In the age of digital, where screens have become the dominant feature of our lives and our lives are dominated by screens, the appeal of tangible printed objects hasn't waned. It doesn't matter if it's for educational reasons or creative projects, or just adding an extra personal touch to your space, Superannuation Contributions Tax Rebate have become an invaluable source. This article will take a dive through the vast world of "Superannuation Contributions Tax Rebate," exploring what they are, how you can find them, and ways they can help you improve many aspects of your life.

Get Latest Superannuation Contributions Tax Rebate Below

Superannuation Contributions Tax Rebate

Superannuation Contributions Tax Rebate -

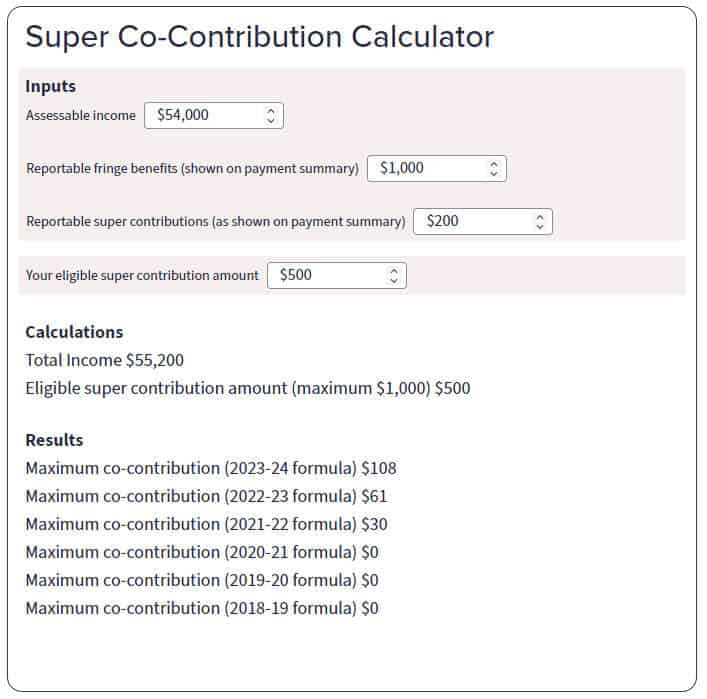

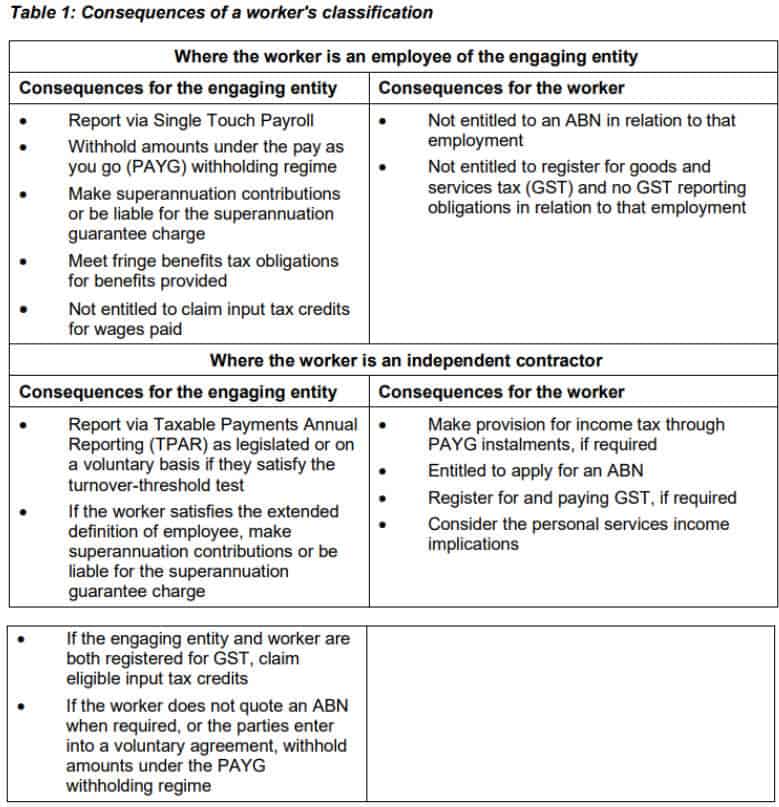

Web 30 juin 2021 nbsp 0183 32 You are entitled to a tax offset of up to 540 for 2021 22 if the sum of your spouse s assessable income excluding any assessable First home super saver released

Web You typically pay 15 tax on your super contributions and your withdrawals are tax free if you re 60 or older The investment earnings on your super are also only taxed at 15

Printables for free cover a broad range of printable, free materials available online at no cost. They come in many kinds, including worksheets templates, coloring pages, and many more. The appealingness of Superannuation Contributions Tax Rebate is in their variety and accessibility.

More of Superannuation Contributions Tax Rebate

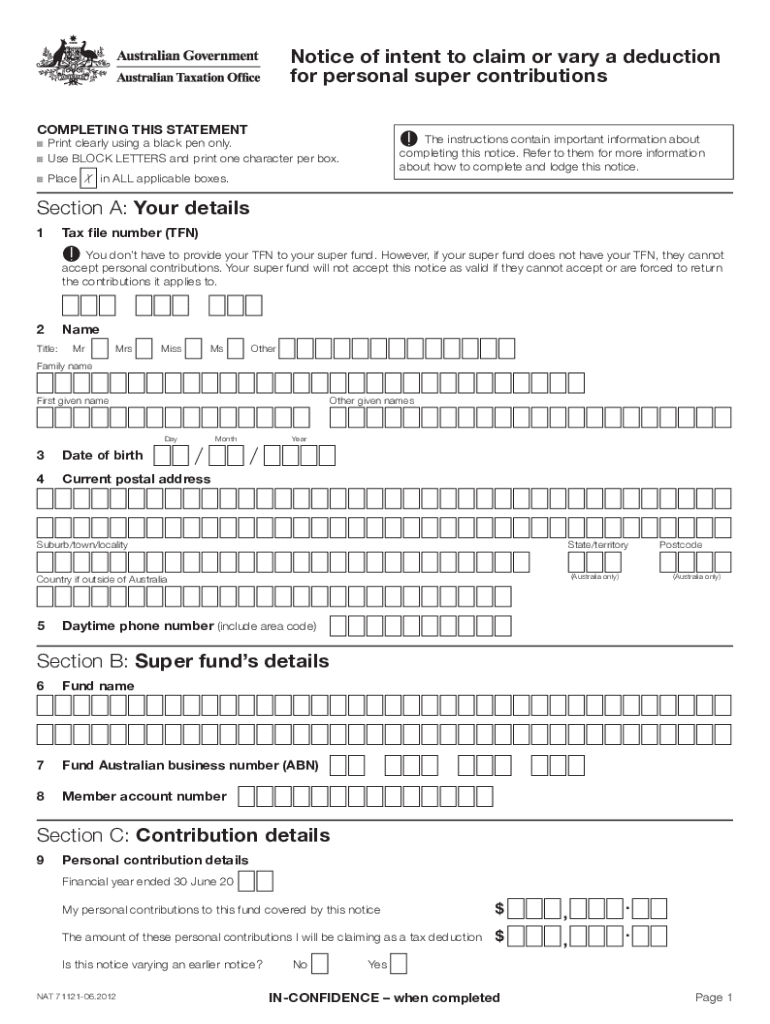

Deduction For Personal Super Contributions Australian Taxation Office

Deduction For Personal Super Contributions Australian Taxation Office

Web If your taxable income is less than 37 000 your contributions tax is refunded back to your super account under the low income super tax offset LISTO scheme If your combined taxable income and concessional

Web 1 juil 2023 nbsp 0183 32 The concessional contributions cap remains at 27 500 for the 2023 24 financial year

Superannuation Contributions Tax Rebate have gained immense popularity for several compelling reasons:

-

Cost-Effective: They eliminate the need to buy physical copies or expensive software.

-

The ability to customize: They can make print-ready templates to your specific requirements whether you're designing invitations for your guests, organizing your schedule or decorating your home.

-

Education Value The free educational worksheets offer a wide range of educational content for learners of all ages, which makes them a great device for teachers and parents.

-

Accessibility: Quick access to numerous designs and templates reduces time and effort.

Where to Find more Superannuation Contributions Tax Rebate

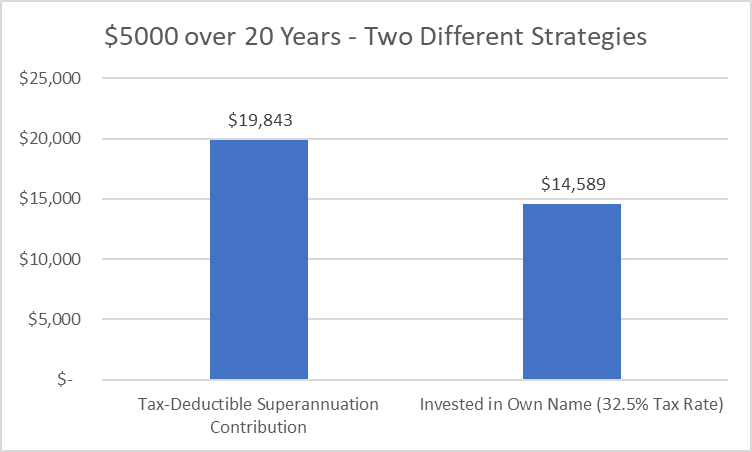

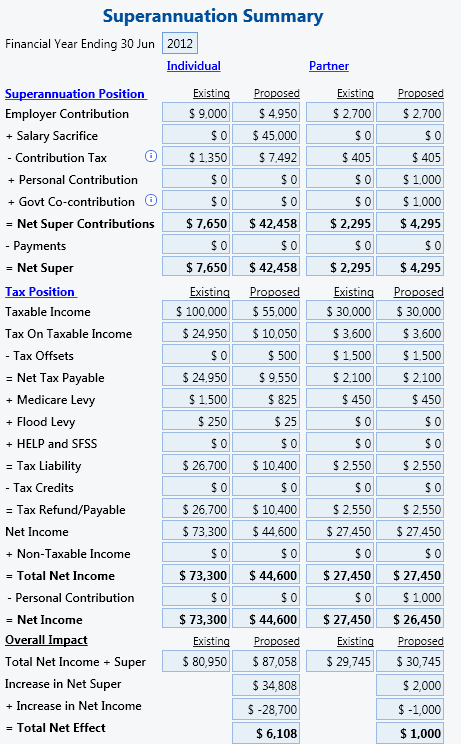

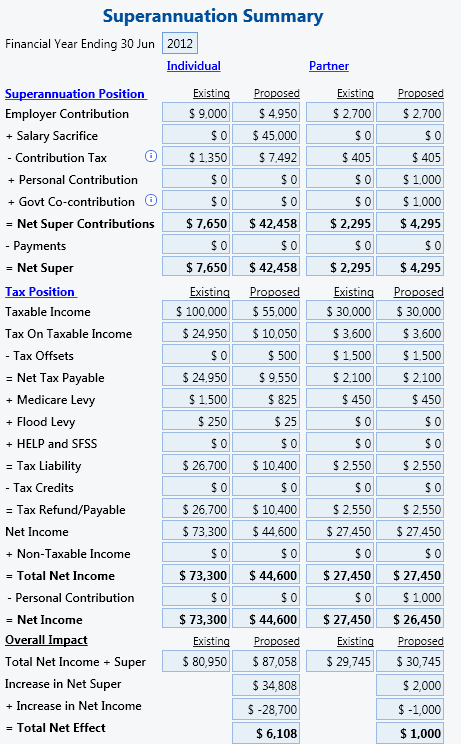

The Newest Tax Effective Superannuation Contribution Eureka Report

The Newest Tax Effective Superannuation Contribution Eureka Report

Web 30 juin 2021 nbsp 0183 32 You are entitled to a tax offset of up to 540 for 2021 22 if the sum of your spouse s assessable income excluding any assessable First home super saver released

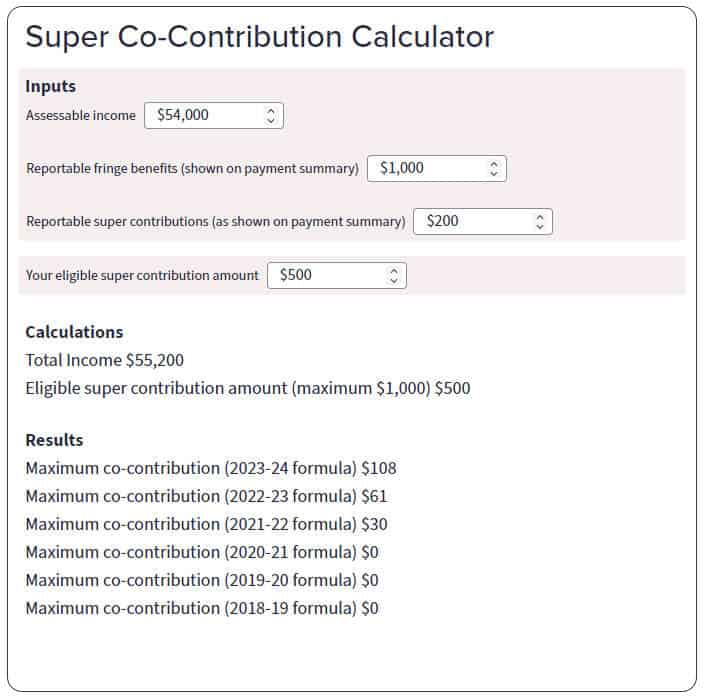

Web If you are a low or middle income earner and make personal after tax super contributions to your super fund the Government also contributes to your super called super co

In the event that we've stirred your curiosity about Superannuation Contributions Tax Rebate Let's take a look at where the hidden treasures:

1. Online Repositories

- Websites like Pinterest, Canva, and Etsy offer a vast selection of Superannuation Contributions Tax Rebate to suit a variety of uses.

- Explore categories like home decor, education, organizational, and arts and crafts.

2. Educational Platforms

- Educational websites and forums frequently provide worksheets that can be printed for free with flashcards and other teaching materials.

- This is a great resource for parents, teachers and students looking for extra sources.

3. Creative Blogs

- Many bloggers share their innovative designs with templates and designs for free.

- These blogs cover a broad array of topics, ranging everything from DIY projects to party planning.

Maximizing Superannuation Contributions Tax Rebate

Here are some unique ways that you can make use of Superannuation Contributions Tax Rebate:

1. Home Decor

- Print and frame stunning artwork, quotes, or festive decorations to decorate your living areas.

2. Education

- Use printable worksheets for free for teaching at-home, or even in the classroom.

3. Event Planning

- Designs invitations, banners and other decorations for special occasions like weddings or birthdays.

4. Organization

- Stay organized with printable calendars with to-do lists, planners, and meal planners.

Conclusion

Superannuation Contributions Tax Rebate are a treasure trove of useful and creative resources designed to meet a range of needs and hobbies. Their accessibility and versatility make these printables a useful addition to both professional and personal life. Explore the vast collection of printables for free today and unlock new possibilities!

Frequently Asked Questions (FAQs)

-

Are Superannuation Contributions Tax Rebate really gratis?

- Yes they are! You can download and print these resources at no cost.

-

Can I utilize free printables for commercial use?

- It depends on the specific terms of use. Always check the creator's guidelines before utilizing their templates for commercial projects.

-

Do you have any copyright issues in printables that are free?

- Certain printables might have limitations on their use. Be sure to review the terms of service and conditions provided by the author.

-

How do I print Superannuation Contributions Tax Rebate?

- Print them at home using a printer or visit a local print shop for top quality prints.

-

What program will I need to access Superannuation Contributions Tax Rebate?

- The majority of printables are in the PDF format, and can be opened using free programs like Adobe Reader.

Superannuation Contributions Australia Have A Question

Non Concessional Superannuation Contributions Post Tax

Check more sample of Superannuation Contributions Tax Rebate below

Non Concessional Superannuation Contributions Post Tax

Plansoft Calculator Features Superannuation Contributions

Super Contributions Tax Needs Rethink

Non Concessional Superannuation Contributions Post Tax

Superannuation Employer Contributions Your Payroll AU

Superannuation Form Fill Online Printable Fillable Blank PdfFiller

https://aware.com.au/member/super/understand-super-basics/how-super-i…

Web You typically pay 15 tax on your super contributions and your withdrawals are tax free if you re 60 or older The investment earnings on your super are also only taxed at 15

https://www.ato.gov.au/.../2022/In-detail/Personal-super-contributions

Web Super contributions too much can mean extra tax There are limits to the amount you can contribute to your super each year If you exceed these contribution caps you

Web You typically pay 15 tax on your super contributions and your withdrawals are tax free if you re 60 or older The investment earnings on your super are also only taxed at 15

Web Super contributions too much can mean extra tax There are limits to the amount you can contribute to your super each year If you exceed these contribution caps you

Non Concessional Superannuation Contributions Post Tax

Plansoft Calculator Features Superannuation Contributions

Superannuation Employer Contributions Your Payroll AU

Superannuation Form Fill Online Printable Fillable Blank PdfFiller

Personal Superannuation Deductions In Individual Tax Return ITR LodgeiT

Superannuation Guarantee 2023 Atotaxrates info

Superannuation Guarantee 2023 Atotaxrates info

Deakin Business School Super Co contribution Has Cost 10 Billion To