In this day and age in which screens are the norm and the appeal of physical printed objects hasn't waned. It doesn't matter if it's for educational reasons such as creative projects or simply to add an extra personal touch to your home, printables for free have proven to be a valuable resource. We'll take a dive deeper into "Should I Make A Non Deductible Ira Contribution," exploring what they are, where they can be found, and ways they can help you improve many aspects of your daily life.

Get Latest Should I Make A Non Deductible Ira Contribution Below

Should I Make A Non Deductible Ira Contribution

Should I Make A Non Deductible Ira Contribution -

A non deductible IRA is a retirement account that behaves like a traditional IRA except that it is funded with after tax dollars Here s how it works

Anyone with earned income can make a non deductible after tax contribution to an IRA and benefit from tax deferred growth But it may not be worth it due in part to often

The Should I Make A Non Deductible Ira Contribution are a huge selection of printable and downloadable content that can be downloaded from the internet at no cost. They come in many designs, including worksheets coloring pages, templates and many more. The appealingness of Should I Make A Non Deductible Ira Contribution is in their versatility and accessibility.

More of Should I Make A Non Deductible Ira Contribution

Simple Ira Contribution Rules Choosing Your Gold IRA

Simple Ira Contribution Rules Choosing Your Gold IRA

A nondeductible IRA is a retirement savings account to which you contribute after tax dollars but that allows you to grow your money for retirement without paying taxes until gains are

The name gives it away A nondeductible IRA is a traditional IRA for which you don t get an immediate tax deduction for your contributions While there s no tax benefit for these contributions

The Should I Make A Non Deductible Ira Contribution have gained huge popularity due to several compelling reasons:

-

Cost-Efficiency: They eliminate the necessity of purchasing physical copies of the software or expensive hardware.

-

customization There is the possibility of tailoring designs to suit your personal needs in designing invitations making your schedule, or even decorating your house.

-

Educational Impact: Printables for education that are free are designed to appeal to students of all ages, making them a useful resource for educators and parents.

-

Accessibility: Instant access to a plethora of designs and templates saves time and effort.

Where to Find more Should I Make A Non Deductible Ira Contribution

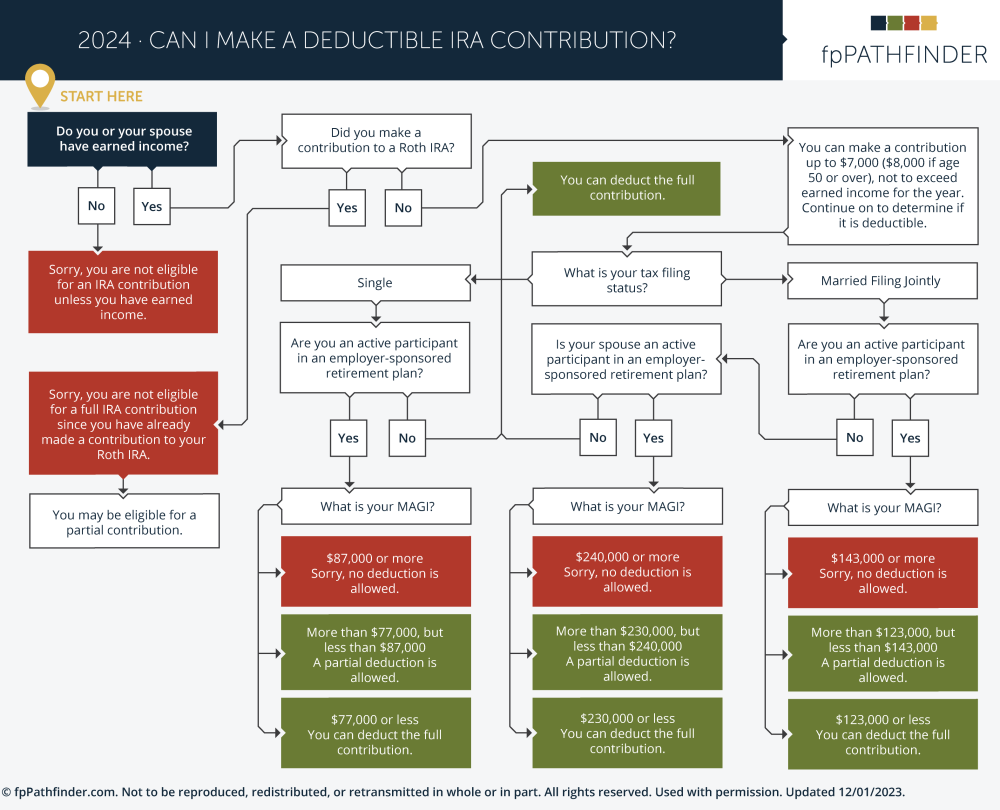

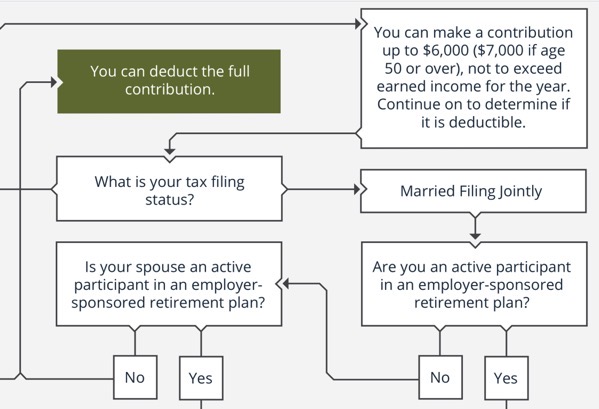

Can I Make A Deductible IRA Contribution FpPathfinder Guides

Can I Make A Deductible IRA Contribution FpPathfinder Guides

Everything you need to know about nondeductible IRAs and what to do if it s your only IRA option

Key Takeaways Form 8606 is a tax form distributed by the Internal Revenue Service IRS and used by filers who make nondeductible contributions to an individual retirement account IRA Any

After we've peaked your interest in Should I Make A Non Deductible Ira Contribution Let's take a look at where they are hidden treasures:

1. Online Repositories

- Websites like Pinterest, Canva, and Etsy offer an extensive collection of printables that are free for a variety of purposes.

- Explore categories like the home, decor, the arts, and more.

2. Educational Platforms

- Educational websites and forums usually provide free printable worksheets as well as flashcards and other learning tools.

- Great for parents, teachers, and students seeking supplemental sources.

3. Creative Blogs

- Many bloggers share their imaginative designs with templates and designs for free.

- The blogs covered cover a wide array of topics, ranging starting from DIY projects to party planning.

Maximizing Should I Make A Non Deductible Ira Contribution

Here are some ways how you could make the most of printables for free:

1. Home Decor

- Print and frame beautiful artwork, quotes or other seasonal decorations to fill your living spaces.

2. Education

- Utilize free printable worksheets to enhance learning at home as well as in the class.

3. Event Planning

- Make invitations, banners and decorations for special occasions like weddings and birthdays.

4. Organization

- Get organized with printable calendars as well as to-do lists and meal planners.

Conclusion

Should I Make A Non Deductible Ira Contribution are a treasure trove of useful and creative resources designed to meet a range of needs and interests. Their access and versatility makes them an essential part of each day life. Explore the vast array of Should I Make A Non Deductible Ira Contribution and explore new possibilities!

Frequently Asked Questions (FAQs)

-

Are printables available for download really available for download?

- Yes you can! You can print and download the resources for free.

-

Can I download free templates for commercial use?

- It's all dependent on the usage guidelines. Always review the terms of use for the creator prior to using the printables in commercial projects.

-

Are there any copyright issues with printables that are free?

- Some printables could have limitations regarding usage. Always read the terms and regulations provided by the creator.

-

How can I print Should I Make A Non Deductible Ira Contribution?

- You can print them at home using either a printer or go to any local print store for high-quality prints.

-

What program do I need to open printables at no cost?

- Many printables are offered with PDF formats, which is open with no cost software such as Adobe Reader.

What Is A Non deductible IRA Empower

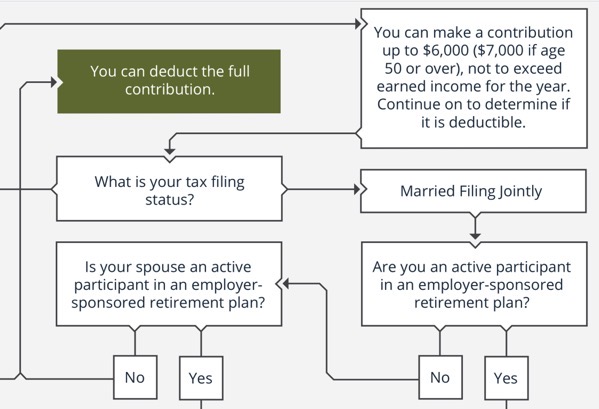

Can I Make A Deductible IRA Contribution Echo45 Advisors

Check more sample of Should I Make A Non Deductible Ira Contribution below

Can A Non Working Spouse Make A Non Deductible IRA Contribution

Deductible IRA Contribution Independent Fiduciary Advisor

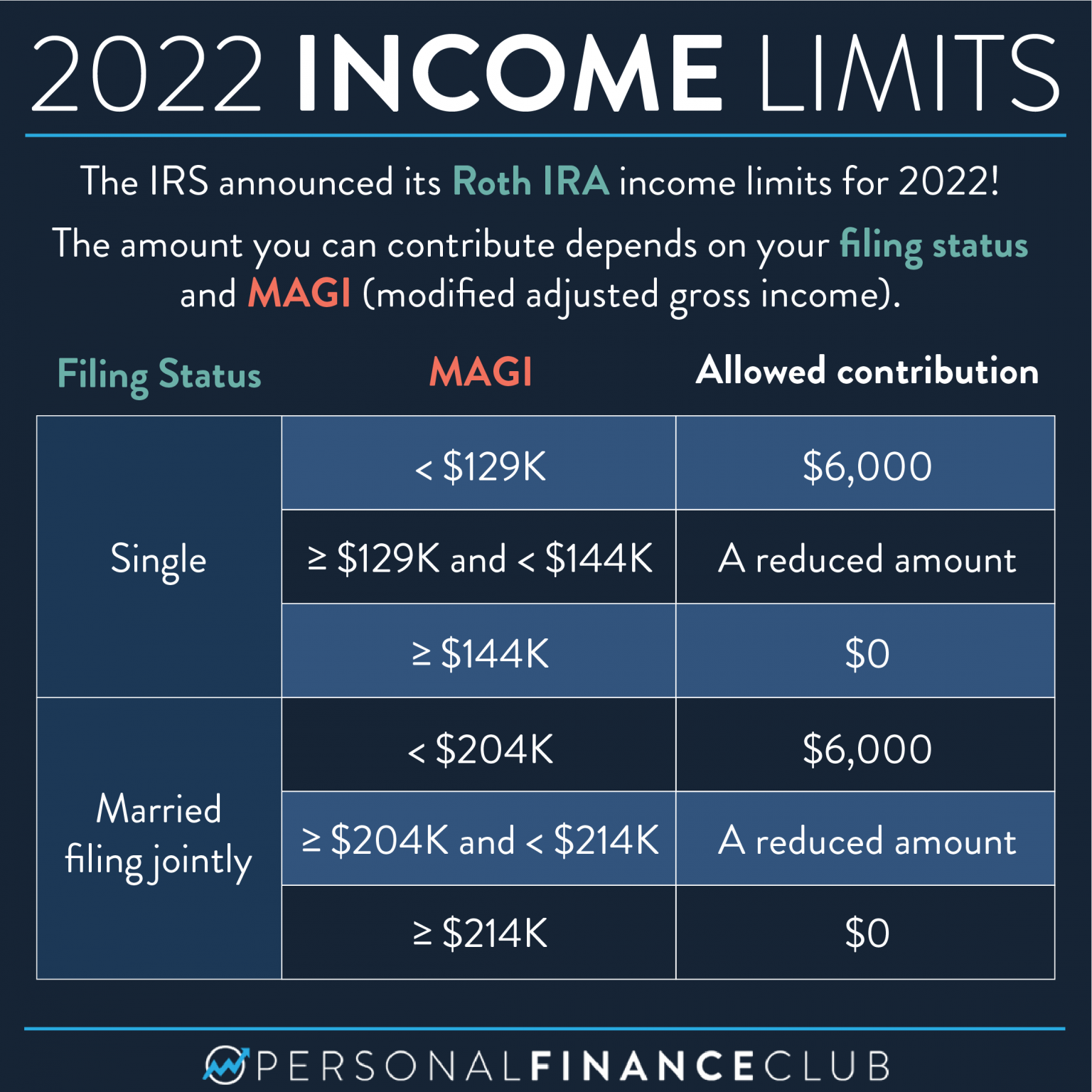

2022 RETIREMENT ACCOUNT CONTRIBUTION LIMITS ANNOUNCED Day Hagan

What Is A Non Deductible IRA SoFi

Non Deductible IRA Contribution Vs Taxable Brokerage Account Savings

Tabela Salarial 2023 Irs Contribution Limits IMAGESEE

https://www.forbes.com › sites › kristinmckenna › ...

Anyone with earned income can make a non deductible after tax contribution to an IRA and benefit from tax deferred growth But it may not be worth it due in part to often

https://www.financestrategists.com › retir…

A Non Deductible IRA is a special type of Individual Retirement Arrangement in which when an IRA is opened or started the contributions that are made into it are not deductible from the investor s federal income taxes

Anyone with earned income can make a non deductible after tax contribution to an IRA and benefit from tax deferred growth But it may not be worth it due in part to often

A Non Deductible IRA is a special type of Individual Retirement Arrangement in which when an IRA is opened or started the contributions that are made into it are not deductible from the investor s federal income taxes

What Is A Non Deductible IRA SoFi

Deductible IRA Contribution Independent Fiduciary Advisor

Non Deductible IRA Contribution Vs Taxable Brokerage Account Savings

Tabela Salarial 2023 Irs Contribution Limits IMAGESEE

Make A Deductible IRA Contribution For 2018 It s Not Too Late

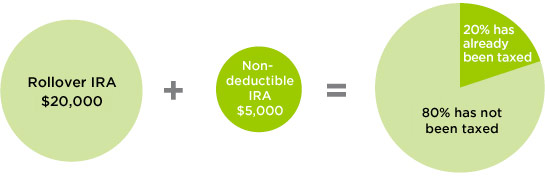

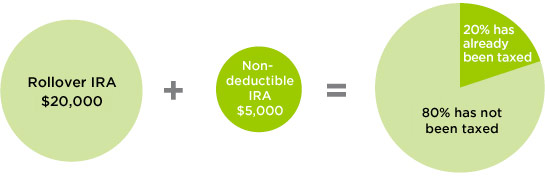

Non deductible IRA Contributions And Roth Conversions Putnam Wealth

Non deductible IRA Contributions And Roth Conversions Putnam Wealth

2023 IRS Contribution Limits And Tax Rates By Kristin McKenna Harvest