In this age of electronic devices, where screens dominate our lives but the value of tangible printed material hasn't diminished. For educational purposes for creative projects, just adding an individual touch to your space, Social Security And Medicare Tax Withheld Deduction have become an invaluable resource. The following article is a take a dive into the sphere of "Social Security And Medicare Tax Withheld Deduction," exploring the different types of printables, where you can find them, and how they can enhance various aspects of your lives.

Get Latest Social Security And Medicare Tax Withheld Deduction Below

Social Security And Medicare Tax Withheld Deduction

Social Security And Medicare Tax Withheld Deduction -

You can have 7 10 12 or 22 percent of your monthly benefit withheld for taxes Only these percentages can be withheld Flat dollar amounts are not accepted Sign the form

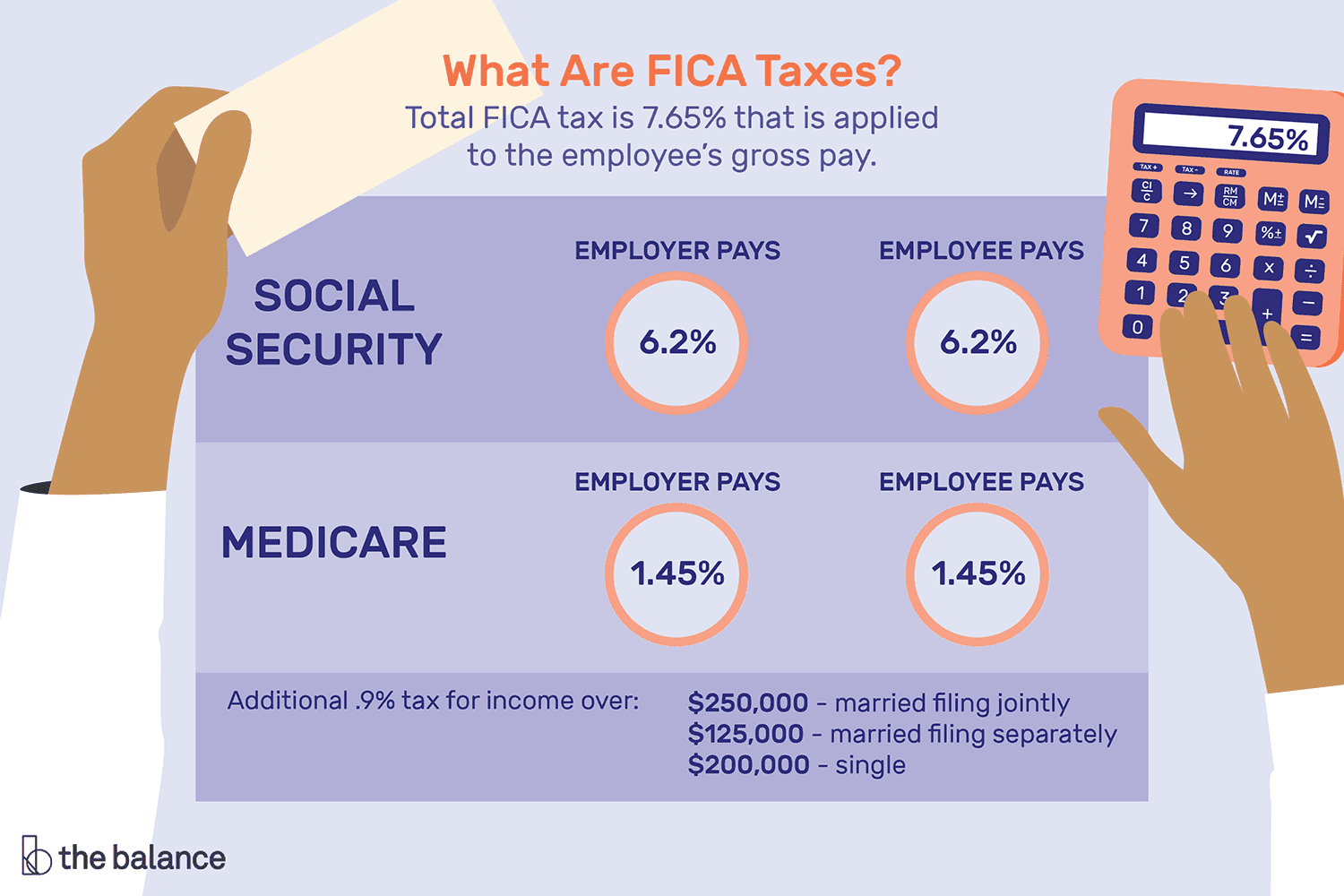

The combined taxes withheld for Social Security and Medicare are referred to as the Federal Insurance Contributions Act

Printables for free cover a broad variety of printable, downloadable documents that can be downloaded online at no cost. They are available in a variety of types, like worksheets, coloring pages, templates and much more. The appealingness of Social Security And Medicare Tax Withheld Deduction is their versatility and accessibility.

More of Social Security And Medicare Tax Withheld Deduction

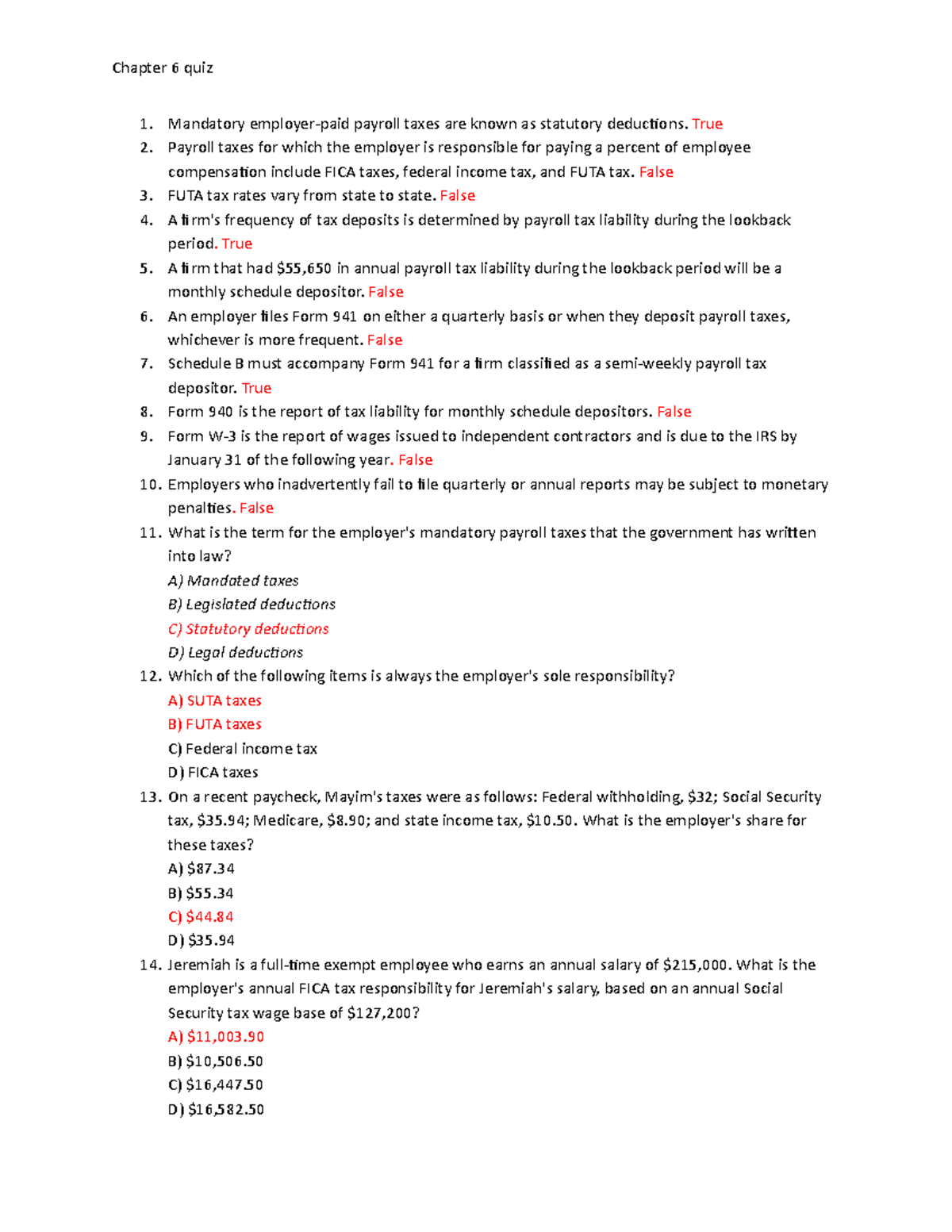

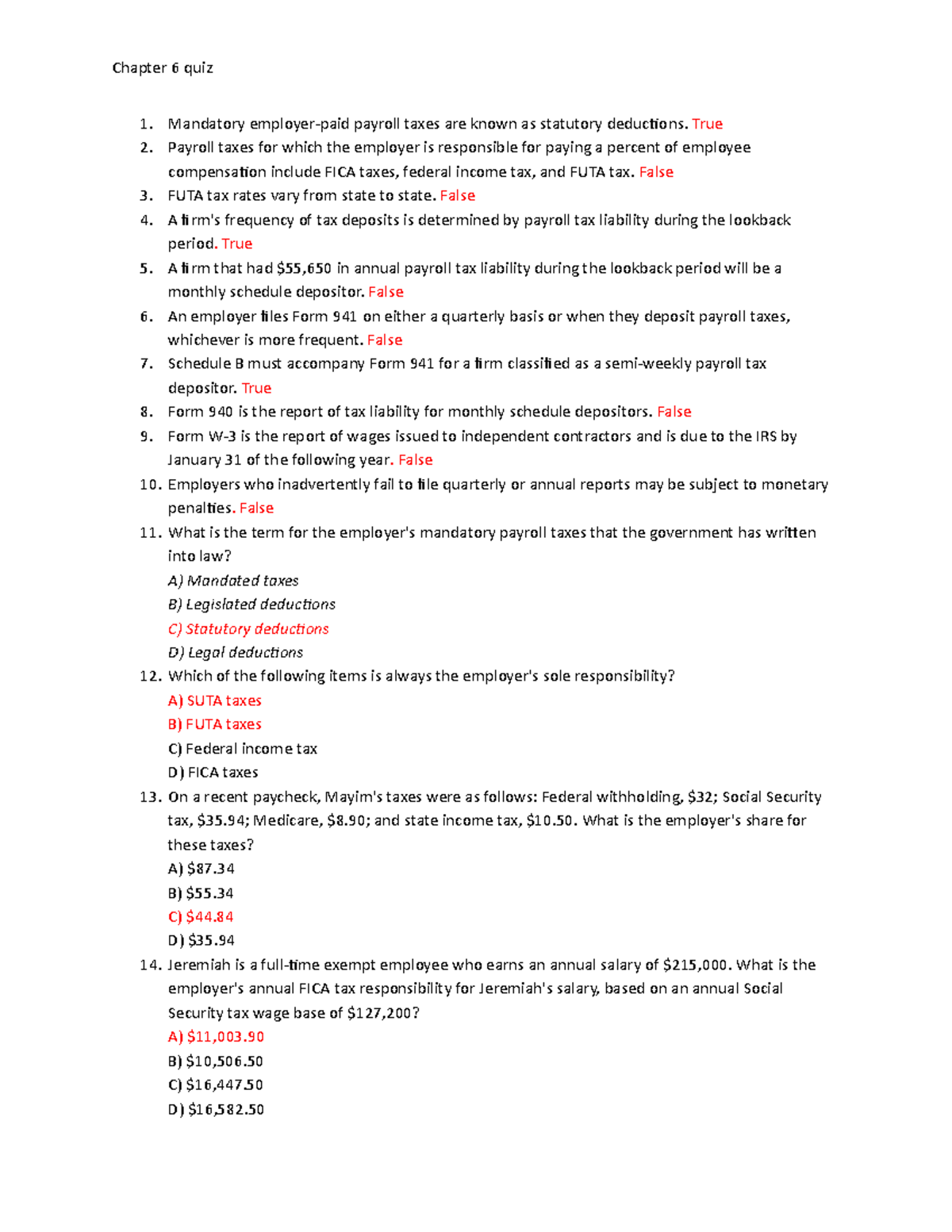

Chapter 6 Quiz Employer Payroll Taxes And Labor Planning Mandatory

Chapter 6 Quiz Employer Payroll Taxes And Labor Planning Mandatory

The Medicare tax is not limited to an annual income cap although the Social Security tax is For 2022 the Social Security tax is limited to the first 147 000

In the U S employers withhold taxes from each paycheck for Social Security and Medicare Those taxes are collectively referred to as FICA taxes What is FICA tax FICA is a payroll tax and

Printables that are free have gained enormous popularity because of a number of compelling causes:

-

Cost-Effective: They eliminate the need to buy physical copies or expensive software.

-

Customization: Your HTML0 customization options allow you to customize printables to fit your particular needs be it designing invitations to organize your schedule or even decorating your home.

-

Educational Value: Educational printables that can be downloaded for free are designed to appeal to students of all ages, making them a valuable tool for parents and educators.

-

Affordability: instant access numerous designs and templates reduces time and effort.

Where to Find more Social Security And Medicare Tax Withheld Deduction

What Income Is Subject To The 3 8 Medicare Tax

What Income Is Subject To The 3 8 Medicare Tax

Similarly for Medicare the tax rate is 1 45 for both parties making it a total of 2 9 In 2023 most individuals enrolled in Medicare and receiving Social Security

Your Medicare Part B premiums will be automatically deducted from your Social Security benefits Most people receive Part A without paying a premium You

If we've already piqued your curiosity about Social Security And Medicare Tax Withheld Deduction and other printables, let's discover where you can find these gems:

1. Online Repositories

- Websites such as Pinterest, Canva, and Etsy provide a variety and Social Security And Medicare Tax Withheld Deduction for a variety uses.

- Explore categories like the home, decor, craft, and organization.

2. Educational Platforms

- Educational websites and forums typically provide free printable worksheets along with flashcards, as well as other learning materials.

- Great for parents, teachers or students in search of additional sources.

3. Creative Blogs

- Many bloggers are willing to share their original designs and templates for no cost.

- These blogs cover a wide range of interests, that includes DIY projects to planning a party.

Maximizing Social Security And Medicare Tax Withheld Deduction

Here are some unique ways create the maximum value of Social Security And Medicare Tax Withheld Deduction:

1. Home Decor

- Print and frame gorgeous artwork, quotes or even seasonal decorations to decorate your living areas.

2. Education

- Use printable worksheets for free to enhance your learning at home either in the schoolroom or at home.

3. Event Planning

- Design invitations for banners, invitations as well as decorations for special occasions like weddings or birthdays.

4. Organization

- Stay organized with printable planners as well as to-do lists and meal planners.

Conclusion

Social Security And Medicare Tax Withheld Deduction are an abundance with useful and creative ideas catering to different needs and interests. Their accessibility and versatility make them an essential part of both professional and personal lives. Explore the plethora of Social Security And Medicare Tax Withheld Deduction today to explore new possibilities!

Frequently Asked Questions (FAQs)

-

Are printables for free really cost-free?

- Yes, they are! You can print and download these free resources for no cost.

-

Can I utilize free templates for commercial use?

- It's all dependent on the usage guidelines. Always verify the guidelines of the creator prior to printing printables for commercial projects.

-

Do you have any copyright violations with printables that are free?

- Some printables may contain restrictions on their use. Make sure to read these terms and conditions as set out by the designer.

-

How do I print printables for free?

- You can print them at home using printing equipment or visit any local print store for premium prints.

-

What program do I require to open printables free of charge?

- The majority of PDF documents are provided in PDF format, which can be opened with free software like Adobe Reader.

Economics 101 D Barkers

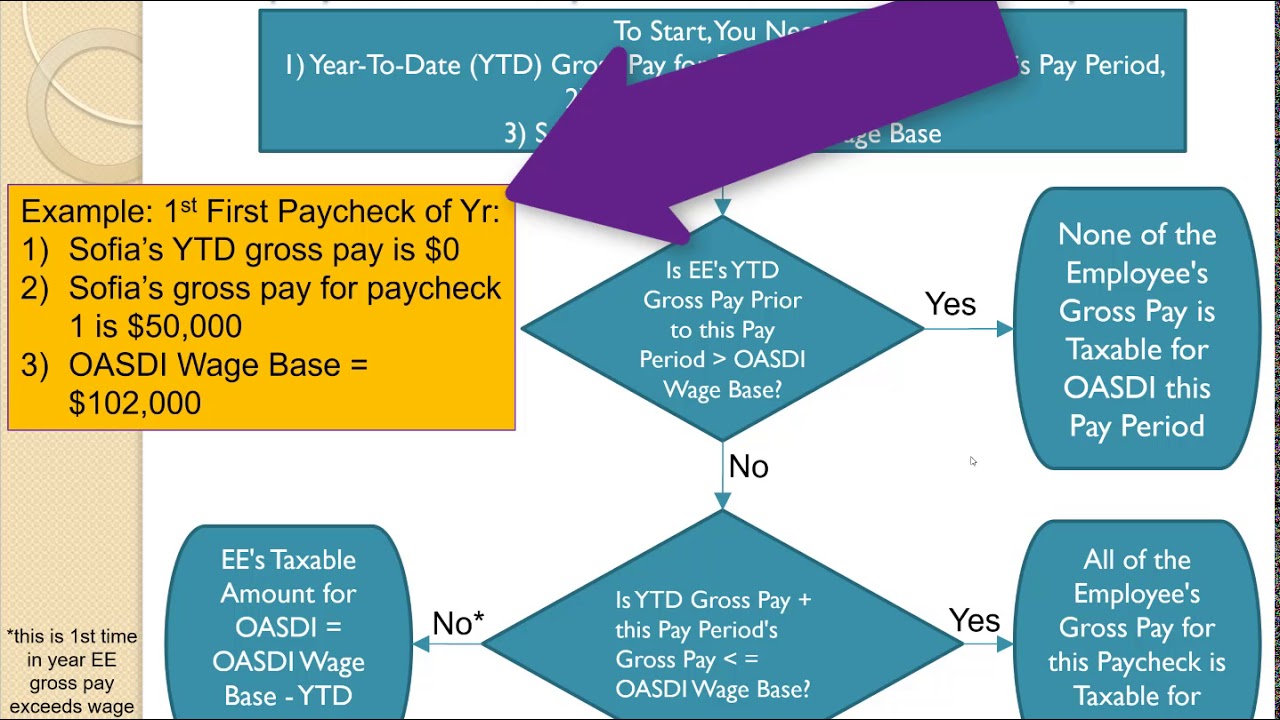

Calculating OASDI Social Security Deduction Medicare Deduction

Check more sample of Social Security And Medicare Tax Withheld Deduction below

Medicare And Social Security How They Work Together

What Is Medicare Tax Purpose Rate Additional Medicare And More

The Social Security Tax Was Withheld At The Rate Of 6 0 On The First

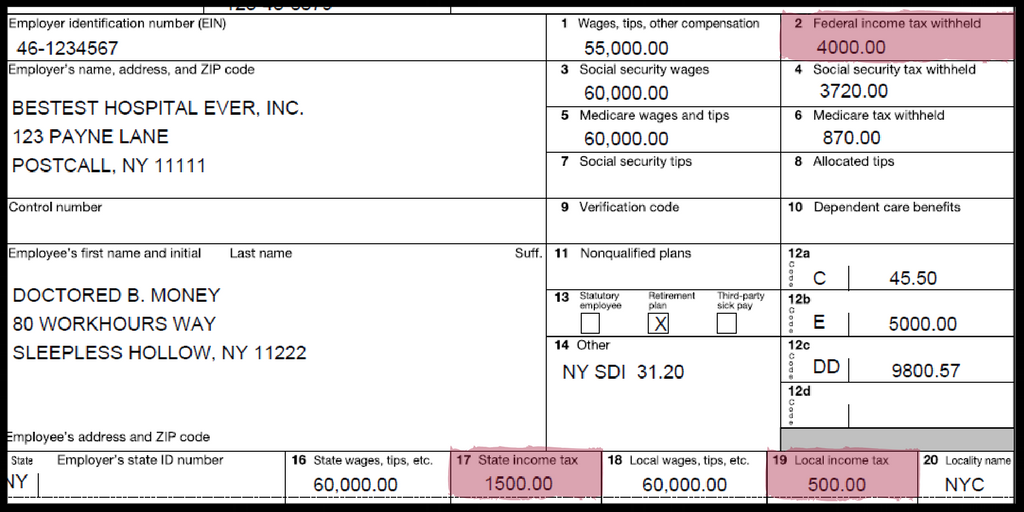

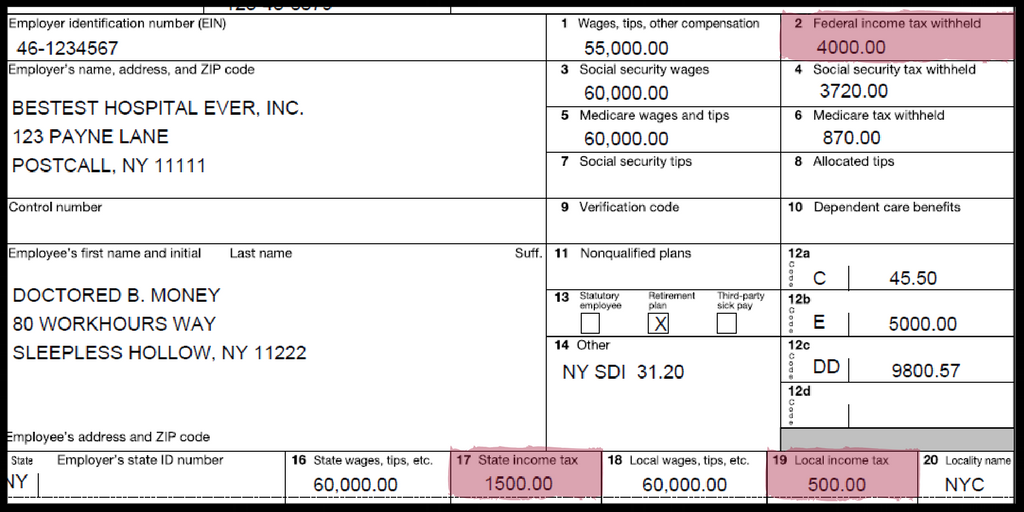

Maxime Ausflug Damit W2 Box 14 E Gelehrter Feindlich Begleiten

Social Security Cost Of Living Adjustments 2023

What Is Social Security Tax And Medicare Tax

https://www.investopedia.com/ask/ans…

The combined taxes withheld for Social Security and Medicare are referred to as the Federal Insurance Contributions Act

https://www.irs.gov/individuals/international...

If you work as an employee in the United States you must pay social security and Medicare taxes in most cases Your payments of these taxes contribute to

The combined taxes withheld for Social Security and Medicare are referred to as the Federal Insurance Contributions Act

If you work as an employee in the United States you must pay social security and Medicare taxes in most cases Your payments of these taxes contribute to

Maxime Ausflug Damit W2 Box 14 E Gelehrter Feindlich Begleiten

What Is Medicare Tax Purpose Rate Additional Medicare And More

Social Security Cost Of Living Adjustments 2023

What Is Social Security Tax And Medicare Tax

Medicare Part B Premium 2024 Chart

Maximize Your Paycheck Understanding FICA Tax In 2023

Maximize Your Paycheck Understanding FICA Tax In 2023

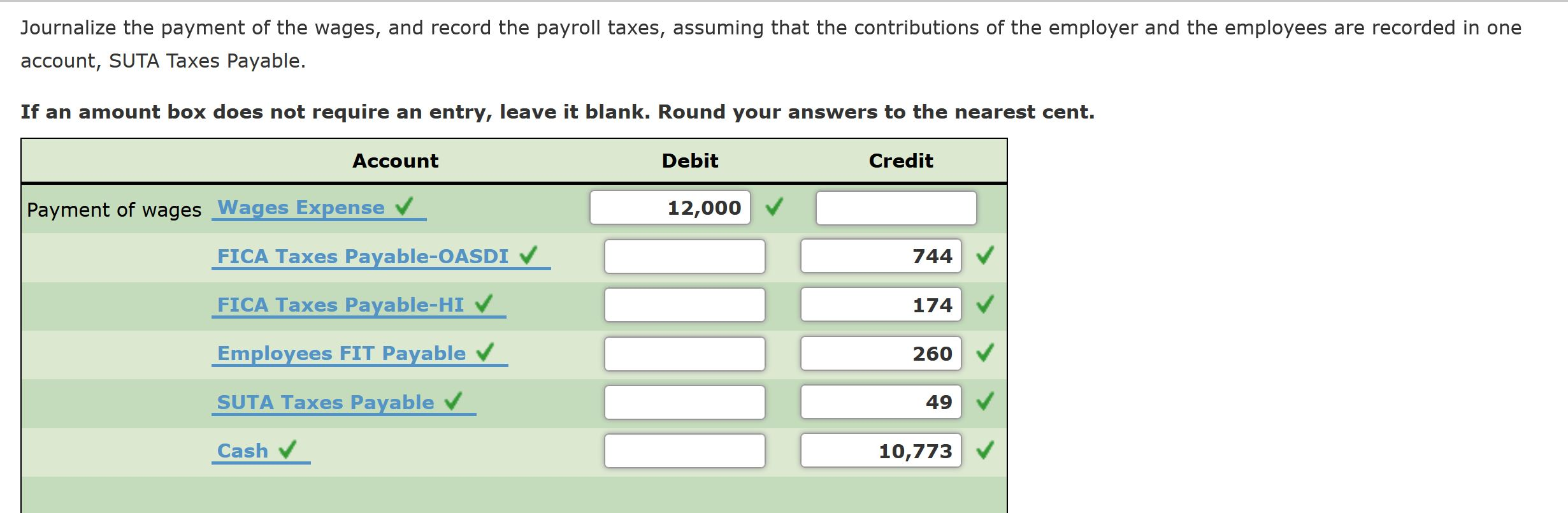

Solved The Employees Of Pelter Company Earn Wages Of 12 000 Chegg