In this digital age, with screens dominating our lives and the appeal of physical printed objects isn't diminished. Whatever the reason, whether for education or creative projects, or simply adding an individual touch to the home, printables for free can be an excellent resource. We'll dive to the depths of "Recovery Rebate Credit Error 2023," exploring what they are, where they are, and how they can improve various aspects of your daily life.

Get Latest Recovery Rebate Credit Error 2023 Below

Recovery Rebate Credit Error 2023

Recovery Rebate Credit Error 2023 -

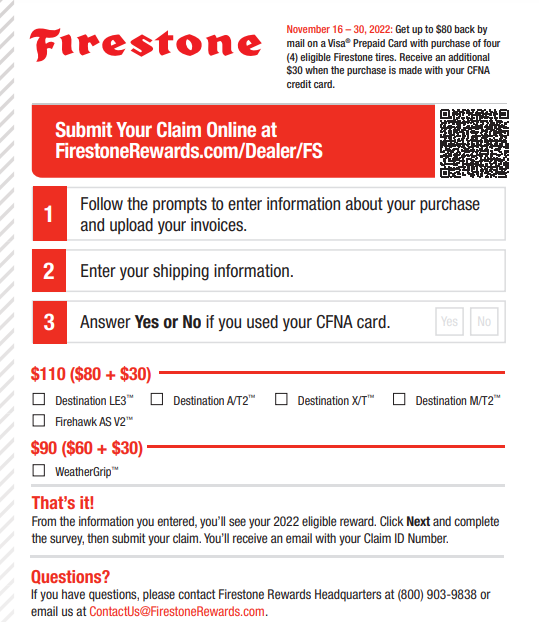

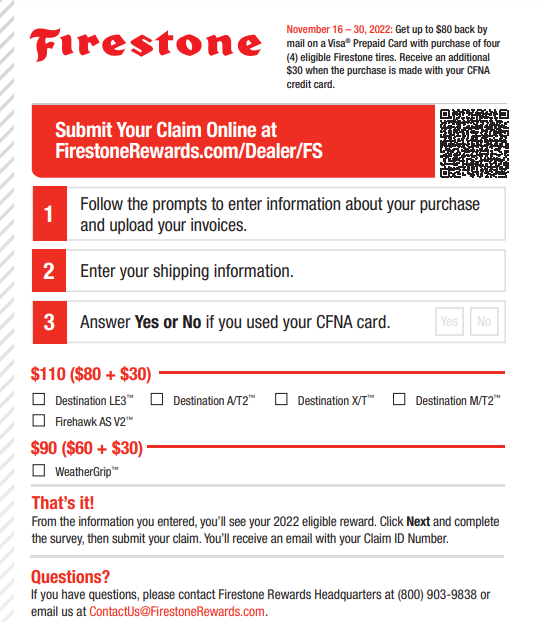

The IRS issued more than 5 million math error notices to taxpayers regarding claims of a Recovery Rebate Credit but failed to inform recipients that they had just 60 days to respond to the

It is critical that eligible individuals claiming a Recovery Rebate Credit understand that the advance payments applied to different tax years Depending on which advance payment is missing the first second or third payment you will file either a 2020 or 2021 tax return to claim a Recovery Rebate Credit

Recovery Rebate Credit Error 2023 include a broad range of downloadable, printable documents that can be downloaded online at no cost. These materials come in a variety of kinds, including worksheets coloring pages, templates and many more. The great thing about Recovery Rebate Credit Error 2023 is in their versatility and accessibility.

More of Recovery Rebate Credit Error 2023

Recovery Rebate Credit 2023 Married Filing Separately Recovery Rebate

Recovery Rebate Credit 2023 Married Filing Separately Recovery Rebate

Two EIPs EIP1 and EIP2 were issued to eligible taxpayers during 2020 and early 2021 These EIPs were advanced payments of the Recovery Rebate Credit RRC a refundable credit claimed on the 2020 Individual Tax Return How do I get these EIPs if I didn t receive them or got an incorrect amount

Millions of taxpayers have received math error notices adjusting their returns including the amount of recovery rebate credit RRC child tax credit or other items claimed on their return As of April 7 2022 the IRS had issued 9 4 million math error notices of which 8 3 million of these are related to the RRC and the child tax credit

Recovery Rebate Credit Error 2023 have garnered immense popularity due to a variety of compelling reasons:

-

Cost-Efficiency: They eliminate the requirement of buying physical copies or costly software.

-

Individualization We can customize printables to your specific needs for invitations, whether that's creating them planning your schedule or even decorating your house.

-

Education Value Printables for education that are free are designed to appeal to students of all ages, which makes them an essential tool for parents and teachers.

-

Simple: Quick access to a plethora of designs and templates reduces time and effort.

Where to Find more Recovery Rebate Credit Error 2023

Recovery Rebate Credit Line 30 Instructions Recovery Rebate

Recovery Rebate Credit Line 30 Instructions Recovery Rebate

The recovery rebate credit is a refundable credit which means you ll get a tax refund if the credit is larger than the tax that you would otherwise have to pay

The IRS issued Letter 6475 Economic Impact Payment EIP 3 End of Year in January 2022 This letter helps EIP recipients determine if they re eligible to claim the Recovery Rebate Credit on their 2021 tax year returns

In the event that we've stirred your interest in Recovery Rebate Credit Error 2023 Let's take a look at where the hidden treasures:

1. Online Repositories

- Websites such as Pinterest, Canva, and Etsy provide a large collection of Recovery Rebate Credit Error 2023 to suit a variety of needs.

- Explore categories such as design, home decor, organizing, and crafts.

2. Educational Platforms

- Educational websites and forums typically offer worksheets with printables that are free or flashcards as well as learning materials.

- Great for parents, teachers or students in search of additional sources.

3. Creative Blogs

- Many bloggers share their imaginative designs and templates, which are free.

- The blogs covered cover a wide range of interests, that includes DIY projects to party planning.

Maximizing Recovery Rebate Credit Error 2023

Here are some innovative ways to make the most use of Recovery Rebate Credit Error 2023:

1. Home Decor

- Print and frame beautiful art, quotes, or seasonal decorations that will adorn your living areas.

2. Education

- Use these printable worksheets free of charge to enhance learning at home either in the schoolroom or at home.

3. Event Planning

- Design invitations, banners and decorations for special events like weddings and birthdays.

4. Organization

- Stay organized with printable calendars checklists for tasks, as well as meal planners.

Conclusion

Recovery Rebate Credit Error 2023 are a treasure trove with useful and creative ideas catering to different needs and desires. Their accessibility and flexibility make them a great addition to each day life. Explore the vast world of Recovery Rebate Credit Error 2023 right now and unlock new possibilities!

Frequently Asked Questions (FAQs)

-

Are printables available for download really completely free?

- Yes, they are! You can download and print these free resources for no cost.

-

Does it allow me to use free templates for commercial use?

- It's contingent upon the specific usage guidelines. Always verify the guidelines of the creator before using their printables for commercial projects.

-

Are there any copyright issues with Recovery Rebate Credit Error 2023?

- Some printables could have limitations on use. Make sure to read the terms and conditions set forth by the designer.

-

How do I print Recovery Rebate Credit Error 2023?

- Print them at home with any printer or head to an area print shop for high-quality prints.

-

What program is required to open printables at no cost?

- Many printables are offered in the PDF format, and can be opened with free software, such as Adobe Reader.

2023 Recovery Rebate Rebate2022

Recovery Rebate Credit Error Letter 2023 Recovery Rebate

Check more sample of Recovery Rebate Credit Error 2023 below

Claim Recovery Rebate Credit In Error Recovery Rebate

Irs Recovery Rebate Credit Error Scam Recovery Rebate

2023 Recovery Rebate Credi Recovery Rebate

Irs Cp11 Recovery Rebate Credit 2023 Recovery Rebate

Recovery Rebate Credit Qualifications 2023 Recovery Rebate

8 Ways What Is Recovery Rebate Credit 2021 Heartsforhoundsrescue

https://www.irs.gov/newsroom/recovery-rebate-credit

It is critical that eligible individuals claiming a Recovery Rebate Credit understand that the advance payments applied to different tax years Depending on which advance payment is missing the first second or third payment you will file either a 2020 or 2021 tax return to claim a Recovery Rebate Credit

https://www.irs.gov/pub/taxpros/fs-2022-27.pdf

This Fact Sheet updates frequently asked questions FAQs for the 2021 Recovery Rebate Credit Individuals who did not qualify for or did not receive the full amount of the third Economic Impact Payment may be eligible to claim the 2021 Recovery Rebate Credit based on their 2021 tax year information This update modifies Questions 1 5 8 and

It is critical that eligible individuals claiming a Recovery Rebate Credit understand that the advance payments applied to different tax years Depending on which advance payment is missing the first second or third payment you will file either a 2020 or 2021 tax return to claim a Recovery Rebate Credit

This Fact Sheet updates frequently asked questions FAQs for the 2021 Recovery Rebate Credit Individuals who did not qualify for or did not receive the full amount of the third Economic Impact Payment may be eligible to claim the 2021 Recovery Rebate Credit based on their 2021 tax year information This update modifies Questions 1 5 8 and

Irs Cp11 Recovery Rebate Credit 2023 Recovery Rebate

Irs Recovery Rebate Credit Error Scam Recovery Rebate

Recovery Rebate Credit Qualifications 2023 Recovery Rebate

8 Ways What Is Recovery Rebate Credit 2021 Heartsforhoundsrescue

Recovery Rebate Credit Married In 2023 Recovery Rebate

IRS Stimulus Update Recovery Rebate Credit Error Letter s Understanding

IRS Stimulus Update Recovery Rebate Credit Error Letter s Understanding

Intoxalock Rebate Form 2023 Printable Rebate Form Rebate2022