In the age of digital, where screens rule our lives, the charm of tangible printed materials isn't diminishing. Whether it's for educational purposes or creative projects, or simply adding some personal flair to your area, Should I Take An Inherited Annuity In A Lump Sum are now a useful source. For this piece, we'll take a dive through the vast world of "Should I Take An Inherited Annuity In A Lump Sum," exploring the benefits of them, where they are, and how they can enhance various aspects of your lives.

Get Latest Should I Take An Inherited Annuity In A Lump Sum Below

Should I Take An Inherited Annuity In A Lump Sum

Should I Take An Inherited Annuity In A Lump Sum -

Take a lump sum payout Take the full amount in installments paid over the next five years Receive the annuity in regular installments over your lifetime You have 60 days to

If you have in fact inherited a qualified annuity whether you choose to receive payments take the full amount as a lump sum distribution or roll it into an inherited IRA will

Should I Take An Inherited Annuity In A Lump Sum cover a large assortment of printable materials online, at no cost. They are available in a variety of types, such as worksheets coloring pages, templates and more. The beauty of Should I Take An Inherited Annuity In A Lump Sum is their versatility and accessibility.

More of Should I Take An Inherited Annuity In A Lump Sum

Case Study Investing An Inherited Lump Sum

Case Study Investing An Inherited Lump Sum

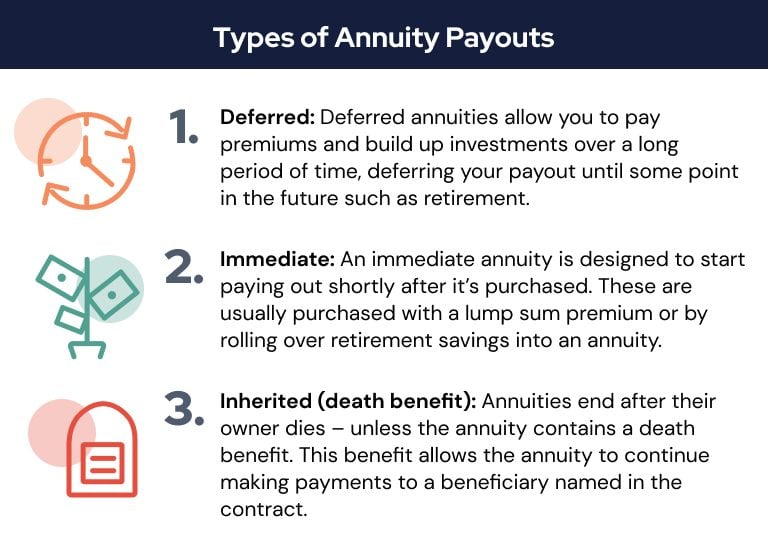

Payouts of inherited annuities must follow certain distribution rules most beneficiaries that choose not to immediately withdraw the death benefit in a lump sum will either need to follow a five year rule or a life expectancy payout

Heirs can take an annuity death benefit as a lump sum payment or as regular periodic payouts Lump Sum Payment With a lump sum payment the designated beneficiary receives the balance of the annuity and will need to manage the

Should I Take An Inherited Annuity In A Lump Sum have risen to immense popularity due to a myriad of compelling factors:

-

Cost-Effective: They eliminate the need to buy physical copies or expensive software.

-

Customization: Your HTML0 customization options allow you to customize print-ready templates to your specific requirements whether it's making invitations, organizing your schedule, or decorating your home.

-

Educational Impact: Free educational printables offer a wide range of educational content for learners from all ages, making them a valuable tool for teachers and parents.

-

Affordability: Instant access to a plethora of designs and templates, which saves time as well as effort.

Where to Find more Should I Take An Inherited Annuity In A Lump Sum

Inherited Annuity Taxation Irs Garth Ratcliff

Inherited Annuity Taxation Irs Garth Ratcliff

Yes you can cash it out If dad dies and you re the beneficiary of that annuity you have the opportunity with most policies not all to cash out Unfortunately it s like herding

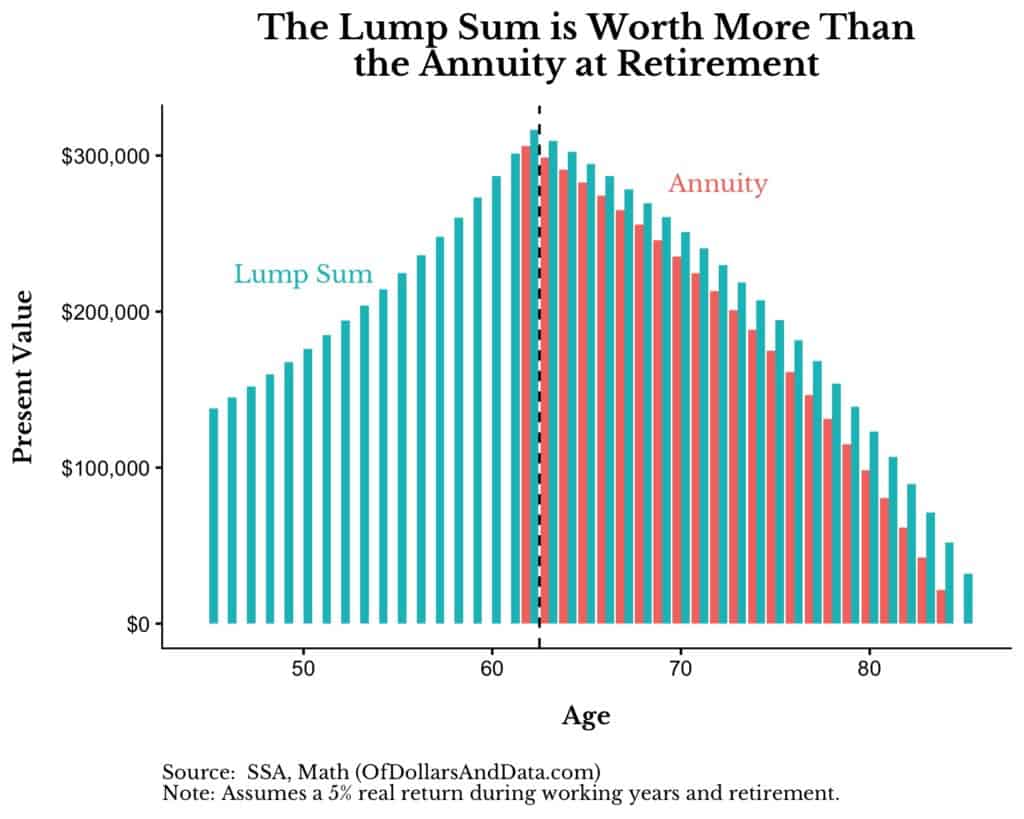

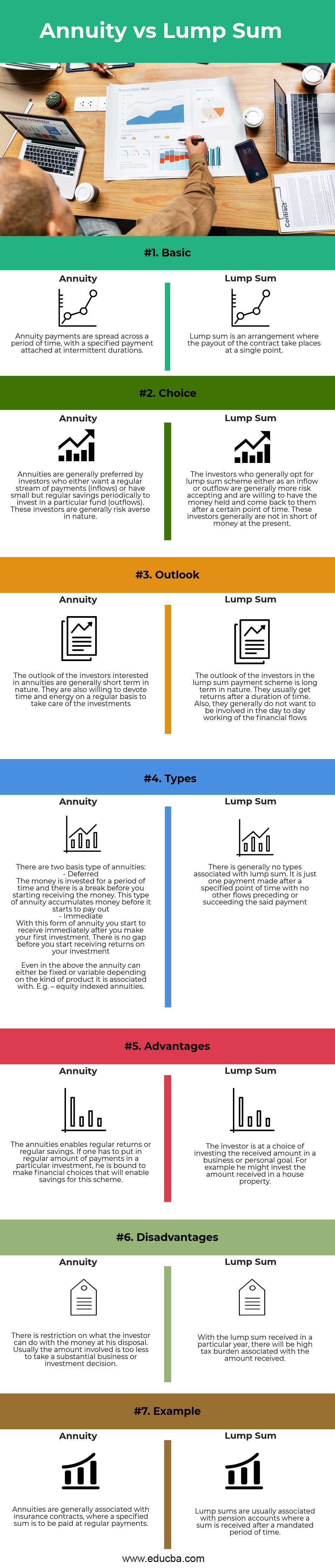

A lump sum distribution allows you to receive the entire annuity amount at once This option is straightforward but comes with immediate tax implications The inherited amount is considered taxable income for the year you receive it

In the event that we've stirred your interest in Should I Take An Inherited Annuity In A Lump Sum Let's take a look at where you can find these elusive treasures:

1. Online Repositories

- Websites such as Pinterest, Canva, and Etsy offer a huge selection and Should I Take An Inherited Annuity In A Lump Sum for a variety reasons.

- Explore categories such as furniture, education, the arts, and more.

2. Educational Platforms

- Forums and educational websites often provide worksheets that can be printed for free or flashcards as well as learning tools.

- Perfect for teachers, parents and students looking for extra sources.

3. Creative Blogs

- Many bloggers are willing to share their original designs and templates free of charge.

- These blogs cover a wide array of topics, ranging ranging from DIY projects to party planning.

Maximizing Should I Take An Inherited Annuity In A Lump Sum

Here are some new ways how you could make the most of printables that are free:

1. Home Decor

- Print and frame gorgeous images, quotes, and seasonal decorations, to add a touch of elegance to your living spaces.

2. Education

- Utilize free printable worksheets to build your knowledge at home (or in the learning environment).

3. Event Planning

- Design invitations, banners and decorations for special events like birthdays and weddings.

4. Organization

- Stay organized with printable calendars as well as to-do lists and meal planners.

Conclusion

Should I Take An Inherited Annuity In A Lump Sum are an abundance of practical and innovative resources that can meet the needs of a variety of people and pursuits. Their availability and versatility make them a fantastic addition to each day life. Explore the plethora of printables for free today and explore new possibilities!

Frequently Asked Questions (FAQs)

-

Are Should I Take An Inherited Annuity In A Lump Sum really gratis?

- Yes, they are! You can download and print the resources for free.

-

Does it allow me to use free printables to make commercial products?

- It's all dependent on the usage guidelines. Always verify the guidelines of the creator before using their printables for commercial projects.

-

Are there any copyright rights issues with Should I Take An Inherited Annuity In A Lump Sum?

- Certain printables may be subject to restrictions regarding their use. Be sure to review the conditions and terms of use provided by the designer.

-

How do I print printables for free?

- You can print them at home with your printer or visit a print shop in your area for more high-quality prints.

-

What program do I require to view printables free of charge?

- The majority of printed documents are in the format of PDF, which is open with no cost programs like Adobe Reader.

Inherited Annuity Definition Types Pros Cons Rules Options Taxes

Lottery Lump Sum Vs Annuity Which Payout Option Lottery Blog

Check more sample of Should I Take An Inherited Annuity In A Lump Sum below

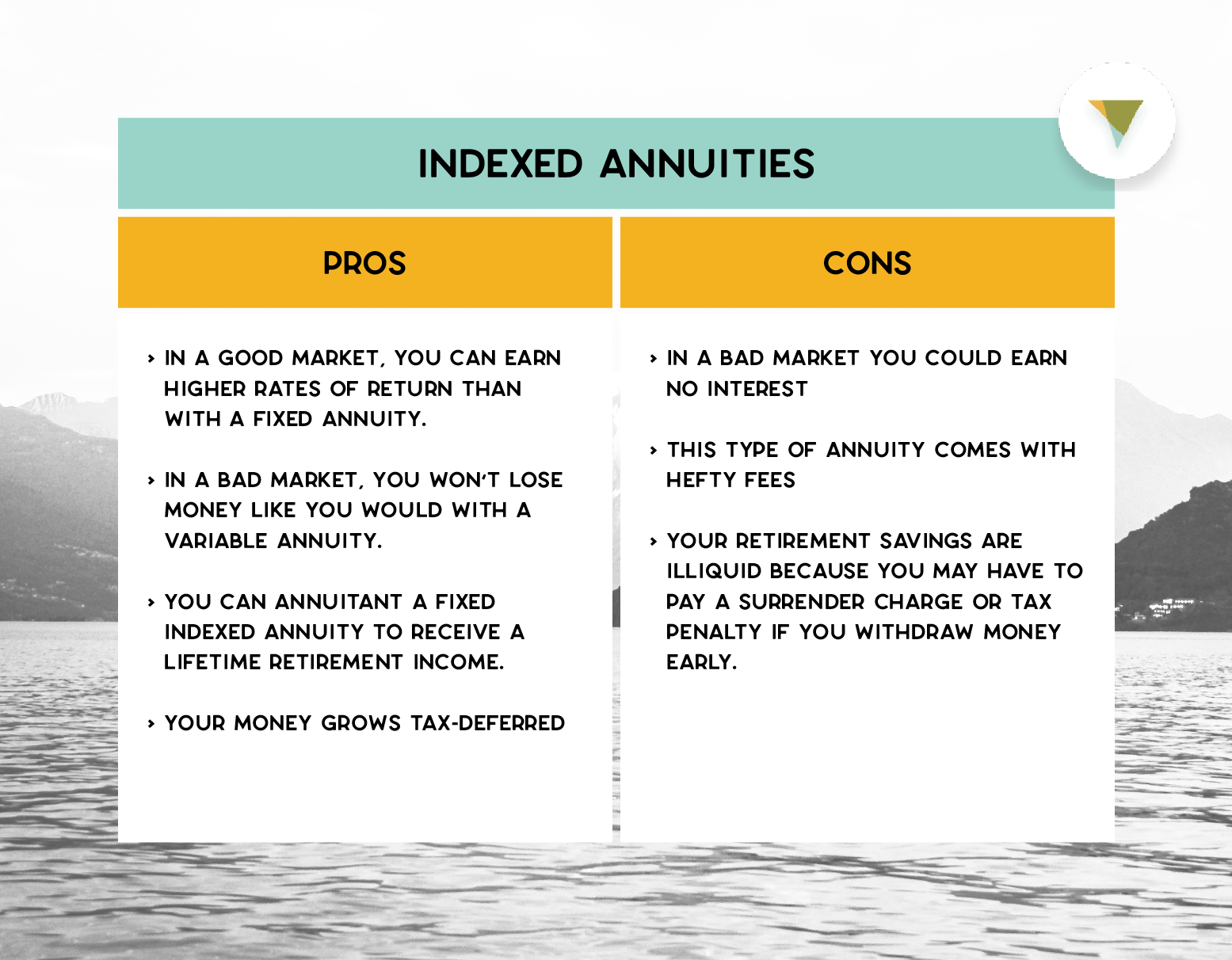

How Does An Indexed Annuity Differ From A Fixed Annuity

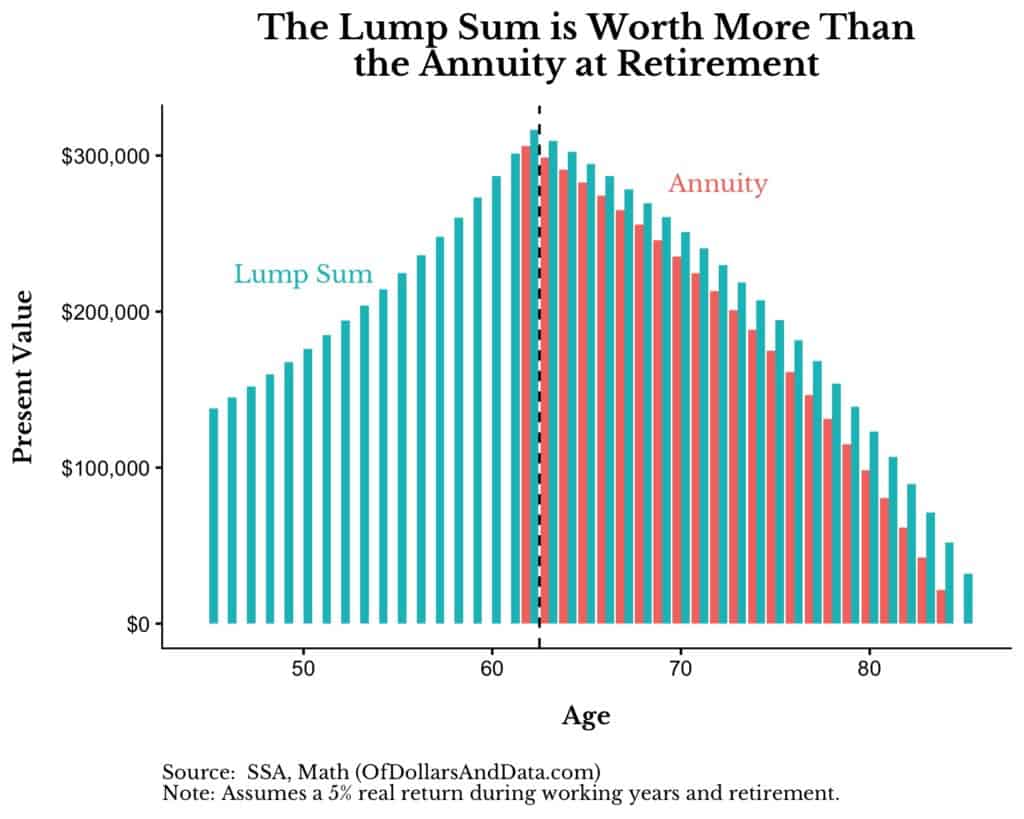

Should You Take The Annuity Or The Lump Sum Of Dollars And Data

Lump Sum Payment Definition Example Tax Implications

Lump Sum In Malay Tips To Take Retirement Money As Lump Sum Or

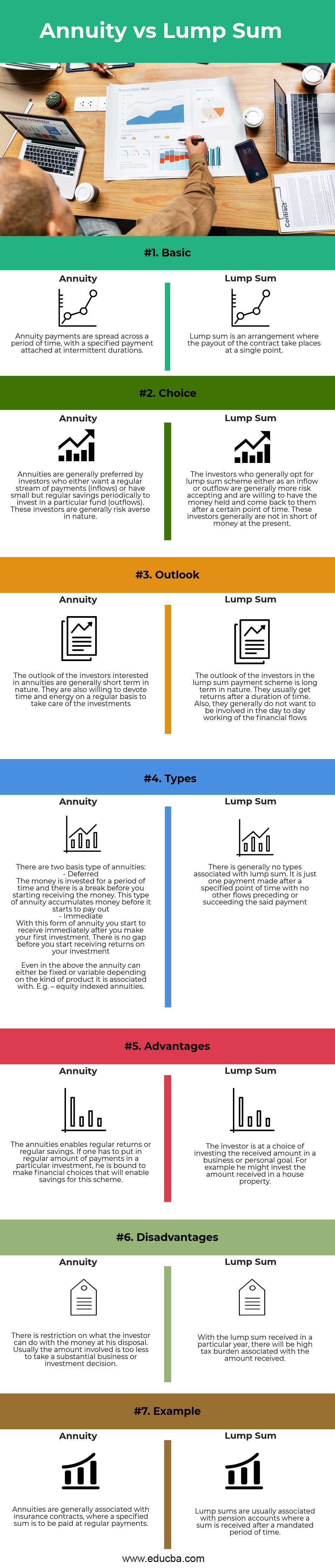

Annuity Vs Lump Sum Top 7 Useful Differences To Know

5 Things To Know About Required Minimum Distributions AZ IRA Real Estate

https://smartasset.com/financial-advisor/ask-an-advisor-annuity-beneficiary

If you have in fact inherited a qualified annuity whether you choose to receive payments take the full amount as a lump sum distribution or roll it into an inherited IRA will

https://www.annuity.org/annuities/inheriting-an-annuity

When you inherit an annuity from a parent you can choose to get a lump sum payout stretch the payments out over your lifetime or disclaim the annuity altogether A lump

If you have in fact inherited a qualified annuity whether you choose to receive payments take the full amount as a lump sum distribution or roll it into an inherited IRA will

When you inherit an annuity from a parent you can choose to get a lump sum payout stretch the payments out over your lifetime or disclaim the annuity altogether A lump

Lump Sum In Malay Tips To Take Retirement Money As Lump Sum Or

Should You Take The Annuity Or The Lump Sum Of Dollars And Data

Annuity Vs Lump Sum Top 7 Useful Differences To Know

5 Things To Know About Required Minimum Distributions AZ IRA Real Estate

The Difference Between Ordinary Annuity And Annuity Due

:max_bytes(150000):strip_icc()/Term-a-annuity-d4d5906faea940828244ef128f416cc5.jpg)

Guide To Annuities What They Are Types And How They Work

:max_bytes(150000):strip_icc()/Term-a-annuity-d4d5906faea940828244ef128f416cc5.jpg)

Guide To Annuities What They Are Types And How They Work

Lump Sum Vs Annuity Pay Out Webinar With Peter Song View Financial