In this day and age where screens have become the dominant feature of our lives but the value of tangible printed objects hasn't waned. Whether it's for educational purposes for creative projects, simply adding the personal touch to your space, Rebate Under Section 10 Of Income Tax Act have become an invaluable resource. The following article is a dive to the depths of "Rebate Under Section 10 Of Income Tax Act," exploring what they are, how you can find them, and the ways that they can benefit different aspects of your daily life.

Get Latest Rebate Under Section 10 Of Income Tax Act Below

Rebate Under Section 10 Of Income Tax Act

Rebate Under Section 10 Of Income Tax Act -

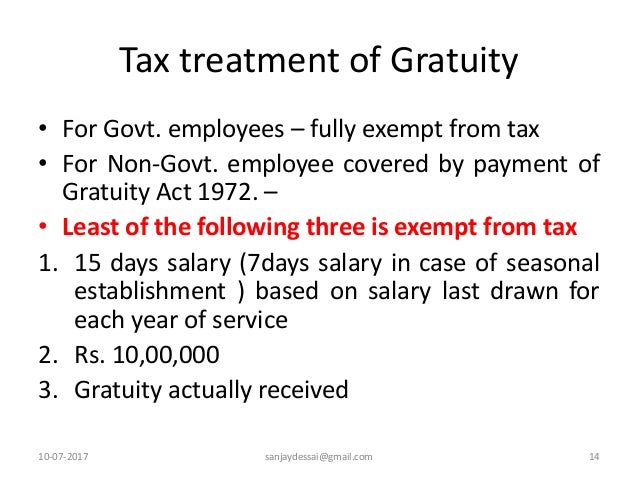

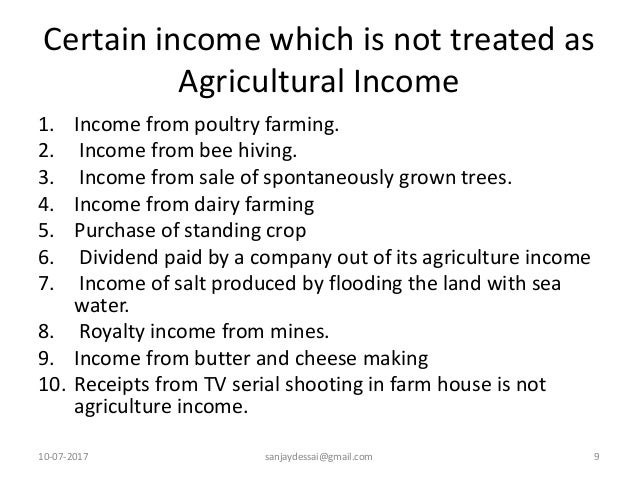

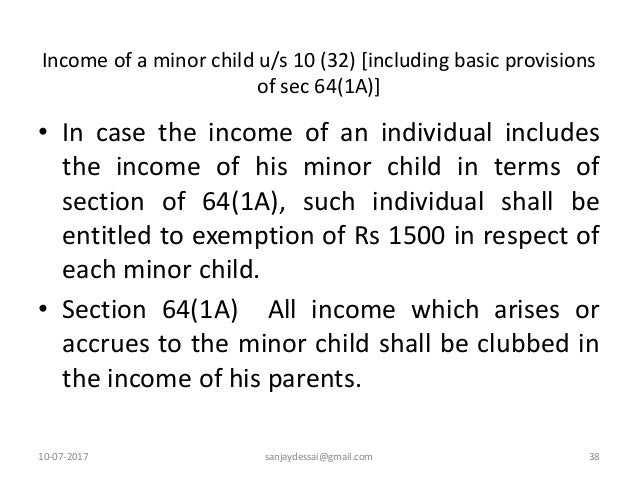

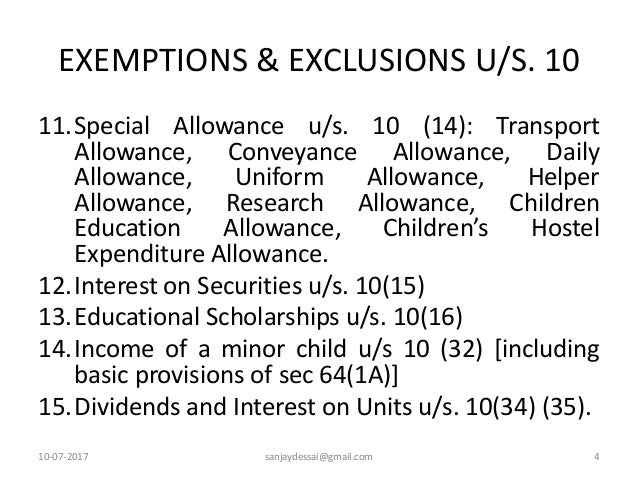

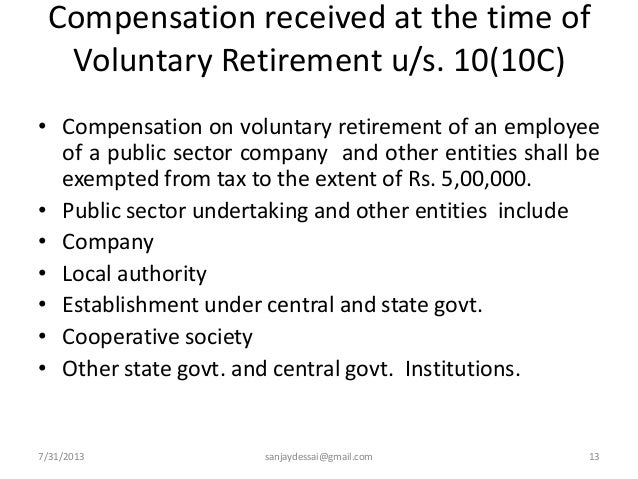

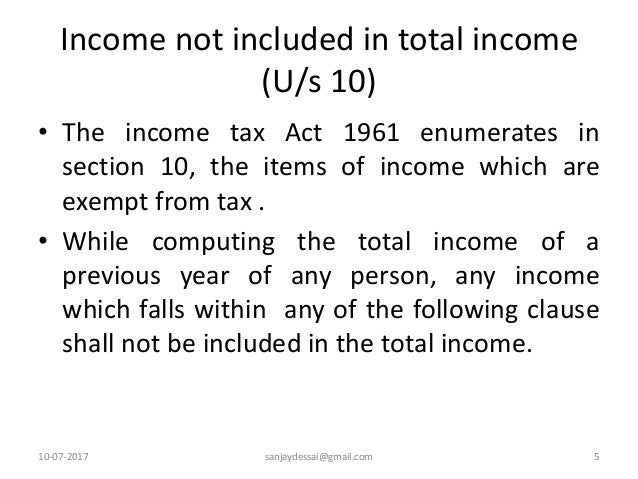

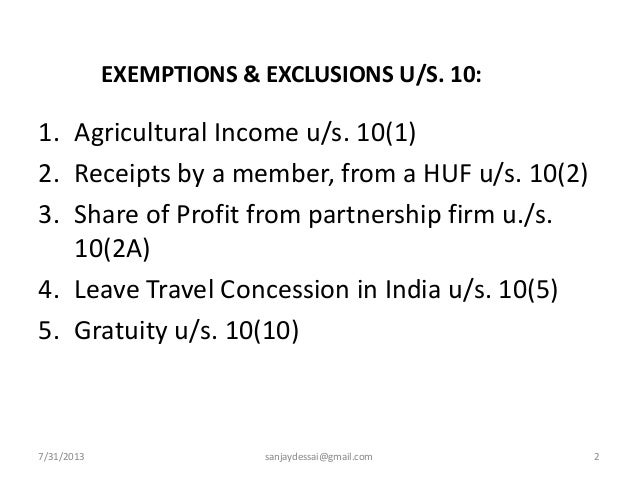

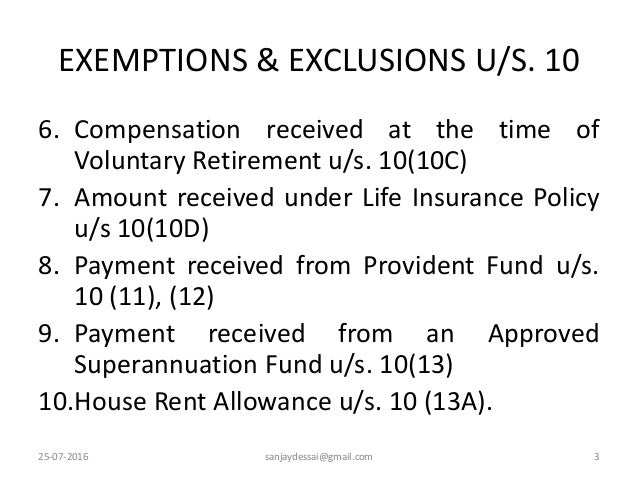

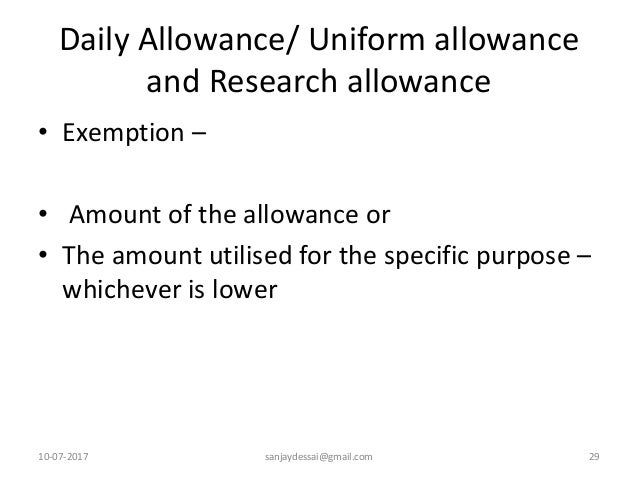

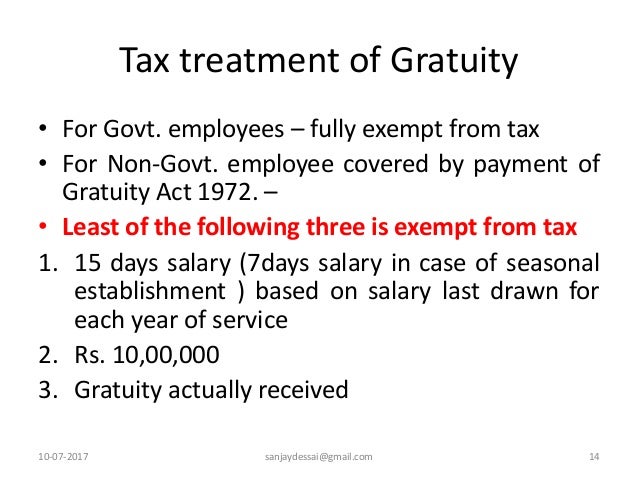

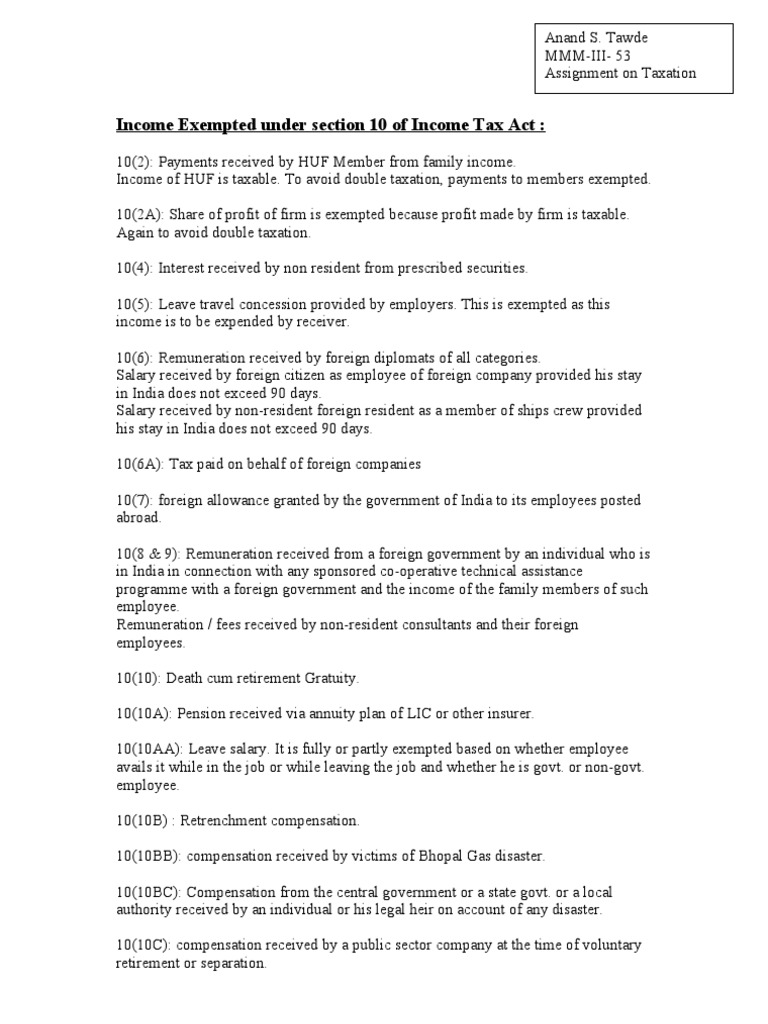

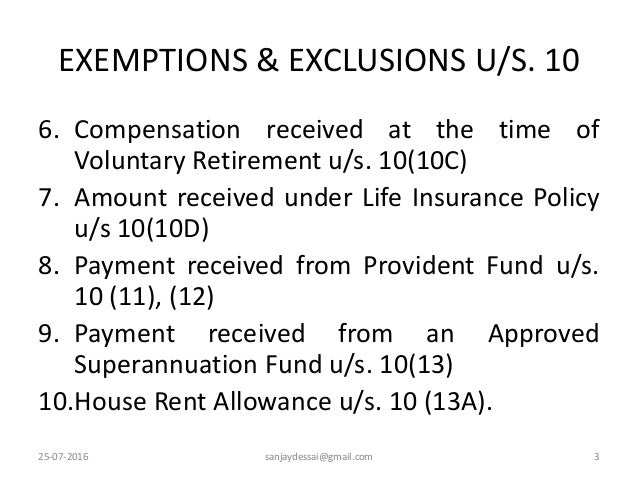

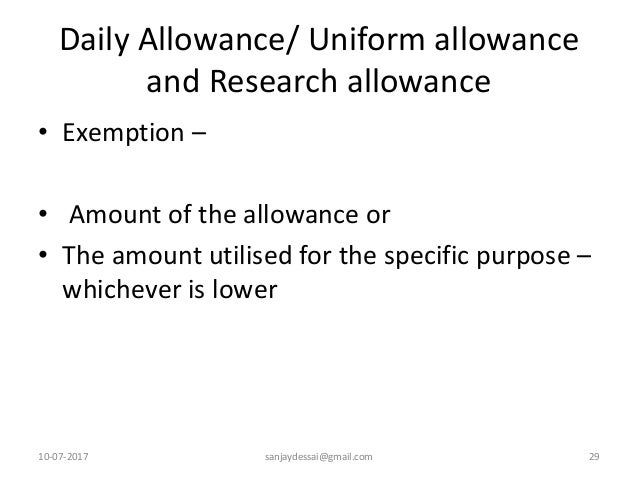

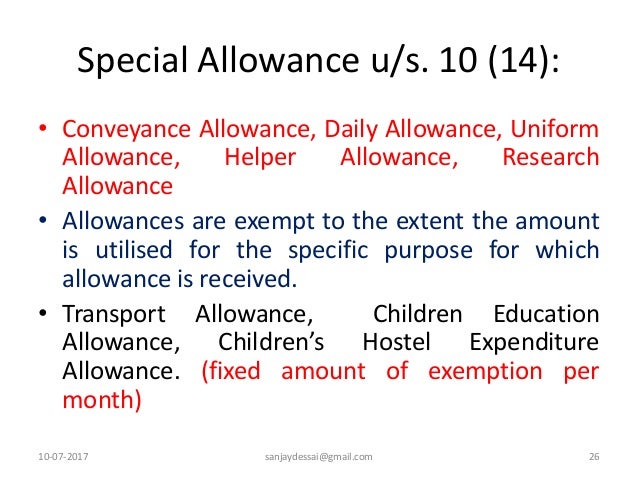

Web Section 10 of the Income Tax Act 1961 offers a long list of tax exemptions that are made especially for salaried people These allowances are greatly beneficial in taking some

Web 8 sept 2023 nbsp 0183 32 Under this Income Tax Act section tax rebate is given to salaried professionals Offers tax exemptions such as tuition fee for children s education travel

Rebate Under Section 10 Of Income Tax Act offer a wide array of printable content that can be downloaded from the internet at no cost. These resources come in many formats, such as worksheets, templates, coloring pages and more. The appealingness of Rebate Under Section 10 Of Income Tax Act is their versatility and accessibility.

More of Rebate Under Section 10 Of Income Tax Act

Income Exempted Under Section 10 Of Income Tax Act 1961 For Assessmen

Income Exempted Under Section 10 Of Income Tax Act 1961 For Assessmen

Web 16 mars 2023 nbsp 0183 32 Analyzing Exemptions Under Section 10 10d 1 Tax Rebate on Life Insurance Policy You can claim tax exemptions under Section 10 10D of the Income

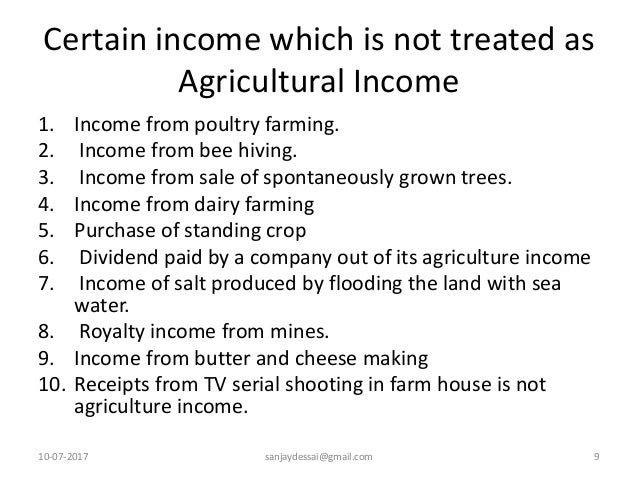

Web 12 juil 2023 nbsp 0183 32 Updated on 12 Jul 2023 What is Section 10 of Income Tax Act Section 10 of Income Tax Act 1961 includes such income that does not form part of the total

Rebate Under Section 10 Of Income Tax Act have gained a lot of popularity because of a number of compelling causes:

-

Cost-Efficiency: They eliminate the necessity to purchase physical copies of the software or expensive hardware.

-

Customization: Your HTML0 customization options allow you to customize printed materials to meet your requirements in designing invitations and schedules, or even decorating your home.

-

Educational Value Education-related printables at no charge can be used by students of all ages, making them a useful aid for parents as well as educators.

-

Simple: Quick access to many designs and templates, which saves time as well as effort.

Where to Find more Rebate Under Section 10 Of Income Tax Act

Income Exempted Under Section 10 Of Income Tax Act 1961 For Assessmen

Income Exempted Under Section 10 Of Income Tax Act 1961 For Assessmen

Web 3 sept 2022 nbsp 0183 32 The Inflation Reduction Act which President Biden signed into law Aug 16 offers tax credits and rebates to consumers who buy clean vehicles and appliances or take other steps to reduce

Web 20 ao 251 t 2022 nbsp 0183 32 What is Rebate Section 87 In simple terms rebate is deduction from income tax payable Here Income Tax Payable Tax Payable Cess Surcharge

We hope we've stimulated your interest in Rebate Under Section 10 Of Income Tax Act Let's see where you can locate these hidden gems:

1. Online Repositories

- Websites like Pinterest, Canva, and Etsy provide a large collection of Rebate Under Section 10 Of Income Tax Act for various needs.

- Explore categories such as decoration for your home, education, the arts, and more.

2. Educational Platforms

- Educational websites and forums usually provide worksheets that can be printed for free including flashcards, learning tools.

- Perfect for teachers, parents and students in need of additional resources.

3. Creative Blogs

- Many bloggers provide their inventive designs or templates for download.

- These blogs cover a broad variety of topics, from DIY projects to planning a party.

Maximizing Rebate Under Section 10 Of Income Tax Act

Here are some innovative ways that you can make use of printables that are free:

1. Home Decor

- Print and frame stunning art, quotes, or decorations for the holidays to beautify your living areas.

2. Education

- Utilize free printable worksheets to enhance your learning at home as well as in the class.

3. Event Planning

- Invitations, banners and decorations for special events like birthdays and weddings.

4. Organization

- Be organized by using printable calendars, to-do lists, and meal planners.

Conclusion

Rebate Under Section 10 Of Income Tax Act are an abundance of practical and innovative resources for a variety of needs and interest. Their access and versatility makes them a valuable addition to every aspect of your life, both professional and personal. Explore the plethora of Rebate Under Section 10 Of Income Tax Act and uncover new possibilities!

Frequently Asked Questions (FAQs)

-

Are the printables you get for free available for download?

- Yes you can! You can print and download the resources for free.

-

Can I make use of free printables in commercial projects?

- It's dependent on the particular conditions of use. Always read the guidelines of the creator before utilizing printables for commercial projects.

-

Are there any copyright rights issues with printables that are free?

- Some printables may contain restrictions regarding their use. Be sure to review the terms and conditions set forth by the author.

-

How do I print printables for free?

- Print them at home using any printer or head to a print shop in your area for better quality prints.

-

What program is required to open printables that are free?

- Many printables are offered in PDF format. These can be opened with free software like Adobe Reader.

Income Exempted Under Section 10 Of Income Tax Act 1961 For Assessmen

Incomes Exempt From Tax Under Section 10

Check more sample of Rebate Under Section 10 Of Income Tax Act below

Income Exempted Under Section 10 Of Income Tax Act 1961 For Assessmen

SECTION 10 OF INCOME TAX ACT 1961 PDF DOWNLOAD Pdf Documents

Incomes Exempt From Tax Under Section 10

Income Exempted Under Section 10 Of Income Tax Act Pension Employment

Income Exempt Under Section 10 For Assessment Year 2016 17

Income Exempted Under Section 10 Of Income Tax Act 1961 For Assessmen

https://www.bankbazaar.com/tax/special-allowance-under-section-10-for...

Web 8 sept 2023 nbsp 0183 32 Under this Income Tax Act section tax rebate is given to salaried professionals Offers tax exemptions such as tuition fee for children s education travel

https://blog.ipleaders.in/section-10-of-income-tax-act-1961

Web 22 mai 2022 nbsp 0183 32 This article provides an exhaustive overview of the exemptions available under Section 10 of the Income Tax Act 1961 with relevant case laws and illustrations

Web 8 sept 2023 nbsp 0183 32 Under this Income Tax Act section tax rebate is given to salaried professionals Offers tax exemptions such as tuition fee for children s education travel

Web 22 mai 2022 nbsp 0183 32 This article provides an exhaustive overview of the exemptions available under Section 10 of the Income Tax Act 1961 with relevant case laws and illustrations

Income Exempted Under Section 10 Of Income Tax Act Pension Employment

SECTION 10 OF INCOME TAX ACT 1961 PDF DOWNLOAD Pdf Documents

Income Exempt Under Section 10 For Assessment Year 2016 17

Income Exempted Under Section 10 Of Income Tax Act 1961 For Assessmen

Income Exempted Under Section 10 Of Income Tax Act 1961 For Assessmen

Income Tax Rebate On Home Loan Applicable Sections Under I T Act

Income Tax Rebate On Home Loan Applicable Sections Under I T Act

CBDT Guidelines Under Clause 10D Section 10 Of The Income tax Act 1961