Today, when screens dominate our lives it's no wonder that the appeal of tangible, printed materials hasn't diminished. For educational purposes project ideas, artistic or just adding a personal touch to your space, Rebate Under Provision Of Income Tax have become an invaluable source. With this guide, you'll dive into the world "Rebate Under Provision Of Income Tax," exploring their purpose, where they are available, and how they can enhance various aspects of your daily life.

Get Latest Rebate Under Provision Of Income Tax Below

Rebate Under Provision Of Income Tax

Rebate Under Provision Of Income Tax -

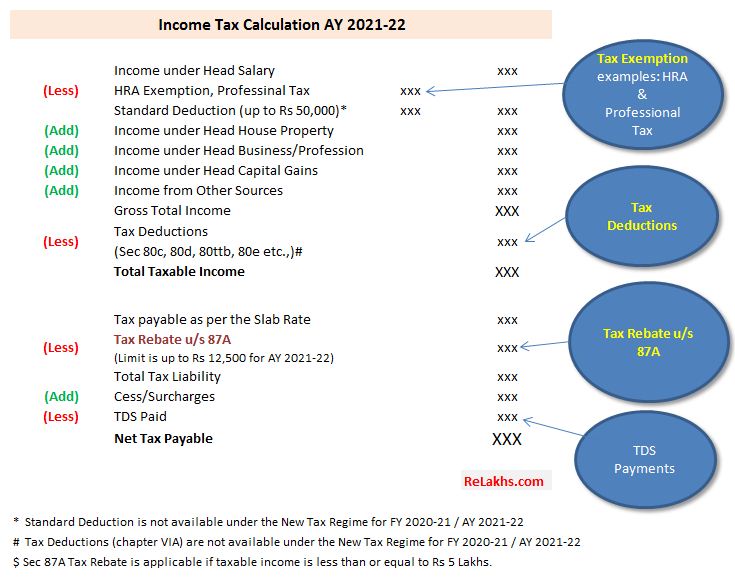

Web You can claim a maximum rebate of up to 12 500 under Section 87A of the Income Tax Act for the financial year 2022 23 The maximum amount of the 87A rebate has been

Web 1 f 233 vr 2023 nbsp 0183 32 A tax provision is the estimated amount of income tax that a company is legally expected to pay to the IRS for the current year It is just one type of provision that corporate finance departments set aside to

Printables for free cover a broad assortment of printable materials available online at no cost. These materials come in a variety of designs, including worksheets templates, coloring pages and much more. The beauty of Rebate Under Provision Of Income Tax is their flexibility and accessibility.

More of Rebate Under Provision Of Income Tax

Income Tax Rebate Under Section 87A Goyal Mangal Company

Income Tax Rebate Under Section 87A Goyal Mangal Company

Web 15 mai 2022 nbsp 0183 32 Flat tax Revenu fiscal de r 233 f 233 rence Donation D 233 fiscalisation Actualit 233 s Imp 244 ts D 233 fiscalisation D 233 couvrez les dispositifs permettant de payer moins d imp 244 t sur

Web 18 juil 2023 nbsp 0183 32 Section 80C is one of the most popular and favourite sections amongst the taxpayers as it allows to reduce taxable income by making tax saving investments or

Print-friendly freebies have gained tremendous appeal due to many compelling reasons:

-

Cost-Efficiency: They eliminate the requirement of buying physical copies or costly software.

-

Customization: They can make printables to your specific needs in designing invitations, organizing your schedule, or even decorating your house.

-

Educational value: Educational printables that can be downloaded for free can be used by students of all ages, which makes these printables a powerful source for educators and parents.

-

Simple: The instant accessibility to a myriad of designs as well as templates saves time and effort.

Where to Find more Rebate Under Provision Of Income Tax

All You Need To Know About Tax Rebate Under Section 87A By Enterslice

All You Need To Know About Tax Rebate Under Section 87A By Enterslice

Web Individuals can enjoy a tax rebate under Section 87A when they earn a net taxable income within 5 00 000 in a given financial year Eligible candidates can claim a tax rebate of

Web 28 ao 251 t 2020 nbsp 0183 32 Des investissements plafonn 233 s Pour b 233 n 233 ficier du dispositif 171 IR PME 187 les particuliers doivent effectuer des souscriptions en num 233 raire au capital initial ou aux

Now that we've ignited your interest in Rebate Under Provision Of Income Tax and other printables, let's discover where they are hidden treasures:

1. Online Repositories

- Websites like Pinterest, Canva, and Etsy provide a variety in Rebate Under Provision Of Income Tax for different uses.

- Explore categories such as decoration for your home, education, management, and craft.

2. Educational Platforms

- Educational websites and forums typically offer free worksheets and worksheets for printing as well as flashcards and other learning tools.

- It is ideal for teachers, parents or students in search of additional resources.

3. Creative Blogs

- Many bloggers provide their inventive designs and templates free of charge.

- These blogs cover a broad range of interests, all the way from DIY projects to planning a party.

Maximizing Rebate Under Provision Of Income Tax

Here are some fresh ways to make the most of printables for free:

1. Home Decor

- Print and frame stunning art, quotes, or seasonal decorations that will adorn your living areas.

2. Education

- Use free printable worksheets to reinforce learning at home (or in the learning environment).

3. Event Planning

- Create invitations, banners, as well as decorations for special occasions such as weddings, birthdays, and other special occasions.

4. Organization

- Make sure you are organized with printable calendars or to-do lists. meal planners.

Conclusion

Rebate Under Provision Of Income Tax are a treasure trove with useful and creative ideas which cater to a wide range of needs and interest. Their access and versatility makes them a valuable addition to both professional and personal life. Explore the plethora of Rebate Under Provision Of Income Tax right now and uncover new possibilities!

Frequently Asked Questions (FAQs)

-

Are the printables you get for free gratis?

- Yes, they are! You can print and download these free resources for no cost.

-

Do I have the right to use free printing templates for commercial purposes?

- It's based on the rules of usage. Make sure you read the guidelines for the creator before using printables for commercial projects.

-

Do you have any copyright issues in Rebate Under Provision Of Income Tax?

- Certain printables might have limitations on use. Be sure to read these terms and conditions as set out by the author.

-

How can I print printables for free?

- Print them at home using printing equipment or visit the local print shops for the highest quality prints.

-

What software do I need in order to open Rebate Under Provision Of Income Tax?

- The majority of printed documents are as PDF files, which can be opened with free software such as Adobe Reader.

Comparative Provisions Of The Rebate Download Table

Decoding Section 87A Rebate Provision Under Income Tax Act

Check more sample of Rebate Under Provision Of Income Tax below

Section 87A Tax Rebate Under Section 87A Rebates Income Tax Tax

Tax Rebate On Income Upto 5 Lakh Under Section 87A

Income Tax Rebate Under Income Tax Section 87 A For F Year 2017 18 AY 2

Section 87A Income Tax Rebate Under Section 87A For FY 2019 20

Rebate Of Income Tax Under Section 87A YouTube

How To Check Whether You Are Eligible For The Tax Rebate On Rs 5 Lakhs

https://tax.thomsonreuters.com/blog/tax-provi…

Web 1 f 233 vr 2023 nbsp 0183 32 A tax provision is the estimated amount of income tax that a company is legally expected to pay to the IRS for the current year It is just one type of provision that corporate finance departments set aside to

https://taxguru.in/income-tax/decoding-sectio…

Web 3 ao 251 t 2021 nbsp 0183 32 As per the existing provisions any Indian Resident individual whose income lies below Rs 5 00 000 is eligible to claim a tax amount rebate under this section The amount of tax rebate can be either 100

Web 1 f 233 vr 2023 nbsp 0183 32 A tax provision is the estimated amount of income tax that a company is legally expected to pay to the IRS for the current year It is just one type of provision that corporate finance departments set aside to

Web 3 ao 251 t 2021 nbsp 0183 32 As per the existing provisions any Indian Resident individual whose income lies below Rs 5 00 000 is eligible to claim a tax amount rebate under this section The amount of tax rebate can be either 100

Section 87A Income Tax Rebate Under Section 87A For FY 2019 20

Tax Rebate On Income Upto 5 Lakh Under Section 87A

Rebate Of Income Tax Under Section 87A YouTube

How To Check Whether You Are Eligible For The Tax Rebate On Rs 5 Lakhs

Income Tax Rebate Under Section 87A

Income Tax Rebate U s 87A For A Y 2017 18 F Y 2016 17

Income Tax Rebate U s 87A For A Y 2017 18 F Y 2016 17

Rebate Under Section 87A AY 2021 22 CapitalGreen