In this digital age, where screens have become the dominant feature of our lives and the appeal of physical printed material hasn't diminished. If it's to aid in education for creative projects, simply adding an extra personal touch to your space, Tax Deduction On Interest Earned are now a vital source. For this piece, we'll take a dive deep into the realm of "Tax Deduction On Interest Earned," exploring the different types of printables, where to locate them, and how they can enrich various aspects of your lives.

Get Latest Tax Deduction On Interest Earned Below

Tax Deduction On Interest Earned

Tax Deduction On Interest Earned -

Example calculation So if you earn 14 000 a year from a part time job and 5 000 in interest from savings this is how you would be taxed in 2024 25 0 on the first 12 570 income from your job 0

Tax deductible interest is a borrowing expense that a taxpayer can claim on a federal or state tax return to reduce their

Printables for free include a vast array of printable materials online, at no cost. These materials come in a variety of styles, from worksheets to templates, coloring pages and more. The great thing about Tax Deduction On Interest Earned is their versatility and accessibility.

More of Tax Deduction On Interest Earned

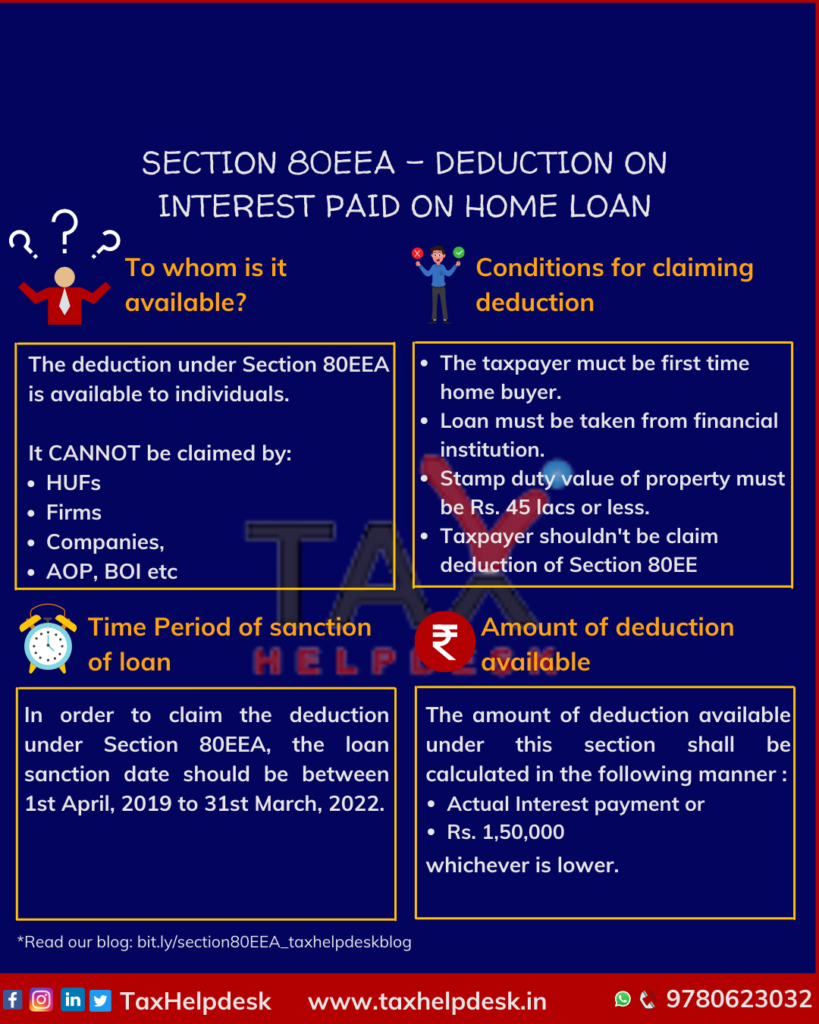

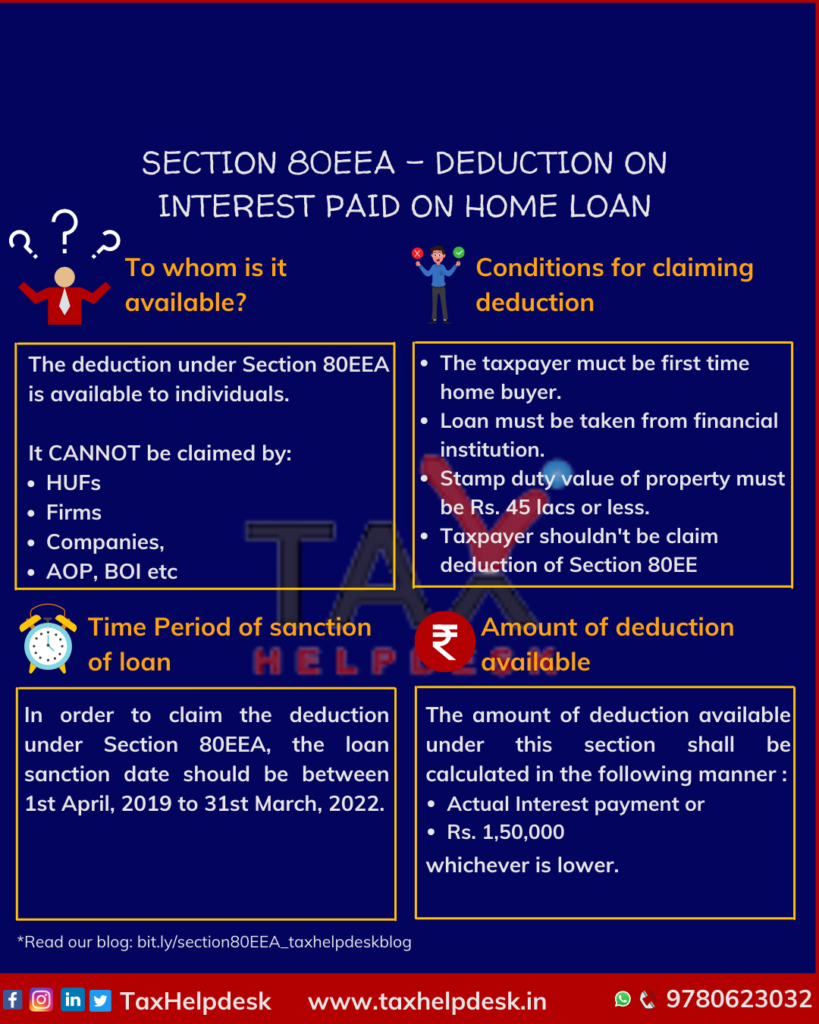

Section 80EEA Deduction On Interest Paid On Home Loan TaxHelpdesk

Section 80EEA Deduction On Interest Paid On Home Loan TaxHelpdesk

Interest is an amount you pay for the use of borrowed money Some interest can be claimed as a deduction or as a credit To deduct interest you paid on a

Section 80TTA of Income Tax Act provides up to Rs 10 000 deduction on such interest Available to Individuals HUF and NRIs only on NRO savings accounts Deduction for

The Tax Deduction On Interest Earned have gained huge popularity for several compelling reasons:

-

Cost-Efficiency: They eliminate the need to purchase physical copies or expensive software.

-

Flexible: We can customize printed materials to meet your requirements whether it's making invitations as well as organizing your calendar, or even decorating your house.

-

Education Value Education-related printables at no charge cater to learners of all ages, which makes them a vital aid for parents as well as educators.

-

Affordability: Access to a plethora of designs and templates cuts down on time and efforts.

Where to Find more Tax Deduction On Interest Earned

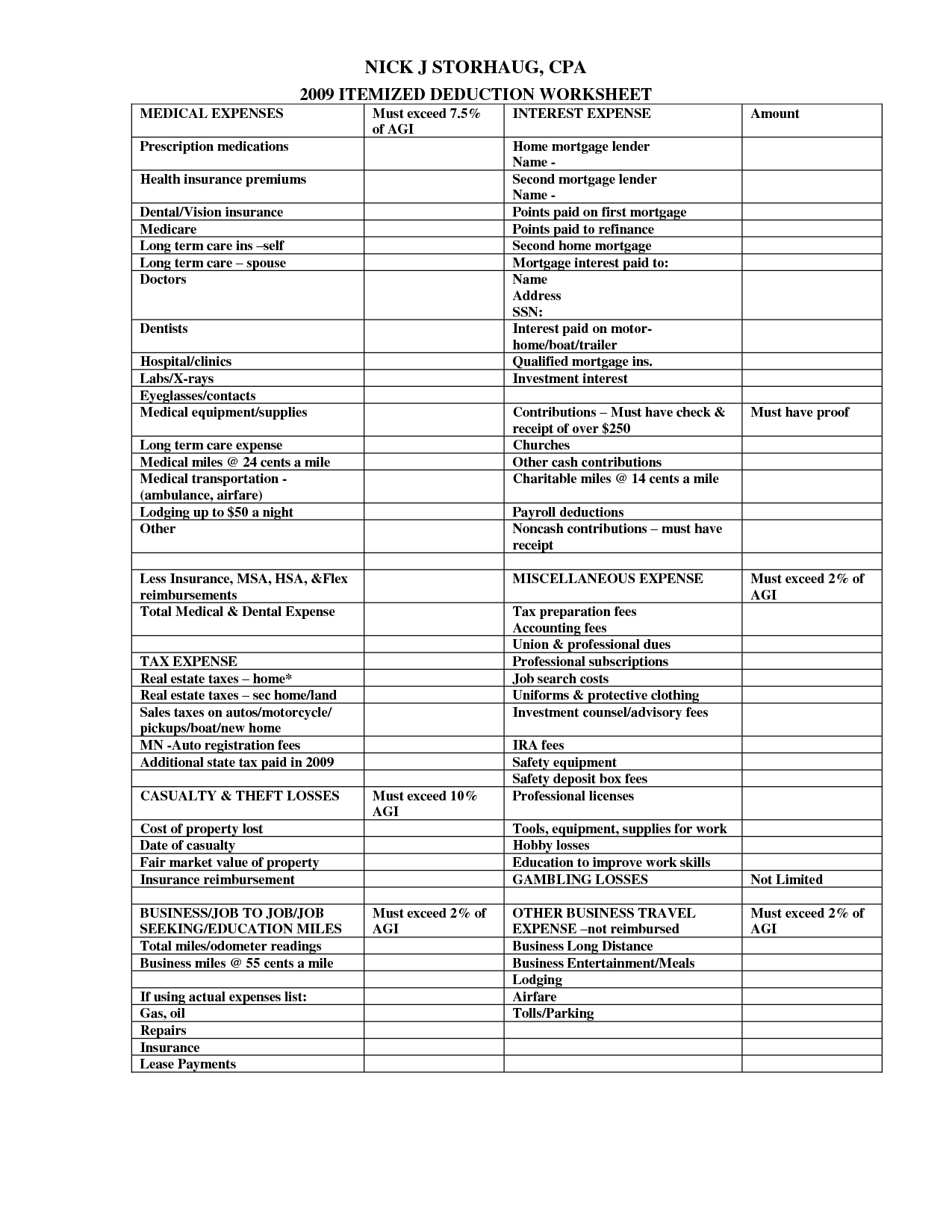

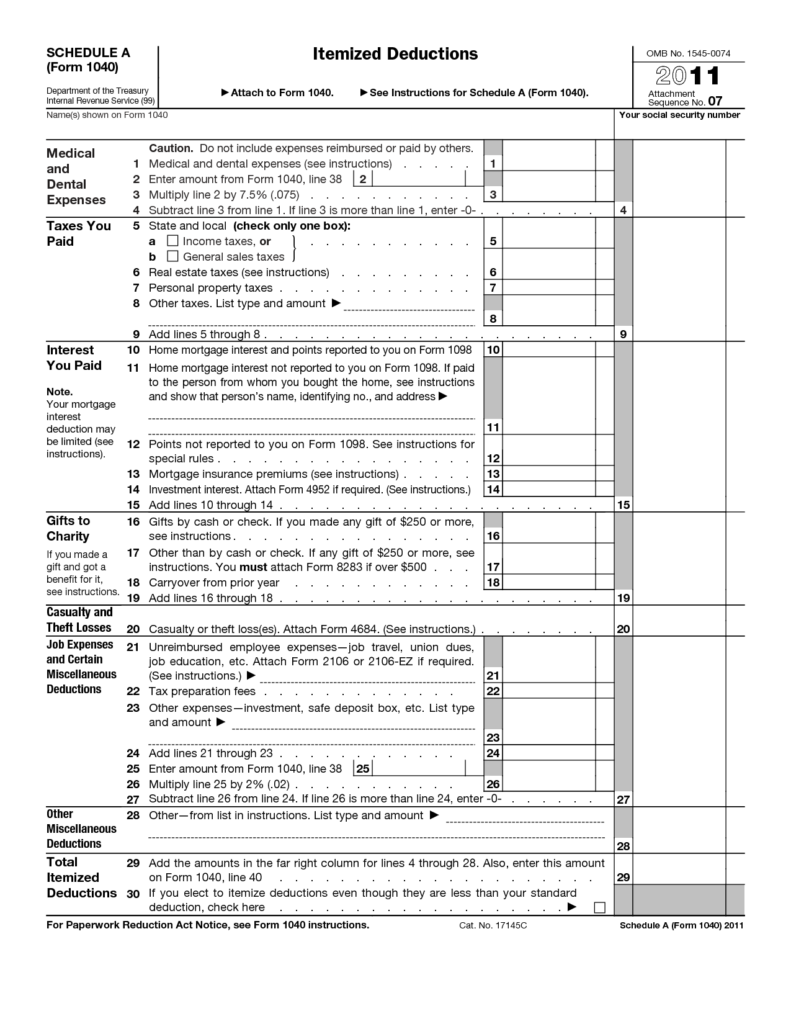

5 Itemized Tax Deduction Worksheet Worksheeto

5 Itemized Tax Deduction Worksheet Worksheeto

Interest on high yield savings accounts and CDs is subject to ordinary income tax You will receive Form 1099 INT from any account that earned more than 10 during the year

The IRS treats interest earned on a savings account as earned income meaning it can be taxed So if you received 125 in interest on a high yield savings

We hope we've stimulated your curiosity about Tax Deduction On Interest Earned Let's find out where they are hidden treasures:

1. Online Repositories

- Websites like Pinterest, Canva, and Etsy provide a variety of Tax Deduction On Interest Earned for various purposes.

- Explore categories such as interior decor, education, management, and craft.

2. Educational Platforms

- Forums and websites for education often offer free worksheets and worksheets for printing as well as flashcards and other learning materials.

- Perfect for teachers, parents and students looking for extra sources.

3. Creative Blogs

- Many bloggers post their original designs and templates free of charge.

- The blogs covered cover a wide array of topics, ranging everything from DIY projects to planning a party.

Maximizing Tax Deduction On Interest Earned

Here are some innovative ways to make the most use of printables that are free:

1. Home Decor

- Print and frame stunning artwork, quotes or even seasonal decorations to decorate your living spaces.

2. Education

- Print worksheets that are free to enhance learning at home and in class.

3. Event Planning

- Design invitations for banners, invitations and decorations for special occasions such as weddings, birthdays, and other special occasions.

4. Organization

- Keep track of your schedule with printable calendars as well as to-do lists and meal planners.

Conclusion

Tax Deduction On Interest Earned are a treasure trove of practical and imaginative resources which cater to a wide range of needs and needs and. Their accessibility and flexibility make they a beneficial addition to your professional and personal life. Explore the wide world of Tax Deduction On Interest Earned today to explore new possibilities!

Frequently Asked Questions (FAQs)

-

Are the printables you get for free available for download?

- Yes, they are! You can download and print these items for free.

-

Can I download free printables in commercial projects?

- It's based on specific terms of use. Always review the terms of use for the creator before utilizing printables for commercial projects.

-

Do you have any copyright issues with Tax Deduction On Interest Earned?

- Certain printables could be restricted concerning their use. You should read these terms and conditions as set out by the designer.

-

How do I print printables for free?

- Print them at home using either a printer or go to the local print shop for better quality prints.

-

What software do I require to open printables free of charge?

- The majority of printed documents are in the format PDF. This is open with no cost software, such as Adobe Reader.

Worksheet For Tax Deductions

Standard Deduction On Salary Ay 2021 22 Standard Deduction 2021

Check more sample of Tax Deduction On Interest Earned below

2023 IRS Inflation Adjustments Tax Brackets Standard Deduction EITC

Union Budget 2022 Real Estate Sector Demands Tax Relaxations

Tax Deduction On Interest Income Earned On Savings By Senior Citizens

Standard Deduction 2020 Self Employed Standard Deduction 2021

State And Local Tax Refund Worksheet 2022

Section 80EEA Deduction On Interest Paid On Home Loan TaxHelpdesk

https://www.investopedia.com/terms/t/t…

Tax deductible interest is a borrowing expense that a taxpayer can claim on a federal or state tax return to reduce their

https://www.investopedia.com/ask/ans…

Any interest earned on a savings account is taxable income Your bank will send you a 1099 INT form for any interest earned over 10 but you should report any interest earned even

Tax deductible interest is a borrowing expense that a taxpayer can claim on a federal or state tax return to reduce their

Any interest earned on a savings account is taxable income Your bank will send you a 1099 INT form for any interest earned over 10 but you should report any interest earned even

Standard Deduction 2020 Self Employed Standard Deduction 2021

Union Budget 2022 Real Estate Sector Demands Tax Relaxations

State And Local Tax Refund Worksheet 2022

Section 80EEA Deduction On Interest Paid On Home Loan TaxHelpdesk

The Stephenson Fam Is Home Mortgage Interest Deduction A Good Idea

Deduction U s 80P 2 d Of Income Tax Act Allowable On Interest Earned

Deduction U s 80P 2 d Of Income Tax Act Allowable On Interest Earned

8 Best Images Of Tax Itemized Deduction Worksheet IRS 2021 Tax Forms