In a world where screens have become the dominant feature of our lives and our lives are dominated by screens, the appeal of tangible printed objects isn't diminished. If it's to aid in education for creative projects, simply adding personal touches to your area, Senior Citizen Medical Insurance Tax Rebate have become an invaluable source. The following article is a dive deeper into "Senior Citizen Medical Insurance Tax Rebate," exploring the benefits of them, where to find them and how they can improve various aspects of your lives.

Get Latest Senior Citizen Medical Insurance Tax Rebate Below

Senior Citizen Medical Insurance Tax Rebate

Senior Citizen Medical Insurance Tax Rebate -

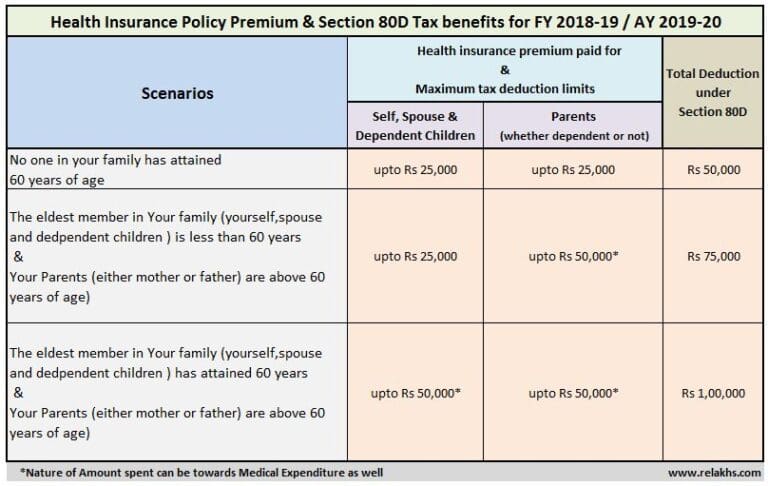

Web Tax benefits with respect to medical insurance and expenditure According to Section 80D of the Income Tax Act Senior Citizens may avail a higher deduction of up to 50 000

Web As per Section 80D medical expenses paid on the maintenance of senior citizens without any health insurance policy are eligible for a tax deduction of up to Rs 50 000 per

The Senior Citizen Medical Insurance Tax Rebate are a huge array of printable documents that can be downloaded online at no cost. They come in many forms, like worksheets templates, coloring pages and more. The beauty of Senior Citizen Medical Insurance Tax Rebate lies in their versatility and accessibility.

More of Senior Citizen Medical Insurance Tax Rebate

World Senior Citizen s Day 2022 From Tax Rebates To Medical Insurance

World Senior Citizen s Day 2022 From Tax Rebates To Medical Insurance

Web 2 d 233 c 2022 nbsp 0183 32 Under the amended 80D for senior citizens tax rebate of up to 50 000 can be claimed for the following health related expenses Preventative health check ups

Web 9 mars 2022 nbsp 0183 32 When you file income tax returns do not forget to include the income tax rebate for senior citizens that you can avail of under Section 80D of the Income Tax

Senior Citizen Medical Insurance Tax Rebate have gained immense popularity because of a number of compelling causes:

-

Cost-Efficiency: They eliminate the need to purchase physical copies or expensive software.

-

Modifications: The Customization feature lets you tailor print-ready templates to your specific requirements be it designing invitations or arranging your schedule or even decorating your house.

-

Educational Value: The free educational worksheets can be used by students from all ages, making these printables a powerful device for teachers and parents.

-

It's easy: You have instant access a myriad of designs as well as templates cuts down on time and efforts.

Where to Find more Senior Citizen Medical Insurance Tax Rebate

Health Insurance Tax Benefits u s 80D For FY 2018 19 AY 2019 20

Health Insurance Tax Benefits u s 80D For FY 2018 19 AY 2019 20

Web After the introduction of this amendment the total deduction allowed to super senior citizens for payment Medical Insurance Premium Medical Expenses is Rs 30 000

Web 20 janv 2023 nbsp 0183 32 As per Section 80D of the Income Tax Act senior citizens can claim a maximum deduction of Rs 50 000 per annum incurred on medical expenses provided

We hope we've stimulated your interest in Senior Citizen Medical Insurance Tax Rebate Let's take a look at where you can discover these hidden gems:

1. Online Repositories

- Websites like Pinterest, Canva, and Etsy have a large selection of printables that are free for a variety of goals.

- Explore categories like design, home decor, organization, and crafts.

2. Educational Platforms

- Forums and websites for education often provide worksheets that can be printed for free or flashcards as well as learning tools.

- Perfect for teachers, parents as well as students who require additional resources.

3. Creative Blogs

- Many bloggers offer their unique designs and templates for free.

- These blogs cover a broad range of topics, including DIY projects to party planning.

Maximizing Senior Citizen Medical Insurance Tax Rebate

Here are some innovative ways that you can make use of Senior Citizen Medical Insurance Tax Rebate:

1. Home Decor

- Print and frame gorgeous images, quotes, or even seasonal decorations to decorate your living spaces.

2. Education

- Print free worksheets for teaching at-home as well as in the class.

3. Event Planning

- Design invitations for banners, invitations and decorations for special events such as weddings or birthdays.

4. Organization

- Be organized by using printable calendars with to-do lists, planners, and meal planners.

Conclusion

Senior Citizen Medical Insurance Tax Rebate are a treasure trove filled with creative and practical information catering to different needs and hobbies. Their accessibility and versatility make them an essential part of every aspect of your life, both professional and personal. Explore the many options of Senior Citizen Medical Insurance Tax Rebate right now and discover new possibilities!

Frequently Asked Questions (FAQs)

-

Are Senior Citizen Medical Insurance Tax Rebate really for free?

- Yes you can! You can print and download these free resources for no cost.

-

Do I have the right to use free printables in commercial projects?

- It's all dependent on the usage guidelines. Always consult the author's guidelines before using their printables for commercial projects.

-

Do you have any copyright concerns with printables that are free?

- Certain printables could be restricted on their use. Be sure to check the terms and conditions provided by the author.

-

How can I print Senior Citizen Medical Insurance Tax Rebate?

- Print them at home using the printer, or go to a print shop in your area for top quality prints.

-

What software do I require to view printables at no cost?

- The majority are printed as PDF files, which is open with no cost software such as Adobe Reader.

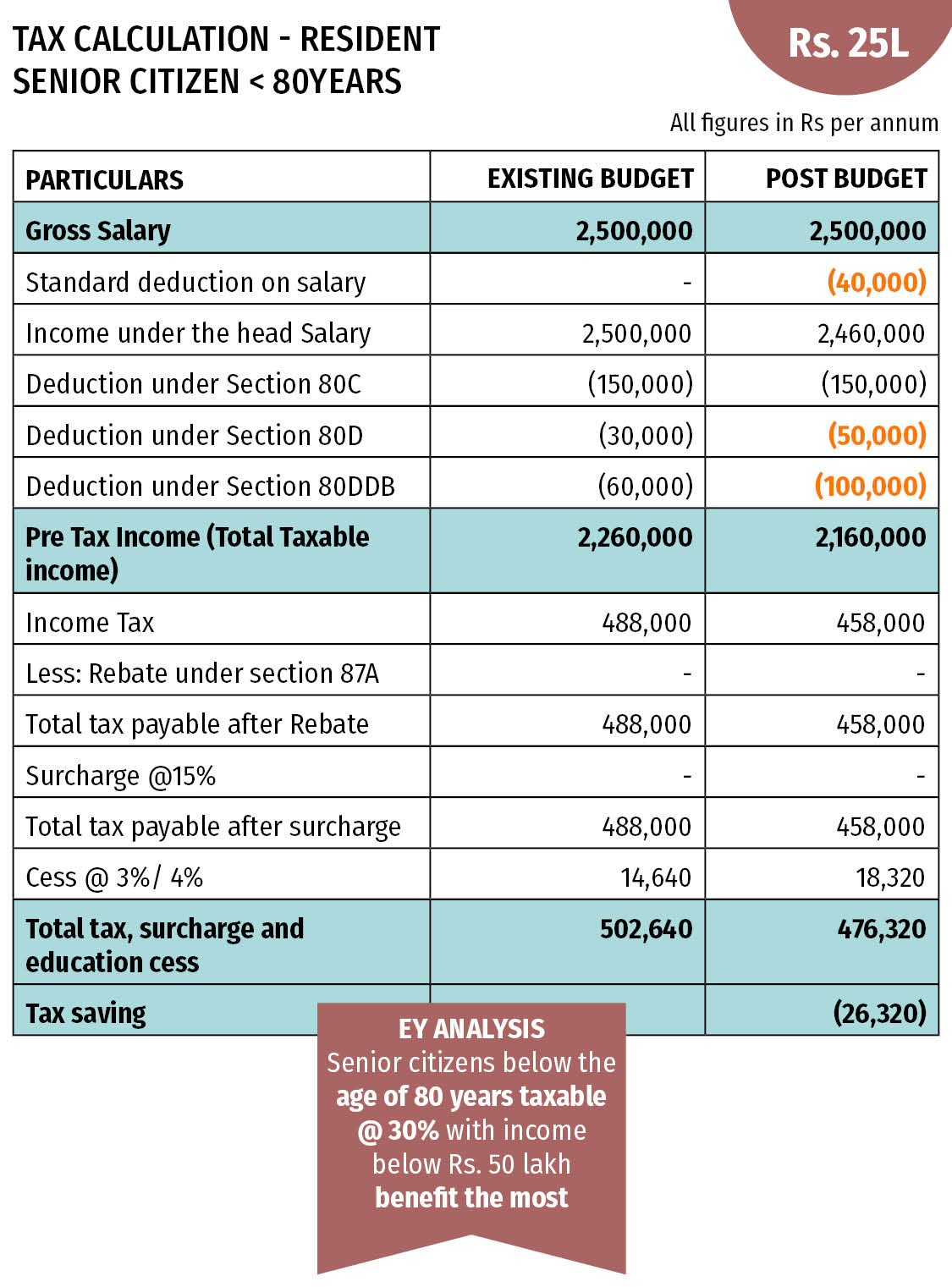

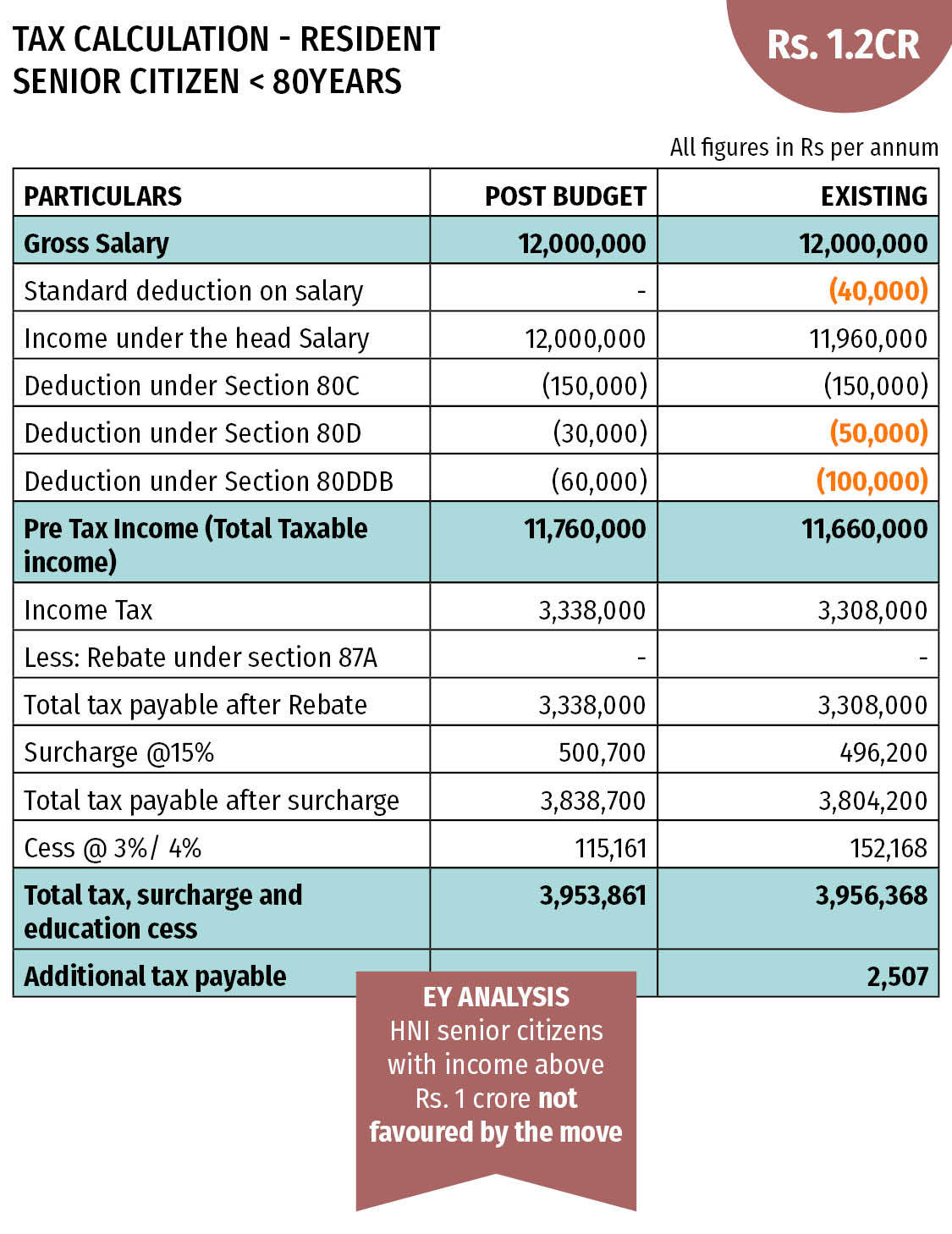

Senior Citizen Income Tax Calculation 2023 24 Examples New Tax Slabs

Section 80D Tax Benefits Health Or Mediclaim Insurance FY 2017 18

Check more sample of Senior Citizen Medical Insurance Tax Rebate below

Tax Benefits For Senior Citizens Budget 2018 Proposes Tax Other

Senior Citizen Income Tax Calculation 2022 23 Excel Calculator

Health Insurance For Senior Citizens Life Insurance

What s The Distinction Between PMI And Home Loan Defense Insurance

Section 80D Tax Benefits Health Or Mediclaim Insurance FY 2017 18

Tax Benefits For Senior Citizens Budget 2018 Proposes Tax Other

https://www.policybazaar.com/health-insurance/section80d-deductions

Web As per Section 80D medical expenses paid on the maintenance of senior citizens without any health insurance policy are eligible for a tax deduction of up to Rs 50 000 per

https://www.policybazaar.com/health-insurance/senior-citizen-health...

Web The Income Tax Act allows you to claim a maximum deduction of Rs 50 000 as of FY 2021 22 on medical expenses incurred on the healthcare of senior citizens eligible parents

Web As per Section 80D medical expenses paid on the maintenance of senior citizens without any health insurance policy are eligible for a tax deduction of up to Rs 50 000 per

Web The Income Tax Act allows you to claim a maximum deduction of Rs 50 000 as of FY 2021 22 on medical expenses incurred on the healthcare of senior citizens eligible parents

What s The Distinction Between PMI And Home Loan Defense Insurance

Senior Citizen Income Tax Calculation 2022 23 Excel Calculator

Section 80D Tax Benefits Health Or Mediclaim Insurance FY 2017 18

Tax Benefits For Senior Citizens Budget 2018 Proposes Tax Other

Section 80D Of Income Tax 80D Deduction For Medical Insurance Mediclaim

Section 80d Preventive Health Check Up Tax Deduction The Gray Tower

Section 80d Preventive Health Check Up Tax Deduction The Gray Tower

Actualizar 54 Imagen Senior Citizen Tax Deduction Ecover mx