In a world in which screens are the norm The appeal of tangible printed materials hasn't faded away. If it's to aid in education project ideas, artistic or simply adding an extra personal touch to your home, printables for free have proven to be a valuable resource. In this article, we'll take a dive into the sphere of "Sbi Mutual Fund Income Tax Rebate," exploring what they are, where you can find them, and how they can add value to various aspects of your lives.

Get Latest Sbi Mutual Fund Income Tax Rebate Below

Sbi Mutual Fund Income Tax Rebate

Sbi Mutual Fund Income Tax Rebate -

Web VDOM DHTML tml gt Are SBI mutual funds taxable Quora Something went wrong

Web 37 on base tax where specified income exceeds Rs 5 crore 25 where specified income exceeds Rs 2 crore but does not exceed Rs 5 crore 15 where total income exceeds Rs 1 crore but does not exceed Rs 2 crore and 10 where total income exceeds Rs 50 lakhs but does not exceed Rs 1 crore

Sbi Mutual Fund Income Tax Rebate cover a large range of downloadable, printable content that can be downloaded from the internet at no cost. They are available in a variety of kinds, including worksheets templates, coloring pages, and more. One of the advantages of Sbi Mutual Fund Income Tax Rebate lies in their versatility as well as accessibility.

More of Sbi Mutual Fund Income Tax Rebate

Tax Saving Mutual Funds Top 5 ELSS Funds For 2020 INVESTIFY IN

Tax Saving Mutual Funds Top 5 ELSS Funds For 2020 INVESTIFY IN

Web 21 juil 2023 nbsp 0183 32 Top performing Tax Saving Mutual Funds in 3 years till July 20 2023 Investments up to Rs 1 5 lakh per year in an Equity Linked Savings Scheme ELSS qualify for deduction under Section 80C of

Web 12 f 233 vr 2020 nbsp 0183 32 Updated on 27 Jul 2023 What is Tax on Mutual Funds Tax on mutual funds vastly depends on factors such as what kind of funds you have invested in equity debt or hybrid the duration of your investment long term or short term mutual fund income capital gains and dividend income and which income tax slab you belong to

Print-friendly freebies have gained tremendous popularity due to a myriad of compelling factors:

-

Cost-Efficiency: They eliminate the need to buy physical copies or expensive software.

-

Customization: Your HTML0 customization options allow you to customize the design to meet your needs for invitations, whether that's creating them and schedules, or even decorating your house.

-

Educational Use: Printables for education that are free provide for students of all ages, which makes them a great aid for parents as well as educators.

-

Easy to use: Instant access to various designs and templates saves time and effort.

Where to Find more Sbi Mutual Fund Income Tax Rebate

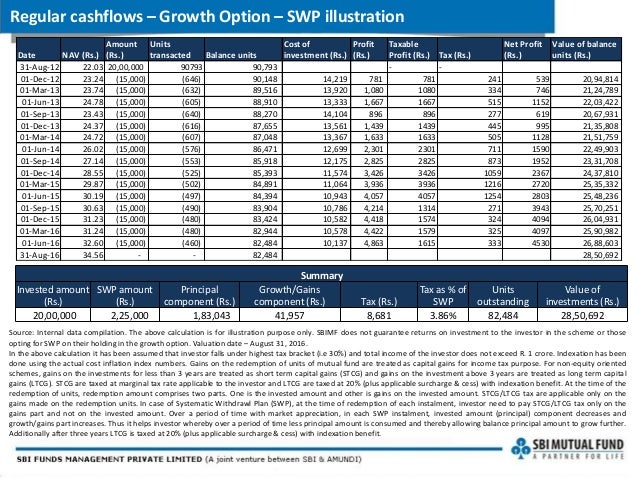

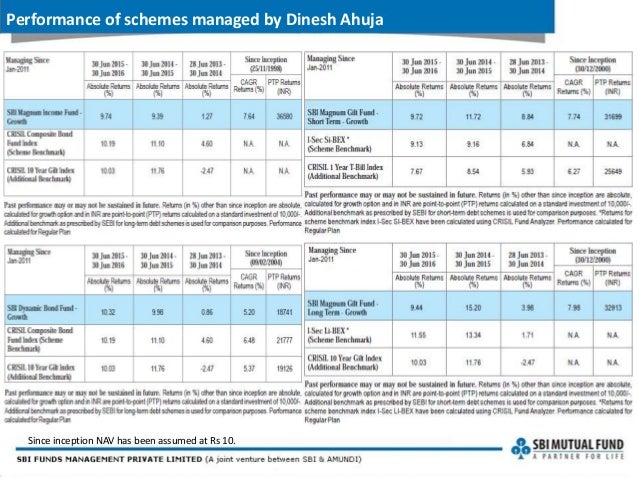

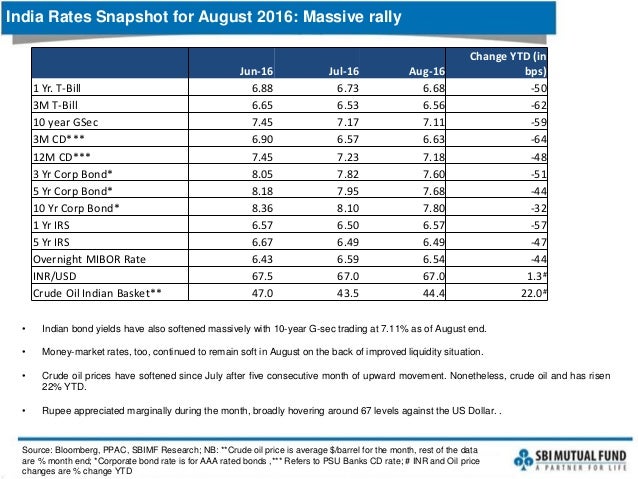

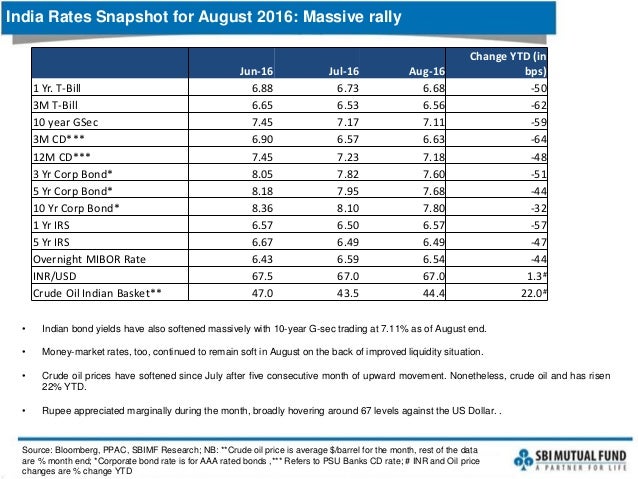

SBI Magnum Monthly Income Plan A Hybrid Mutual Fund Scheme Aug 2016

SBI Magnum Monthly Income Plan A Hybrid Mutual Fund Scheme Aug 2016

Web 1 avr 2016 nbsp 0183 32 Under section 80C up to 1 50 000 in premiums paid can be reduced from your total taxable income Apart from this you can claim deduction for premiums paid or amount deposited for annuity plans of any insurer under section 80CCC Only those plans are eligible that are meant for receiving a pension from a fund

Web 20 f 233 vr 2020 nbsp 0183 32 Synopsis If you have any mutual fund queries message on ET Mutual Funds on Facebook We will get it answered by our panel of experts iStock I want to know if my SIP investment can be used for tax exemption How would I get to know whether my investments qualify for tax deduction Vigneshwaran

After we've peaked your curiosity about Sbi Mutual Fund Income Tax Rebate Let's take a look at where you can discover these hidden gems:

1. Online Repositories

- Websites like Pinterest, Canva, and Etsy have a large selection of Sbi Mutual Fund Income Tax Rebate to suit a variety of reasons.

- Explore categories such as decoration for your home, education, crafting, and organization.

2. Educational Platforms

- Educational websites and forums typically provide worksheets that can be printed for free Flashcards, worksheets, and other educational tools.

- Ideal for parents, teachers as well as students who require additional sources.

3. Creative Blogs

- Many bloggers share their creative designs as well as templates for free.

- These blogs cover a wide spectrum of interests, everything from DIY projects to party planning.

Maximizing Sbi Mutual Fund Income Tax Rebate

Here are some fresh ways of making the most use of printables for free:

1. Home Decor

- Print and frame beautiful images, quotes, as well as seasonal decorations, to embellish your living spaces.

2. Education

- Print free worksheets to build your knowledge at home and in class.

3. Event Planning

- Designs invitations, banners as well as decorations for special occasions such as weddings and birthdays.

4. Organization

- Be organized by using printable calendars or to-do lists. meal planners.

Conclusion

Sbi Mutual Fund Income Tax Rebate are an abundance with useful and creative ideas that satisfy a wide range of requirements and interest. Their accessibility and versatility make them a wonderful addition to both professional and personal life. Explore the endless world of Sbi Mutual Fund Income Tax Rebate today and discover new possibilities!

Frequently Asked Questions (FAQs)

-

Are the printables you get for free free?

- Yes you can! You can print and download these items for free.

-

Can I make use of free printables to make commercial products?

- It's contingent upon the specific terms of use. Always check the creator's guidelines prior to printing printables for commercial projects.

-

Do you have any copyright concerns when using Sbi Mutual Fund Income Tax Rebate?

- Certain printables could be restricted regarding their use. Make sure you read the terms and condition of use as provided by the creator.

-

How can I print printables for free?

- Print them at home using the printer, or go to the local print shop for top quality prints.

-

What software must I use to open printables at no cost?

- The majority of PDF documents are provided in PDF format, which can be opened using free software such as Adobe Reader.

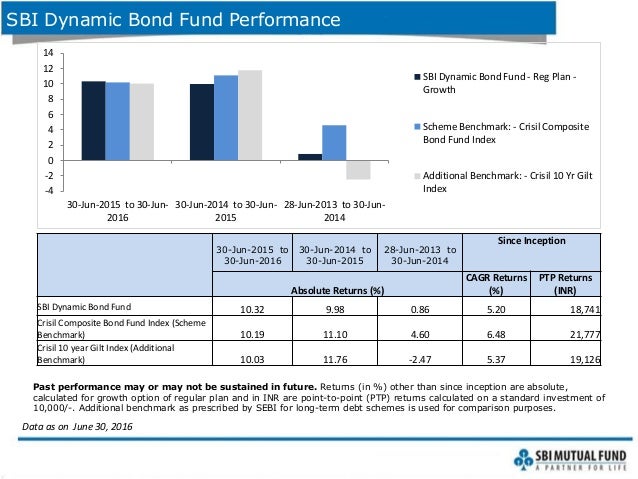

SBI Dynamic Bond Fund An Income Mutual Fund Scheme Aug 16

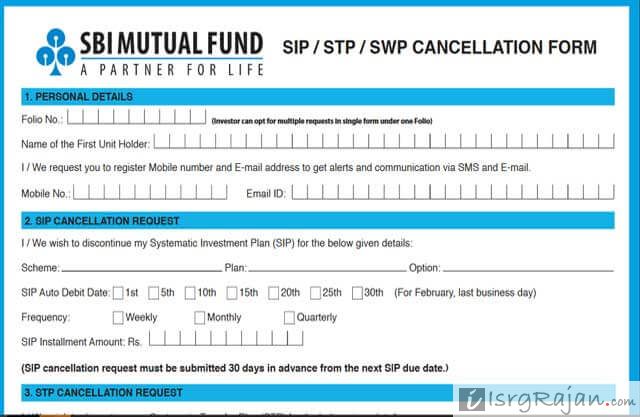

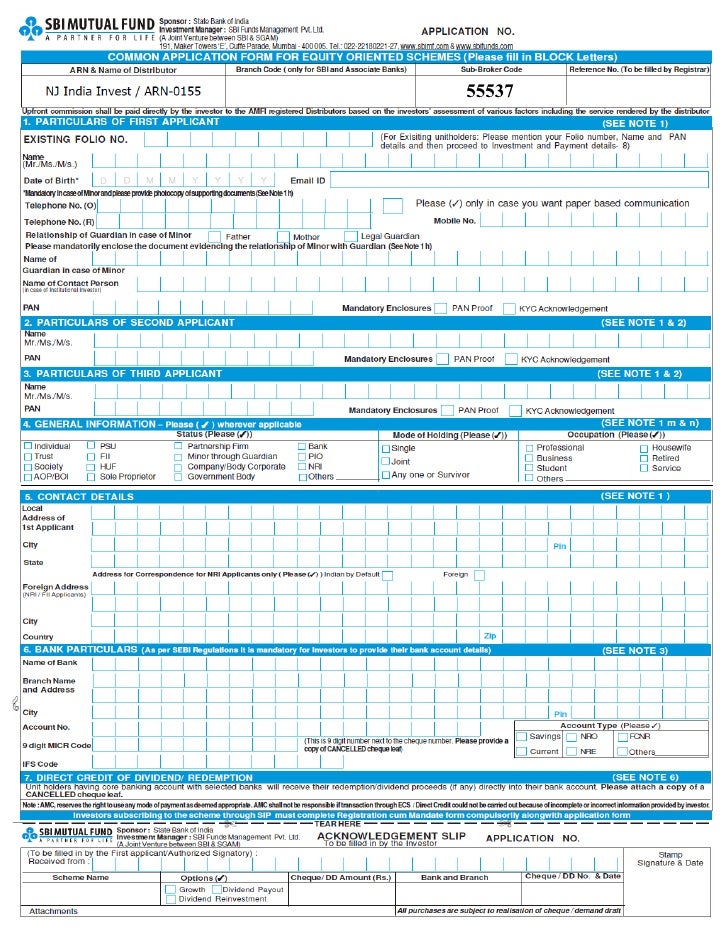

Sbi Mutual Fund Common Application Form Equity With Kim

Check more sample of Sbi Mutual Fund Income Tax Rebate below

Download SBI Mutual Fund Investments Statement PDF YouTube

Sbi Mutual Fund

SBI Magnum Monthly Income Plan A Hybrid Mutual Fund Scheme Aug 2016

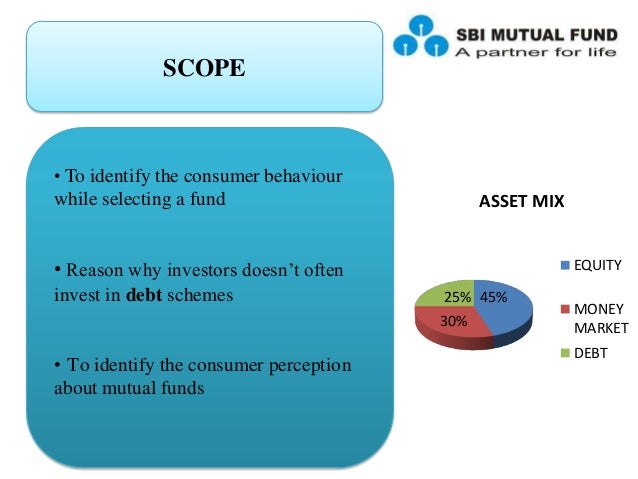

How SBI Mutual Fund Is Misleading Investors Through Its Advertisements

Basics Of Mutual Fund Investment Beginners Guide 2020

Sbi Deposit Interest Rates

https://www.sbimf.com/docs/default-source/pdf/sbi-mf-tax-r…

Web 37 on base tax where specified income exceeds Rs 5 crore 25 where specified income exceeds Rs 2 crore but does not exceed Rs 5 crore 15 where total income exceeds Rs 1 crore but does not exceed Rs 2 crore and 10 where total income exceeds Rs 50 lakhs but does not exceed Rs 1 crore

https://economictimes.indiatimes.com/mf/analysis/do-all-mutual-funds...

Web 11 oct 2019 nbsp 0183 32 No all mutual funds do not qualify for tax deductions under Section 80C of the income tax Act Only investments in equity linked saving schemes or ELSSs qualify for tax deduction under section 80C Investors can invest in ELSSs and claim tax deductions of up to Rs 1 5 lakh under Section 80C of the Income Tax Act

Web 37 on base tax where specified income exceeds Rs 5 crore 25 where specified income exceeds Rs 2 crore but does not exceed Rs 5 crore 15 where total income exceeds Rs 1 crore but does not exceed Rs 2 crore and 10 where total income exceeds Rs 50 lakhs but does not exceed Rs 1 crore

Web 11 oct 2019 nbsp 0183 32 No all mutual funds do not qualify for tax deductions under Section 80C of the income tax Act Only investments in equity linked saving schemes or ELSSs qualify for tax deduction under section 80C Investors can invest in ELSSs and claim tax deductions of up to Rs 1 5 lakh under Section 80C of the Income Tax Act

How SBI Mutual Fund Is Misleading Investors Through Its Advertisements

Sbi Mutual Fund

Basics Of Mutual Fund Investment Beginners Guide 2020

Sbi Deposit Interest Rates

Sbi Mutual Fund Common Application Form

SBI Dynamic Bond Fund An Income Mutual Fund Scheme Aug 16

SBI Dynamic Bond Fund An Income Mutual Fund Scheme Aug 16

SBI Magnum Monthly Income Plan A Good Hybrid Mutual Fund Scheme For