education

- Use printable worksheets from the internet to reinforce learning at home either in the schoolroom or at home.

3. Event Planning

- Design invitations for banners, invitations as well as decorations for special occasions like weddings and birthdays.

4. Organization

- Stay organized by using printable calendars with to-do lists, planners, and meal planners.

Conclusion

Tax Energy Credit are a treasure trove of practical and imaginative resources for a variety of needs and interest. Their access and versatility makes them a great addition to the professional and personal lives of both. Explore the endless world of Tax Energy Credit to open up new possibilities!

Frequently Asked Questions (FAQs)

-

Are printables for free really gratis?

- Yes they are! You can print and download the resources for free.

-

Can I use free printables for commercial use?

- It is contingent on the specific rules of usage. Always verify the guidelines provided by the creator before utilizing their templates for commercial projects.

-

Are there any copyright problems with Tax Energy Credit?

- Some printables may come with restrictions on their use. You should read the terms and conditions provided by the designer.

-

How can I print printables for free?

- You can print them at home using any printer or head to a print shop in your area for superior prints.

-

What software will I need to access Tax Energy Credit?

- Most printables come as PDF files, which is open with no cost software like Adobe Reader.

Inflation Reduction Act Of 2022 Clean Vehicle Energy Credit Bregante

Clean Energy Tax Credits Get A Boost In New Climate Law Article EESI

Check more sample of Tax Energy Credit below

Federal Solar Tax Credits For Businesses Department Of Energy

Residential Energy Credit Application 2024 ElectricRate

2023 Residential Clean Energy Credit Guide ReVision Energy

How Does The Tax Credit System Work Leia Aqui How Do Tax Credits

Rebates Tax Incentives Residential Renewable Energy Tax Credit

Tax Credits Save You More Than Deductions Here Are The Best Ones

https://www.vero.fi/.../calculator-for-the-tax-credit-for-electricity

You can claim a tax credit for electricity that you have used in your permanent home between 1 January and 30 April 2023 The credit is 60 of the electricity expenses exceeding 2 000 However you can claim a credit

https://www.irs.gov/credits-deductions/home-energy-tax-credits

Home energy tax credits If you make energy improvements to your home tax credits are available for a portion of qualifying expenses The credit amounts and types of qualifying expenses were expanded by the Inflation Reduction Act of 2022

You can claim a tax credit for electricity that you have used in your permanent home between 1 January and 30 April 2023 The credit is 60 of the electricity expenses exceeding 2 000 However you can claim a credit

Home energy tax credits If you make energy improvements to your home tax credits are available for a portion of qualifying expenses The credit amounts and types of qualifying expenses were expanded by the Inflation Reduction Act of 2022

How Does The Tax Credit System Work Leia Aqui How Do Tax Credits

Residential Energy Credit Application 2024 ElectricRate

Rebates Tax Incentives Residential Renewable Energy Tax Credit

Tax Credits Save You More Than Deductions Here Are The Best Ones

EV Tax Credit Changes Mean Low income Buyers Can Soon Get Full 7 500

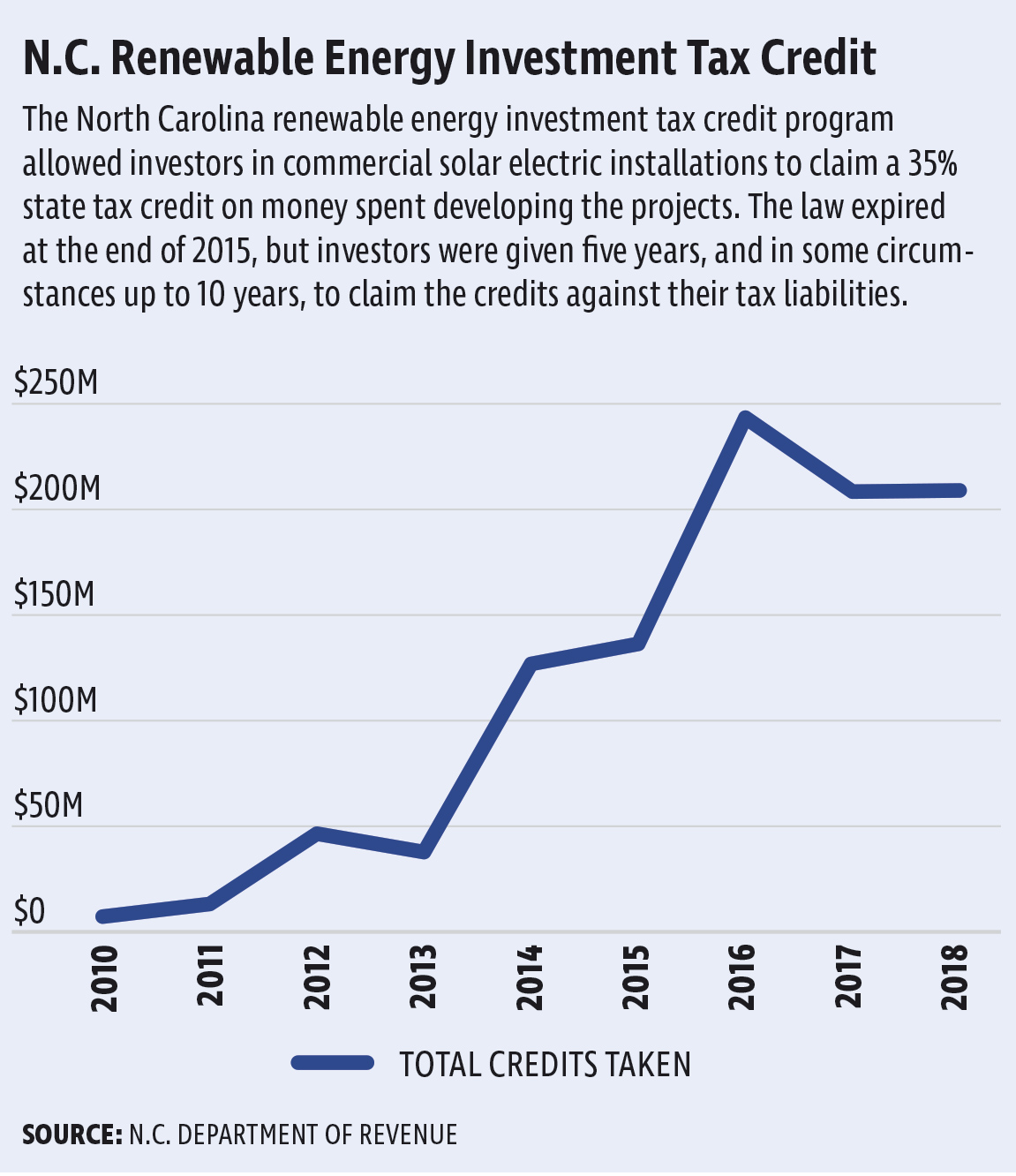

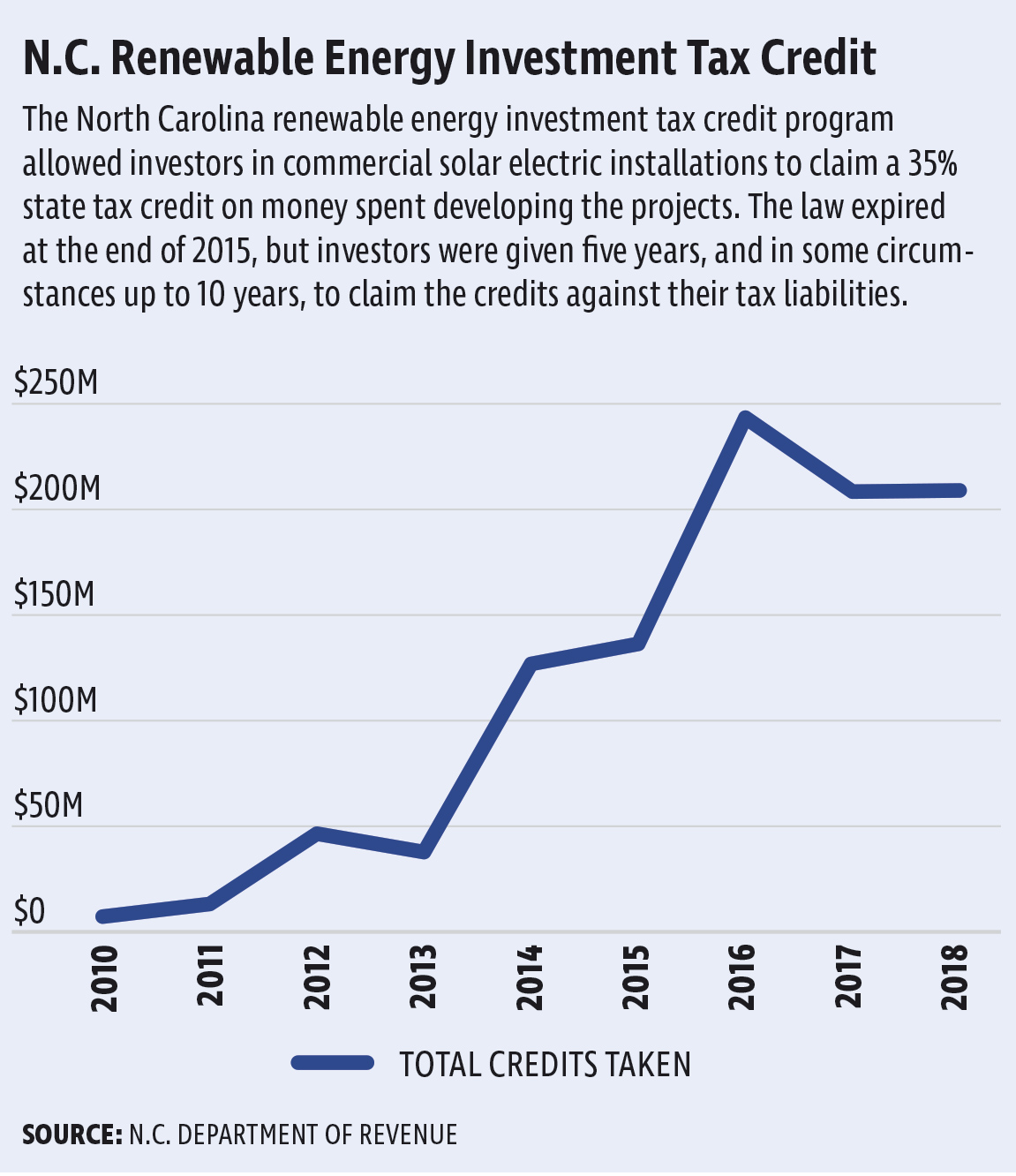

N C Has Issued More Than 1 Billion In Renewable Energy Tax Credits

N C Has Issued More Than 1 Billion In Renewable Energy Tax Credits

25C Tax Credit Fact Sheet Building Performance Association