In the digital age, where screens have become the dominant feature of our lives yet the appeal of tangible printed objects isn't diminished. In the case of educational materials in creative or artistic projects, or simply to add some personal flair to your home, printables for free have become a valuable resource. The following article is a take a dive deep into the realm of "Rebate U S 87a In New Tax Regime For Fy 2023 24," exploring the different types of printables, where to locate them, and how they can enhance various aspects of your life.

Get Latest Rebate U S 87a In New Tax Regime For Fy 2023 24 Below

Rebate U S 87a In New Tax Regime For Fy 2023 24

Rebate U S 87a In New Tax Regime For Fy 2023 24 -

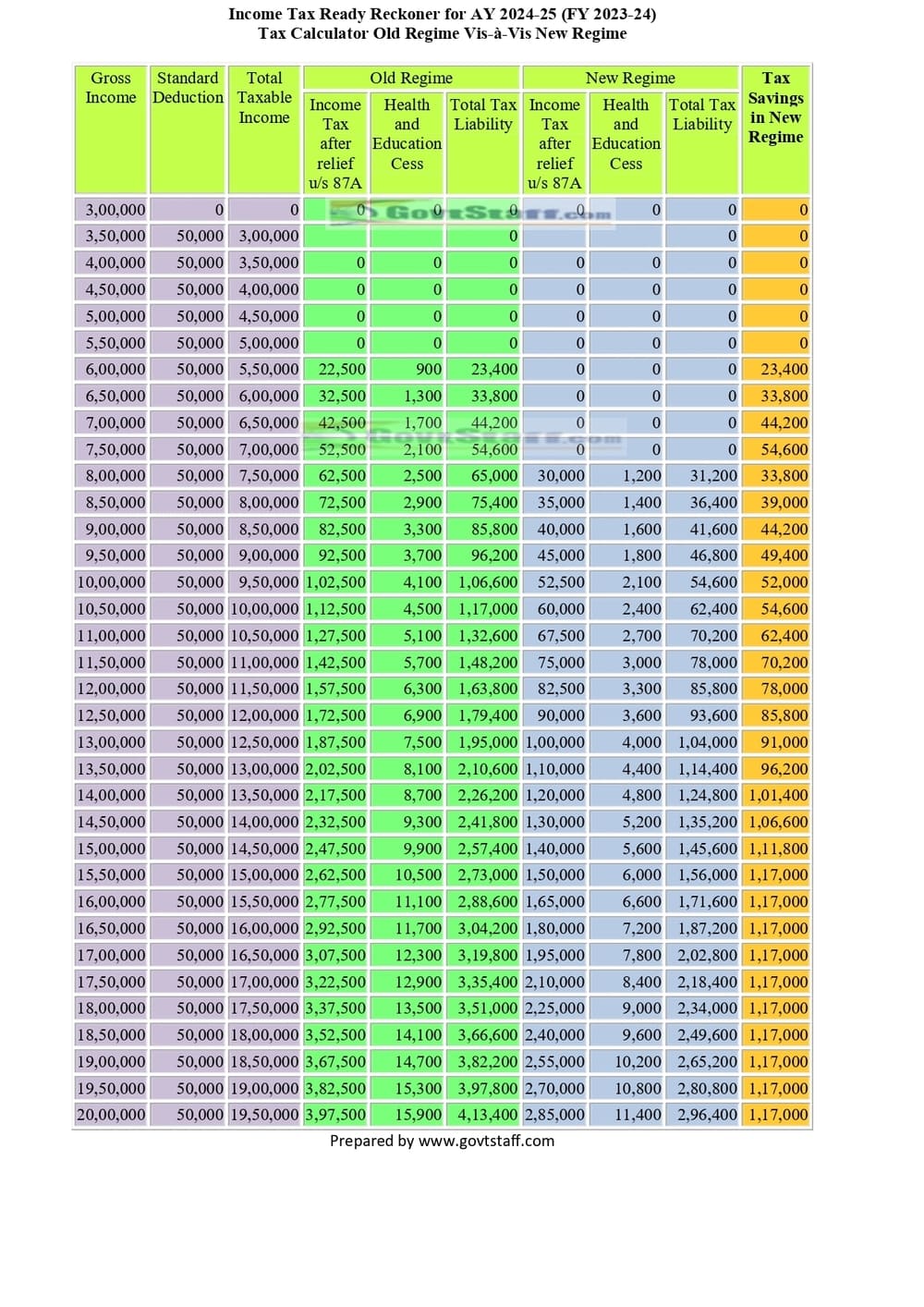

Therefore the Section 87A Tax rebate is available under both new and old tax regimes for FY2023 24 So you can claim Sec 87A Rebate of Rs 25 000 under the new tax regime and Rs 12 500 under the old tax regimes

For the FY 2023 24 AY 2024 25 the rebate limit has been increased to Rs 7 00 000 under the new tax regime This means a resident individual with taxable income up to Rs 7 00 000 will

Rebate U S 87a In New Tax Regime For Fy 2023 24 include a broad collection of printable content that can be downloaded from the internet at no cost. These printables come in different formats, such as worksheets, templates, coloring pages and many more. The appealingness of Rebate U S 87a In New Tax Regime For Fy 2023 24 is their flexibility and accessibility.

More of Rebate U S 87a In New Tax Regime For Fy 2023 24

4 TAX REBATE U s 87A New TAX REBATE EXAMPLES Income Tax

4 TAX REBATE U s 87A New TAX REBATE EXAMPLES Income Tax

Tax Rebate u s 87A for AY 2024 25 and Onwards New Regime Section 44 of the Finance Act 2023 has introduced higher tax rebate of up to Rs 25 000 for resident

Under Section 87A taxpayers are entitled to a rebate of up to Rs 12 500 effectively reducing their income tax liability This rebate is applicable to individuals whose

Printables for free have gained immense popularity due to a myriad of compelling factors:

-

Cost-Efficiency: They eliminate the necessity of purchasing physical copies or costly software.

-

Modifications: There is the possibility of tailoring printables to your specific needs in designing invitations to organize your schedule or decorating your home.

-

Educational Worth: The free educational worksheets offer a wide range of educational content for learners of all ages. This makes them a great aid for parents as well as educators.

-

Convenience: Quick access to a variety of designs and templates saves time and effort.

Where to Find more Rebate U S 87a In New Tax Regime For Fy 2023 24

New Tax Regime Vs Old Tax Regime How To Choose The Better Option For

New Tax Regime Vs Old Tax Regime How To Choose The Better Option For

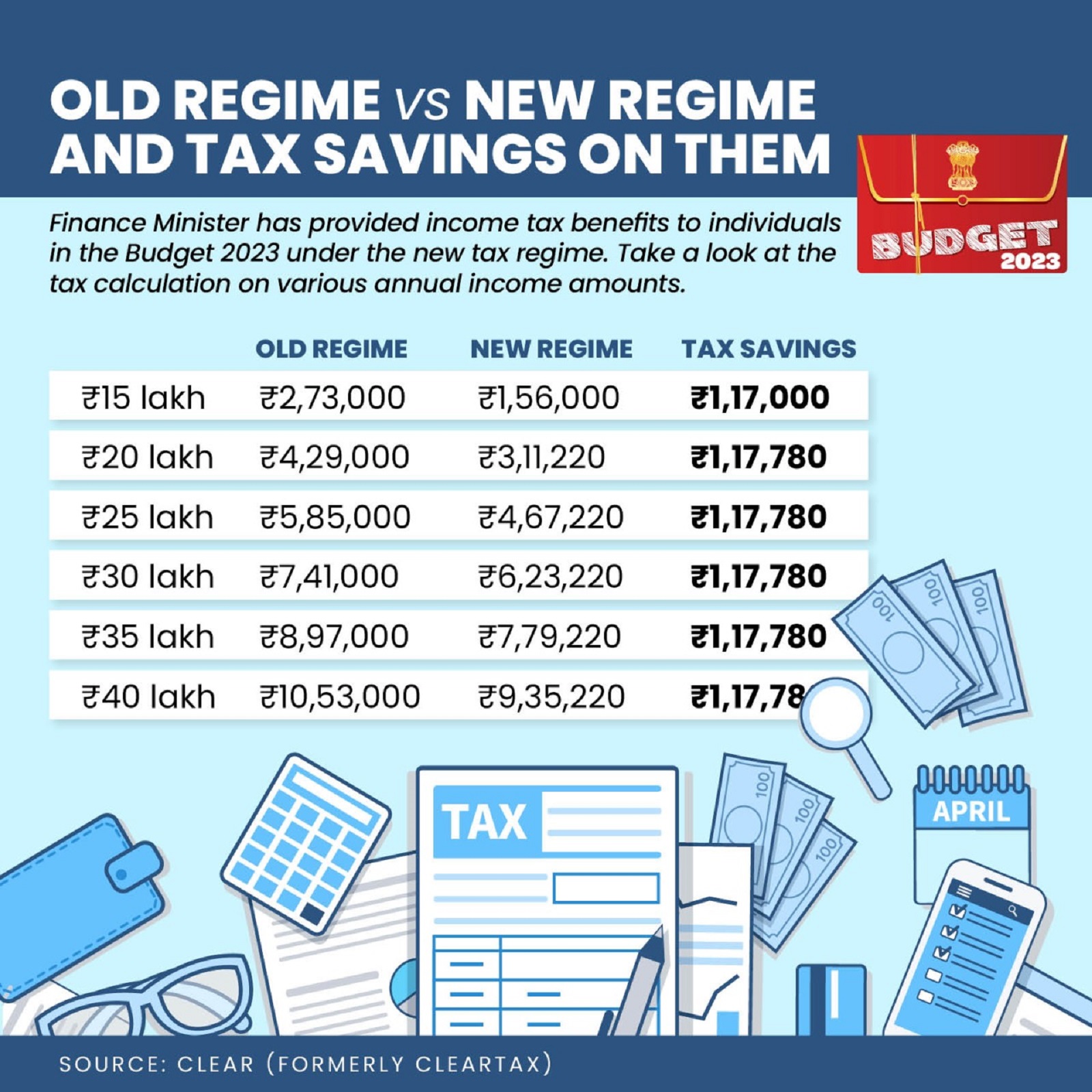

The maximum limit of rebate available under section 87A of the Income tax Act 1961 has been increased to Rs 25 000 from Rs 12 500 in Budget 2023 Getty Images 3 6 Who are eligible for this rebate under section 87A

In Budget 2023 the tax rebate for individuals has been increased to INR 25 000 which means individuals having taxable income up to INR 7 00 000 can claim rebate under

Now that we've piqued your interest in Rebate U S 87a In New Tax Regime For Fy 2023 24 and other printables, let's discover where you can locate these hidden treasures:

1. Online Repositories

- Websites such as Pinterest, Canva, and Etsy offer a vast selection in Rebate U S 87a In New Tax Regime For Fy 2023 24 for different reasons.

- Explore categories like decorations for the home, education and crafting, and organization.

2. Educational Platforms

- Forums and educational websites often offer free worksheets and worksheets for printing including flashcards, learning tools.

- Ideal for parents, teachers and students who are in need of supplementary resources.

3. Creative Blogs

- Many bloggers post their original designs as well as templates for free.

- The blogs are a vast array of topics, ranging ranging from DIY projects to planning a party.

Maximizing Rebate U S 87a In New Tax Regime For Fy 2023 24

Here are some innovative ways how you could make the most of Rebate U S 87a In New Tax Regime For Fy 2023 24:

1. Home Decor

- Print and frame stunning images, quotes, or festive decorations to decorate your living areas.

2. Education

- Print worksheets that are free to help reinforce your learning at home also in the classes.

3. Event Planning

- Invitations, banners and decorations for special occasions such as weddings and birthdays.

4. Organization

- Stay organized by using printable calendars along with lists of tasks, and meal planners.

Conclusion

Rebate U S 87a In New Tax Regime For Fy 2023 24 are a treasure trove of creative and practical resources designed to meet a range of needs and preferences. Their access and versatility makes they a beneficial addition to both professional and personal life. Explore the wide world of Rebate U S 87a In New Tax Regime For Fy 2023 24 today and open up new possibilities!

Frequently Asked Questions (FAQs)

-

Are printables that are free truly free?

- Yes, they are! You can download and print the resources for free.

-

Are there any free printables for commercial use?

- It's based on specific conditions of use. Always consult the author's guidelines prior to using the printables in commercial projects.

-

Are there any copyright concerns with printables that are free?

- Certain printables could be restricted regarding their use. Be sure to review the terms and regulations provided by the author.

-

How do I print printables for free?

- You can print them at home with a printer or visit the local print shops for superior prints.

-

What program must I use to open printables at no cost?

- A majority of printed materials are in the format PDF. This can be opened using free software like Adobe Reader.

Income Tax Ready Reckoner For AY 2024 25 FY 2023 24 Tax Calculator

Income Tax Slabs Comparison After Budget 2023 Taxes Under Old Regime

Check more sample of Rebate U S 87a In New Tax Regime For Fy 2023 24 below

Rebate U s 87A

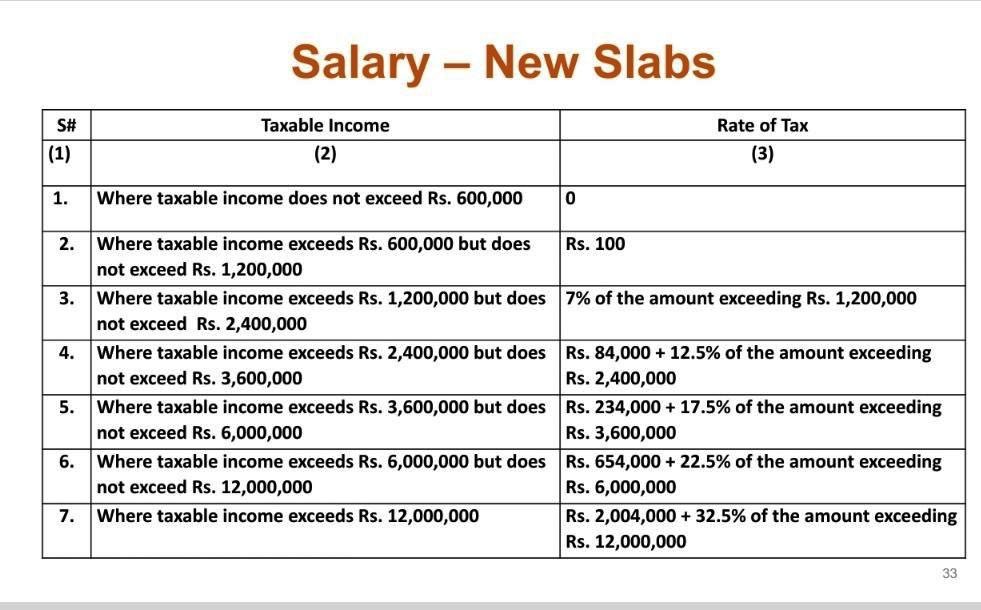

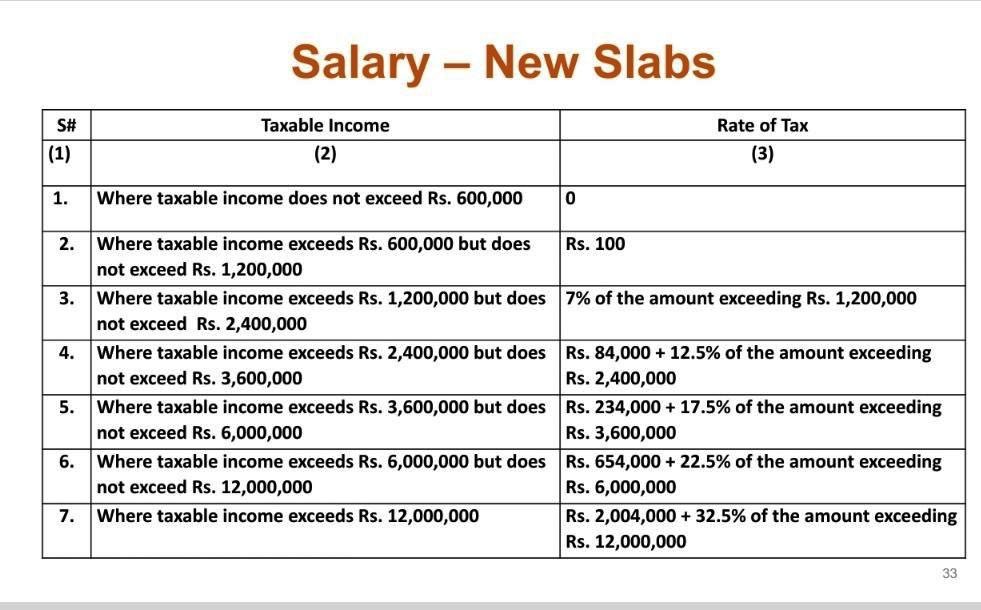

Income Tax Slabs Year 2022 23 Info Ghar Educational News

New Income Tax Slab 2023 24

Rebate Limit New Income Slabs Standard Deduction Understanding What

Revised Tax Rebate Under Sec 87A After Budget 2019 BasuNivesh

Senior Citizen Income Tax Calculation 2023 24 Examples New Tax Slabs

https://tax2win.in/guide/section-87a

For the FY 2023 24 AY 2024 25 the rebate limit has been increased to Rs 7 00 000 under the new tax regime This means a resident individual with taxable income up to Rs 7 00 000 will

https://taxguru.in/income-tax/marginal-r…

Section 87A rebate does not allow in old regime if your income go above 5 00 000 But A New proviso inserted in section 87A by the Finance Act 2023 w e f 1 4 2024 Applicable from FY 2023 24 Provided that where the

For the FY 2023 24 AY 2024 25 the rebate limit has been increased to Rs 7 00 000 under the new tax regime This means a resident individual with taxable income up to Rs 7 00 000 will

Section 87A rebate does not allow in old regime if your income go above 5 00 000 But A New proviso inserted in section 87A by the Finance Act 2023 w e f 1 4 2024 Applicable from FY 2023 24 Provided that where the

Rebate Limit New Income Slabs Standard Deduction Understanding What

Income Tax Slabs Year 2022 23 Info Ghar Educational News

Revised Tax Rebate Under Sec 87A After Budget 2019 BasuNivesh

Senior Citizen Income Tax Calculation 2023 24 Examples New Tax Slabs

Income Tax Rebate Under Section 87A

Tax Rebate Under Section 87A In Old New Tax Regime FinCalC

Tax Rebate Under Section 87A In Old New Tax Regime FinCalC

Old Personal Tax Regime Vs New Tax Regime Choosing Made Easy Here Mint