In this digital age, when screens dominate our lives The appeal of tangible printed objects isn't diminished. It doesn't matter if it's for educational reasons such as creative projects or simply to add an individual touch to the area, Tax Deduction For Work Clothes Self Employed can be an excellent resource. Here, we'll take a dive deeper into "Tax Deduction For Work Clothes Self Employed," exploring the different types of printables, where they are available, and how they can enhance various aspects of your lives.

Get Latest Tax Deduction For Work Clothes Self Employed Below

Tax Deduction For Work Clothes Self Employed

Tax Deduction For Work Clothes Self Employed -

You can usually depreciate tools over a seven year recovery period or use the Section 179 expense deduction Under Section 179 you can expense the full cost of a tool the year you place it in service The deduction is limited to the amount of your self employment income You can deduct the cost of the tools as an unreimbursed employee expense

Clothing expenses You can claim allowable business expenses for uniforms protective clothing needed for your work costumes for actors or entertainers You cannot claim for everyday clothing

Tax Deduction For Work Clothes Self Employed encompass a wide assortment of printable documents that can be downloaded online at no cost. These resources come in various forms, including worksheets, coloring pages, templates and many more. The appeal of printables for free is their flexibility and accessibility.

More of Tax Deduction For Work Clothes Self Employed

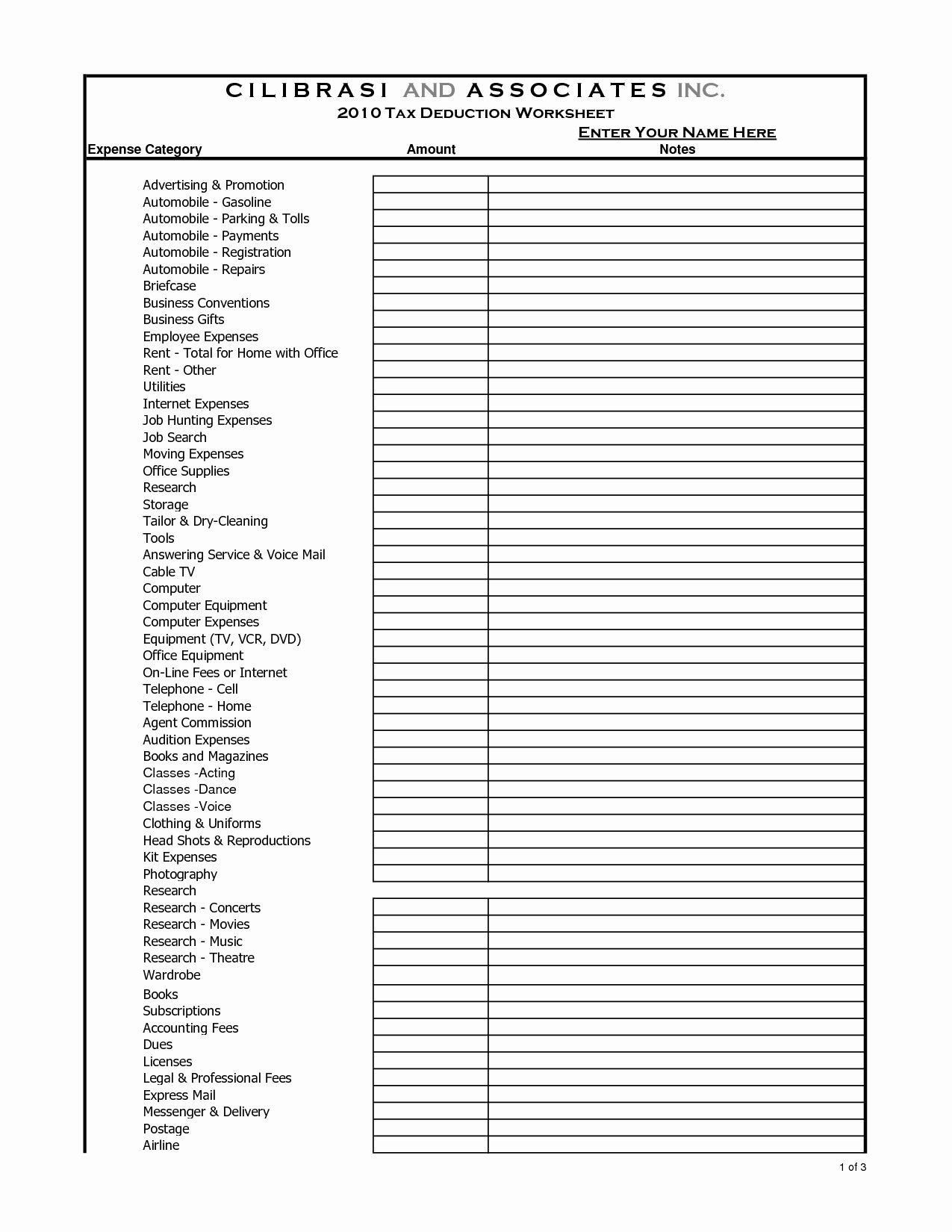

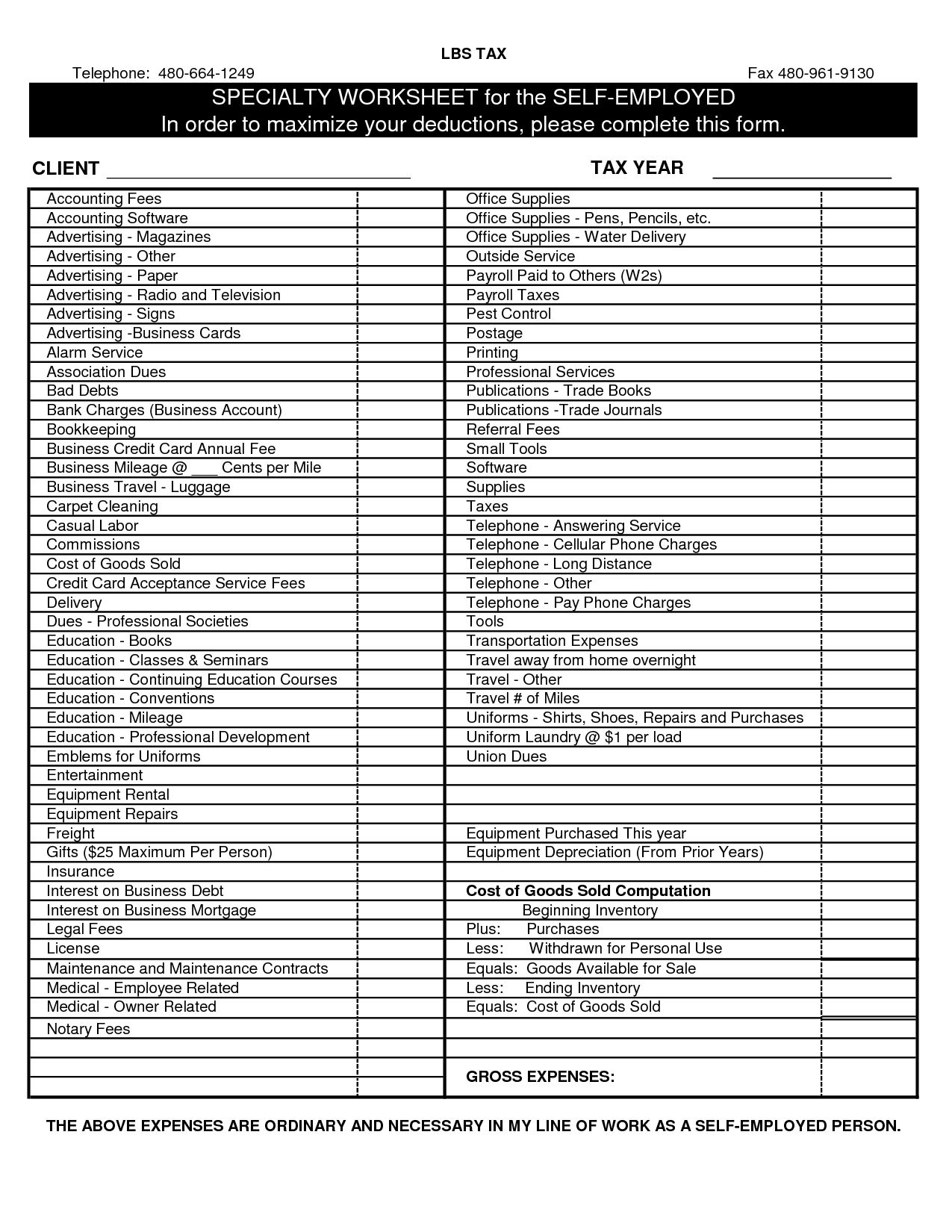

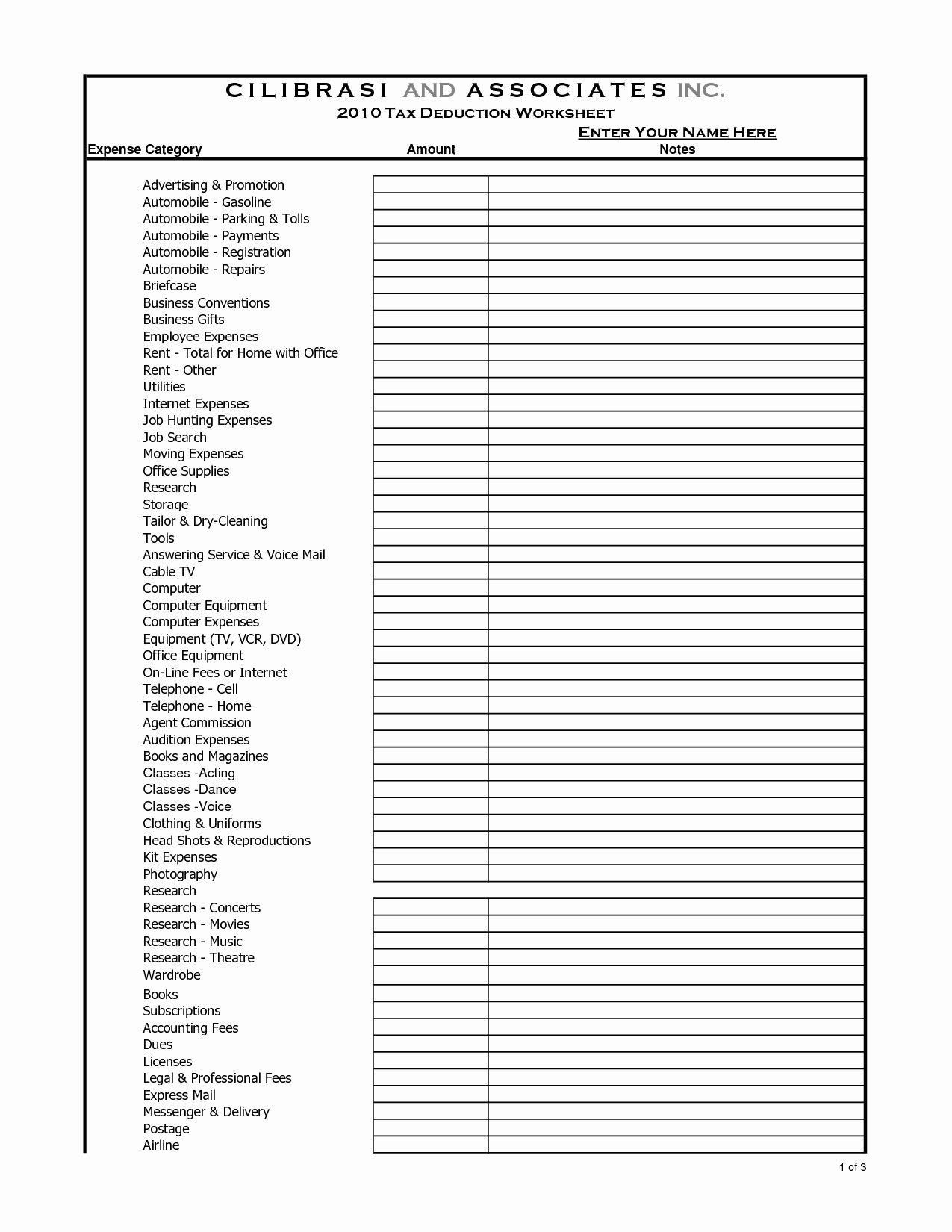

2016 Self Employment Tax And Deduction Worksheet Db excel

2016 Self Employment Tax And Deduction Worksheet Db excel

The tax relief will reduce the amount of tax you pay For example if you claim a flat rate expense of 60 and pay tax at a rate of 20 in that year you will pay 12 less tax If you are

Here are some examples of work attire that can be deducted Protective clothing If you are running a business that requires protective clothing you can deduct the cost of these items For example if you own a construction company you can deduct the cost of purchases such as hard hats and safety boots Uniforms and work clothes

Tax Deduction For Work Clothes Self Employed have garnered immense popularity due to numerous compelling reasons:

-

Cost-Efficiency: They eliminate the necessity of purchasing physical copies or expensive software.

-

Customization: We can customize printed materials to meet your requirements in designing invitations making your schedule, or decorating your home.

-

Educational Worth: Printing educational materials for no cost can be used by students of all ages, which makes them an essential tool for parents and educators.

-

Affordability: The instant accessibility to numerous designs and templates reduces time and effort.

Where to Find more Tax Deduction For Work Clothes Self Employed

43 How To Donate Clothes For A Tax Deduction Pics WallsGround

43 How To Donate Clothes For A Tax Deduction Pics WallsGround

You can deduct some of these as part of your annual tax return to work out your taxable profit as long as they re allowable expense The list of tax deductible expenses is long but includes

Claim the Tax Deductions For Clothes You can write off clothes for the business you work at by going to the Miscellaneous Itemized Deductions section You may find it on an attachment of your tax return namely Schedule A Form 1040 Add the deduction there and take out 2 of the total adjusted gross income

After we've peaked your interest in printables for free, let's explore where you can find these elusive treasures:

1. Online Repositories

- Websites such as Pinterest, Canva, and Etsy provide a variety in Tax Deduction For Work Clothes Self Employed for different needs.

- Explore categories like decoration for your home, education, the arts, and more.

2. Educational Platforms

- Forums and websites for education often provide worksheets that can be printed for free, flashcards, and learning tools.

- Great for parents, teachers and students looking for extra sources.

3. Creative Blogs

- Many bloggers offer their unique designs and templates, which are free.

- These blogs cover a wide range of interests, that range from DIY projects to planning a party.

Maximizing Tax Deduction For Work Clothes Self Employed

Here are some new ways for you to get the best of printables for free:

1. Home Decor

- Print and frame stunning artwork, quotes as well as seasonal decorations, to embellish your living spaces.

2. Education

- Print worksheets that are free to reinforce learning at home and in class.

3. Event Planning

- Design invitations and banners and decorations for special events like weddings or birthdays.

4. Organization

- Be organized by using printable calendars, to-do lists, and meal planners.

Conclusion

Tax Deduction For Work Clothes Self Employed are a treasure trove of innovative and useful resources designed to meet a range of needs and desires. Their access and versatility makes they a beneficial addition to both professional and personal lives. Explore the world of Tax Deduction For Work Clothes Self Employed and uncover new possibilities!

Frequently Asked Questions (FAQs)

-

Are printables actually completely free?

- Yes, they are! You can print and download these items for free.

-

Can I download free printables for commercial uses?

- It is contingent on the specific terms of use. Always read the guidelines of the creator before using printables for commercial projects.

-

Do you have any copyright issues with Tax Deduction For Work Clothes Self Employed?

- Some printables may have restrictions on usage. Be sure to check the terms and condition of use as provided by the designer.

-

How can I print Tax Deduction For Work Clothes Self Employed?

- You can print them at home using either a printer or go to a local print shop to purchase higher quality prints.

-

What program do I need in order to open printables that are free?

- Many printables are offered in the format PDF. This is open with no cost software like Adobe Reader.

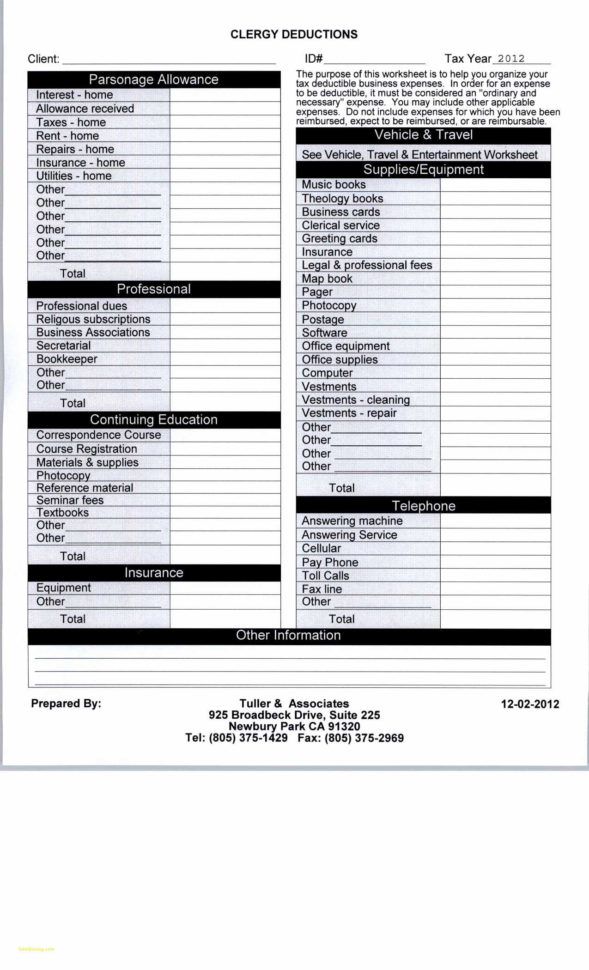

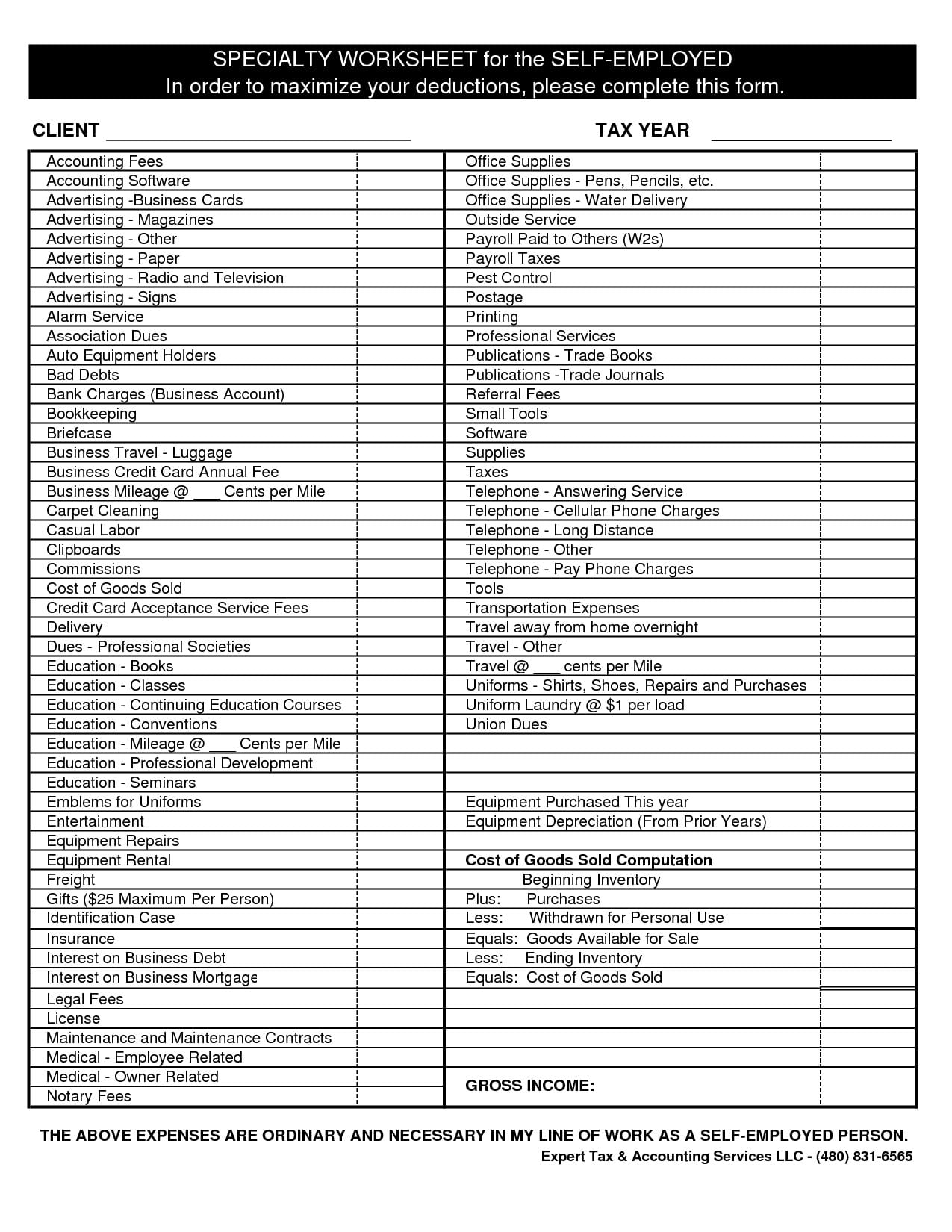

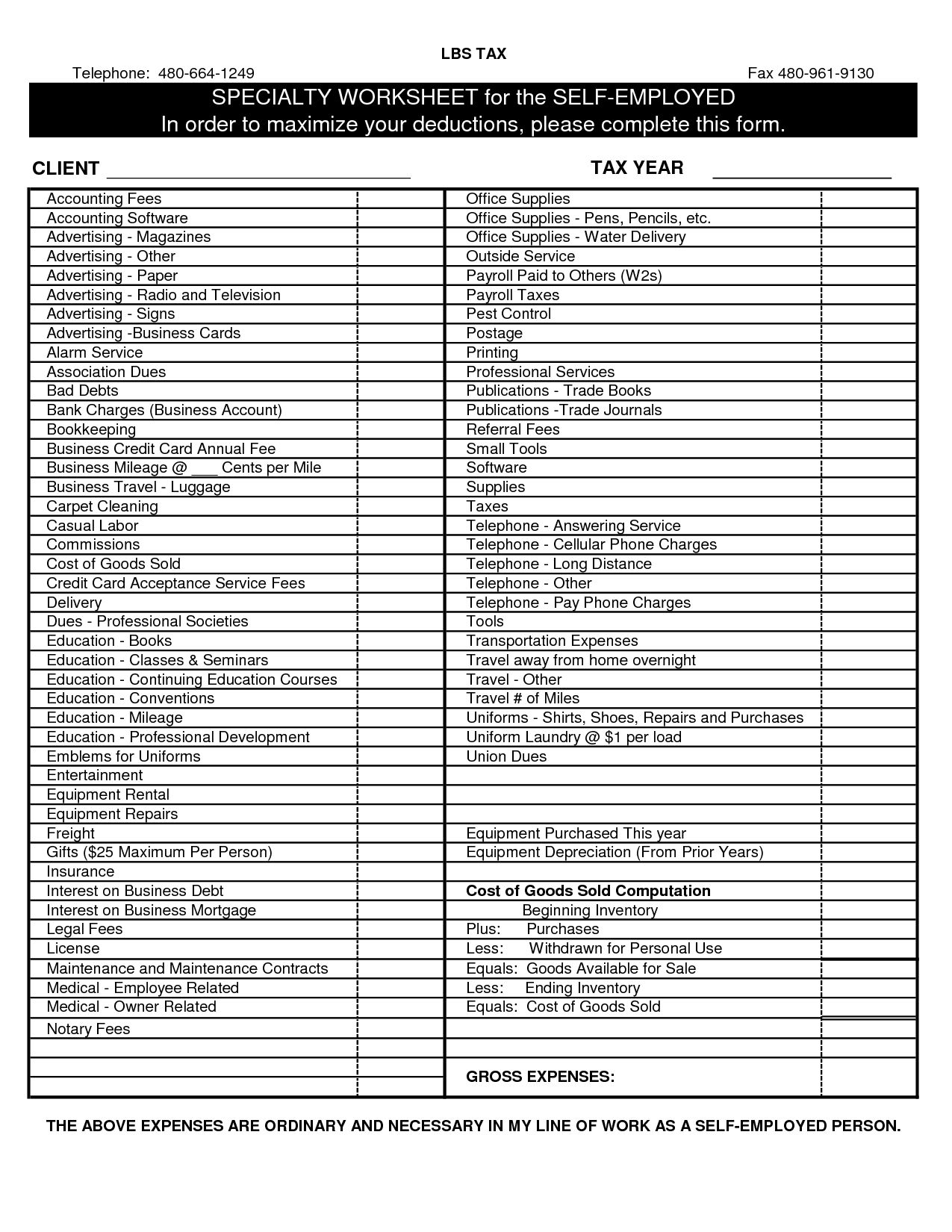

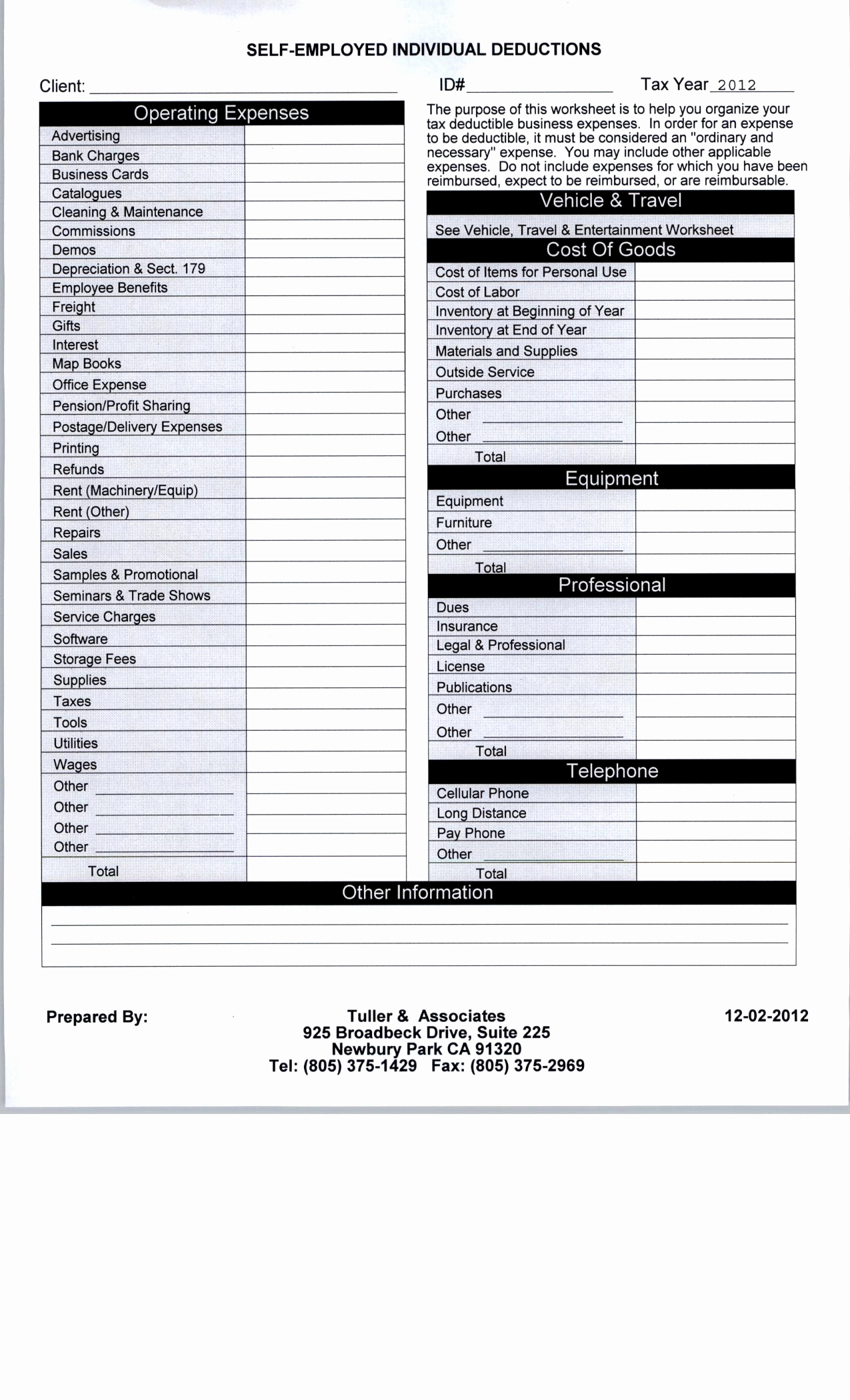

Self Employed Tax Deductions Worksheet Db excel

Tax Deduction Spreadsheet Spreadsheet Downloa Tax Deduction Sheet Tax

Check more sample of Tax Deduction For Work Clothes Self Employed below

2017 Self Employment Tax And Deduction Worksheet Db excel

FunctionalBest Of Self Employed Tax Deductions Worksheet

Truck Expenses Worksheet Spreadsheet Template Printable Worksheets

A Singaporean s Guide How To Claim Income Tax Deduction For Work

The Epic Cheatsheet To Deductions For The Self Employed Business Tax

The Ultimate Self Employed Deduction Cheat Sheet Exceptional Tax

https://www.gov.uk/expenses-if-youre-self-employed/clothing

Clothing expenses You can claim allowable business expenses for uniforms protective clothing needed for your work costumes for actors or entertainers You cannot claim for everyday clothing

https://turbotax.intuit.com/tax-tips/jobs-and...

Step 2 Document your employer s policies Step 3 Save your receipts Click to expand Beginning in 2018 unreimbursed employee expenses are no longer eligible for a tax deduction on your federal tax return however some states such as California continue to provide a deduction on your state tax return if you qualify

Clothing expenses You can claim allowable business expenses for uniforms protective clothing needed for your work costumes for actors or entertainers You cannot claim for everyday clothing

Step 2 Document your employer s policies Step 3 Save your receipts Click to expand Beginning in 2018 unreimbursed employee expenses are no longer eligible for a tax deduction on your federal tax return however some states such as California continue to provide a deduction on your state tax return if you qualify

A Singaporean s Guide How To Claim Income Tax Deduction For Work

FunctionalBest Of Self Employed Tax Deductions Worksheet

The Epic Cheatsheet To Deductions For The Self Employed Business Tax

The Ultimate Self Employed Deduction Cheat Sheet Exceptional Tax

Business Expense Spreadsheet For Taxes New Self Employed Tax And

Tax Deduction For Work Clothing Uniform

Tax Deduction For Work Clothing Uniform

How To Claim A Tax Deduction For Work Clothes Sapling