In the digital age, when screens dominate our lives yet the appeal of tangible printed objects isn't diminished. Whether it's for educational purposes or creative projects, or simply to add an individual touch to the space, Section 80gg Income Tax Deduction On House Rent Paid have proven to be a valuable source. The following article is a dive to the depths of "Section 80gg Income Tax Deduction On House Rent Paid," exploring what they are, how to get them, as well as how they can enhance various aspects of your daily life.

Get Latest Section 80gg Income Tax Deduction On House Rent Paid Below

Section 80gg Income Tax Deduction On House Rent Paid

Section 80gg Income Tax Deduction On House Rent Paid -

Section 80GG of the Income Tax Act is a provision that allows individual taxpayers to claim a deduction for the rent paid for a residential accommodation if they do not receive House Rent Allowance HRA from their employer This deduction is available to all individual taxpayers including self employed individuals and salaried individuals

Deductions is respect of rents paid Under Section 80GG an Individual can claim deduction for the rent paid even if he don t get HRA Not many people are aware of this deduction Under Section 80GG Section 80GG allows the Individuals to a deduction in respect of house rent paid by him for his own residence Such deduction

Printables for free include a vast assortment of printable material that is available online at no cost. They are available in a variety of forms, like worksheets templates, coloring pages and many more. The benefit of Section 80gg Income Tax Deduction On House Rent Paid is their versatility and accessibility.

More of Section 80gg Income Tax Deduction On House Rent Paid

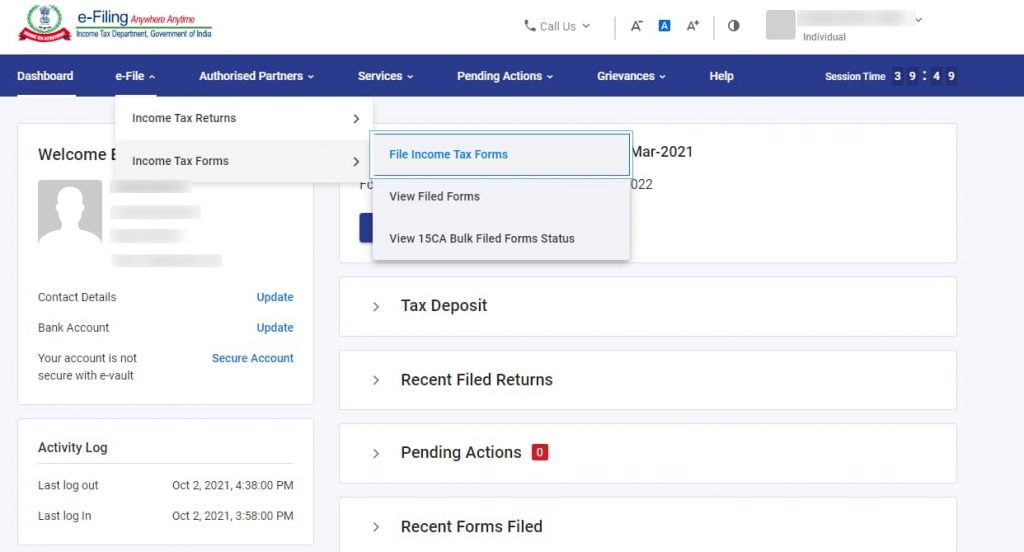

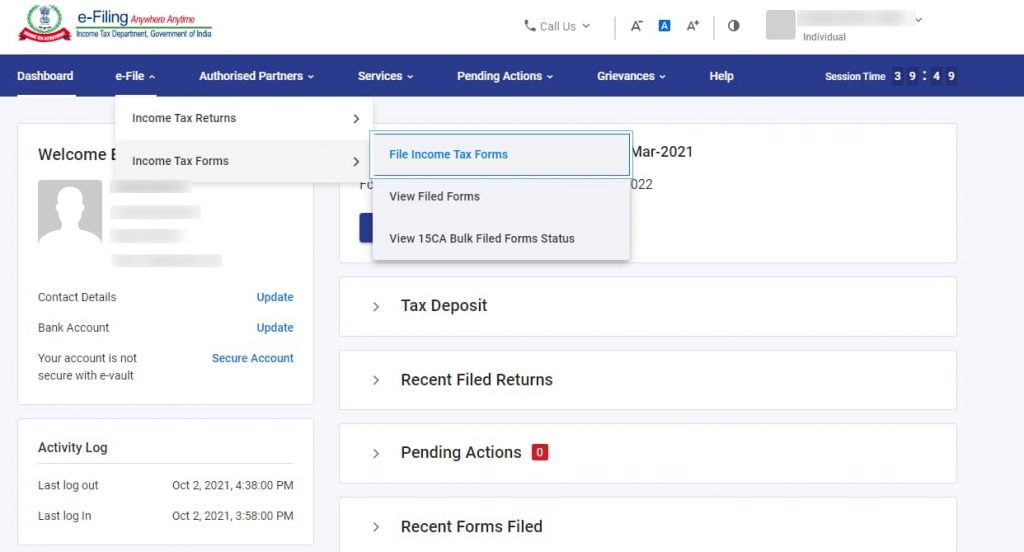

SECTION 80GG INCOME TAX DEDUCTION ON HOUSE RENT PAID IN 80GG IFORM 10BA

SECTION 80GG INCOME TAX DEDUCTION ON HOUSE RENT PAID IN 80GG IFORM 10BA

Section 80GG permits a person to claim a deduction for rent paid for the house Get to know its meaning eligibility criteria calculation etc on Groww Section 80GG

I Actual HRA received Rs 84 000 7 000 12 ii 50 of salary metro city Rs 90 000 50 of Rs 1 80 000 iii Excess of rent paid annually over 10 of annual salary Rs 82 800 Rs 1 00 800 10 of Rs 1 80 000

Section 80gg Income Tax Deduction On House Rent Paid have risen to immense popularity because of a number of compelling causes:

-

Cost-Efficiency: They eliminate the need to buy physical copies or costly software.

-

customization: The Customization feature lets you tailor designs to suit your personal needs in designing invitations to organize your schedule or even decorating your home.

-

Educational Benefits: Education-related printables at no charge are designed to appeal to students of all ages. This makes them a useful source for educators and parents.

-

Accessibility: You have instant access various designs and templates helps save time and effort.

Where to Find more Section 80gg Income Tax Deduction On House Rent Paid

Deductions Under Chapter VIA

Deductions Under Chapter VIA

If you are not receiving a House Rent allowance but paying rent you can still get a tax deduction on the rent paid under Section 80GG of the Income Tax Act 1961 The maximum deduction allowed under Section 80GG is Rs 60 000 per annum which means Rs 5000 per month

30 Sep 2023 Section 80GG is a provision under Chapter VI A of the Income Tax Act 1961 It provides tax reprieve to those who do not avail of house rent allowance To become eligible for tax deduction under section 80GG an individual must reside in a rented property

If we've already piqued your curiosity about Section 80gg Income Tax Deduction On House Rent Paid Let's take a look at where you can find these gems:

1. Online Repositories

- Websites like Pinterest, Canva, and Etsy provide a large collection with Section 80gg Income Tax Deduction On House Rent Paid for all purposes.

- Explore categories such as the home, decor, the arts, and more.

2. Educational Platforms

- Forums and educational websites often provide free printable worksheets or flashcards as well as learning tools.

- It is ideal for teachers, parents as well as students who require additional resources.

3. Creative Blogs

- Many bloggers share their innovative designs and templates for free.

- The blogs are a vast range of interests, that includes DIY projects to planning a party.

Maximizing Section 80gg Income Tax Deduction On House Rent Paid

Here are some creative ways how you could make the most use of printables for free:

1. Home Decor

- Print and frame beautiful artwork, quotes, or seasonal decorations to adorn your living spaces.

2. Education

- Print worksheets that are free for reinforcement of learning at home and in class.

3. Event Planning

- Create invitations, banners, and decorations for special occasions such as weddings, birthdays, and other special occasions.

4. Organization

- Stay organized by using printable calendars with to-do lists, planners, and meal planners.

Conclusion

Section 80gg Income Tax Deduction On House Rent Paid are an abundance filled with creative and practical information catering to different needs and preferences. Their accessibility and flexibility make them an essential part of each day life. Explore the vast collection that is Section 80gg Income Tax Deduction On House Rent Paid today, and discover new possibilities!

Frequently Asked Questions (FAQs)

-

Are printables for free really absolutely free?

- Yes, they are! You can download and print these items for free.

-

Are there any free templates for commercial use?

- It's based on specific terms of use. Always read the guidelines of the creator before utilizing printables for commercial projects.

-

Are there any copyright issues in printables that are free?

- Some printables may contain restrictions regarding usage. Make sure to read the terms and conditions set forth by the designer.

-

How can I print Section 80gg Income Tax Deduction On House Rent Paid?

- Print them at home using either a printer at home or in the local print shop for high-quality prints.

-

What software will I need to access printables free of charge?

- Most PDF-based printables are available in PDF format, which can be opened using free software like Adobe Reader.

HRA Deduction House Rent Allowance 10 13A And 80GG Income Tax Act

Section 80GG Income Tax Deduction For House Rent Paid

Check more sample of Section 80gg Income Tax Deduction On House Rent Paid below

How To Claim HRA Allowance House Rent Allowance Exemption

Save Tax On Rent Section 80GG Income Tax HRA Not Available YouTube

Section 80GG Deduction For Rent Paid Income Tax Returns Income Tax

Section 80gg Of Income Tax Act Deduction 80gg 80gg 2020 YouTube

80GG OF INCOME TAX ACT I DEDUCTION ON RENT PAID YouTube

Section 80GG Tax Claim Deduction For Rent Paid

https://taxguru.in/income-tax/section-80gg...

Deductions is respect of rents paid Under Section 80GG an Individual can claim deduction for the rent paid even if he don t get HRA Not many people are aware of this deduction Under Section 80GG Section 80GG allows the Individuals to a deduction in respect of house rent paid by him for his own residence Such deduction

https://tax2win.in/guide/claim-deduction-under...

Section 80GG allows an individual to claim a deduction on the rent that is paid towards a furnished or unfurnished house The house must be in use for their residential accommodation By deductions here we mean the amount you can deduct from your gross income of the year to derive the net taxable income on which the

Deductions is respect of rents paid Under Section 80GG an Individual can claim deduction for the rent paid even if he don t get HRA Not many people are aware of this deduction Under Section 80GG Section 80GG allows the Individuals to a deduction in respect of house rent paid by him for his own residence Such deduction

Section 80GG allows an individual to claim a deduction on the rent that is paid towards a furnished or unfurnished house The house must be in use for their residential accommodation By deductions here we mean the amount you can deduct from your gross income of the year to derive the net taxable income on which the

Section 80gg Of Income Tax Act Deduction 80gg 80gg 2020 YouTube

Save Tax On Rent Section 80GG Income Tax HRA Not Available YouTube

80GG OF INCOME TAX ACT I DEDUCTION ON RENT PAID YouTube

Section 80GG Tax Claim Deduction For Rent Paid

Deduction In Respect Of Rent Paid Sec 80GG Tax Filing In Kerala

80GG Deduction For Rent Paid

80GG Deduction For Rent Paid

Section 80GG Income Tax Deduction In Respect Of Rent Paid