In a world with screens dominating our lives, the charm of tangible printed products hasn't decreased. No matter whether it's for educational uses and creative work, or simply adding an individual touch to your space, Sip Return Amount Is Taxable can be an excellent source. Through this post, we'll dive to the depths of "Sip Return Amount Is Taxable," exploring the benefits of them, where you can find them, and ways they can help you improve many aspects of your daily life.

Get Latest Sip Return Amount Is Taxable Below

Sip Return Amount Is Taxable

Sip Return Amount Is Taxable -

No most SIP investment returns are taxable However SIP investments in tax saving mutual fund schemes i e ELSS Mutual Funds are eligible for tax deduction under Section 80C of the Income Tax Act

1 Do we have to pay tax on SIPs in India Yes taxes are levied in India on SIPs The sort of mutual funds used in SIPs and the gains made from them determine how much tax is due 2 Are returns from a mutual fund investment taxable Yes returns from mutual fund investments are taxable

Sip Return Amount Is Taxable include a broad selection of printable and downloadable materials that are accessible online for free cost. They are available in numerous designs, including worksheets templates, coloring pages and much more. The great thing about Sip Return Amount Is Taxable is in their variety and accessibility.

More of Sip Return Amount Is Taxable

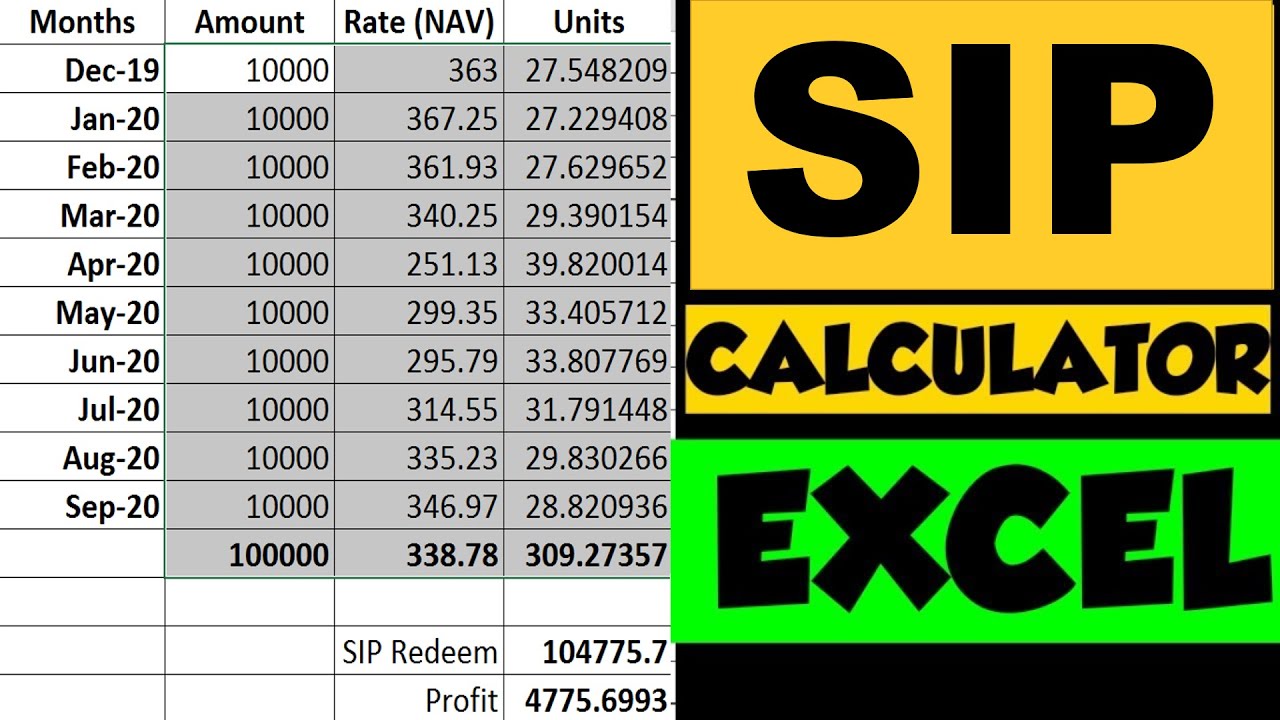

SIP Calculator Systematic Investment Plan Calculator With Inflation

SIP Calculator Systematic Investment Plan Calculator With Inflation

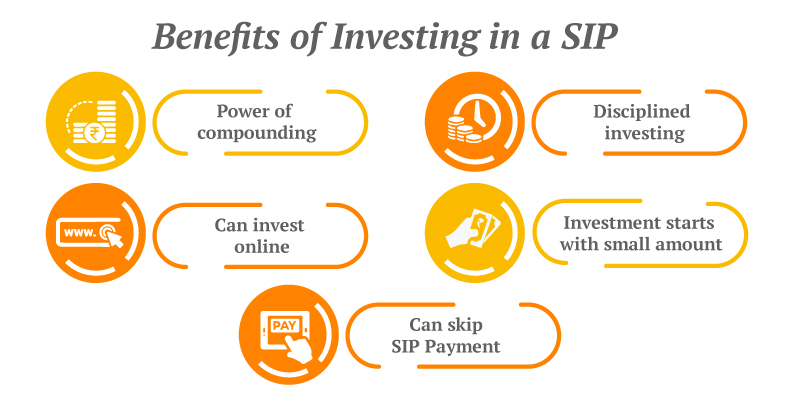

Taxation of Capital Gains When Invested Through SIPs When investing through SIPs Systematic Investment Plans in mutual funds the taxation of capital gains depends on the holding period of the units The redemption of mutual fund units purchased through SIPs is processed on a first in first out basis

Are SIP returns taxable Depends on the type of mutual fund you invest in and when you redeem your investment Returns from equity mutual funds have no tax on them if redeemed after a year of investment If you redeem before a year you will have to pay a tax of 15 on your gains

The Sip Return Amount Is Taxable have gained huge popularity due to several compelling reasons:

-

Cost-Effective: They eliminate the necessity of purchasing physical copies or expensive software.

-

The ability to customize: You can tailor printables to your specific needs whether you're designing invitations making your schedule, or decorating your home.

-

Educational Value: Free educational printables provide for students of all ages, which makes the perfect instrument for parents and teachers.

-

Easy to use: instant access various designs and templates can save you time and energy.

Where to Find more Sip Return Amount Is Taxable

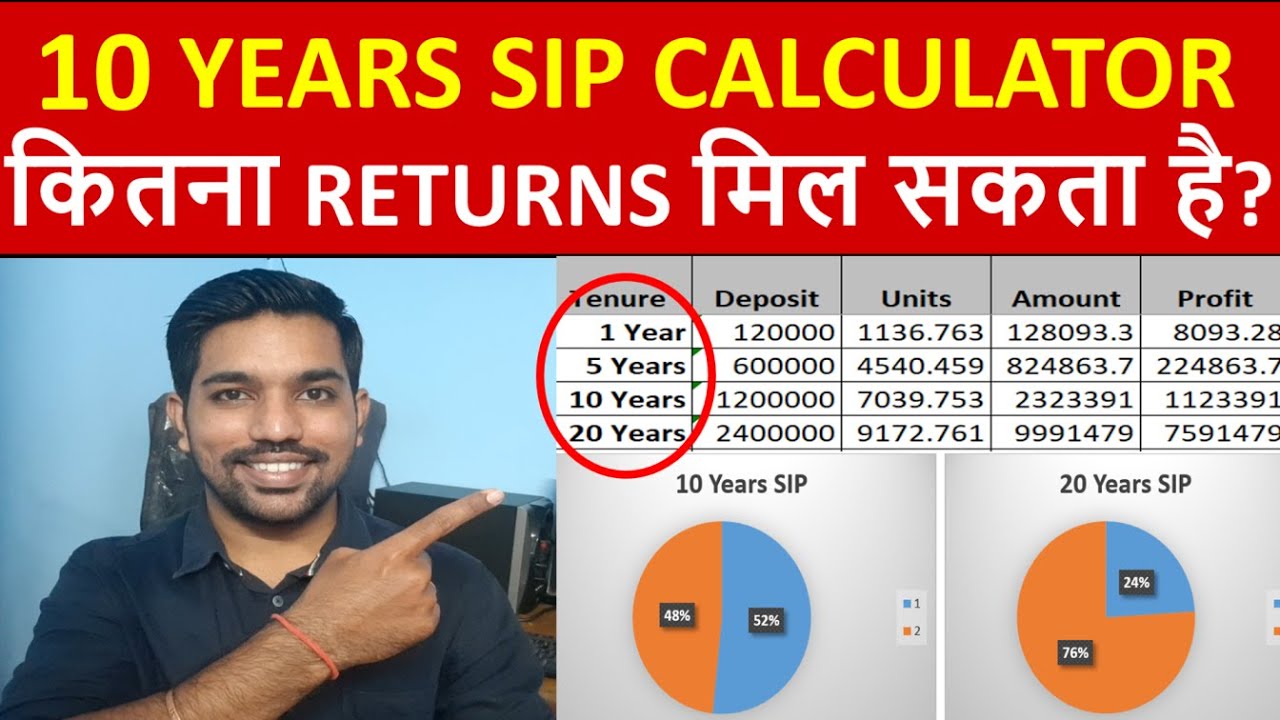

10 Year SIP Return Excel Calculator Calculating The Return Of A

10 Year SIP Return Excel Calculator Calculating The Return Of A

How to invest in SIP for tax free returns While SIPs are not entirely tax free investing in ELSS via SIP can provide tax benefits under Section 80C However LTCG tax still applies Are there any tax free SIP options No SIP offers completely tax free returns The tax liability depends on the type of fund and the duration of the investment

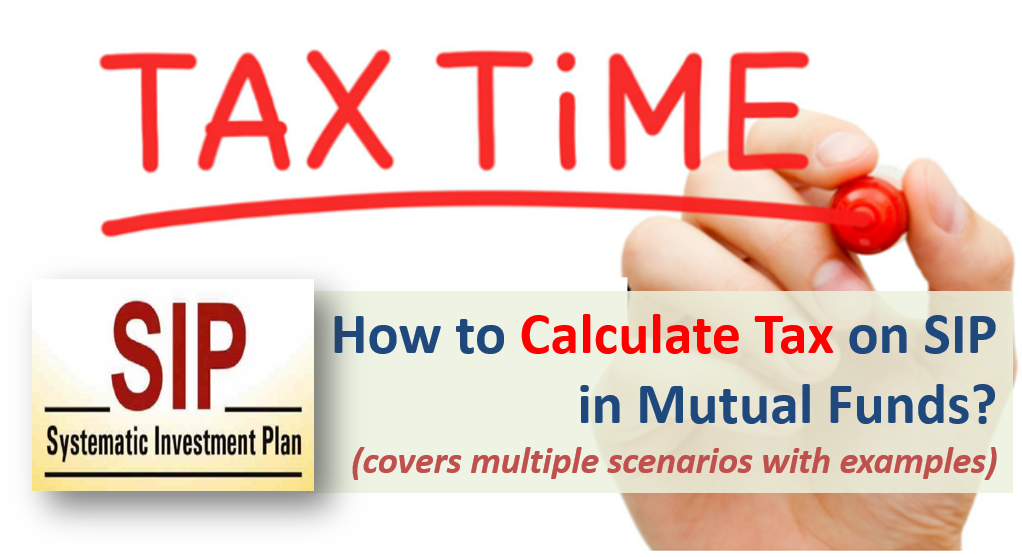

The tax on SIP depends on whether the investment is made in equity or a non equity fund as they have separate tax rates Read here to know how sips are taxed and how to calculate the tax on their SIP returns

Now that we've ignited your interest in printables for free Let's look into where you can find these hidden treasures:

1. Online Repositories

- Websites such as Pinterest, Canva, and Etsy provide an extensive selection of Sip Return Amount Is Taxable suitable for many uses.

- Explore categories such as decorating your home, education, organizational, and arts and crafts.

2. Educational Platforms

- Forums and websites for education often provide worksheets that can be printed for free or flashcards as well as learning materials.

- Perfect for teachers, parents and students looking for additional resources.

3. Creative Blogs

- Many bloggers provide their inventive designs and templates for no cost.

- These blogs cover a wide range of interests, everything from DIY projects to party planning.

Maximizing Sip Return Amount Is Taxable

Here are some inventive ways create the maximum value of printables that are free:

1. Home Decor

- Print and frame stunning artwork, quotes or seasonal decorations that will adorn your living spaces.

2. Education

- Use free printable worksheets to help reinforce your learning at home or in the classroom.

3. Event Planning

- Design invitations for banners, invitations and other decorations for special occasions like birthdays and weddings.

4. Organization

- Stay organized with printable planners, to-do lists, and meal planners.

Conclusion

Sip Return Amount Is Taxable are a treasure trove of innovative and useful resources that cater to various needs and interests. Their accessibility and flexibility make them an invaluable addition to both professional and personal lives. Explore the endless world of Sip Return Amount Is Taxable today to unlock new possibilities!

Frequently Asked Questions (FAQs)

-

Are printables for free really completely free?

- Yes they are! You can print and download these tools for free.

-

Can I make use of free templates for commercial use?

- It's determined by the specific usage guidelines. Always verify the guidelines of the creator before utilizing their templates for commercial projects.

-

Do you have any copyright concerns with printables that are free?

- Certain printables may be subject to restrictions in their usage. Always read the terms and conditions offered by the designer.

-

How do I print printables for free?

- You can print them at home with the printer, or go to the local print shop for high-quality prints.

-

What program is required to open printables for free?

- A majority of printed materials are in PDF format, which is open with no cost programs like Adobe Reader.

1 Systematic Investment Plan SIP Onlinestudy guru

SIP Returns Excel Calculator SIP Vs Lump Sum Returns Systematic

Check more sample of Sip Return Amount Is Taxable below

How Much Tax Will I Pay On 41000 Update New Countrymusicstop

Sip Plan For 5 Years Lic Sip Plan Details 2022 Best Short Term

SIP Returns Calculation Examples 2000 For 1 15 Years FinCalC

The Power Of Compounding In SIP WealthDesk

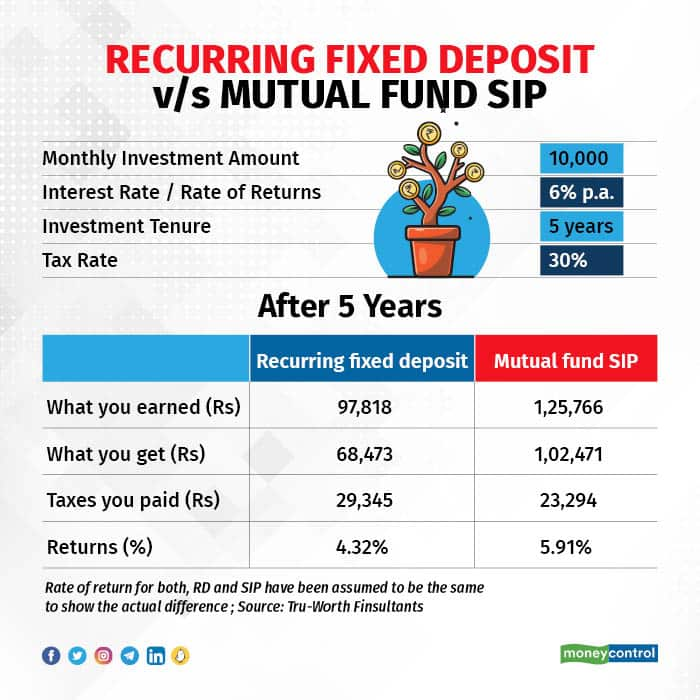

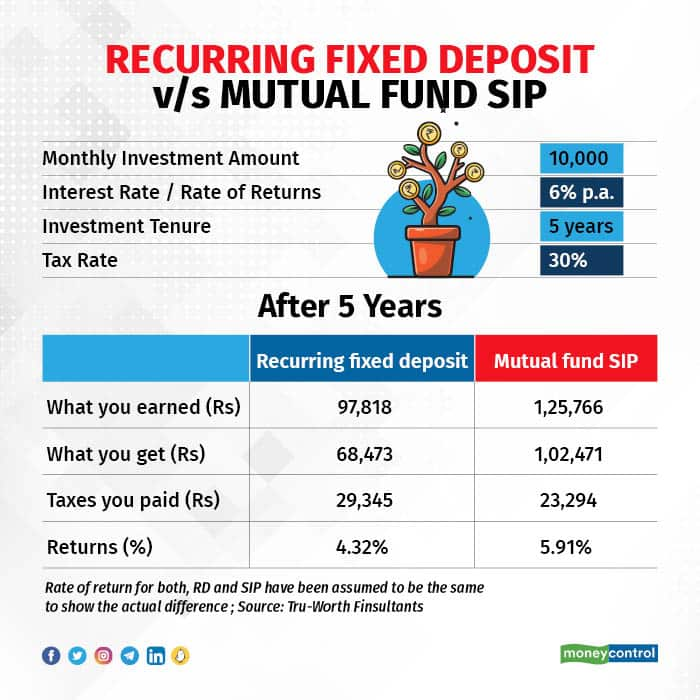

Recurring Deposit Or Mutual Fund SIP Which Is Better

How To Calculate SIP Returns In Mutual Fund SIP Return Kaise

https://fi.money/blog/posts/what-are-the-taxes-on...

1 Do we have to pay tax on SIPs in India Yes taxes are levied in India on SIPs The sort of mutual funds used in SIPs and the gains made from them determine how much tax is due 2 Are returns from a mutual fund investment taxable Yes returns from mutual fund investments are taxable

https://www.apnaplan.com/tax-on-sip

For Equity Mutual Funds Starting April 1 2018 Long Term Capital Gains of more than Rs 1 Lakh would be taxed at the rate of 10 4 including cess This was introduced in Budget 2018 Until last financial year FY 2016 17 the long term capital gains from equity funds were tax free

1 Do we have to pay tax on SIPs in India Yes taxes are levied in India on SIPs The sort of mutual funds used in SIPs and the gains made from them determine how much tax is due 2 Are returns from a mutual fund investment taxable Yes returns from mutual fund investments are taxable

For Equity Mutual Funds Starting April 1 2018 Long Term Capital Gains of more than Rs 1 Lakh would be taxed at the rate of 10 4 including cess This was introduced in Budget 2018 Until last financial year FY 2016 17 the long term capital gains from equity funds were tax free

The Power Of Compounding In SIP WealthDesk

Sip Plan For 5 Years Lic Sip Plan Details 2022 Best Short Term

Recurring Deposit Or Mutual Fund SIP Which Is Better

How To Calculate SIP Returns In Mutual Fund SIP Return Kaise

What Is Pre Tax Commuter Benefit

Calculate Tax On SIP In Mutual Funds

Calculate Tax On SIP In Mutual Funds

What Is Taxable Income Explanation Importance Calculation Bizness