Today, where screens have become the dominant feature of our lives and our lives are dominated by screens, the appeal of tangible printed materials hasn't faded away. In the case of educational materials for creative projects, simply to add an individual touch to the space, Tax Credit Health Insurance are now an essential source. For this piece, we'll dive into the sphere of "Tax Credit Health Insurance," exploring what they are, how they can be found, and how they can add value to various aspects of your lives.

Get Latest Tax Credit Health Insurance Below

Tax Credit Health Insurance

Tax Credit Health Insurance -

Premium tax credit than you qualified for in 2023 You ll have to report the excess amount on your 2023 tax return by filing Form 8962 Premium Tax Credit PDF 110 KB Get a refund or lower the amount of taxes you owe if you used less of the premium tax credit you qualified for or got an increase in the premium tax credit when you reconciled

The Premium Tax Credit helps eligible individuals and families afford health insurance purchased through the Health Insurance Marketplace The IRS will soon mail letters on behalf of the Center for Medicare Medicaid Services sharing information about obtaining Marketplace healthcare coverage

Tax Credit Health Insurance encompass a wide variety of printable, downloadable materials online, at no cost. These resources come in many formats, such as worksheets, templates, coloring pages and more. The great thing about Tax Credit Health Insurance is in their variety and accessibility.

More of Tax Credit Health Insurance

What Are Refundable Tax Credits For 2023 Leia Aqui What Qualifies As

What Are Refundable Tax Credits For 2023 Leia Aqui What Qualifies As

The premium tax credit is a refundable credit that helps lower the cost of your monthly health insurance premium You must meet the requirements and file a specific form with your tax return to qualify for it Find out if you meet the requirements and qualify and what steps you must take to claim the premium tax credit Key Takeaways

The Premium Tax Credit PTC makes health insurance more affordable by helping eligible individuals and their families pay premiums for coverage purchased through the Health Insurance Marketplace also referred to as the Marketplace or Exchange There are two ways to get the credit

Tax Credit Health Insurance have gained immense recognition for a variety of compelling motives:

-

Cost-Efficiency: They eliminate the requirement to purchase physical copies or expensive software.

-

Individualization There is the possibility of tailoring printed materials to meet your requirements whether it's making invitations and schedules, or even decorating your home.

-

Educational Impact: These Tax Credit Health Insurance offer a wide range of educational content for learners of all ages. This makes them a valuable resource for educators and parents.

-

An easy way to access HTML0: The instant accessibility to a variety of designs and templates saves time and effort.

Where to Find more Tax Credit Health Insurance

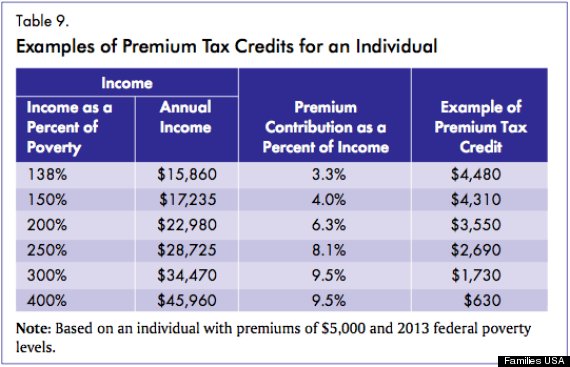

Obamacare Subsidies Target Young Working People Report HuffPost

Obamacare Subsidies Target Young Working People Report HuffPost

The premium tax credit PTC is a refundable tax credit designed to help you pay for health plans purchased through the federal or state exchanges Eligibility for the PTC for an exchange

Taxpayers who purchase health insurance through a Health Insurance Marketplace for themselves or others in their tax family see the Instructions for Form 8962 may be eligible for the premium tax credit This tax credit helps make purchasing health insurance coverage more affordable for people with low to moderate incomes

Now that we've piqued your curiosity about Tax Credit Health Insurance Let's find out where you can locate these hidden treasures:

1. Online Repositories

- Websites like Pinterest, Canva, and Etsy provide a wide selection in Tax Credit Health Insurance for different purposes.

- Explore categories such as decoration for your home, education, organisation, as well as crafts.

2. Educational Platforms

- Educational websites and forums frequently provide worksheets that can be printed for free for flashcards, lessons, and worksheets. tools.

- Perfect for teachers, parents as well as students who require additional sources.

3. Creative Blogs

- Many bloggers post their original designs and templates free of charge.

- These blogs cover a wide range of topics, everything from DIY projects to party planning.

Maximizing Tax Credit Health Insurance

Here are some creative ways for you to get the best of printables for free:

1. Home Decor

- Print and frame gorgeous artwork, quotes or decorations for the holidays to beautify your living spaces.

2. Education

- Use these printable worksheets free of charge to help reinforce your learning at home also in the classes.

3. Event Planning

- Design invitations, banners as well as decorations for special occasions like birthdays and weddings.

4. Organization

- Be organized by using printable calendars along with lists of tasks, and meal planners.

Conclusion

Tax Credit Health Insurance are an abundance filled with creative and practical information that can meet the needs of a variety of people and hobbies. Their accessibility and versatility make them an essential part of any professional or personal life. Explore the plethora of printables for free today and explore new possibilities!

Frequently Asked Questions (FAQs)

-

Are Tax Credit Health Insurance really completely free?

- Yes they are! You can download and print these files for free.

-

Can I use the free printables for commercial purposes?

- It's based on specific rules of usage. Always read the guidelines of the creator prior to using the printables in commercial projects.

-

Do you have any copyright issues when you download printables that are free?

- Some printables could have limitations regarding their use. Be sure to review the terms and regulations provided by the author.

-

How do I print Tax Credit Health Insurance?

- You can print them at home with a printer or visit any local print store for better quality prints.

-

What program do I need in order to open printables for free?

- A majority of printed materials are as PDF files, which is open with no cost programs like Adobe Reader.

Self Insured Health Insurance Deduction What Is The Self Employed

Premium Tax Credit Health Insurance Ppt Powerpoint Presentation

Check more sample of Tax Credit Health Insurance below

Form 8962 Reminders For Tax Season 2023 CrossLink

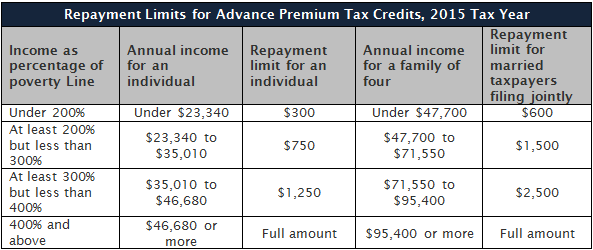

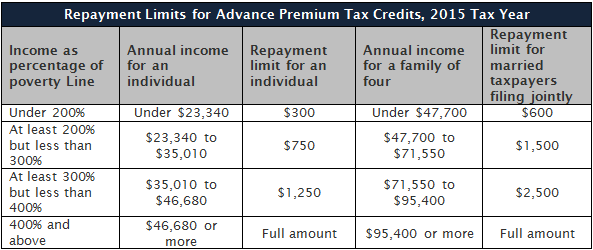

Repayment Limits For Advance Premium Tax Credits 2015 Tax Year faq KFF

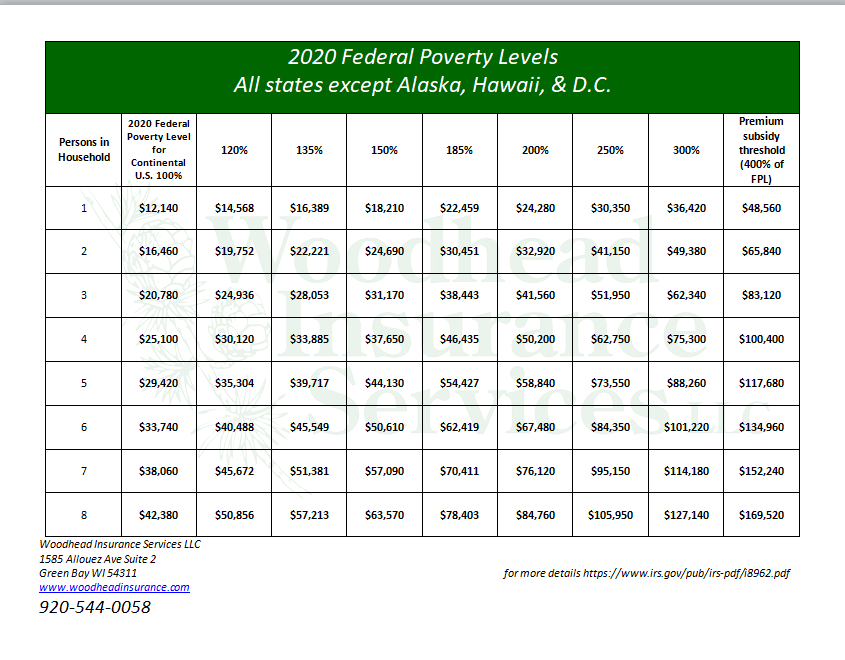

News Woodhead Insurance

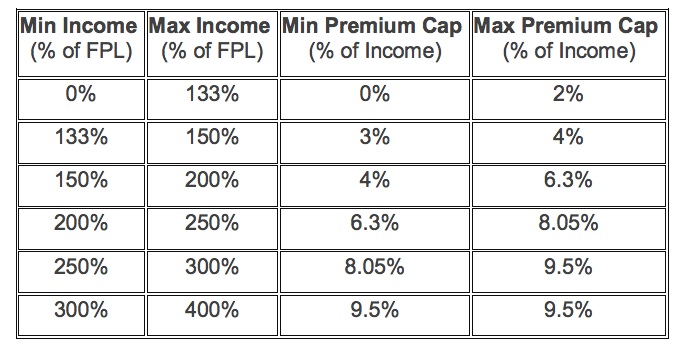

How The Health Insurance Subsidy Works A Guide To The Premium Tax

Dominic Corrado LinkedIn

7 FAQ On The Earned Income Tax Credit Health Insurance Enrollment Process

https://www.irs.gov/.../the-premium-tax-credit-the-basics

The Premium Tax Credit helps eligible individuals and families afford health insurance purchased through the Health Insurance Marketplace The IRS will soon mail letters on behalf of the Center for Medicare Medicaid Services sharing information about obtaining Marketplace healthcare coverage

https://www.valuepenguin.com/health-insurance-tax-credit

What is a health insurance tax credit A premium tax credit also called a premium subsidy lowers the cost of your health insurance You can apply the discount to your insurance bill every month or you can get the credit as a refund on your federal income taxes Catastrophic coverage health plans aren t eligible for premium tax credits

The Premium Tax Credit helps eligible individuals and families afford health insurance purchased through the Health Insurance Marketplace The IRS will soon mail letters on behalf of the Center for Medicare Medicaid Services sharing information about obtaining Marketplace healthcare coverage

What is a health insurance tax credit A premium tax credit also called a premium subsidy lowers the cost of your health insurance You can apply the discount to your insurance bill every month or you can get the credit as a refund on your federal income taxes Catastrophic coverage health plans aren t eligible for premium tax credits

How The Health Insurance Subsidy Works A Guide To The Premium Tax

Repayment Limits For Advance Premium Tax Credits 2015 Tax Year faq KFF

Dominic Corrado LinkedIn

7 FAQ On The Earned Income Tax Credit Health Insurance Enrollment Process

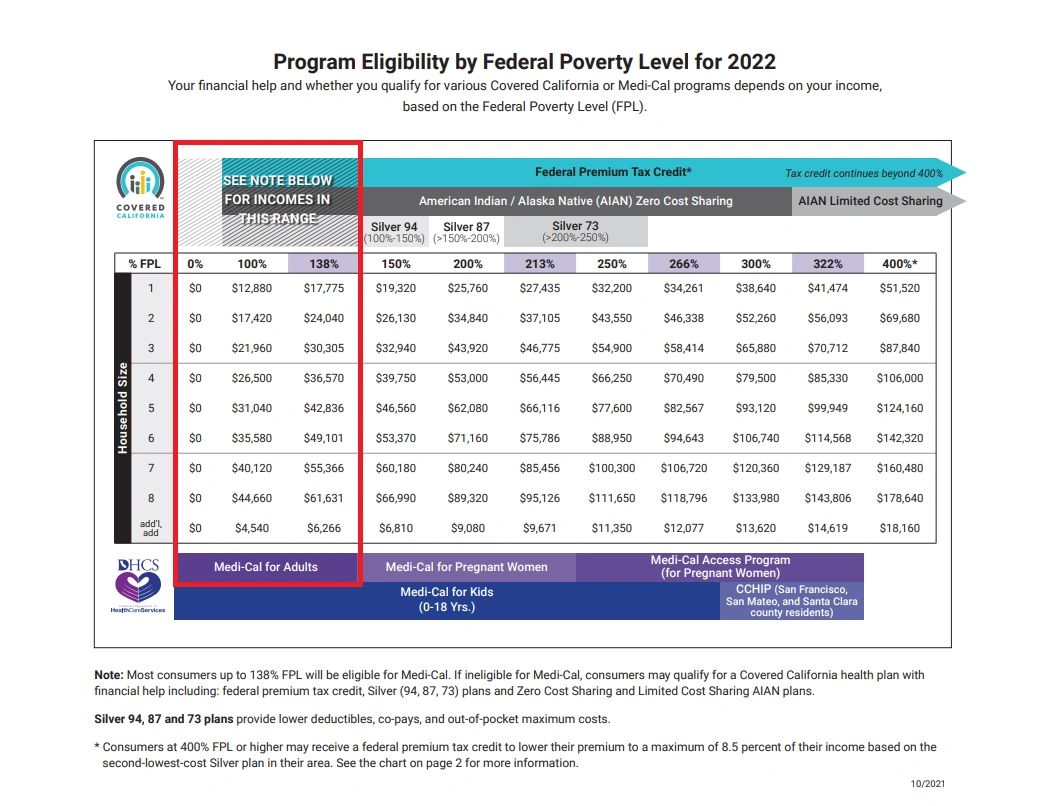

Health Insurance Income Limits For 2022 To Receive ACA Premium S

How To Apply For Health Care Tax Credit PicsHealth

How To Apply For Health Care Tax Credit PicsHealth

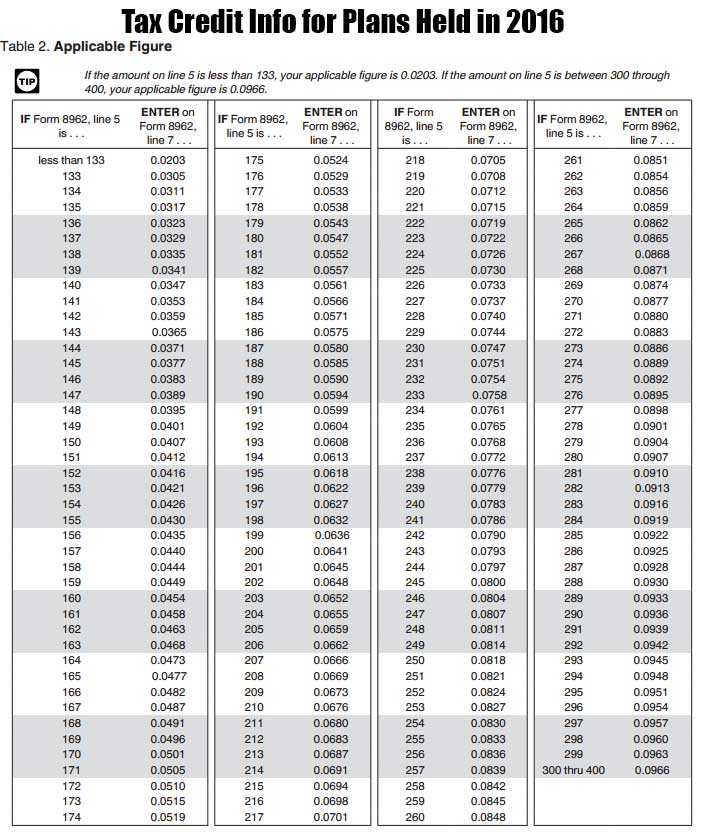

Premium Tax Credit Form 8962 And Instructions Obamacare Facts