Today, where screens have become the dominant feature of our lives however, the attraction of tangible printed objects hasn't waned. In the case of educational materials in creative or artistic projects, or just adding an extra personal touch to your space, Rebates On Excise Tax For Alternate Fuel Usage have become an invaluable resource. The following article is a dive through the vast world of "Rebates On Excise Tax For Alternate Fuel Usage," exploring the different types of printables, where to find them and how they can improve various aspects of your life.

Get Latest Rebates On Excise Tax For Alternate Fuel Usage Below

Rebates On Excise Tax For Alternate Fuel Usage

Rebates On Excise Tax For Alternate Fuel Usage -

Web How to claim the credit Any alternative fuel credit must first be claimed on Form 720 Schedule C to reduce your section 4041 taxable fuel liability for alternative fuel and

Web Table 1 Average fuel excise and explicit carbon taxes across 44 OECD countries and Selected Partner Economies as well as international aviation and maritime transport

Rebates On Excise Tax For Alternate Fuel Usage cover a large range of downloadable, printable material that is available online at no cost. They are available in numerous kinds, including worksheets coloring pages, templates and much more. The benefit of Rebates On Excise Tax For Alternate Fuel Usage is in their versatility and accessibility.

More of Rebates On Excise Tax For Alternate Fuel Usage

Gas Tax Rates By State 2020 State Fuel Excise Taxes Tax Foundation

Gas Tax Rates By State 2020 State Fuel Excise Taxes Tax Foundation

Web The alternative fuel tax credit IRC Section 6426 d is available through December 31 2020 at a rate of 0 50 per gallon of an alternative fuel sold by the taxpayer for use as a

Web The tax test states that the claimant must have paid the tax on the fuel or would have paid the tax if the fuel was used for a taxable purpose In most cases the taxpayer who

The Rebates On Excise Tax For Alternate Fuel Usage have gained huge appeal due to many compelling reasons:

-

Cost-Efficiency: They eliminate the need to purchase physical copies or expensive software.

-

customization There is the possibility of tailoring printed materials to meet your requirements when it comes to designing invitations or arranging your schedule or even decorating your home.

-

Educational Benefits: Education-related printables at no charge provide for students of all ages, which makes these printables a powerful device for teachers and parents.

-

An easy way to access HTML0: Quick access to a plethora of designs and templates, which saves time as well as effort.

Where to Find more Rebates On Excise Tax For Alternate Fuel Usage

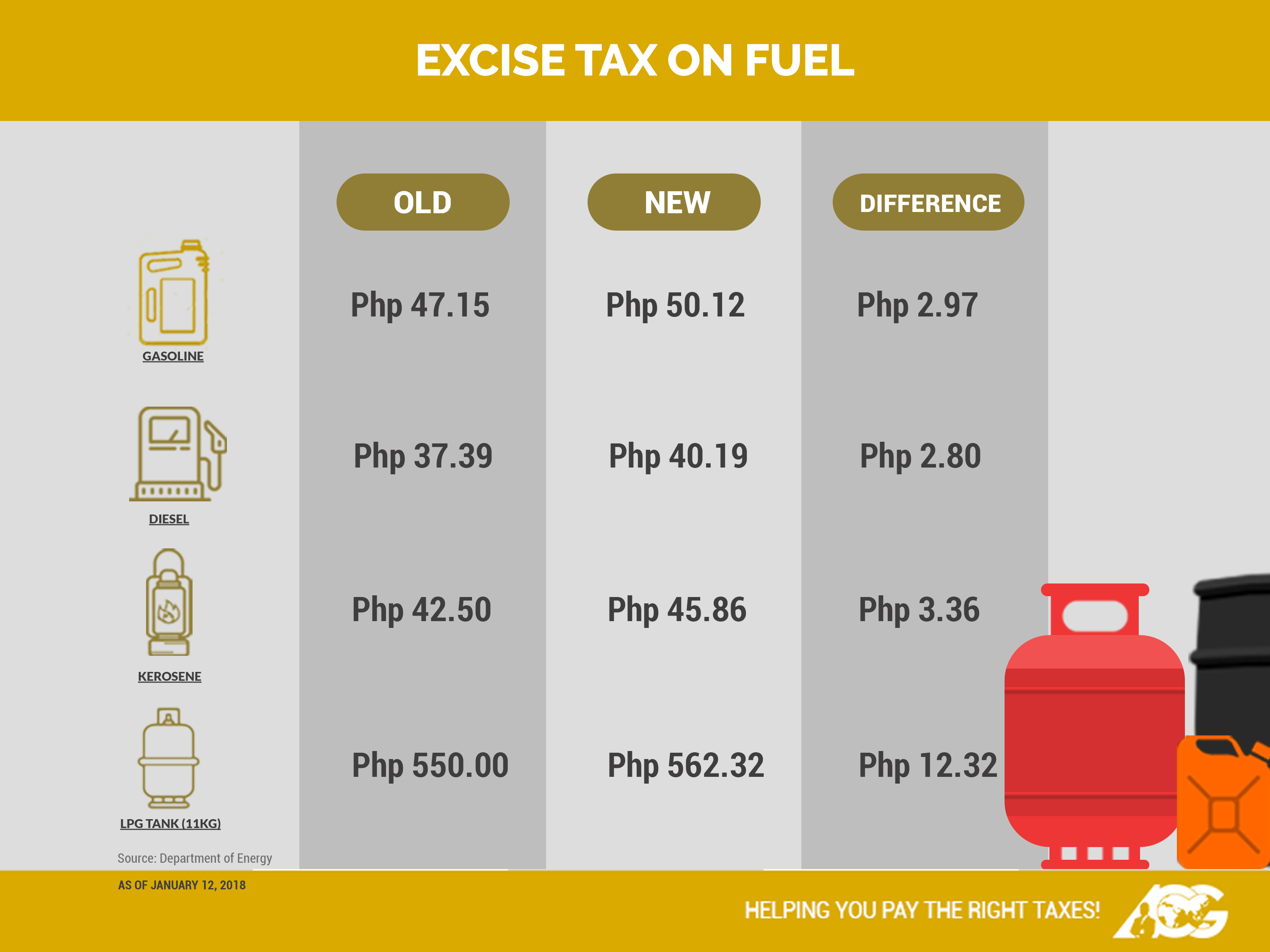

2019 Fuel Excise Tax Increase Is Now In Full Swing Autodeal

2019 Fuel Excise Tax Increase Is Now In Full Swing Autodeal

Web A tax credit in the amount of 0 50 per gallon is available for the following alternative fuels natural gas liquefied hydrogen propane P Series fuel liquid fuel derived from coal

Web The Tax Update Under section 6426 d a taxpayer that uses or sells alternative fuel for use in motor vehicles motorboats or aviation can claim a credit against its section 4041

Now that we've ignited your interest in Rebates On Excise Tax For Alternate Fuel Usage Let's take a look at where you can get these hidden treasures:

1. Online Repositories

- Websites like Pinterest, Canva, and Etsy provide a wide selection of printables that are free for a variety of motives.

- Explore categories like decorations for the home, education and management, and craft.

2. Educational Platforms

- Educational websites and forums often offer free worksheets and worksheets for printing as well as flashcards and other learning materials.

- This is a great resource for parents, teachers and students in need of additional sources.

3. Creative Blogs

- Many bloggers share their imaginative designs with templates and designs for free.

- These blogs cover a wide range of interests, ranging from DIY projects to party planning.

Maximizing Rebates On Excise Tax For Alternate Fuel Usage

Here are some new ways in order to maximize the use use of printables for free:

1. Home Decor

- Print and frame stunning artwork, quotes or festive decorations to decorate your living areas.

2. Education

- Use these printable worksheets free of charge to enhance learning at home, or even in the classroom.

3. Event Planning

- Create invitations, banners, and other decorations for special occasions like birthdays and weddings.

4. Organization

- Make sure you are organized with printable calendars or to-do lists. meal planners.

Conclusion

Rebates On Excise Tax For Alternate Fuel Usage are an abundance of practical and imaginative resources catering to different needs and interests. Their availability and versatility make them a valuable addition to the professional and personal lives of both. Explore the wide world of printables for free today and discover new possibilities!

Frequently Asked Questions (FAQs)

-

Are printables for free really available for download?

- Yes they are! You can download and print these items for free.

-

Do I have the right to use free printables for commercial use?

- It's dependent on the particular conditions of use. Always verify the guidelines provided by the creator before utilizing printables for commercial projects.

-

Do you have any copyright concerns when using printables that are free?

- Certain printables may be subject to restrictions on usage. Be sure to check the terms and regulations provided by the creator.

-

How can I print printables for free?

- You can print them at home with any printer or head to a print shop in your area for more high-quality prints.

-

What software do I need in order to open Rebates On Excise Tax For Alternate Fuel Usage?

- The majority are printed with PDF formats, which can be opened using free programs like Adobe Reader.

Repeated Hike In Excise Duty On Petro Products Surpasses Fuel Subsidy

FUEL EXCISE TAX EXEMPTIONS

Check more sample of Rebates On Excise Tax For Alternate Fuel Usage below

AskTheTaxWhiz Top 10 Questions About The Tax Reform Law

New Excise Taxes On Cars Fuel Effective January 1 2018 Auto News

No Carbon Tax Protest Ban Sign Against The Increase Of Government

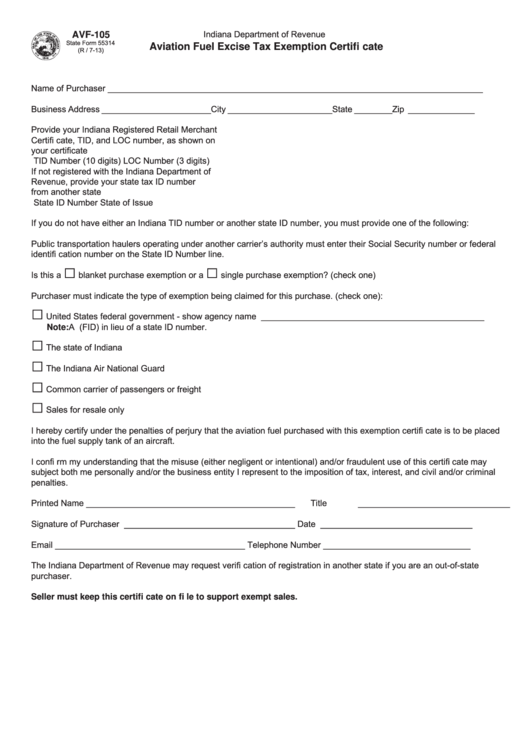

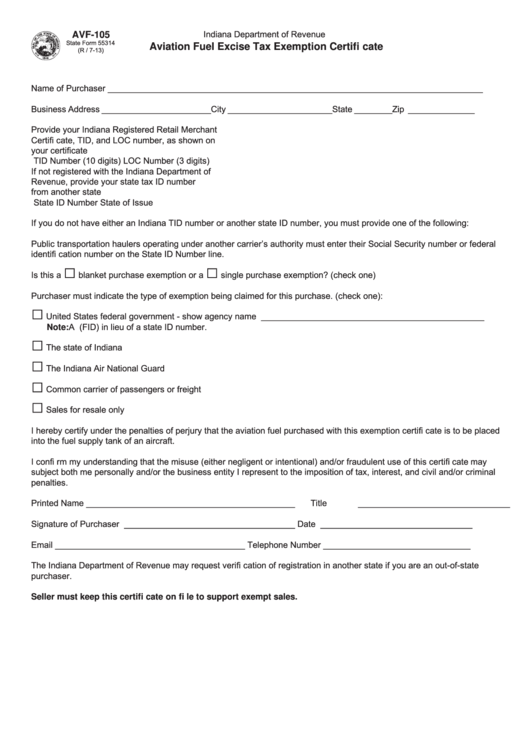

Fillable Form Avf 105 Aviation Fuel Excise Tax Exemption Certificate

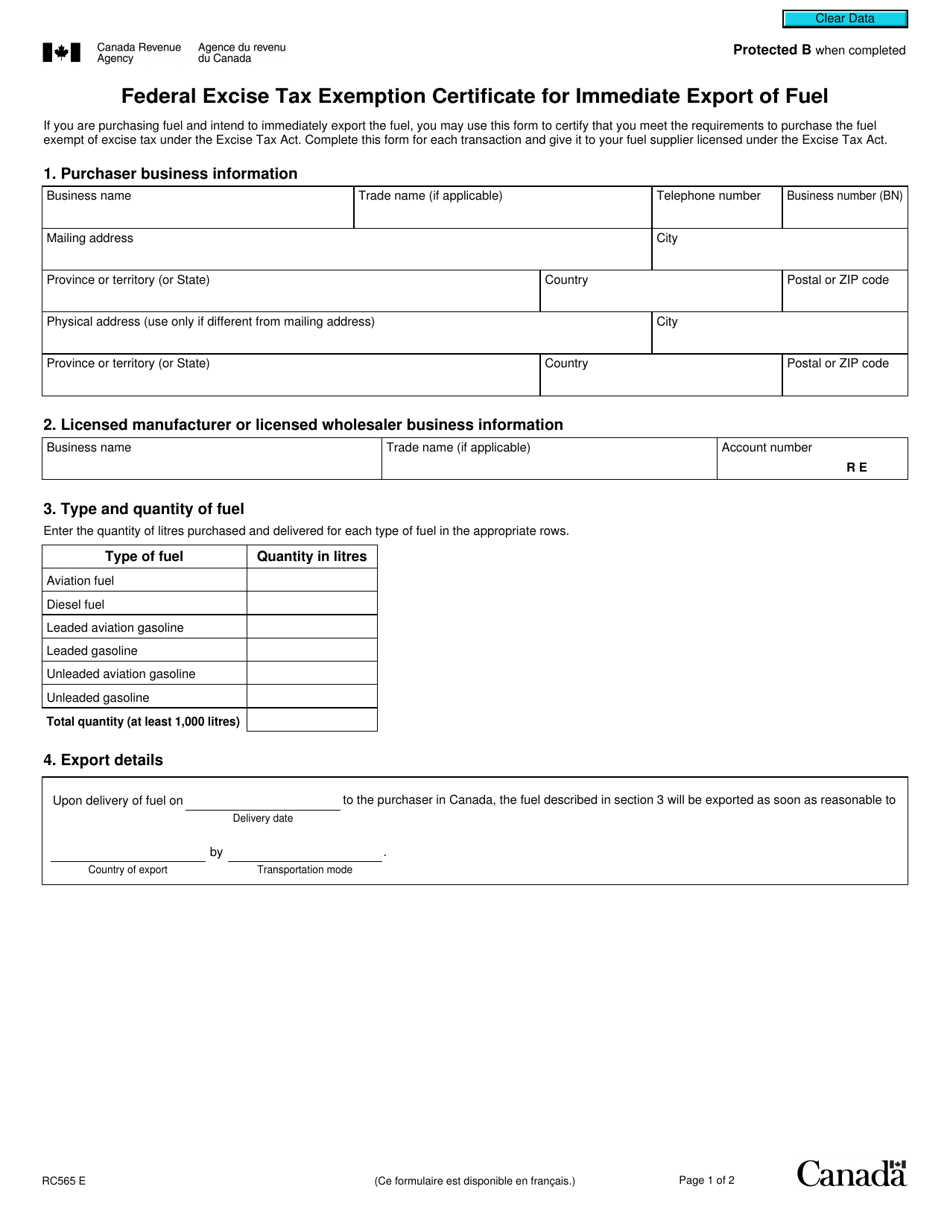

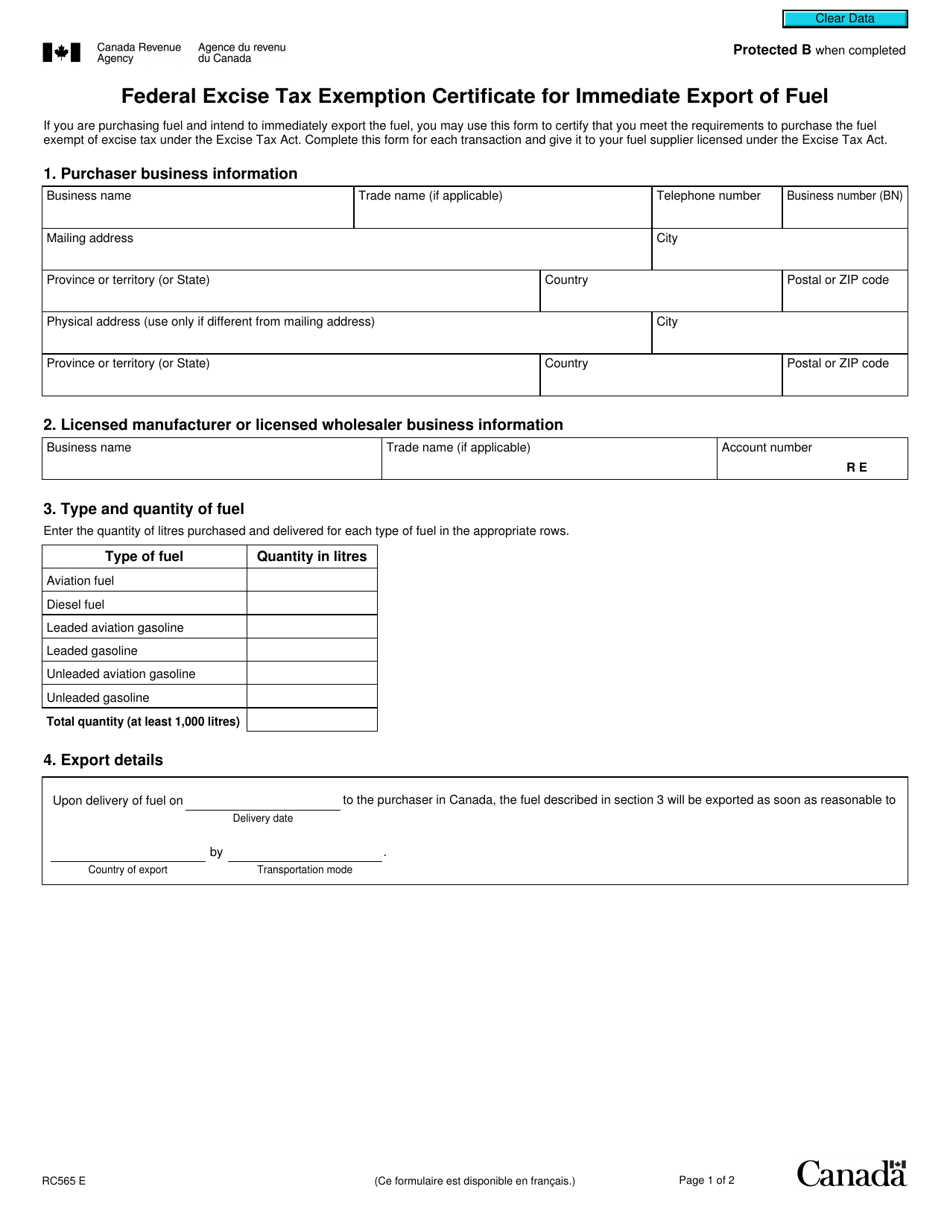

Form RC565 Download Fillable PDF Or Fill Online Federal Excise Tax

TIP Webinar Tipping The Odds In Your Favor Your 2023 Excise Refund

https://www.oecd.org/tax/tax-policy/brochure-taxing-energ…

Web Table 1 Average fuel excise and explicit carbon taxes across 44 OECD countries and Selected Partner Economies as well as international aviation and maritime transport

https://www2.deloitte.com/content/dam/Deloitte/us/Documen…

Web The alternative fuel tax credit provides a 0 50 per gallon credit for alternative fuel used in a motor vehicle motorboat or in aviation Eligible alternative fuels include compressed

Web Table 1 Average fuel excise and explicit carbon taxes across 44 OECD countries and Selected Partner Economies as well as international aviation and maritime transport

Web The alternative fuel tax credit provides a 0 50 per gallon credit for alternative fuel used in a motor vehicle motorboat or in aviation Eligible alternative fuels include compressed

Fillable Form Avf 105 Aviation Fuel Excise Tax Exemption Certificate

New Excise Taxes On Cars Fuel Effective January 1 2018 Auto News

Form RC565 Download Fillable PDF Or Fill Online Federal Excise Tax

TIP Webinar Tipping The Odds In Your Favor Your 2023 Excise Refund

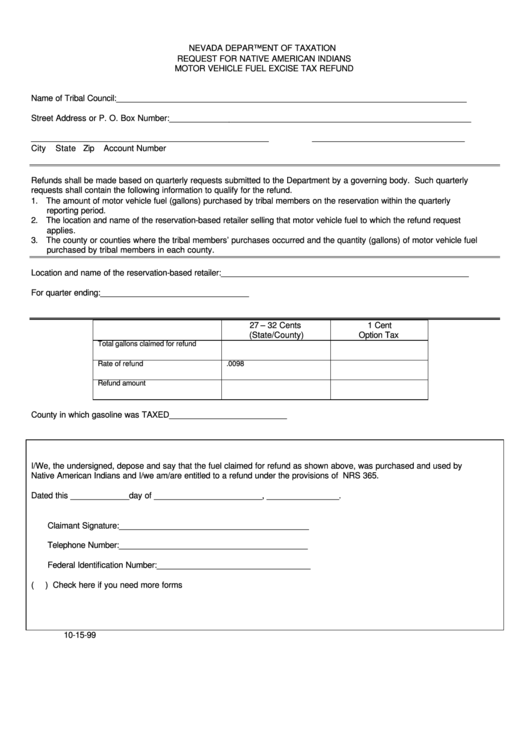

Request For Native American Indians Motor Vehicle Fuel Excise Tax

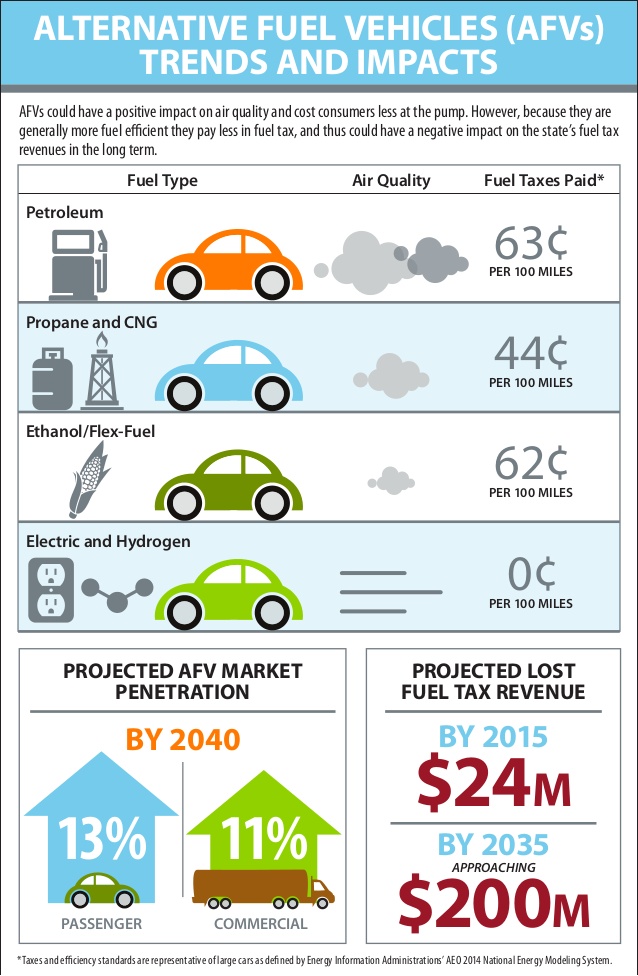

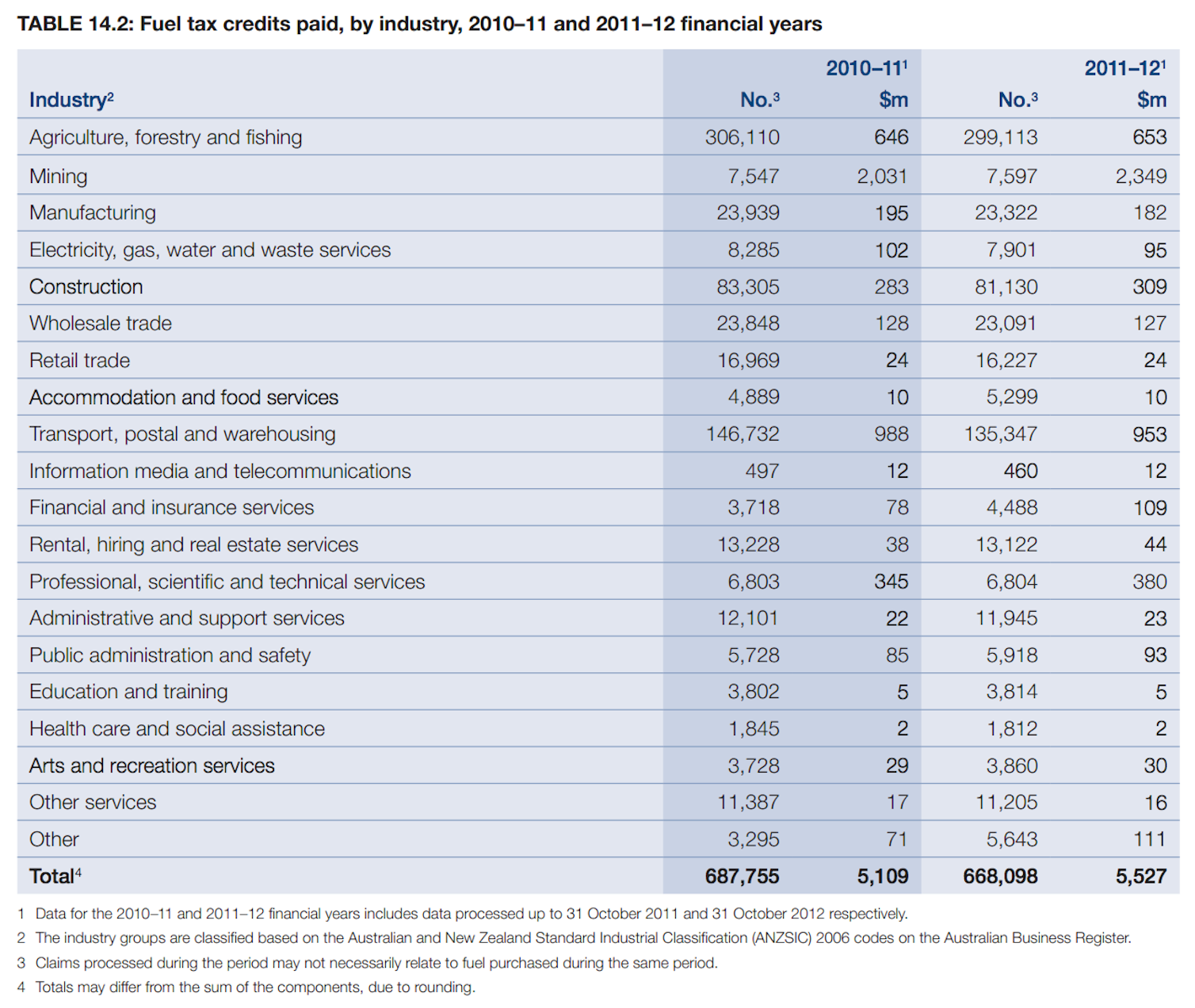

Study Switch To Alternative Fuels Could Cost State Millions In Revenue

Study Switch To Alternative Fuels Could Cost State Millions In Revenue

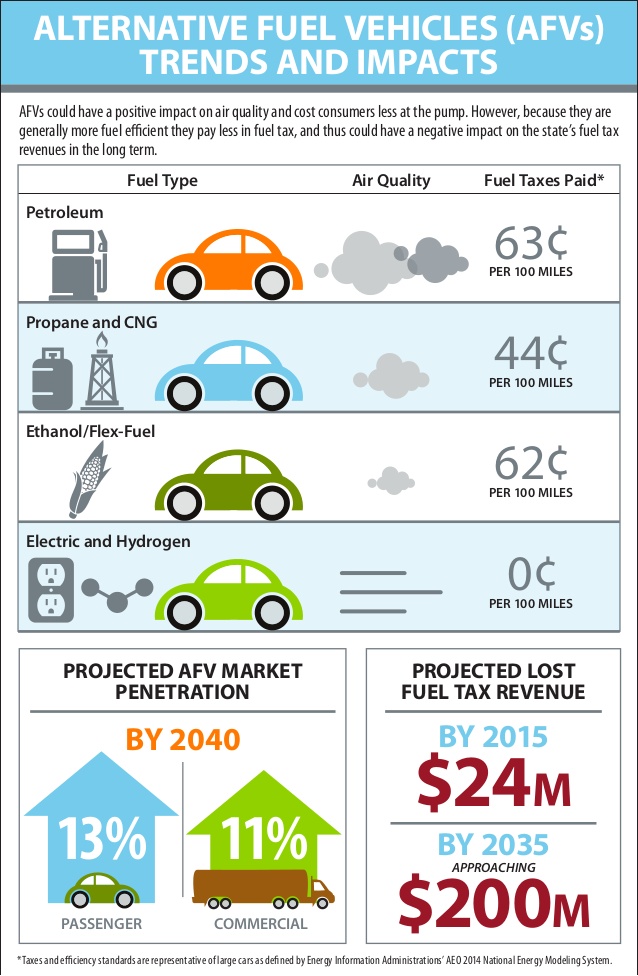

Viewpoints Should Fuel Tax Credits Be Cut In The Budget