In the digital age, when screens dominate our lives and our lives are dominated by screens, the appeal of tangible printed material hasn't diminished. No matter whether it's for educational uses for creative projects, simply adding personal touches to your space, Rent Tax Deduction Form are now an essential resource. The following article is a take a dive in the world of "Rent Tax Deduction Form," exploring their purpose, where they can be found, and how they can enrich various aspects of your lives.

Get Latest Rent Tax Deduction Form Below

Rent Tax Deduction Form

Rent Tax Deduction Form -

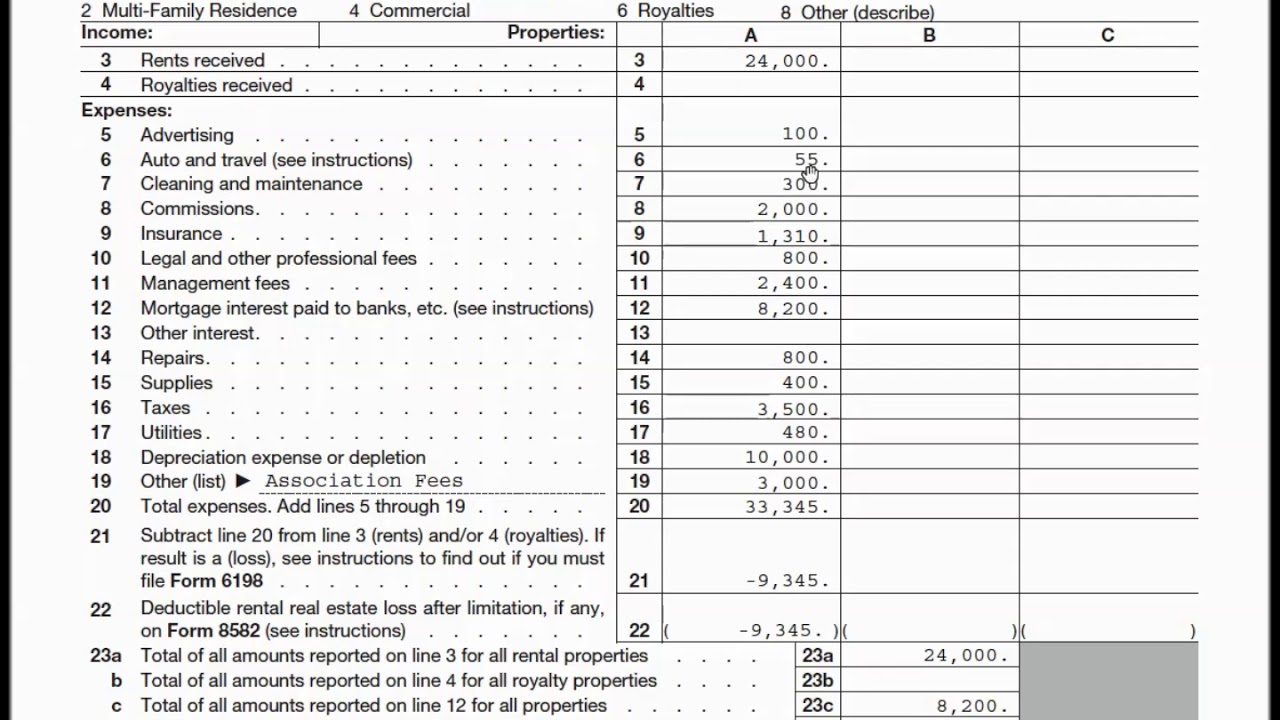

Topic no 414 Rental income and expenses Cash or the fair market value of property or services you receive for the use of real estate or personal property is taxable to you as rental income In general you can deduct expenses of renting property from your rental income

What can you deduct See a list of expenses that can be deducted from rental income Renovations in rented out property See a list of renovation expenses What counts as rental income See a list of what types of income are taxed as rental income How much tax is collected See a summary of the calculation rules Rental income from abroad

Printables for free include a vast selection of printable and downloadable content that can be downloaded from the internet at no cost. They are available in a variety of formats, such as worksheets, templates, coloring pages, and more. The attraction of printables that are free lies in their versatility and accessibility.

More of Rent Tax Deduction Form

How To Calculate Depreciation Expense Rental Property Haiper

How To Calculate Depreciation Expense Rental Property Haiper

Published on April 28 2022 Written by Eric Reed If you re wondering whether you can deduct your rent on your taxes the short answer is yes You can deduct rent if you live in a state that allows it However only 22 states offer this type of deduction Here s what you need to know

If you receive rental income from the rental of a dwelling unit there are certain rental expenses you may deduct on your tax return These expenses may include mortgage interest property tax operating expenses depreciation and repairs

Printables that are free have gained enormous popularity because of a number of compelling causes:

-

Cost-Efficiency: They eliminate the need to purchase physical copies of the software or expensive hardware.

-

Modifications: This allows you to modify the design to meet your needs for invitations, whether that's creating them or arranging your schedule or even decorating your home.

-

Educational Benefits: Education-related printables at no charge provide for students of all ages, making them a valuable instrument for parents and teachers.

-

Easy to use: Fast access the vast array of design and templates helps save time and effort.

Where to Find more Rent Tax Deduction Form

Tax Deductions On Rental Homes Property Tax Deduction

Tax Deductions On Rental Homes Property Tax Deduction

IRS Tax Tip 2022 37 March 9 2022 Rent is any amount paid for the use of property that a small business doesn t own Typically rent can be deducted as a business expense when the rent is for property the taxpayer uses for the business Here are some things small business owners should keep in mind when it comes to deducting rental expenses

Can you claim rent on your taxes as a deduction or credit Depending on your tax situation and province of residence you may be able to claim rent on income tax in Canada Here the team of tax experts at Accountor CPA explores the options for claiming rent on income tax

Now that we've piqued your interest in Rent Tax Deduction Form Let's see where you can get these hidden treasures:

1. Online Repositories

- Websites like Pinterest, Canva, and Etsy offer a huge selection of Rent Tax Deduction Form to suit a variety of purposes.

- Explore categories such as decorations for the home, education and crafting, and organization.

2. Educational Platforms

- Educational websites and forums often offer worksheets with printables that are free including flashcards, learning tools.

- Ideal for teachers, parents, and students seeking supplemental resources.

3. Creative Blogs

- Many bloggers share their innovative designs with templates and designs for free.

- The blogs are a vast range of interests, including DIY projects to planning a party.

Maximizing Rent Tax Deduction Form

Here are some ways in order to maximize the use of Rent Tax Deduction Form:

1. Home Decor

- Print and frame stunning artwork, quotes or other seasonal decorations to fill your living spaces.

2. Education

- Print out free worksheets and activities for teaching at-home and in class.

3. Event Planning

- Design invitations, banners and decorations for special occasions such as weddings and birthdays.

4. Organization

- Keep track of your schedule with printable calendars for to-do list, lists of chores, and meal planners.

Conclusion

Rent Tax Deduction Form are a treasure trove of practical and innovative resources which cater to a wide range of needs and interests. Their accessibility and versatility make these printables a useful addition to every aspect of your life, both professional and personal. Explore the vast array of Rent Tax Deduction Form today to open up new possibilities!

Frequently Asked Questions (FAQs)

-

Do printables with no cost really completely free?

- Yes you can! You can print and download these free resources for no cost.

-

Can I make use of free printables in commercial projects?

- It depends on the specific terms of use. Be sure to read the rules of the creator prior to printing printables for commercial projects.

-

Are there any copyright problems with printables that are free?

- Some printables could have limitations in use. Be sure to check the terms and conditions offered by the creator.

-

How can I print printables for free?

- Print them at home using either a printer at home or in a local print shop to purchase premium prints.

-

What software do I require to view printables that are free?

- The majority of printables are in the format of PDF, which is open with no cost software, such as Adobe Reader.

Tax Deduction Stock Photo Photo By LendingMemo Under CC 2 Flickr

What Will My Tax Deduction Savings Look Like The Motley Fool

Check more sample of Rent Tax Deduction Form below

Standard Deduction U s 16 ia For Ay 2021 22 Standard Deduction 2021

Free Printable Legal Form Itemized Security Deposit Deduction Form

10 2014 Itemized Deductions Worksheet Worksheeto

Employee Income Tax Deduction Form 2023 Employeeform

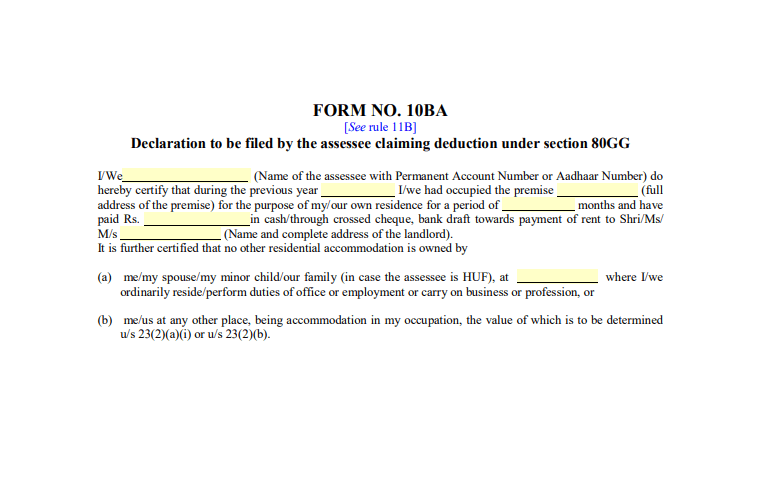

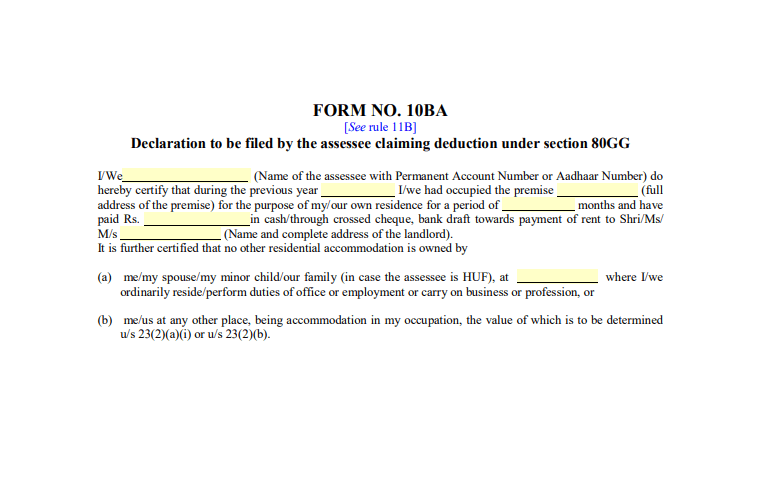

Deduction In Respect Of Rent Paid Sec 80GG Eligibility Calculation

10 Hair Stylist Tax Deduction Worksheet Worksheets Decoomo

https://www.vero.fi/en/individuals/property/rental_income

What can you deduct See a list of expenses that can be deducted from rental income Renovations in rented out property See a list of renovation expenses What counts as rental income See a list of what types of income are taxed as rental income How much tax is collected See a summary of the calculation rules Rental income from abroad

https://www.ird.gov.hk/eng/tax/drd.htm

The Inland Revenue Amendment Tax Deductions for Domestic Rents Ordinance 2022 was enacted on 30 June 2022 to provide for new deduction for domestic rent with effect from the year of assessment 2022 23 The implementation framework of the new deduction is as follows Eligible Persons

What can you deduct See a list of expenses that can be deducted from rental income Renovations in rented out property See a list of renovation expenses What counts as rental income See a list of what types of income are taxed as rental income How much tax is collected See a summary of the calculation rules Rental income from abroad

The Inland Revenue Amendment Tax Deductions for Domestic Rents Ordinance 2022 was enacted on 30 June 2022 to provide for new deduction for domestic rent with effect from the year of assessment 2022 23 The implementation framework of the new deduction is as follows Eligible Persons

Employee Income Tax Deduction Form 2023 Employeeform

Free Printable Legal Form Itemized Security Deposit Deduction Form

Deduction In Respect Of Rent Paid Sec 80GG Eligibility Calculation

10 Hair Stylist Tax Deduction Worksheet Worksheets Decoomo

8 Best Images Of Tax Itemized Deduction Worksheet IRS 2021 Tax Forms

Section 80GG Deduction Income Tax IndiaFilings

Section 80GG Deduction Income Tax IndiaFilings

New Tax Laws Business Deduction Changes You Need To Know About