Today, where screens dominate our lives but the value of tangible printed materials isn't diminishing. It doesn't matter if it's for educational reasons project ideas, artistic or simply adding an element of personalization to your home, printables for free are now a vital resource. In this article, we'll take a dive to the depths of "Tax Credit Under Section 168," exploring what they are, how to locate them, and the ways that they can benefit different aspects of your lives.

Get Latest Tax Credit Under Section 168 Below

Tax Credit Under Section 168

Tax Credit Under Section 168 -

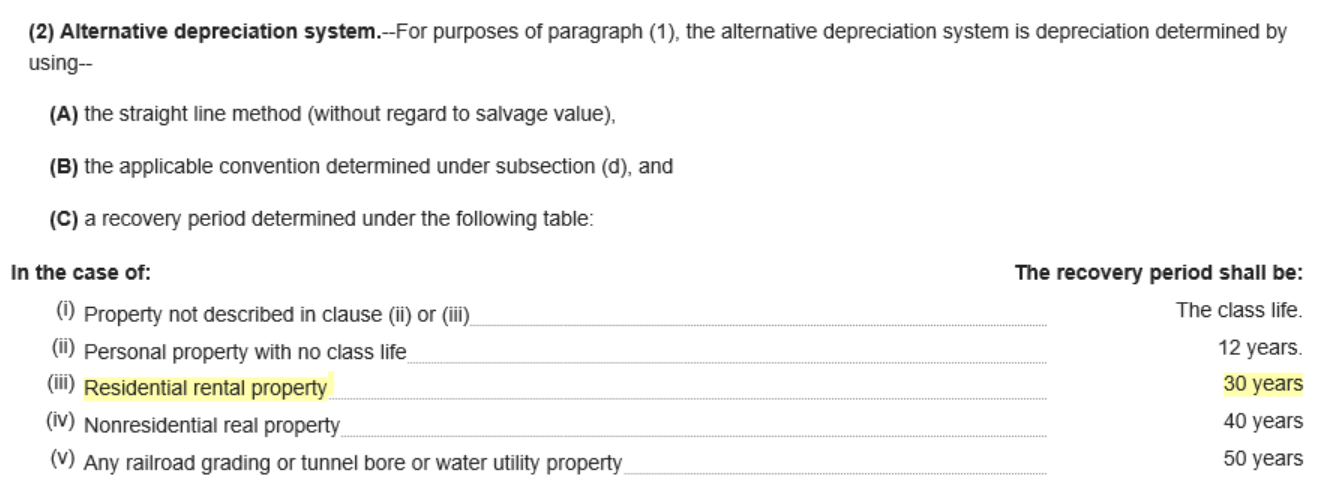

Breaking Down Bonus Depreciation Under IRC Section 168 Bonus depreciation generally allows an additional first year depreciation deduction with respect to qualifying property acquired and placed in

Described in paragraph 4 of section 168 e as in effect before the amendments made by the Tax Reform Act of 1986 or In the case of an organization formerly exempt from tax under section 501 a credit and basis and such share remains the same during the

Printables for free cover a broad assortment of printable content that can be downloaded from the internet at no cost. These printables come in different kinds, including worksheets templates, coloring pages and more. The appealingness of Tax Credit Under Section 168 is in their variety and accessibility.

More of Tax Credit Under Section 168

GST Circular Contra To GST Act Can t Deny The Claim For ITC Refund

GST Circular Contra To GST Act Can t Deny The Claim For ITC Refund

IRC Section 168 k which is commonly known as bonus depreciation BD allows taxpayers to expense up to 60 of the cost of qualified assets they place in

IR 2019 156 September 13 2019 The Treasury Department and the Internal Revenue Service today released final regulations and additional proposed regulations under

Tax Credit Under Section 168 have risen to immense popularity due to several compelling reasons:

-

Cost-Efficiency: They eliminate the necessity of purchasing physical copies or expensive software.

-

customization: You can tailor designs to suit your personal needs be it designing invitations to organize your schedule or even decorating your home.

-

Educational Benefits: These Tax Credit Under Section 168 offer a wide range of educational content for learners of all ages, making them a valuable device for teachers and parents.

-

Accessibility: Access to various designs and templates cuts down on time and efforts.

Where to Find more Tax Credit Under Section 168

Deduction From Salary Under Section 16 Of Income Tax Act How To Earn

Deduction From Salary Under Section 16 Of Income Tax Act How To Earn

The Tax Cuts and Jobs Act TCJA made several amendments to Section 168 k including changes to which property qualifies for bonus depreciation and

Established a basis in solar panels and related equipment for purposes of claiming an energy credit under Secs 46 and 48 and a special allowance for depreciation under Sec 168 k bonus depreciation Satisfied the requirements of then applicable Sec 168 k 5 Had sufficient amounts at risk under Sec 465

If we've already piqued your interest in printables for free Let's see where the hidden treasures:

1. Online Repositories

- Websites such as Pinterest, Canva, and Etsy have a large selection in Tax Credit Under Section 168 for different uses.

- Explore categories such as decorating your home, education, craft, and organization.

2. Educational Platforms

- Educational websites and forums typically offer worksheets with printables that are free for flashcards, lessons, and worksheets. tools.

- It is ideal for teachers, parents and students who are in need of supplementary resources.

3. Creative Blogs

- Many bloggers share their innovative designs or templates for download.

- The blogs are a vast spectrum of interests, including DIY projects to party planning.

Maximizing Tax Credit Under Section 168

Here are some inventive ways in order to maximize the use of printables for free:

1. Home Decor

- Print and frame stunning artwork, quotes or even seasonal decorations to decorate your living areas.

2. Education

- Print worksheets that are free to enhance learning at home also in the classes.

3. Event Planning

- Invitations, banners and decorations for special occasions such as weddings or birthdays.

4. Organization

- Keep track of your schedule with printable calendars or to-do lists. meal planners.

Conclusion

Tax Credit Under Section 168 are a treasure trove with useful and creative ideas which cater to a wide range of needs and desires. Their accessibility and versatility make them an invaluable addition to your professional and personal life. Explore the endless world that is Tax Credit Under Section 168 today, and explore new possibilities!

Frequently Asked Questions (FAQs)

-

Are printables for free really completely free?

- Yes they are! You can print and download these materials for free.

-

Can I utilize free printing templates for commercial purposes?

- It's all dependent on the terms of use. Always verify the guidelines of the creator before utilizing their templates for commercial projects.

-

Do you have any copyright issues with printables that are free?

- Some printables may come with restrictions regarding their use. Check the terms and conditions offered by the creator.

-

How do I print Tax Credit Under Section 168?

- Print them at home with either a printer or go to a local print shop to purchase higher quality prints.

-

What program do I need to open printables at no cost?

- Most PDF-based printables are available in PDF format. These can be opened using free software such as Adobe Reader.

How To Remove A Company Director Section 168 Of The Companies Act 2006

Tax Deduction Information Franklin IN Fletcher CDJR

Check more sample of Tax Credit Under Section 168 below

Input Tax Credit Under GST YouTube

ITC Rules Under GST 2021 Guide On Types Conditions Eligibility

All About Input Tax Credit Under GST Ebizfiling India Pvt Ltd

An In depth Look At Input Tax Credit Under GST Razorpay Business

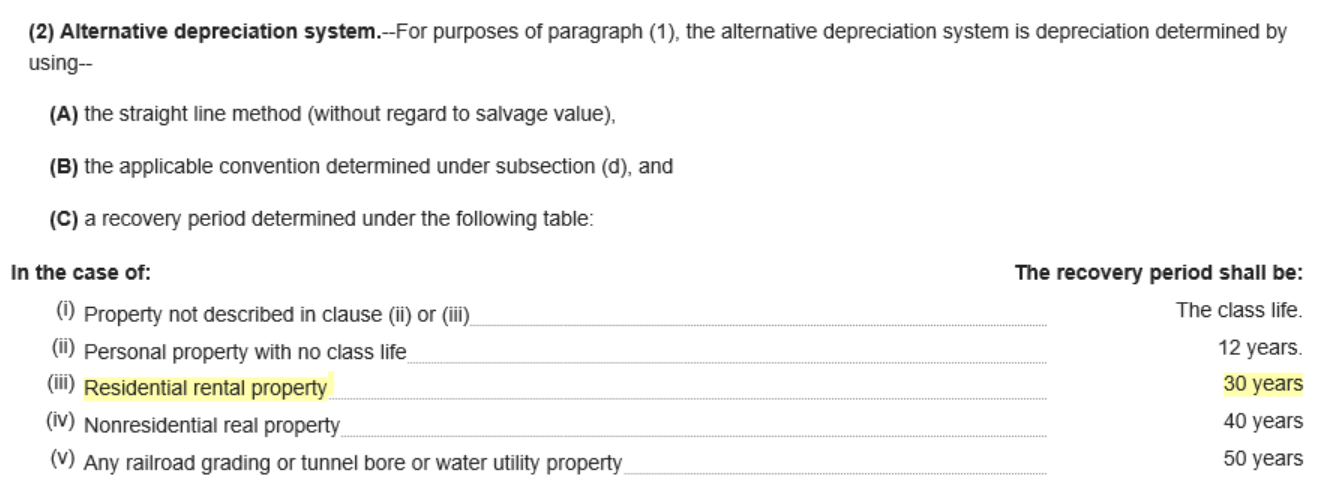

Depreciation Of Foreign Rental Property HTJ Tax

Input Tax Credit Under GST

https://irc.bloombergtax.com/public/uscode/doc/irc/section_168

Described in paragraph 4 of section 168 e as in effect before the amendments made by the Tax Reform Act of 1986 or In the case of an organization formerly exempt from tax under section 501 a credit and basis and such share remains the same during the

https://www.irs.gov/credits-deductions/cost...

Under Internal Revenue Code Section 168 e 3 B qualified facilities qualified property and energy storage technology are considered 5 year property These types of property

Described in paragraph 4 of section 168 e as in effect before the amendments made by the Tax Reform Act of 1986 or In the case of an organization formerly exempt from tax under section 501 a credit and basis and such share remains the same during the

Under Internal Revenue Code Section 168 e 3 B qualified facilities qualified property and energy storage technology are considered 5 year property These types of property

An In depth Look At Input Tax Credit Under GST Razorpay Business

ITC Rules Under GST 2021 Guide On Types Conditions Eligibility

Depreciation Of Foreign Rental Property HTJ Tax

Input Tax Credit Under GST

Transfer Of Input Tax Credit Section 53 Of CGST Act 2017

What s Included In The New Tax Code Section 168 k Film Regulations

What s Included In The New Tax Code Section 168 k Film Regulations

Virtual CPE Program On Blocked Input Tax Credit Under Section 17 5 Of