In the digital age, in which screens are the norm and the appeal of physical printed items hasn't gone away. Whether it's for educational purposes and creative work, or just adding an individual touch to your home, printables for free have become a valuable resource. For this piece, we'll take a dive through the vast world of "Tax Deduction Options Other Than 80c," exploring what they are, where to get them, as well as ways they can help you improve many aspects of your lives.

Get Latest Tax Deduction Options Other Than 80c Below

Tax Deduction Options Other Than 80c

Tax Deduction Options Other Than 80c -

Explore top tax saving options beyond Section 80C for FY 2023 24 including NPS health insurance premiums medical expenses home loan interest electric vehicle purchases charitable donations savings account interest and rebates

Be aware of tax saving options beyond 80C to reduce tax burden Sections like 80D 80G 80E offer deductions Deductions for health insurance educational loans and more available through various sections List of tax saving ways is extensive with choices to suit different financial situations

Tax Deduction Options Other Than 80c provide a diverse range of downloadable, printable documents that can be downloaded online at no cost. These resources come in various formats, such as worksheets, templates, coloring pages, and more. The beauty of Tax Deduction Options Other Than 80c is in their versatility and accessibility.

More of Tax Deduction Options Other Than 80c

Tax Saving Options Other Than 80C Online Demat Trading And Mutual

Tax Saving Options Other Than 80C Online Demat Trading And Mutual

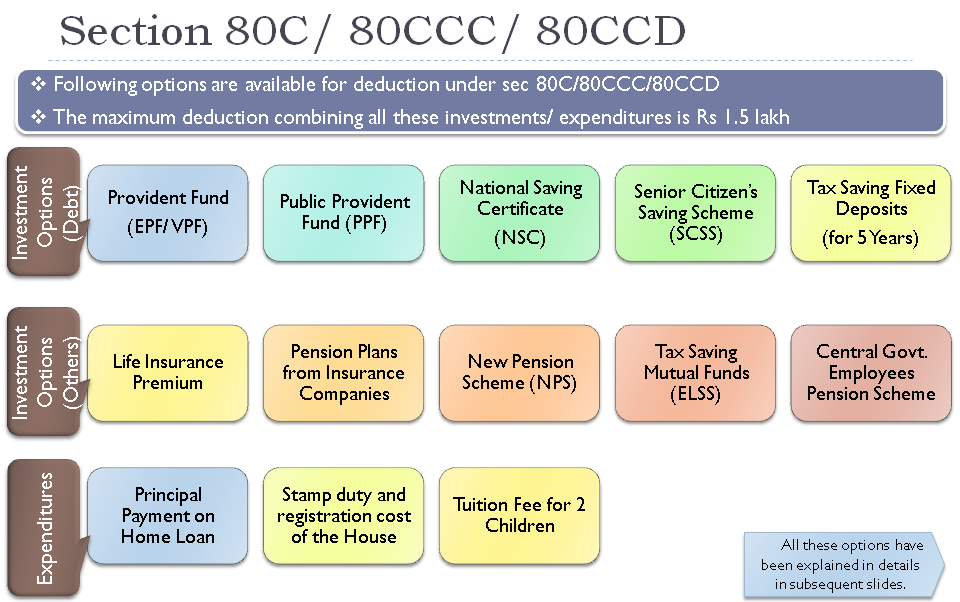

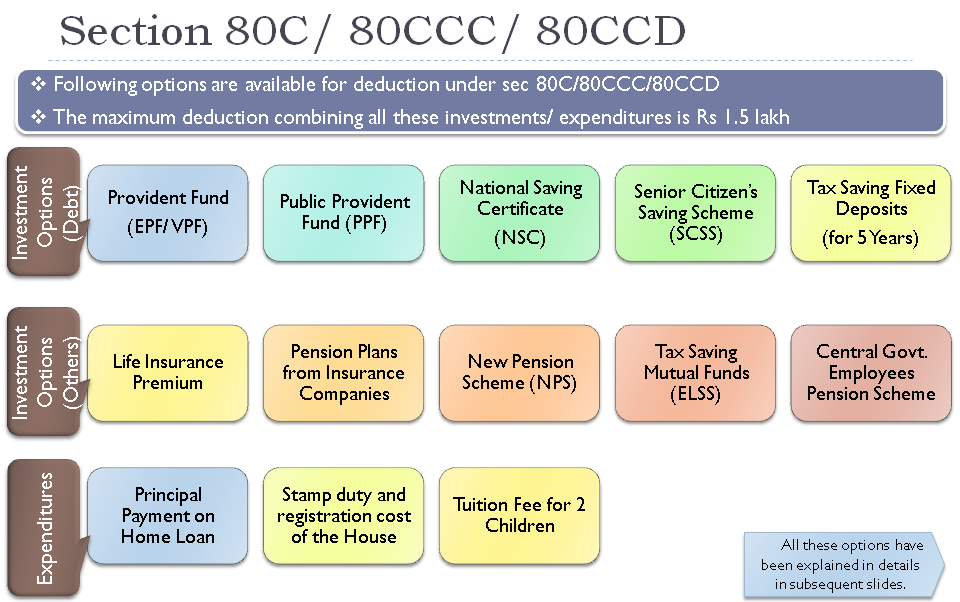

Most of the taxpayers are aware of deductions u s 80C The maximum limit of deduction available u s 80C is Rs 1 50 000 In this article we will discuss the deduction available under various other sections You can use these tools to further reduce your taxable income

Beyond the contribution of Rs 1 5 lakh under Section 80C you can invest an additional Rs 50 000 in NPS which can be claimed as tax deduction under Section 80CCD This gives you the option of

The Tax Deduction Options Other Than 80c have gained huge popularity due to several compelling reasons:

-

Cost-Efficiency: They eliminate the need to purchase physical copies of the software or expensive hardware.

-

Customization: There is the possibility of tailoring printed materials to meet your requirements be it designing invitations planning your schedule or even decorating your home.

-

Educational value: Downloads of educational content for free can be used by students of all ages, making them a great tool for parents and educators.

-

The convenience of immediate access numerous designs and templates helps save time and effort.

Where to Find more Tax Deduction Options Other Than 80c

Tax Deduction Options Other Than Section 80C Instruments

Tax Deduction Options Other Than Section 80C Instruments

ELSS mutual funds are the only class of mutual funds eligible for tax deductions You can save up to Rs 46 800 tax deductions of up to Rs 1 50 000 a year in taxes by investing in ELSS which is covered under Section 80C of

Updated on Apr 1st 2024 25 min read As the famous saying goes A penny saved is a penny earned Tax planning is one of the ways that will help you save on taxes and increase your income The Income Tax Act provides deductions for various investments savings and expenditures incurred by the taxpayer in a particular financial year

We hope we've stimulated your interest in printables for free Let's see where they are hidden treasures:

1. Online Repositories

- Websites such as Pinterest, Canva, and Etsy provide a large collection with Tax Deduction Options Other Than 80c for all uses.

- Explore categories like decorations for the home, education and organization, and crafts.

2. Educational Platforms

- Educational websites and forums usually offer free worksheets and worksheets for printing as well as flashcards and other learning materials.

- This is a great resource for parents, teachers, and students seeking supplemental resources.

3. Creative Blogs

- Many bloggers post their original designs and templates free of charge.

- The blogs covered cover a wide range of interests, everything from DIY projects to planning a party.

Maximizing Tax Deduction Options Other Than 80c

Here are some unique ways of making the most use of Tax Deduction Options Other Than 80c:

1. Home Decor

- Print and frame beautiful artwork, quotes, and seasonal decorations, to add a touch of elegance to your living areas.

2. Education

- Print worksheets that are free to enhance learning at home (or in the learning environment).

3. Event Planning

- Make invitations, banners and other decorations for special occasions like weddings or birthdays.

4. Organization

- Keep track of your schedule with printable calendars or to-do lists. meal planners.

Conclusion

Tax Deduction Options Other Than 80c are a treasure trove of useful and creative resources that meet a variety of needs and pursuits. Their accessibility and versatility make them a fantastic addition to any professional or personal life. Explore the plethora of Tax Deduction Options Other Than 80c today and unlock new possibilities!

Frequently Asked Questions (FAQs)

-

Are printables actually free?

- Yes you can! You can download and print the resources for free.

-

Do I have the right to use free printouts for commercial usage?

- It is contingent on the specific terms of use. Always consult the author's guidelines prior to printing printables for commercial projects.

-

Do you have any copyright problems with printables that are free?

- Some printables could have limitations on usage. Make sure you read the conditions and terms of use provided by the author.

-

How can I print printables for free?

- You can print them at home with the printer, or go to a local print shop for the highest quality prints.

-

What software do I require to open printables free of charge?

- The majority of printed documents are as PDF files, which can be opened with free software like Adobe Reader.

Tax Saving Investment Options Under Section 80C Tax Saving Other Than 80c

Deduction Under Section 80C A Complete List BasuNivesh

Check more sample of Tax Deduction Options Other Than 80c below

80C Deduction Under Incometax Act 80C Deduction Rs 1 50 000

Tax Saving Options Deductions Under 80D To 80U Wealth18

5 Tax Saving Options Other Than Section 80C Savings And Protection

Budget 2014 Impact On Money Taxes And Savings

Income Tax Deduction Other Than 80 C In Hindi

ELSS Funds Offer Tax Saving As Well As Wealth Accumulation Benefits Mint

https://cleartax.in/s/how-to-save-tax-other-than-80c

Be aware of tax saving options beyond 80C to reduce tax burden Sections like 80D 80G 80E offer deductions Deductions for health insurance educational loans and more available through various sections List of tax saving ways is extensive with choices to suit different financial situations

https://life.futuregenerali.in/life-insurance-made...

15 Tax Saving Options Other Than Section 80C Go beyond 80C tax benefits to become a smart tax saver Here is a complete list of tax free deductions available under Section 80 apart from Section 80C By Future Generali Updated On Aug 07 2023 12 min

Be aware of tax saving options beyond 80C to reduce tax burden Sections like 80D 80G 80E offer deductions Deductions for health insurance educational loans and more available through various sections List of tax saving ways is extensive with choices to suit different financial situations

15 Tax Saving Options Other Than Section 80C Go beyond 80C tax benefits to become a smart tax saver Here is a complete list of tax free deductions available under Section 80 apart from Section 80C By Future Generali Updated On Aug 07 2023 12 min

Budget 2014 Impact On Money Taxes And Savings

Tax Saving Options Deductions Under 80D To 80U Wealth18

Income Tax Deduction Other Than 80 C In Hindi

ELSS Funds Offer Tax Saving As Well As Wealth Accumulation Benefits Mint

10 Smart Tax Saving Options Other Than 80C Save Your Money Anupam

Income Tax Deductions Available For The Financial Year 2017 18

Income Tax Deductions Available For The Financial Year 2017 18

Section 80C Deduction Claim Deduction U s 80c Of Income Tax Act YouTube