In the digital age, in which screens are the norm but the value of tangible printed objects hasn't waned. If it's to aid in education, creative projects, or simply adding some personal flair to your home, printables for free can be an excellent resource. This article will dive into the sphere of "Tax Deductions For Home Health Care Workers," exploring their purpose, where to locate them, and how they can enrich various aspects of your life.

Get Latest Tax Deductions For Home Health Care Workers Below

Tax Deductions For Home Health Care Workers

Tax Deductions For Home Health Care Workers -

Home care can be expensive nearly 5 000 per month on average but there are ways to help make it more affordable Certain home care services you ve paid for yourself your spouse or another dependent can qualify as a

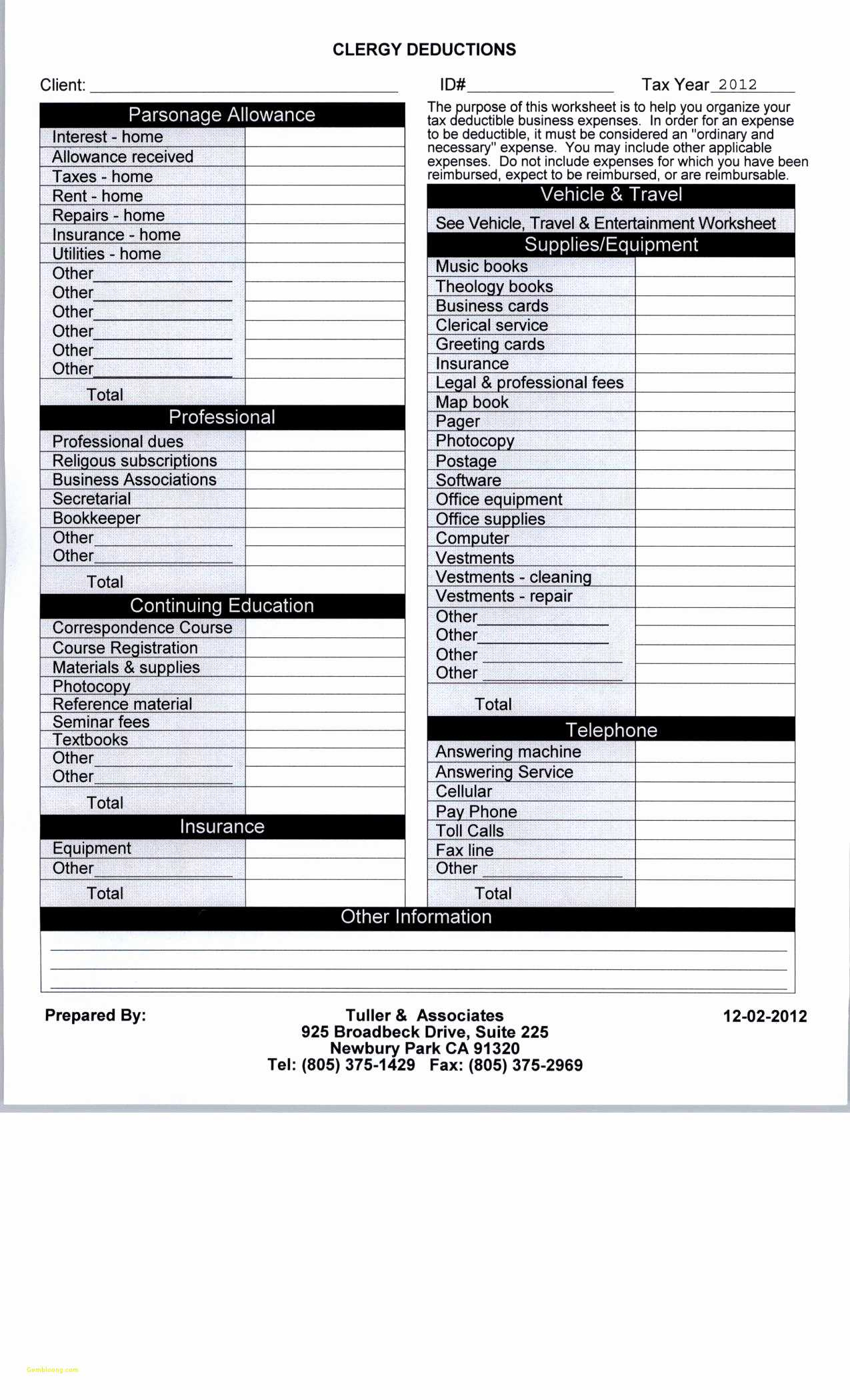

There are some tax deductions for home health care workers you may qualify for as long as the expenses are more than 2 percent of your adjusted gross income and your employer doesn t reimburse you for them

Printables for free cover a broad assortment of printable, downloadable materials online, at no cost. These printables come in different kinds, including worksheets templates, coloring pages, and more. The great thing about Tax Deductions For Home Health Care Workers lies in their versatility and accessibility.

More of Tax Deductions For Home Health Care Workers

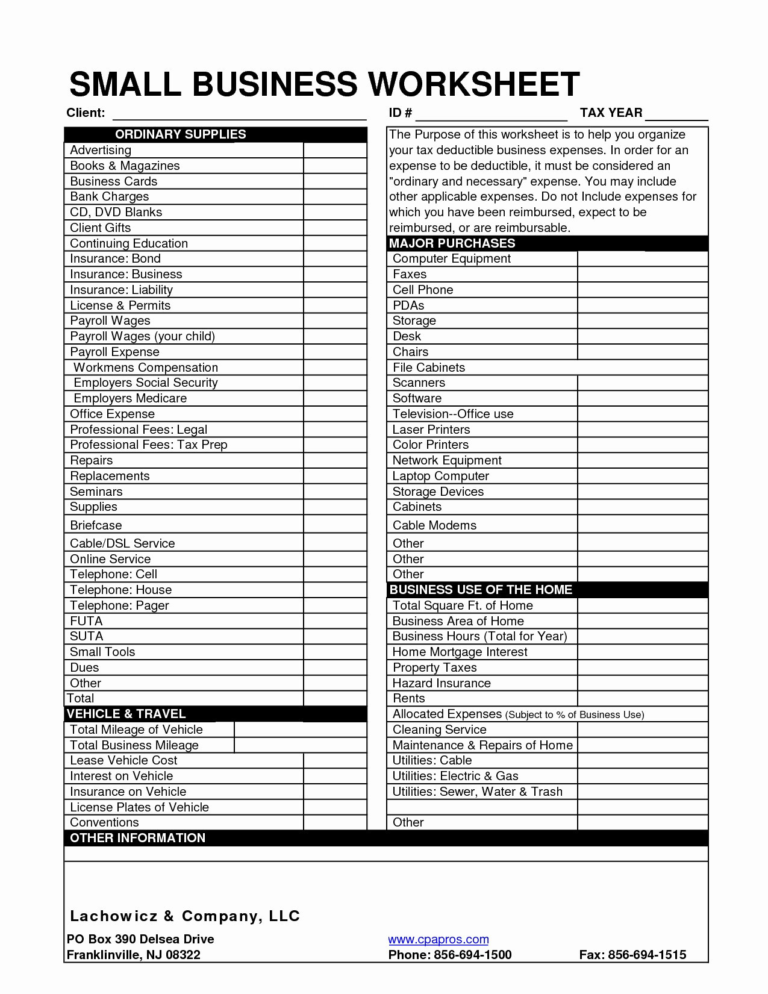

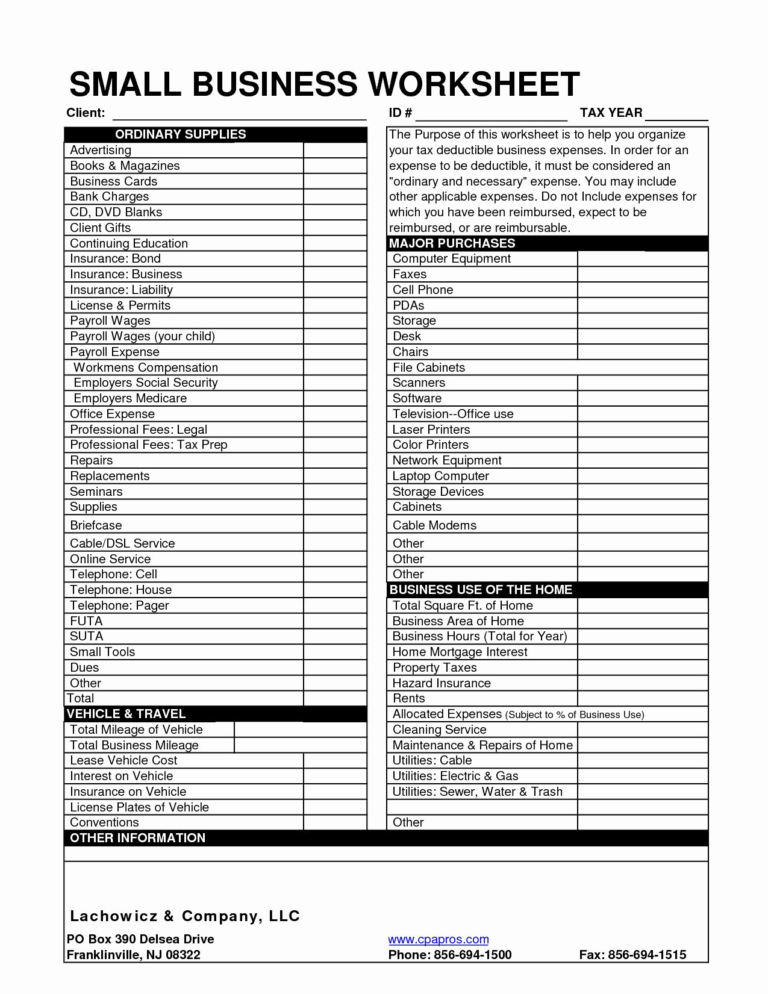

5 Tax Deductions Small Business Owners Need To Know

5 Tax Deductions Small Business Owners Need To Know

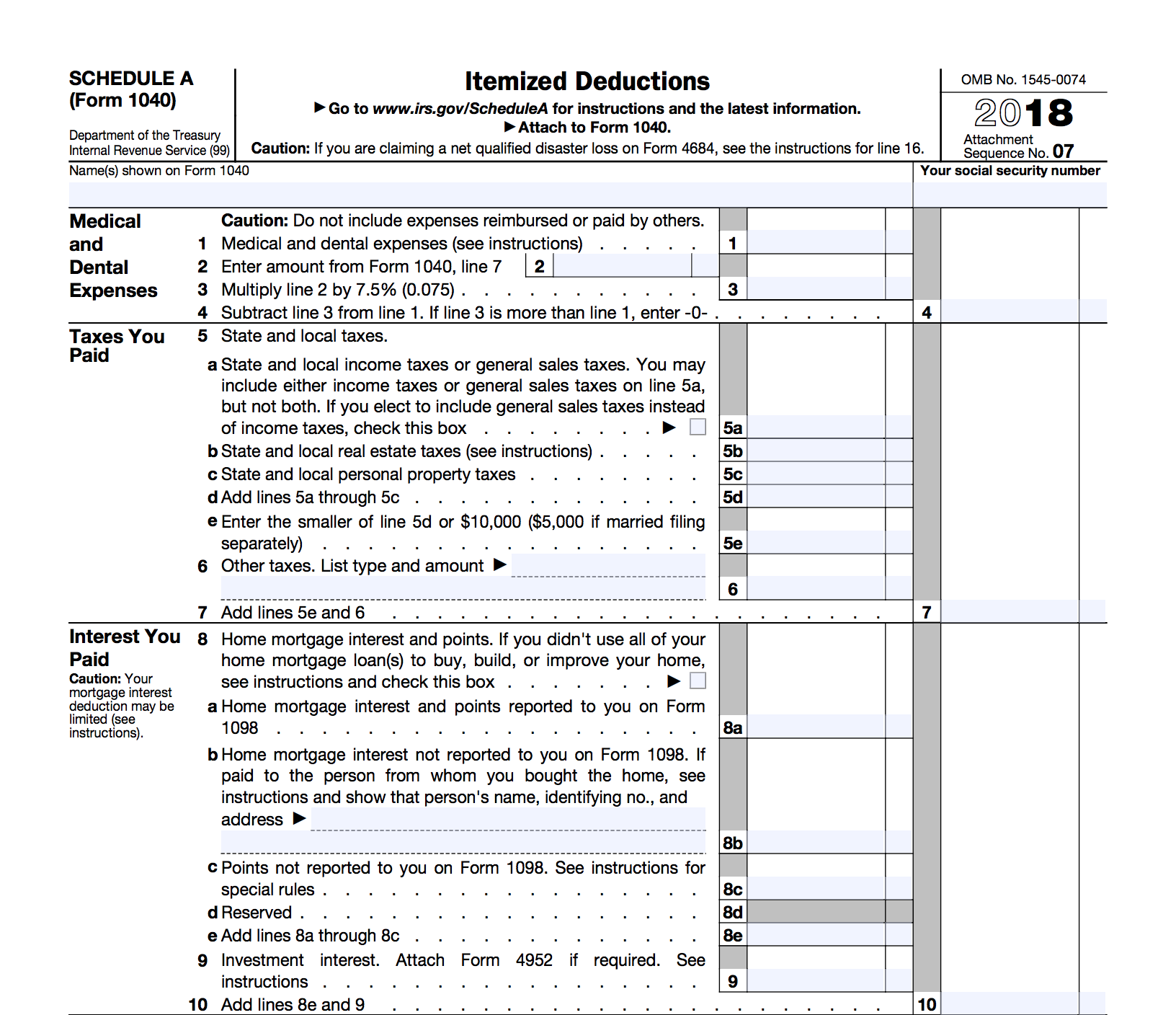

If you pay for at home home care services the IRS may let you deduct the cost from your annual taxes The IRS does allow citizens to deduct certain medical deductions to cover the cost of doctors therapists surgeons psychiatrists and prescription medications

In this article we ll navigate the complexities of tax deductions for home health care workers the various expenses that can be claimed documentation requirements and best practices for maximizing deductions for home health care workers in your employ

The Tax Deductions For Home Health Care Workers have gained huge popularity because of a number of compelling causes:

-

Cost-Effective: They eliminate the requirement of buying physical copies or expensive software.

-

Personalization You can tailor designs to suit your personal needs whether it's making invitations to organize your schedule or decorating your home.

-

Educational Use: Printing educational materials for no cost can be used by students of all ages, which makes the perfect tool for teachers and parents.

-

The convenience of immediate access various designs and templates is time-saving and saves effort.

Where to Find more Tax Deductions For Home Health Care Workers

Tax Deduction Spreadsheet Spreadsheet Downloa Tax Deduction Sheet Tax

Tax Deduction Spreadsheet Spreadsheet Downloa Tax Deduction Sheet Tax

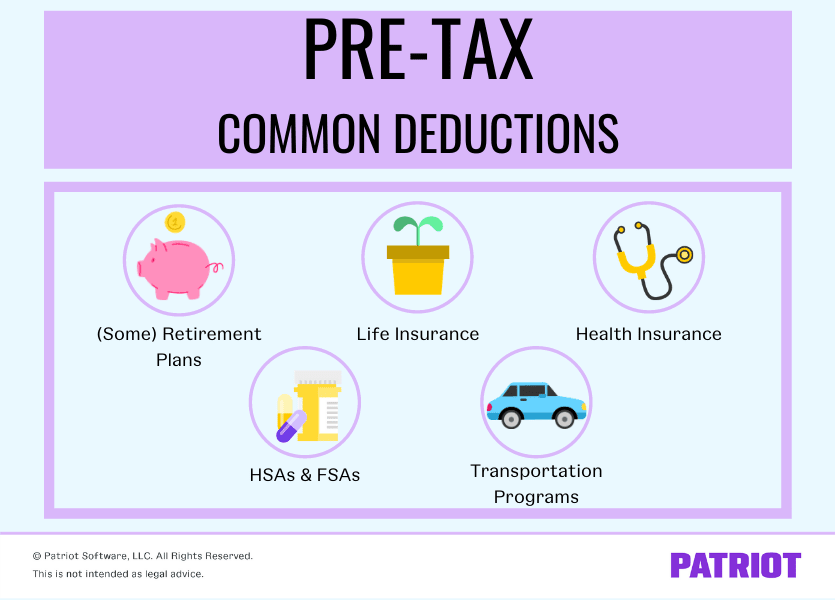

This is an adjustment to income rather than an itemized deduction for premiums you paid on a health insurance policy covering medical care including a qualified long term care insurance policy for yourself your spouse and dependents

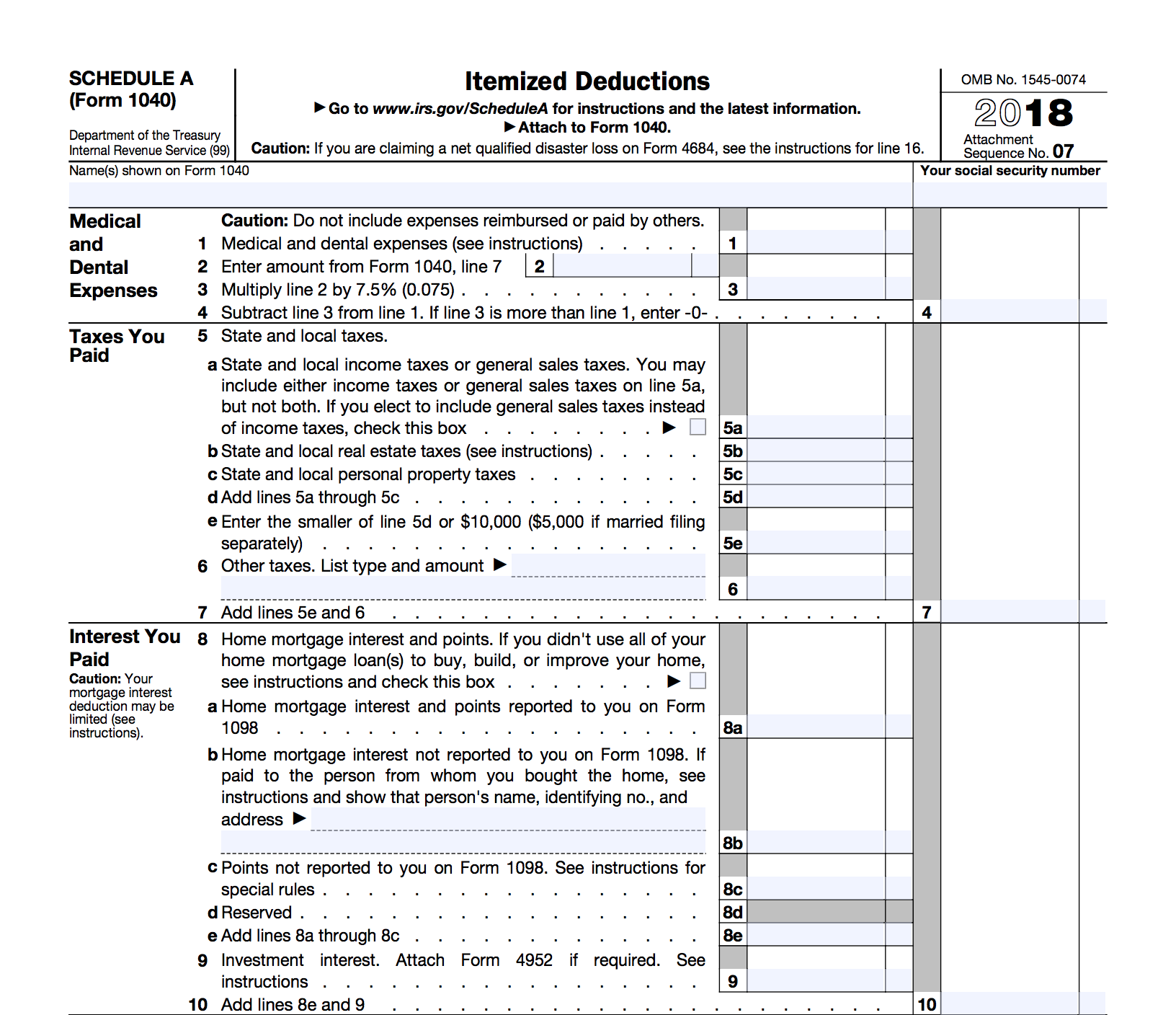

You can deduct on Schedule A Form 1040 only the part of your medical and dental expenses that is more than 7 5 of your adjusted gross income AGI This publication also explains how to treat impairment related work expenses and health insurance premiums if you are self employed

After we've peaked your interest in Tax Deductions For Home Health Care Workers Let's look into where you can get these hidden treasures:

1. Online Repositories

- Websites like Pinterest, Canva, and Etsy provide an extensive selection with Tax Deductions For Home Health Care Workers for all reasons.

- Explore categories like home decor, education, the arts, and more.

2. Educational Platforms

- Educational websites and forums usually offer free worksheets and worksheets for printing, flashcards, and learning tools.

- Ideal for teachers, parents as well as students who require additional sources.

3. Creative Blogs

- Many bloggers share their creative designs with templates and designs for free.

- The blogs are a vast selection of subjects, that range from DIY projects to planning a party.

Maximizing Tax Deductions For Home Health Care Workers

Here are some inventive ways of making the most of Tax Deductions For Home Health Care Workers:

1. Home Decor

- Print and frame stunning artwork, quotes or seasonal decorations that will adorn your living areas.

2. Education

- Print free worksheets to enhance your learning at home, or even in the classroom.

3. Event Planning

- Design invitations, banners and decorations for special occasions like weddings or birthdays.

4. Organization

- Stay organized with printable planners, to-do lists, and meal planners.

Conclusion

Tax Deductions For Home Health Care Workers are an abundance of practical and innovative resources that satisfy a wide range of requirements and interests. Their accessibility and flexibility make them an invaluable addition to every aspect of your life, both professional and personal. Explore the many options of Tax Deductions For Home Health Care Workers and discover new possibilities!

Frequently Asked Questions (FAQs)

-

Are Tax Deductions For Home Health Care Workers really available for download?

- Yes, they are! You can download and print these documents for free.

-

Can I use the free printables for commercial uses?

- It depends on the specific usage guidelines. Always verify the guidelines provided by the creator before using printables for commercial projects.

-

Are there any copyright problems with printables that are free?

- Some printables may have restrictions concerning their use. You should read the terms of service and conditions provided by the designer.

-

How do I print printables for free?

- Print them at home with either a printer at home or in the local print shop for high-quality prints.

-

What software do I require to view Tax Deductions For Home Health Care Workers?

- The majority of printables are in the format PDF. This can be opened using free programs like Adobe Reader.

The Ultimate List Of Tax Deductions For Online Sellers In 2020 Gusto

10 Best Images Of Business Tax Deductions Worksheet Tax Itemized

Check more sample of Tax Deductions For Home Health Care Workers below

Are Employee Health Insurance Premiums Subject To Fica Distributional

Tax Deductions Armstrong Economics

Tax Deductions For Self Employed Bruce L Anderson CPA CGA

Hrpaych reducded Payroll Services Washington State University

Standard Deduction 2020 Vs Itemized Standard Deduction 2021

Tax Deductions For Home Owners By Chris Karen

https://mileiq.com/blog/tax-deductions-health-care-workers

There are some tax deductions for home health care workers you may qualify for as long as the expenses are more than 2 percent of your adjusted gross income and your employer doesn t reimburse you for them

https://www.irs.gov/.../family-caregivers-and-self-employment-tax

The following FAQs illustrate some fact patterns involving family member caregivers who are not employees Q 1 Must a taxpayer pay self employment tax on the income they received from an insurance company to care for their spouse who was injured in an accident and permanently disabled The taxpayer is caring for their spouse in

There are some tax deductions for home health care workers you may qualify for as long as the expenses are more than 2 percent of your adjusted gross income and your employer doesn t reimburse you for them

The following FAQs illustrate some fact patterns involving family member caregivers who are not employees Q 1 Must a taxpayer pay self employment tax on the income they received from an insurance company to care for their spouse who was injured in an accident and permanently disabled The taxpayer is caring for their spouse in

Hrpaych reducded Payroll Services Washington State University

Tax Deductions Armstrong Economics

Standard Deduction 2020 Vs Itemized Standard Deduction 2021

Tax Deductions For Home Owners By Chris Karen

The BIG List Of Common Tax Deductions For Home Daycare Home Daycare

10 Best Images Of 2014 Itemized Deductions Worksheet 1040 Forms

10 Best Images Of 2014 Itemized Deductions Worksheet 1040 Forms

The Ultimate List Of Tax Deductions For Shop Owners In 2019