Today, where screens rule our lives it's no wonder that the appeal of tangible printed materials hasn't faded away. If it's to aid in education for creative projects, simply adding an extra personal touch to your space, Single Tax Deduction 2023 are now a useful resource. Through this post, we'll take a dive through the vast world of "Single Tax Deduction 2023," exploring their purpose, where to find them, and the ways that they can benefit different aspects of your daily life.

Get Latest Single Tax Deduction 2023 Below

Single Tax Deduction 2023

Single Tax Deduction 2023 -

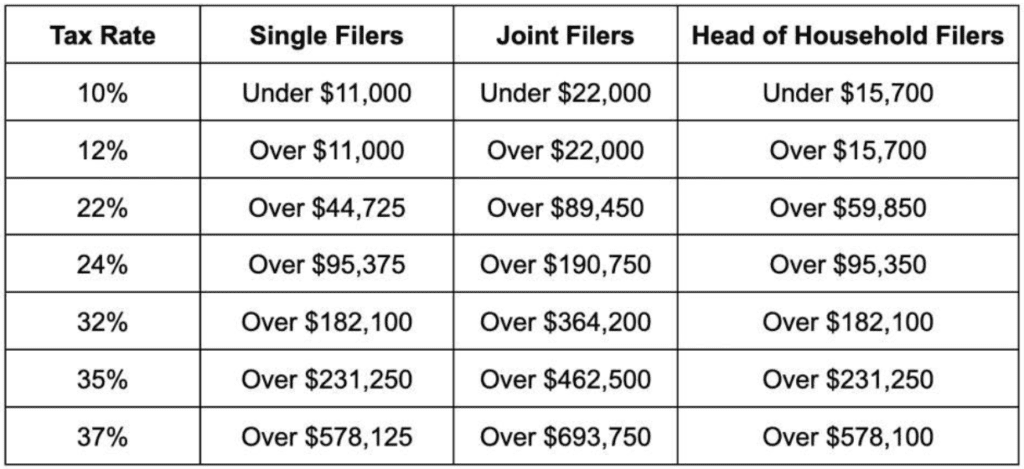

The IRS is increasing energy related tax breaks as well as standard deductions for single and married people and heads of households

The maximum Earned Income Tax Credit in 2023 for single and joint filers is 560 if the filer has no children Table 5 The maximum credit is 3 995 for one child 6 604 for two children and 7 430 for three or more

Single Tax Deduction 2023 include a broad assortment of printable, downloadable materials available online at no cost. They are available in a variety of types, such as worksheets templates, coloring pages, and many more. The benefit of Single Tax Deduction 2023 is their flexibility and accessibility.

More of Single Tax Deduction 2023

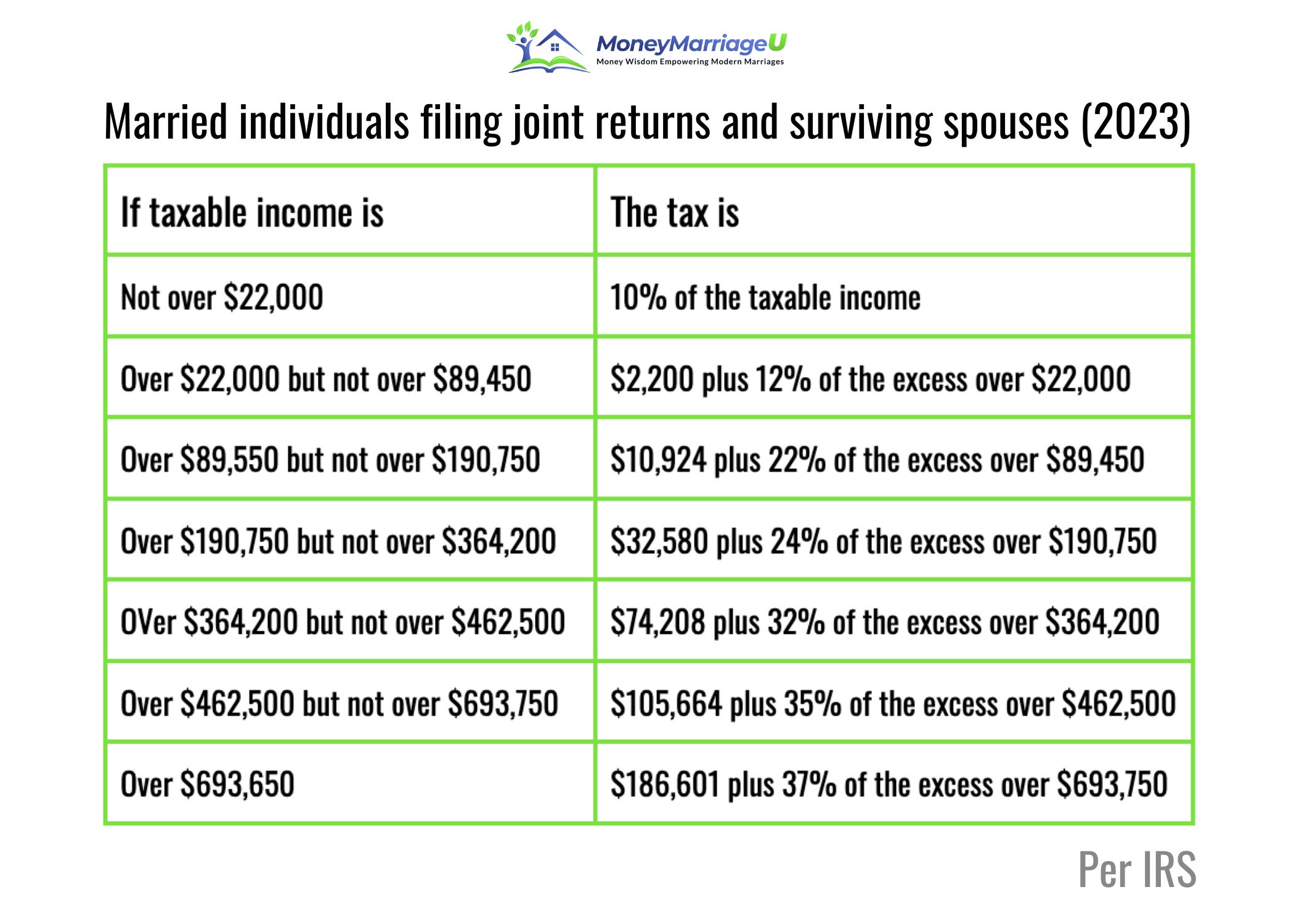

2022 Tax Brackets Married Filing Jointly Irs Printable Form

2022 Tax Brackets Married Filing Jointly Irs Printable Form

Introduction This publication discusses some tax rules that affect every person who may have to file a federal income tax return It answers some basic questions who must file who should

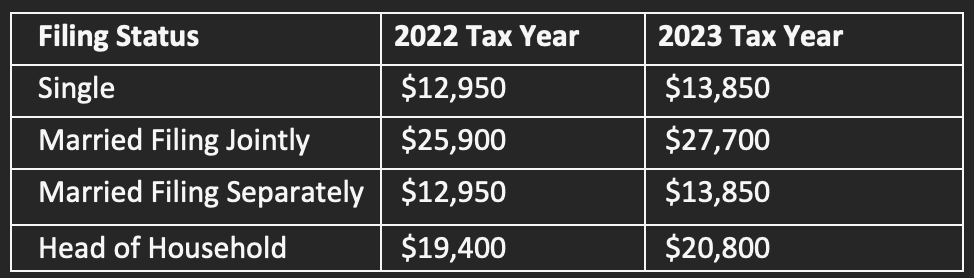

What s the Standard Deduction for 2023 and 2024 The standard deduction for tax year 2024 is 14 600 for singles 29 200 for joint filers and 21 900 for heads of household Learn more

Single Tax Deduction 2023 have gained a lot of popularity due to numerous compelling reasons:

-

Cost-Efficiency: They eliminate the necessity to purchase physical copies of the software or expensive hardware.

-

Personalization It is possible to tailor print-ready templates to your specific requirements whether you're designing invitations and schedules, or even decorating your home.

-

Educational value: Printing educational materials for no cost provide for students from all ages, making them a great device for teachers and parents.

-

Easy to use: You have instant access a plethora of designs and templates is time-saving and saves effort.

Where to Find more Single Tax Deduction 2023

2023 IRS Standard Deduction

2023 IRS Standard Deduction

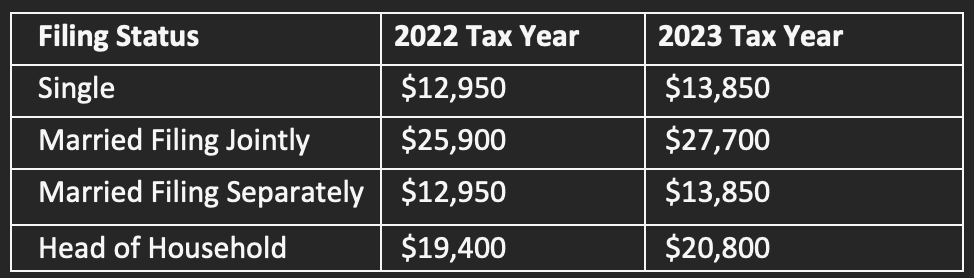

The 2023 standard deduction for single taxpayers and married filing separately will be 13 850 This is a jump of 900 from the 2022 standard deduction You may be wondering

For a married couple filing a joint tax return that deduction will jump to 27 700 in 2023 from 25 900 in 2022 for singles and couples filing separately it will rise to 13 850 from 12 950

If we've already piqued your interest in printables for free we'll explore the places you can find these elusive treasures:

1. Online Repositories

- Websites like Pinterest, Canva, and Etsy provide a wide selection and Single Tax Deduction 2023 for a variety purposes.

- Explore categories like decorating your home, education, organisation, as well as crafts.

2. Educational Platforms

- Forums and websites for education often provide worksheets that can be printed for free with flashcards and other teaching tools.

- Perfect for teachers, parents as well as students searching for supplementary resources.

3. Creative Blogs

- Many bloggers share their innovative designs and templates for free.

- These blogs cover a broad range of interests, all the way from DIY projects to party planning.

Maximizing Single Tax Deduction 2023

Here are some fresh ways to make the most use of printables for free:

1. Home Decor

- Print and frame beautiful artwork, quotes, or decorations for the holidays to beautify your living spaces.

2. Education

- Use these printable worksheets free of charge for reinforcement of learning at home for the classroom.

3. Event Planning

- Make invitations, banners and decorations for special occasions like birthdays and weddings.

4. Organization

- Make sure you are organized with printable calendars including to-do checklists, daily lists, and meal planners.

Conclusion

Single Tax Deduction 2023 are an abundance filled with creative and practical information that cater to various needs and preferences. Their access and versatility makes these printables a useful addition to both personal and professional life. Explore the world of Single Tax Deduction 2023 now and discover new possibilities!

Frequently Asked Questions (FAQs)

-

Are printables that are free truly for free?

- Yes, they are! You can print and download the resources for free.

-

Can I use free printables to make commercial products?

- It's contingent upon the specific usage guidelines. Always verify the guidelines provided by the creator prior to printing printables for commercial projects.

-

Do you have any copyright issues in Single Tax Deduction 2023?

- Some printables may have restrictions in use. Be sure to check the terms and regulations provided by the creator.

-

How can I print printables for free?

- You can print them at home using any printer or head to the local print shop for top quality prints.

-

What program must I use to open Single Tax Deduction 2023?

- The majority of printables are with PDF formats, which is open with no cost software like Adobe Reader.

The 2023 Tax Brackets By Income Modern Husbands Free Nude Porn Photos

Oct 19 Irs Here Are The New Income Tax Brackets For 2023 Free Nude

Check more sample of Single Tax Deduction 2023 below

2022 Tax Brackets KrissDaemon

Should You Take The Standard Deduction On Your 2021 2022 Taxes

Your First Look At 2023 Tax Brackets Deductions And Credits 3

2023 IRS Inflation Adjustments Tax Brackets Standard Deduction EITC

Federal Income Tax Deduction Chart My XXX Hot Girl

/dotdash_Final_What_Tax_Breaks_Are_Afforded_to_a_Qualifying_Widow_Nov_2020-01-c5d6697fa005491f8a0049780f7c2b82.jpg)

Tax Rates Absolute Accounting Services

https://taxfoundation.org/data/all/feder…

The maximum Earned Income Tax Credit in 2023 for single and joint filers is 560 if the filer has no children Table 5 The maximum credit is 3 995 for one child 6 604 for two children and 7 430 for three or more

https://money.usnews.com/money/pers…

These are the standard deduction amounts for tax year 2023 Married couples filing jointly 27 700 an 1 800 increase from 2022 Single taxpayers 13 850 a 900 increase from 2022

The maximum Earned Income Tax Credit in 2023 for single and joint filers is 560 if the filer has no children Table 5 The maximum credit is 3 995 for one child 6 604 for two children and 7 430 for three or more

These are the standard deduction amounts for tax year 2023 Married couples filing jointly 27 700 an 1 800 increase from 2022 Single taxpayers 13 850 a 900 increase from 2022

2023 IRS Inflation Adjustments Tax Brackets Standard Deduction EITC

Should You Take The Standard Deduction On Your 2021 2022 Taxes

/dotdash_Final_What_Tax_Breaks_Are_Afforded_to_a_Qualifying_Widow_Nov_2020-01-c5d6697fa005491f8a0049780f7c2b82.jpg)

Federal Income Tax Deduction Chart My XXX Hot Girl

Tax Rates Absolute Accounting Services

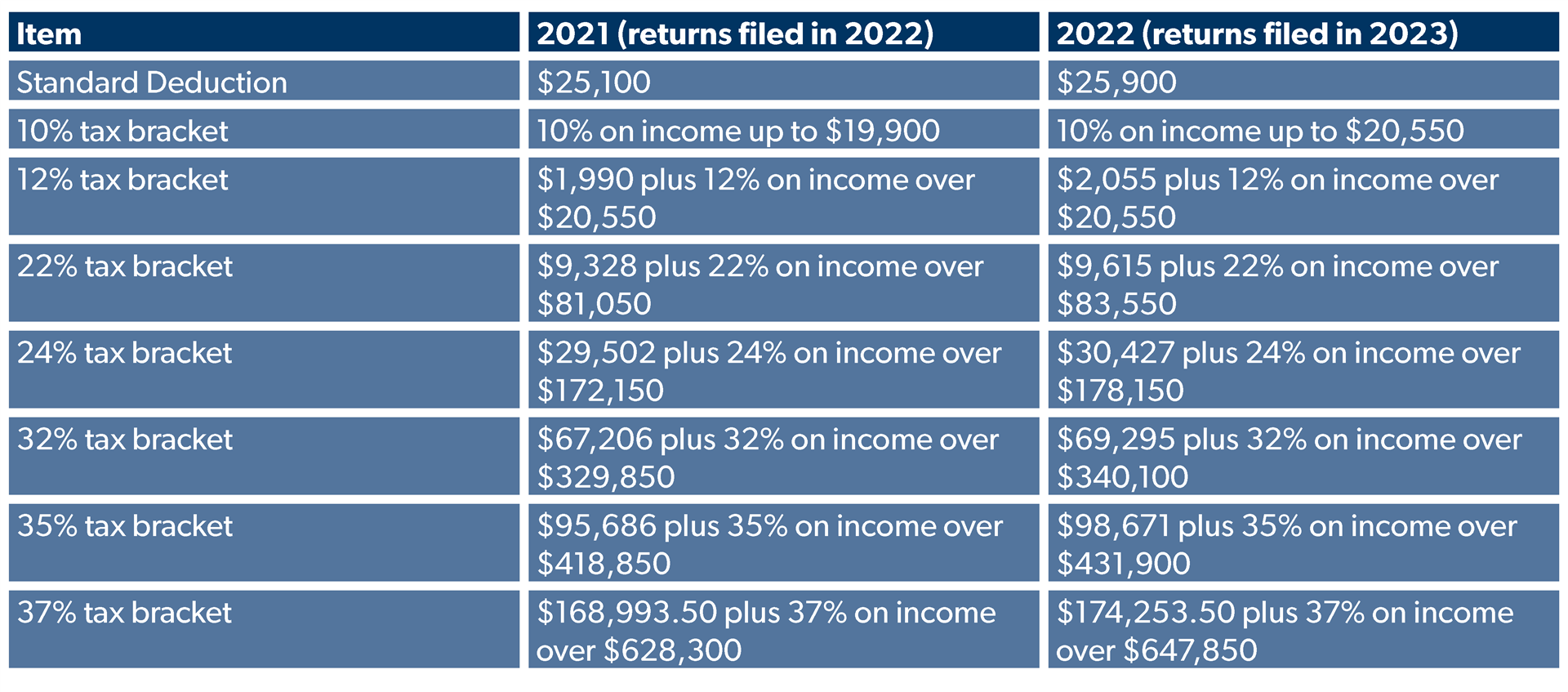

2023 Tax Bracket Changes And IRS Annual Inflation Adjustments

2023 Tax Brackets And Tax Code PriorTax Blog

2023 Tax Brackets And Tax Code PriorTax Blog

2021 Taxes For Retirees Explained Cardinal Guide