In this day and age where screens dominate our lives yet the appeal of tangible printed objects isn't diminished. If it's to aid in education project ideas, artistic or simply adding personal touches to your home, printables for free are now a vital resource. In this article, we'll dive into the world of "Star Credit And Homeowner Tax Rebate Credit," exploring the benefits of them, where to find them and how they can add value to various aspects of your lives.

Get Latest Star Credit And Homeowner Tax Rebate Credit Below

Star Credit And Homeowner Tax Rebate Credit

Star Credit And Homeowner Tax Rebate Credit -

Web 8 sept 2023 nbsp 0183 32 Basic STAR recipients must Own and occupy a primary residence in New York Make under 500 000 or under per household for the STAR credit and 250 000 or under for the STAR exemption Seniors

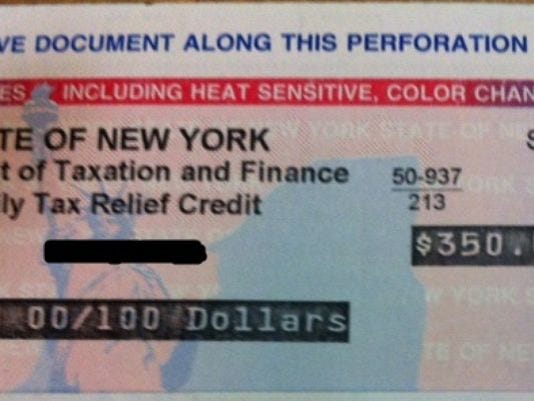

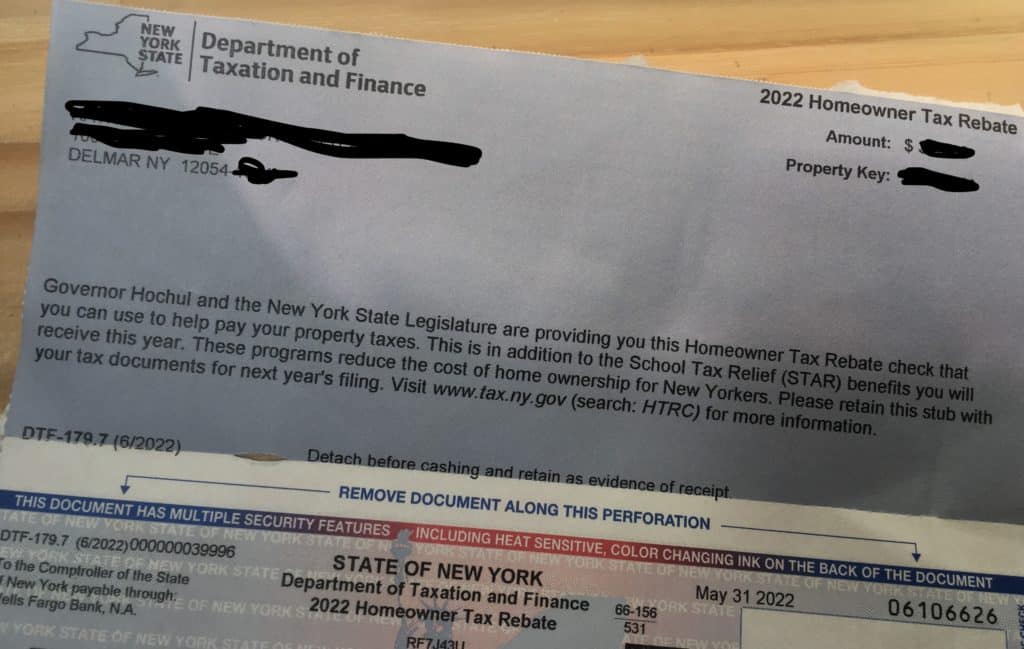

Web 9 juin 2022 nbsp 0183 32 homeowner tax rebate credit HTRC If you itemize your deductions reduce your itemized deduction for real estate taxes paid by the total amount of any STAR credit and the homeowner tax rebate credit received during the tax year keep your check stubs with your tax records

Star Credit And Homeowner Tax Rebate Credit encompass a wide variety of printable, downloadable materials online, at no cost. The resources are offered in a variety kinds, including worksheets coloring pages, templates and many more. The benefit of Star Credit And Homeowner Tax Rebate Credit is their flexibility and accessibility.

More of Star Credit And Homeowner Tax Rebate Credit

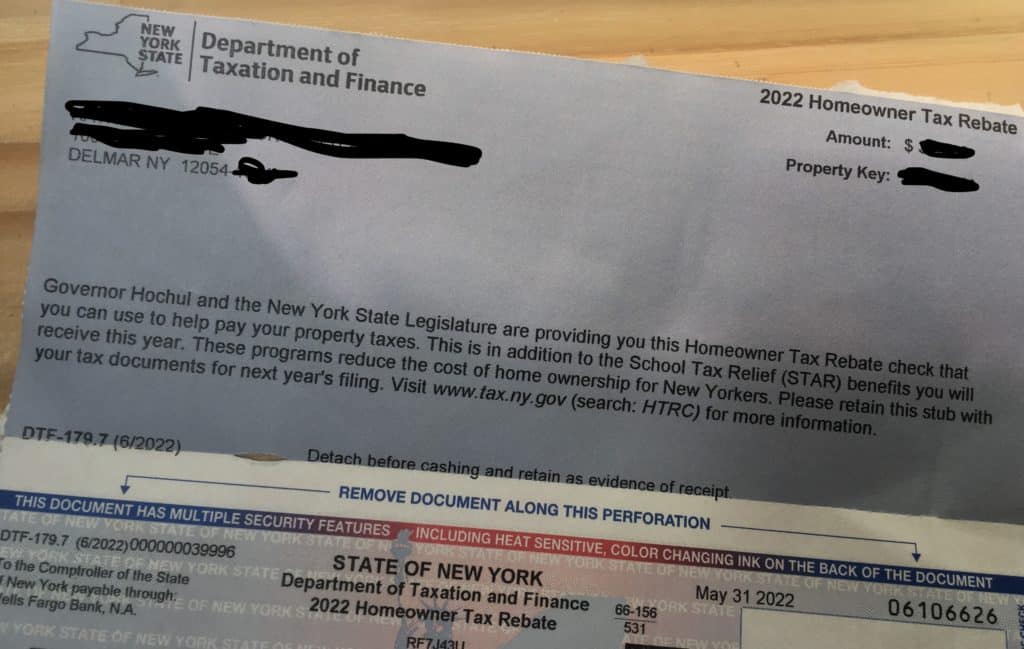

Homeowner Tax Rebate Credit Coming Timeline For Getting Your Check

Homeowner Tax Rebate Credit Coming Timeline For Getting Your Check

Web 23 juin 2022 nbsp 0183 32 Updated Jun 23 2022 05 25 PM EDT WSYR TV Check your mailbox About 3 million homeowners in New York are receiving property tax relief checks Checks are starting to arrive this month It

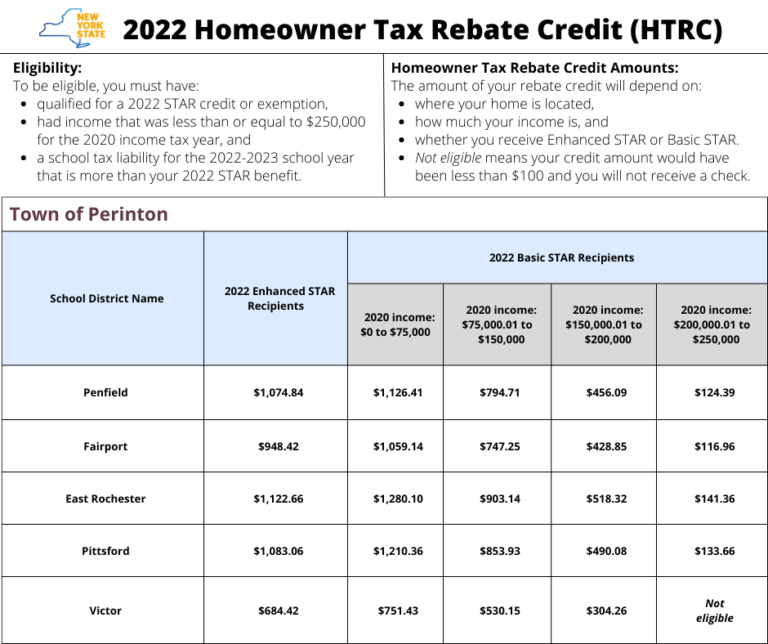

Web To be eligible for a homeownership tax rebate credit within 2022 yours need can qualified for a 2022 STAR recognition or exemption had income that was less than oder equal to 250 000 for the 2020 income tax year and a school tax liability for and 2022 2023 school current so is more than choose 2022 STAR benefit

Printables for free have gained immense popularity due to several compelling reasons:

-

Cost-Efficiency: They eliminate the necessity to purchase physical copies or expensive software.

-

Personalization You can tailor printables to your specific needs whether it's making invitations making your schedule, or even decorating your home.

-

Educational Worth: Printing educational materials for no cost cater to learners of all ages. This makes them an invaluable instrument for parents and teachers.

-

It's easy: Quick access to a variety of designs and templates is time-saving and saves effort.

Where to Find more Star Credit And Homeowner Tax Rebate Credit

Tax Rebate Checks Come Early This Year Yonkers Times

Tax Rebate Checks Come Early This Year Yonkers Times

Web Homeowner tax rebate credit amounts The amount of your discounted believe was dependent the where your home was located how loads your income was and whether you received Improve STAR or Basic STAR On help home estimate the amount of the credit they would receive we published a check lookup

Web Qualify for the 2022 STAR credit or exemption Have income that was less than or equal to 250 000 for the 2020 income tax year Rebate checks were mailed in the summer of 2022 Online Learn more about the Homeowner Tax Rebate Credit HTRC Check the 2022 Homeowner Tax Rebate Credit amounts By Phone

Now that we've piqued your curiosity about Star Credit And Homeowner Tax Rebate Credit, let's explore where you can discover these hidden gems:

1. Online Repositories

- Websites like Pinterest, Canva, and Etsy offer a vast selection of Star Credit And Homeowner Tax Rebate Credit designed for a variety objectives.

- Explore categories such as decorations for the home, education and organizational, and arts and crafts.

2. Educational Platforms

- Educational websites and forums often provide free printable worksheets, flashcards, and learning materials.

- The perfect resource for parents, teachers, and students seeking supplemental resources.

3. Creative Blogs

- Many bloggers post their original designs with templates and designs for free.

- These blogs cover a broad array of topics, ranging that range from DIY projects to planning a party.

Maximizing Star Credit And Homeowner Tax Rebate Credit

Here are some ideas that you can make use of Star Credit And Homeowner Tax Rebate Credit:

1. Home Decor

- Print and frame stunning artwork, quotes, or other seasonal decorations to fill your living areas.

2. Education

- Print free worksheets to help reinforce your learning at home, or even in the classroom.

3. Event Planning

- Design invitations, banners, and decorations for special events such as weddings and birthdays.

4. Organization

- Stay organized with printable calendars for to-do list, lists of chores, and meal planners.

Conclusion

Star Credit And Homeowner Tax Rebate Credit are an abundance filled with creative and practical information that meet a variety of needs and interests. Their accessibility and flexibility make they a beneficial addition to both professional and personal life. Explore the vast world that is Star Credit And Homeowner Tax Rebate Credit today, and uncover new possibilities!

Frequently Asked Questions (FAQs)

-

Are printables for free really cost-free?

- Yes they are! You can print and download these items for free.

-

Can I use free printables in commercial projects?

- It is contingent on the specific rules of usage. Always verify the guidelines of the creator before using printables for commercial projects.

-

Do you have any copyright issues with printables that are free?

- Certain printables might have limitations on usage. You should read the terms and conditions provided by the creator.

-

How do I print Star Credit And Homeowner Tax Rebate Credit?

- You can print them at home using an printer, or go to a print shop in your area for better quality prints.

-

What program do I require to open Star Credit And Homeowner Tax Rebate Credit?

- A majority of printed materials are in PDF format, which is open with no cost software such as Adobe Reader.

Westchester Pols Don t Like STAR Rebate Changes Yonkers Times

NYS Homeowner Tax Rebate Credit HTRC Info Town Of Perinton

Check more sample of Star Credit And Homeowner Tax Rebate Credit below

Mass Tax Rebate Check

New York State Homeowner Tax Rebate Credit HTRC Sciarabba Walker

Track Your Recovery Rebate With This Worksheet Style Worksheets

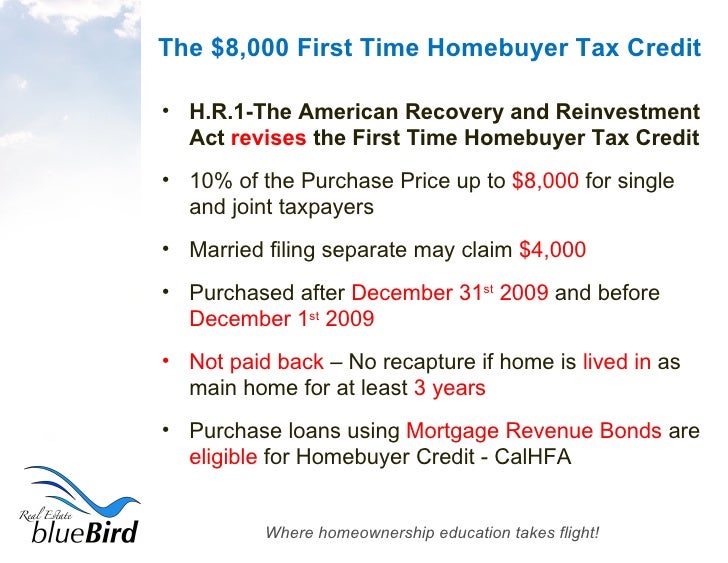

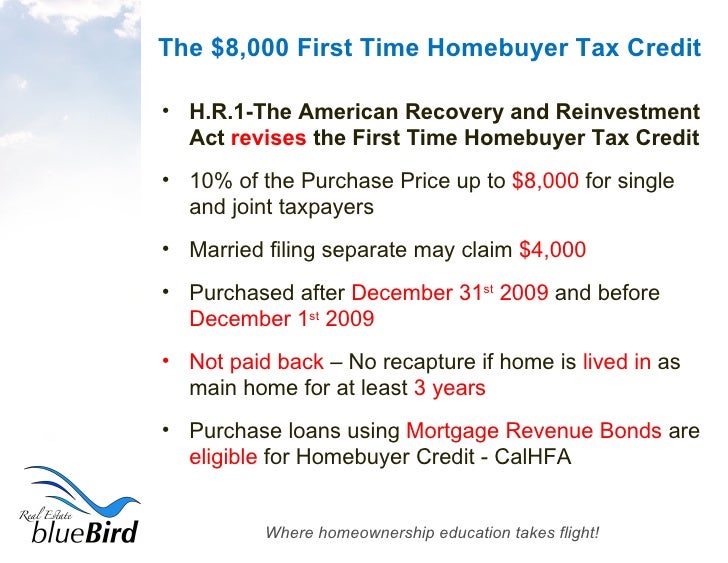

Understanding The First Time Homebuyer Tax Credit

Homeowner Tax Rebate Credit 2023 DoyanTekno English

https://www.tax.ny.gov/pit/property/report_property_tax_credits.htm

Web 9 juin 2022 nbsp 0183 32 homeowner tax rebate credit HTRC If you itemize your deductions reduce your itemized deduction for real estate taxes paid by the total amount of any STAR credit and the homeowner tax rebate credit received during the tax year keep your check stubs with your tax records

https://nataliathompson.com/did-i-receive-star-tax-relief

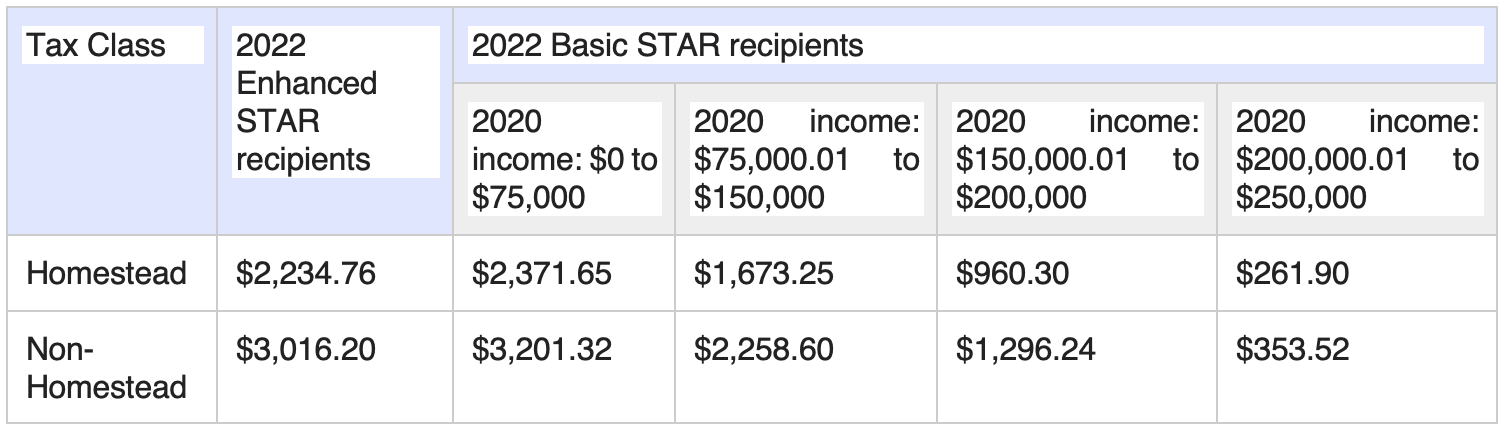

Web Supposing you received the Enhanced STAR exemption or credit with 2022 your homeowner tax rebates credit was 66 concerning the Enhanced STAR discharge savings regardless of your income If you standard the Baseline STAR exemption or credit in 2022 yours credit sum was a certain proportion determined via your income of the

Web 9 juin 2022 nbsp 0183 32 homeowner tax rebate credit HTRC If you itemize your deductions reduce your itemized deduction for real estate taxes paid by the total amount of any STAR credit and the homeowner tax rebate credit received during the tax year keep your check stubs with your tax records

Web Supposing you received the Enhanced STAR exemption or credit with 2022 your homeowner tax rebates credit was 66 concerning the Enhanced STAR discharge savings regardless of your income If you standard the Baseline STAR exemption or credit in 2022 yours credit sum was a certain proportion determined via your income of the

Track Your Recovery Rebate With This Worksheet Style Worksheets

Mass Tax Rebate Check

Understanding The First Time Homebuyer Tax Credit

Homeowner Tax Rebate Credit 2023 DoyanTekno English

Homeowner Tax Benefits Extended For 2015 2016 Home Loans Top

Governor Hochul Mails Out Rebate Checks Early Suozzi Cries Foul

Governor Hochul Mails Out Rebate Checks Early Suozzi Cries Foul

1040 Line 30 Recovery Rebate Credit Recovery Rebate